Azerbaijan: Decline Of Oil Prices And Developments In Renewable Energy Sector – Analysis

By CCEE

By Hajar Huseynova*

After four years of relative stability at around 110 USD per barrel, crude oil prices have fallen dramatically over the past eighteen months. The ongoing decline in oil prices, and the certainty that they will not increase in the short term, have triggered discussions on the potential impact on Azerbaijan’s alternative and renewable energy (ARE) industry. Low oil prices have previously affected various countries around the globe; for example the collapse of oil prices in the 1980s led to the dismantling of renewable energy programs in many countries. A key question now is how long this decline will continue, and whether greater benefit lies in buying cheap oil or investing in renewable energy sector. However, there is not an established link between the decline of oil prices and the competitiveness of renewable energy. The only clear thing is that the decrease in the former will negatively affect investment in the latter.

In the case of Azerbaijan, the oil sector has played a major role in boosting Azerbaijan’s economic development over the last decade and its contribution to the GDP of the country has remained between 30-55 percent overall.

The declining oil prices definitely affects the country’s GDP, and the reduced investment opportunities raises questions about RE sector development. This brief provides an overview of renewable energy developments in Azerbaijan.

Analysis

Azerbaijan is known as an oil and gas country with extensive renewable energy potential. Wind, solar and hydropower in particular hold promising capacity. Technically feasible wind energy is equal to 2.4 billion kWh, and estimated solar energy output could reach around 16 billion kWh. In addition, the hydropower plants (HPP) are the country’s second largest electricity generators, with the potential to contribute up to 14.6 per cent of total national electricity output.

Changes in Azerbaijan renewable energy policy

In fact, prior to the tremendous decline in oil prices, the Azerbaijani government was focusing on the development of renewable energy potential. The first step was aimed at providing for domestic energy consumption.

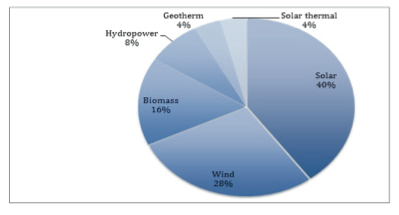

The turning point came in 2012, with the adoption of the state strategic devel- opment strategy for 2020. The huge RE potential in Azerbaijan was outlined, and the document set a goal for 2020: to achieving 20 percent of electricity generation and 9.7 percent of overall energy. Accordingly, the expected share of each RE sector within this 20 percent is 40 per cent solar, 28 per cent wind, 16 percent solid waste and biomass, 8 percent hydropower and 4 percent for geothermal and solar thermal each. (Figure 1).

Despite the drop in oil prices, the government has continued to support the further development of the RE sector in order to achieve the 2020 goals. In his speech in August 2015, President Aliyev once again highlighted the necessity of diversification.

The diversification of domestic energy consumption and development of renewable energy potential is aimed at achieving two goals:

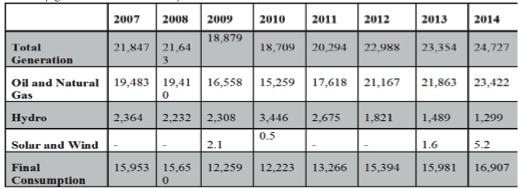

The first goal is to increase the contribution of renewable energy domestic electric consumption. In 2014, there were gradual improvements in this regard. Overall electricity consumption constituted 16,907 mln kWh; solar and wind energy provided 5.2 mln kWh electricity and the overall share of renewable energy (hydro, solar and wind) in the grid system was increased to 5.2 per cent. In comparison with two years earlier, the contributions of solar and wind energy have increased, but at the same time the share of HPPs has decreased. (Table 1)

However, according to an SSC (State Statistic Committee of Azerbaijan) report the renewables’ share in the energy market has dropped, and constituted less than one percent in October 2015.

This decline shows the vulnerability of the renewable sector in Azerbaijan, as a recently developed energy sector. The slow progress towards the first goal is the result of multiple problems, including technical issues and partly the lack of an institutional regulatory framework to support renewable energy.

The government has launched some reform plans for the electricity sector, for instance, with Azernerji JSC, a state owned energy sector leader.

In early 2015, a new company (Azerishiq OJSC) was created to sell power and maintenance activities. This demonstrates the need to improve the institutional capacity of the structures that are dealing with the renewable energy issues.

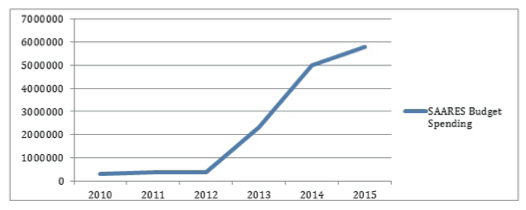

The second goal has two dimensions. The first is structural change. One of the achievements in this regard was the establishment of The State Agency on Alternative and Renewable Energy Sources (SAARES) in 2009 to drive development and change public attitudes to RE in Azerbaijan. One issue was that during the first three years, its budget was only included administrative costs (Figure 2); however as of 2013 the agency also has a budget for implementing projects in the ARE sector.

As Figure 2 demonstrates, the budget is growing annually and was approximately 6 million AZN in 2015. Along with internal institutional optimization, Azerbaijan also implements RE projects internally as well as in cooperation with its neighboring countries. The new wind energy plant in Yeni Yashma and a small HPP in Shaki in cooperation with the EU, UNDP, Norwegian government and SAARES are examples of SAARES’ projects. Additionally, according to SAARES, a 50 megawatt capacity wind plant will be connected to the grid system in 2015.

The other dimension is increasing investment in the renewable sector. Despite SAARES’ increased budget, the decline in oil prices means that the Azerbaijani government’s main focus is gaining foreign investment and/or increasing cooperation at the regional and international levels in order to develop renewable energy sector. Last year, notably, Azerbaijan started negotiations with its Iran, Turkey and Georgia on the cooperation of ARE projects. Additionally, Azerbaijan intends to collaborate with Serbia, Portugal and Germany in the RE sector.

Azerbaijan and Iran established a working group in July 2015, aimed at the implementation of joint renewable energy projects, information and experience sharing between the two countries, and jointly attracting investors. The main focus is on developing joint geothermal energy, wind and hydropower plants. Currently, Azalternativenerji LLC is about to establish wind turbines in Khaf, Iran. The cooperation between Azerbaijan and Iran on ARE started in November 2014. Given that the countries are mainly planning to collaborate on hydropower and geothermal energy, the MoU also covers the management of transboundary river banks.

Additionally, Azalternativenerji LLC, the Azerbaijan state company under the auspices of SAARES, signed a three-year long MoU with Turkish oil company Turcas Petrol in July 2015 on developing joint ARE projects in both countries. The cooperation is focused on solar, wind and geothermal energy sources, intended to contribute to the energy supply security of both countries. Discussions of RE collaboration with Georgia are also ongoing. Recently, the chairman of SAARES, Akim Badalov visited Georgia and met with the Energy Minister of Georgia. During the meeting, potential cooperation areas such as establishment of hydropower and hybrid power plants were discussed. The establishment of a bilateral working group on the alternative energy sector is anticipated.

These various bilateral and multilateral negotiations alongside the continued levels of investment in renewable energy indicates that the development of the RE sector remains a key priority. But in the short term, the indicator of success will be whether the government allocates more space in the budget for investment, and also how successful Baku is in attracting foreign investment to this sector. The impact of structural changes on the domestic energy market will be another indicator.

Conclusion

To conclude, considering the intermittent character and vulnerability of renewable energy sources, together with the established position of fossil fuels in the domestic energy market, the decline in oil prices has had relatively little impact on this sector. Moreover, fluctuations in oil prices once again highlight the importance of non-conventional energy sources, both in fossil-fuel rich and energy dependent countries.

Therefore, the implementation of RE projects and cooperation with other countries is a positive sign in terms of RE sector development in Azerbaijan. However, while there is official state interest in developing the RE sector – demonstrated by, inter alia, increasing the SAARES budget for implementing ARE related projects, there remain obstacles. These include the established position of conventional electricity generation in Azerbaijan, low returns on investment in renewables, weak promotion of renewables in the country, lack of clear regulations for renewables, and the absence of a smart grid system. All these factors provide for challenging market conditions for renewables. Thus in order to ensure development, ways forward include: additional financial support through FDIs and development organizations, local market optimization to boost investment in RE, establishment of clear regulations for a smart grid system, and awareness raising.

About the author:

*Ms. Hajar Huseynova, Research Assistant specializing in Renewable Energy and Environmental issues at the Caspian Center for Energy and Environment of ADA University.

Source:

This article was published by CCEE as Policy Brief Series 20 (PDF)