Mixed Signals: China In The Middle East – Analysis

By FRIDE

By Kerry Brown*

As of 2014, China is the second-largest trading partner of the Arab world. In 2013, China surpassed the US as the Persian Gulf’s main oil client. From 2003 to 2013, China’s crude imports from the Middle East and North Africa (MENA) grew by 12 per cent annually, and China-Arab trade by 25 per cent. China’s energy needs have guided much of its Middle East strategy. Although in recent years China’s relations with the Middle East have developed broader commercial bonds, China’s larger strategic intentions in the region, and in particular the prospects of a stronger political and security engagement, remain uncertain.

Unlike the United States (US) or the European Union (EU), China does not have a specific Middle East policy as such. Its policy towards the region sits within broader foreign policy parameters; respect for sovereignty of others and non-interference in their domestic affairs, and support for a more multi-polar world order as an alternative to Western hegemony. The Chinese State Council, China’s highest executive body, has issued White Papers on many foreign policy subjects, but not on China’s relationship with the Middle East. Moreover, Middle Eastern affairs are split between two separate departments in the Ministry of Foreign Affairs in Beijing rather than being gifted with its own one – the Department of West Asian and North African Affairs, and the Department of European and Central Asian Affairs.

The complexity of the Middle East region is mapped in the modes of engagement between China and its partners there. A China-Arab States Cooperation Forum (CASCF) was founded in 2004. China’s relations with the League of Arab States and the Gulf Cooperation Council (GCC) are currently low profile and not geared up for more ambitious engagement. A strategic dialogue with the GCC to structure the relationship was only established in 2010, long after similar dialogues were launched with the EU and the US. Until then, China had not talked of a ‘strategic partnership’ with any country or grouping of countries in the Middle East, although Beijing has recently started to show a desire to potentially develop these types of higher-profile relationships. Its dominant discourse so far has been almost wholly in terms of economic cooperation, especially on energy.

And while China has increasingly expended time and effort on some of the major MENA countries (as will be shown later in this policy brief), it has not, as Russia did over Syria at the United Nations (UN) in 2012, stuck its neck out and taken policy positions on regional issues that might lead to tensions with others, including Western countries.

What marks Chinese Middle East relations are the ways in which they are intimately linked to China’s domestic energy policy. This is the main link to China’s domestic concerns, although there are also emerging links with jihadist terrorist campaigns in the Xinjiang region that are starting to worry Beijing much more than before. Even so, at the moment its policy in the region is driven mainly by the imperative to preserve its access to energy resources. Unless China finds alternative (domestic or external) sources of energy, it may need to deepen its political and security role in the region. But China is currently reluctant to become an increasingly important player in the Middle East.

China’s Foreign Policy Priorities

China-Middle East relations should be put in a broader foreign policy context. China has traditionally defined its diplomatic interests in concentric circles, where the US is its top priority; the EU and China’s regional neighbours such as India, Japan and Russia are included in its second tier concerns; and a number of other circles extend out, from the wider Asia Pacific to Latin America and Africa.

In this template, importance to China is defined in terms of geopolitics, investment and economic relations and natural resource supplies. China does not rely on binding treaty alliances like the US, but on material interests that link with its own internal priorities – economic growth, and the construction of a rich, strong country. Proximity is also important – China is most concerned about those partners that are in its regional strategic space (including the US).

In this broad picture, the Middle East is unique for China – of moderate priority compared to many other regions with the exception of the importance of its oil supplies. The preservation of access to oil means that China is a cautious, even reluctant, player in Middle Eastern political and security affairs.

There is good reason for this. The Middle East is high-risk territory. It is one Beijing sees largely as a zone of influence of the US or, in some cases, Russia, and highly problematic in its internal politics. China’s relations with the region are based on loose pragmatic links through the GCC and the CASCF. With the GCC, China has been discussing a free trade agreement. But this is a long way from the (albeit so far largely theoretical) coherence and ambition of Beijing’s framing of its relationship with the EU, which it calls a ‘civilisational partner’, or with the US where it is seeking a ‘new model for great power relations.’

The growing importance of China’s energy interests in the Middle East, however, is disrupting this pattern of low levels of cooperation between China and the Middle East. This explains the schizophrenic behaviour of Chinese policy towards the Middle East that struggles to reconcile defending key geo-economic interests with a preference to remain hands-off politically.

Oil, Trade and Investment

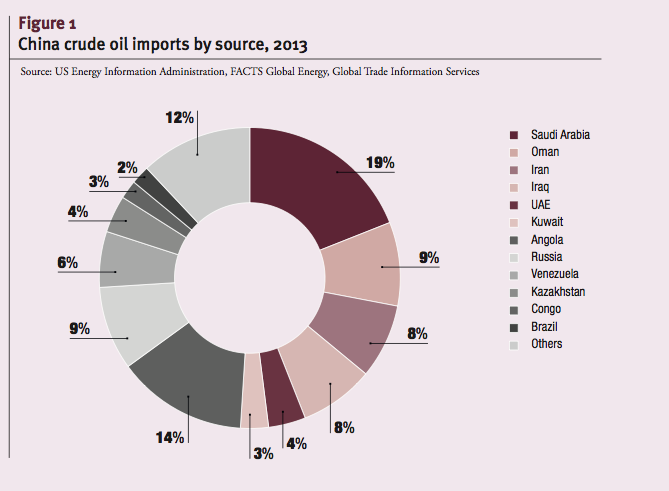

While China’s prime source of energy is coal, 20 per cent now comes from oil. Since 1993, China has imported more oil than it can source in the country itself. Today, as the charts below show, over 50 per cent of this comes from the Middle East, and this dependency is likely to grow. China’s total imports from the Middle East (primarily composed of crude oil and gas) grew from $3.8 billion in 1999 to $160 billion in 2012. China’s trade with Saudi Arabia alone has risen 10-fold since 2003, and according to official figures, Saudi Arabia has replaced the US as China’s single most important trading partner. Projections from the International Energy Agency in 2012 suggested that Middle Eastern oil exports to China could more than double by 2035. This more than anything else gives China direct interest in the Middle Eastern region, reflected in major oil deals signed with both Iran and Saudi Arabia amongst others.

Perhaps in order to provide a more coherent framework for engagement, Chinese President Xi Jinping has talked of a ‘New Silk Road’, reviving old logistics and trade routes between China and Europe through Central Asia and the Middle East. This carries a pragmatic purpose (to strategically improve China’s links to sources of oil that are more diverse and more secure than at present) but also has a historic grounding. The Chinese government has been promoting this idea widely. While it might be embraced by Middle Eastern partners as a means to secure more Chinese investment and economic cooperation, whether its underlying message of a more Sino-centric world would also be acknowledged is open to question.

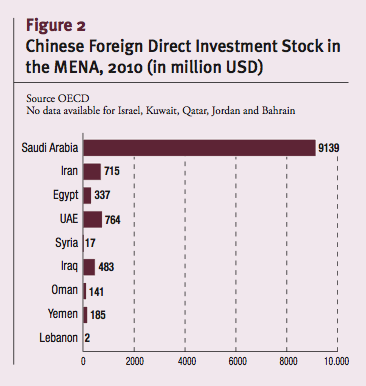

Chinese exports and foreign direct investment into the region have also soared over the past decade. Between 1999 and 2012, Chinese exports to the MENA grew from $6.47 billion to $121 billion. In 2012, China’s most important export destinations in the region were the United Arab Emirates (UAE) ($30 billion), Saudi Arabia ($18 billion), Iran ($11 billion), and Egypt ($8 billion). Primary export goods included light industrial products, textiles, clothing, machinery, and automobiles.

In spite of periodic unrest, China’s investments in the Middle East have also grown, with Saudi Arabia, Iran, Egypt, the UAE and Iraq figuring amongst its top commitments, up to 2012. Middle Eastern investments into China are negligible by comparison, with only Turkey, Israel and Kuwait making any meaningful commitments, none amounting to more than $189 million stock (Israel). The vast majority of Chinese investment is in energy projects, with some diversification recently into tourist and transport infrastructure, particularly in Egypt where an agreement was signed in 2012 to build a high-speed train link between Cairo and Alexandria. China’s most important economic actors in the region are the state energy companies – Sinopac, Petrochina and the Chinese Offshore Overseas Oil Corporation. (See Figure 2)

The Limits of Neutrality

China has maintained good relations with almost all Middle East countries. For example, in the context of the Israeli-Palestinian conflict, China has traditionally maintained good links with both parties. It was a strong ally of the Palestinian Liberation Organisation under Arafat in the 1980s, but enjoyed good relations with Israel (which has been one of Beijing’s main arms suppliers in recent decades).

In the aftermath of the 2011 Arab uprisings, China had its most difficult test to its largely non-committal stance. It banned discussion of the revolutions in the internet in China, and clamped down on any domestic political activists who attempted to draw parallels with the situation in Egypt and Libya and what was happening in China. Some Chinese officials simply stated that the Arab protests were against inefficient governance, and in China’s case no such charges could be laid against it. Despite this, the removal of Mubarak in Egypt, the collapse of Gaddafi’s regime in Libya and the uprisings in Syria deeply unsettled China. In acclimatizing to the new situation, it often found itself wrong-footed. It embraced the Morsi regime in 2012, and at Morsi’s first foreign visit to Beijing that year, a number of deals were signed. But his removal in the summer of 2013 was followed by a period of rebuilding bridges and trying to figure out how to work with a leadership that seemed much closer to the US than the one they had just removed. This illustrates how China – like other external powers – sometimes misreads the politics of the region.

On Libya, Beijing abstained from the 2011 United Nations Security Council (UNSC) vote sanctioning military intervention. But following the NATO-led air campaign and Gaddafi’s removal from power, Beijing felt it had been short-changed into implicitly supporting regime change, when it had originally believed that the UNSC resolution only allowed military intervention for humanitarian purposes. It also had to ship out over 36,000 citizens from the area – its largest ever repatriation – revealing just how extensive its energy and economic interests had grown in the region. Since then, China has tried to rebuild relations with Tripoli, mainly in an effort to recover some of its pre-war construction and infrastructure contracts, which were worth some $20 billion before the 2011 conflict.

The Libya experience framed China’s subsequent response to Syria, where it stood with Russia, despite immense pressure from the US and the United Kingdom (UK), and voted against any military involvement. In view of the ongoing instability in Egypt and above all Libya, Beijing now probably feels vindicated in believing that the US and its allies were naive in thinking that political reform along the lines originally envisaged was really going to offer quick and sustainable solutions.

Since 2011, the horrendous conflict in Syria and the sub- sequent strengthening of jihadist Islamist extremism have shown the strengths and weaknesses of the Chinese position. On the one hand, Beijing feels it has been proven right in its skepticism about the effectiveness of sweeping away former regimes and replacing them with new, often-weaker ones. On the other hand, the moral bankruptcy of simply standing back and watching Syria’s self-destruction has shown that the world’s second-biggest economy has little geopolitical imagination when it comes to trying to solve problems in a region with which it has increasing economic links. The most that China has offered is $3.3 million humanitarian assistance as of early 2014. The jihadist challenge does link to radical Islamist action in its own country. A spate of terrorist attacks in China that have intensified since 2012 has only heightened this awareness. China, therefore, whether it likes it or not, may have to gradually take more overt political positions to preserve its interests because of the links between domestic challenges (such as energy dependence), and global challenges (such as transnational jihadism).

A Political Role for China?

The combination of China’s increasing economic and geopolitical weight along with its continuing need for imported oil from the MENA region will pose challenges to its preferred low profile position, where its political commitments are only focused on defending what it believes are its core interests. China’s preferred position of neutrality is being challenged by events in the MENA. While the US will maintain strong interests in the region, and remain a major player there, it is also intensely aware of how much China is building up its interests in the region. Washington may resent any perceived free-riding by China, but nor may the US want deeper Chinese involvement in areas where the positions of Washington and Beijing might diverge.

There needs to be a framework for China to engage in the MENA region transparently and collaboratively so that misunderstandings are avoided with both regional and external powers. The idea that China can maintain a dialogue with a benignly economic focus on the region without having a strategy to deal with harder security issues is probably unsustainable. Its interests are now becoming too complex and extensive. Already with Iran, for example, China has intimated at something more substantial. In May 2014, Chinese Defence Minister Chang Wanquan stated that he wanted to ‘deepen defence relations’. According to the Xinhua news agency, Chang told Iranian Defence Minister Hossein Dehqan that the development of bilateral relations has ‘remained positive and steady, featuring frequent high-level exchanges and deepened political mutual trust’.

Few details of what the content of a defence relationship might look like have been provided by Beijing or Tehran, but even voicing the concept was a bolder move than China had hitherto made. This could be the face of things to come.

And yet, Beijing gives very mixed signals on its desire for greater political engagement in the MENA region. For example, with Gulf governments Chinese leaders have said that ‘China is eying the establishment of a strategic partnership, using the prospective free trade agreement with the GCC countries as a driving force to boost pragmatic cooperation in all fields’ (Foreign Minister Wang Yi, in January 2014). Such a move may appear to have potential in principle, but it seems a minimalist approach in practice, and shows how underdeveloped the political frameworks for Chinese-Middle Eastern dialogue are, compared with other regions and countries. For instance, the press release following the China-GCC January meeting very vaguely underlined the ‘strategic importance of the Middle East and Gulf region’, as well as naming an all-encompassing list of potential fields for cooperation.

From an outside perspective, there is a clear mismatch between this sort of unambitious political approach, and the growing economic importance of the region to China. Perhaps in reaction to the cautious mixed signals from Beijing, nor has there been a strong initiative from any players in the region to try to model a different, more comprehensive relationship with China.

Conclusion

China’s growing dependence on Middle Eastern energy is likely to gradually undo its narrow geo-economic focus on region. Beijing’s growing economic stakes in the Gulf will necessarily go hand in hand with an increasing need to take the securing of these stakes in its own hands. China has been sending mixed signals in this regard. Beijing struggles to come to terms with its fundamental Middle Eastern dilemma: how to actively secure one of its key geopolitical interests (oil supply) without damaging another (the principle of non-intervention on which its broader foreign policy relies).

For the West, a stronger political role for China in the Middle East could be both boon and bane. Keen on involving China more closely on multilateral solutions to pressing Middle Eastern crises, the EU and the US might be underestimating the spoiler role an enhanced Chinese political and security engagement in the region may imply. China’s siding with Russia on Syria gave a glimpse of what a stronger political involvement from Beijing could mean for regional dynamics. Many of the Middle Eastern crises have global reach and can only be tackled jointly by all the main players active in the region, including China. But whether and how Beijing wishes to play a stronger and more cooperative political role in the Middle East remains unclear.

About the author:

*Kerry Brown is professor at the University of Sydney and associate fellow at Chatham House.

Source:

This article was published by FRIDE as Policy Brief 190 (PDF)

This Policy Brief belongs to the project ‘Transitions and Geopolitics in the Arab World: links and implications for international actors’, led by FRIDE and HIVOS. We acknowledge the generous support of the Ministry of Foreign Affairs of Norway. For further information on this project, please contact: Kawa Hassan, Hivos (k.hassan@ hivos.nl) or Kristina Kausch, FRIDE (kkausch@ fride.org).