China Recalibrates Carbon-Trading Plan – Analysis

By RFA

By Michael Lelyveld

After years of anticipation, China plans to launch a nationwide carbon-trading system in November to help curb greenhouse gas emissions, but full implementation still faces further delays.

The official announcement of the new emissions market, also known as the “cap-and-trade program,” is expected in time for the next United Nations climate conference in Bonn, Germany starting Nov. 6, analysts said.

The program aims to manage carbon emissions by major energy users in eight key industrial sectors, the official English-language China Daily said, citing reports by the National Development and Reform Commission (NDRC) and the U.S.-based journal Scientific American.

According to the NDRC, China’s top planning agency, the system will cover companies with annual energy consumption of over 10,000 metric tons of standard coal in the petrochemical, chemical, building materials, iron and steel, nonferrous metals, paper, electricity and aviation sectors, China Daily said.

The establishment of a national system follows four years of cap-and-trade pilot programs in seven cities and provinces since 2013. So far, the programs have included over 2,000 companies in Beijing, Tianjin, Shanghai, Chongqing, Shenzhen and Hubei and Guangdong provinces, the paper said.

Cap-and-trade programs have the potential of accelerating efforts to reduce emissions by creating incentives for companies through assignment of carbon quotas that can be turned into tradeable credits if savings exceed pre-set limits.

Companies can exceed their quotas by buying credits, eventually establishing a market price for carbon emissions.

Carbon markets have been operating successfully in the European Union and the U.S. state of California, despite some problems in determining prices and emissions caps. In time, China’s national trading system could become the largest in the world.

The plan could help China meet its pledges to cut carbon emissions per unit of gross domestic product by 40-45 percent below 2005 levels by 2020 and reach peak emissions by around 2030.

Global warming impact

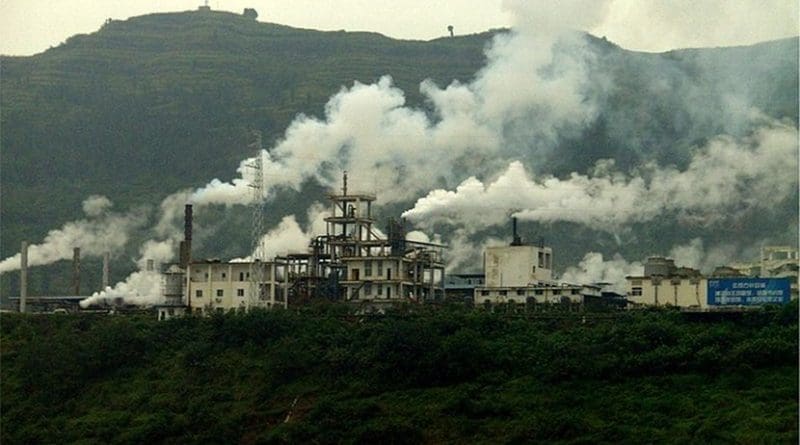

China’s reductions could have major consequences for global warming.

In 2015, China accounted for 10.357 billion metric tons of carbon dioxide (CO2) emissions, or 28.5 percent of the world’s total.

While China’s CO2 releases were 91 percent greater than those of the second-place United States, they remained 56 percent lower on a per capita basis, according to Global Carbon Atlas data.

But the significance of China’s potential step forward in curbing emissions has been hard to assess due to differences in reporting and the prospect of delays.

In 2014, the NDRC said it planned to launch the nationwide trading system in 2016, the U.N.-affiliated Climate Action Program reported at the time.

Startup plans have faced further delays this year.

In June, an unidentified “government researcher” told Reuters that the nationwide trading platform would begin in November at the “very earliest.”

The China Daily report on the startup also left out a long list of qualifying comments and details from the Scientific American article on which it was based.

“Details of China’s national system are still murky, but enough information has emerged that observers are skeptical it will be immediately comparable to existing programs, due to design features as well as the haste with which China is rolling it out,” the Scientific American article said.

Among the details, the platform will initially cover only three of China’s industries—electricity, aluminum and cement—rather than the eight sectors designated for trading.

“That’s due to a lack of good data on emissions and output from the rest of the sectors,” said Scientific American in its ClimateWire report.

The impact will still be significant because cement production accounts for “fully half” of China’s CO2 emissions, said Angel Hsu, an assistant professor at Yale-NUS College in Singapore, as quoted by Scientific American.

Elsewhere in the article, Scientific American stated that the new emissions market “will cover roughly a quarter of the country’s industrial CO2.”

The apparent difficulty in estimating the industries may be troubling for efforts to determine China’s total emissions and contribution to climate change.

“Concerns remain about the quality and opacity of China’s emissions reporting data,” the journal said.

Gaming the system

The delayed launch of the national system coincides with the government’s crackdown on environmental violations with harsher penalties for data falsification and fraud.

“Authorities are worried that unreliable data in some industrial sectors would undermine the integrity of the market and allow firms to game the system,” Reuters said.

Faulty estimates have already posed problems for some provincial pilot trading, according to a recent posting by Latham & Watkins LLP.

“Verifying emissions data has been an issue for regulators managing China’s eight pilot programs, with Hubei province recently delaying its compliance deadline due to problems verifying total emissions for 2016,” the London-based law firm said.

David Fridley, staff scientist for the China Energy Group at Lawrence Berkeley National Laboratory in California, said the national program is starting with emissions from the three industries that are easiest to measure.

“It’s enormously more complicated to get accurate emissions measurements for a diverse industry such as petrochemicals or chemicals, since each plant may have a different mix of processing equipment and a number of boundary issues … as well,” Fridley said.

The trading system is expected to run on a trial basis until 2020 while the other sectors are eventually brought in, Fridley said by email.

“I don’t think the slow start is significant since carbon trading wasn’t designed to be the main tool to achieve emissions reductions but as a way to discover a price for carbon, at least initially,” he said.

Like its EU and California counterparts, China’s platform may be seen as a work in progress for some time.

“No carbon-trading system in the world has actually resulted in significant emissions reductions yet,” Scientific American said. Instead, the programs have served to build consensus around climate policies, it said.

Estimates of how much carbon has been covered by China’s existing pilot programs are widely divergent.

The seven pilot markets include some 2,000 businesses with 1.2 billion tons of annual emissions, or nearly one-eighth of China’s total, according to a Fudan University economics professor cited by Scientific American.

As of May, total trading volume reached 160 million tons, said a report cited by China Daily. At the end of June, “aggregate carbon turnover” stood at 446 million tons, the Climate Action Program reported.

Based on the lower figure, pilot trading would affect only 1.5 percent of China’s emissions. The higher figure would cover about 4 percent.

“Whether China’s system will be any better than what California or the EU has, or if it will even succeed, is impossible to say before it even begins, so its ultimate contribution to China’s 2030 goals is unknown,” Fridley said.