California Begins 2016 With Supply Disruptions And Higher Prices – Analysis

By EIA

As 2016 begins, California is the only gasoline market in the United States now experiencing increasing prices and higher prices than at the same time last year. The California average regular gasoline retail price increased 22 cents per gallon (gal) over the past three weeks, and was $2.88 per gallon on January 4, 2016, 85 cents/gal higher than the U.S. average, and 20 cents/gal higher than at the same time last year. California’s fuel supply problems date back to an extended outage at ExxonMobil’s Torrance, California refinery that began in February 2015. The recent increase in prices follows a series of additional refinery outages throughout the West Coast, resulting in falling gasoline stock levels and the need to import gasoline from distant sources that require higher prices and longer transit times.

Petroleum Administration for Defense District (PADD) 5 (West Coast) is relatively isolated from other U.S. markets and located far from international sources of supply, so the region depends on in-region production to meet demand. Unplanned refinery outages can have noticeable effects on liquid fuel markets, disrupting supplies of gasoline and distillate, particularly in regions that are tightly balanced, such as California. While refineries make arrangements for alternative sources of supply during periods of planned maintenance to ensure that supply obligations are met, it sometimes takes days or weeks for markets to adjust to the sudden loss of production when an unexpected outage occurs. As a result, unplanned outages often result in a reduction in supply that causes prices to increase, sometimes significantly. The severity and duration of these price spikes depend on how quickly the refinery problem can be resolved and how soon supply from alternative sources can reach the affected market.

Prior to the start of the new year, a combination of planned seasonal refinery turnarounds and several unplanned refinery outages—mostly of gasoline production units in California and Washington—reduced refinery utilization. Trade press reports indicated that unplanned outages occurred on the fluid catalytic cracking units (FCC), which are primarily used to make gasoline, at Tesoro’s Carson and Wilmington refineries in Southern California. The capacity of those two units, combined with that of the already offline FCC unit at the Torrance refinery equals 204,920 b/d of FCC capacity potentially offline, more than 131,000 b/d above the maximum realized unplanned outages during the month of December in PADD 5 from 2005 through 2014.

In addition, trade press reports also indicated that unplanned outages occurred at Tesoro’s Anacortes refinery and Phillips 66 Ferndale refinery in northwest Washington. These and other unplanned outages occurred at the same time as regional refineries typically take units out of service to perform seasonal maintenance, leading to a significant reduction in refinery utilization. From the week ending November 27 to the week ending December 25, PADD 5 refinery utilization rates fell from 88.8% to 82.1%. Trade press reports also indicate that the late-November fire at Petróleos Mexicanos’s (Pemex) Salina Cruz refinery in Mexico prompted Pemex to purchase supplies from PADD 5 refineries, resulting in increased exports from PADD 5 to Mexico and further tightening supplies available to domestic customers.

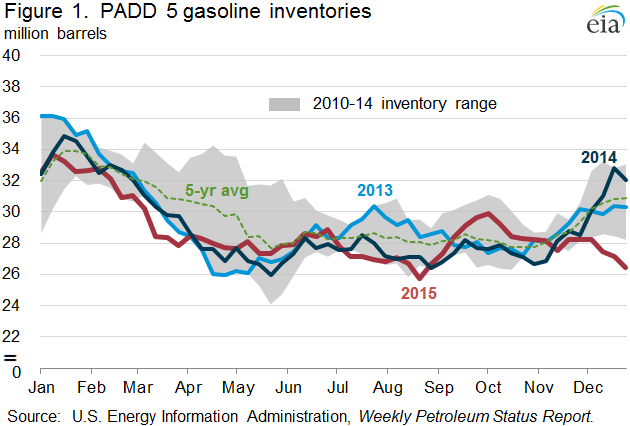

Falling refinery utilization and gasoline production led to significant inventory drawdowns for that time of year. From the week ending November 27 to the week ending December 25, PADD 5 total motor gasoline stocks typically have built 2.1 million barrels, based on the averages, for those weeks over the past five years. However, with the production outages noted above, inventories fell a total of 1.8 million barrels during that period in 2015, resulting in PADD 5 inventories 4.5 million barrels below the five-year average for the week ending December 25 (Figure 1).

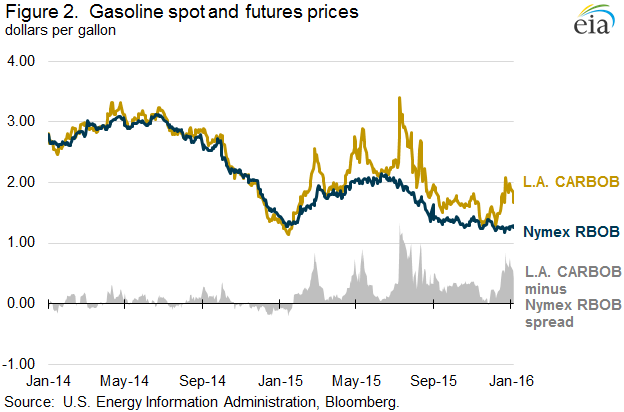

Refinery outages limiting production and falling gasoline inventories have tightened West Coast gasoline markets, particularly in California, where wholesale and retail gasoline prices have increased in recent weeks. The wholesale price in Los Angeles (LA) for California Reformulated Blendstock for Oxygenate Blending (CARBOB) grade gasoline was $2.08/gal on December 23, an 84-cent/gal premium over the New York Mercantile Exchange (Nymex) Reformulated Blendstock for Oxygenate Blending (RBOB) front month futures contract, a standard pricing basis for gasoline, the highest ever premium in December. During the last two weeks of December LA CARBOB prices averaged $1.89/gal, and averaged a 65-cent/gal premium over Nymex RBOB (Figure 2). Higher wholesale prices have been passed through to retail prices.

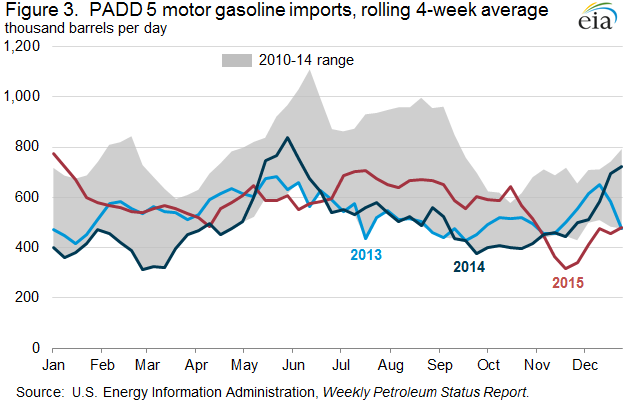

Because PADD 5 is relatively isolated from other markets, after in-regional refinery production and inventories, additional supply will likely have to be imported from distant sources, requiring higher wholesale prices for an extended period. With transport times from supply sources to California estimated to be from 15 days to more than 30 days, persistent price spreads are needed to encourage import flows. Before December, the price spread between LA CARBOB and Nymex RBOB was volatile, ranging from a premium of 37 cents/gal on November 2 to a one-cent discount on November 27. Such volatile price spreads discouraged gasoline imports into the West Coast, with PADD 5’s rolling four-week average gasoline imports falling from 66,000 barrels per day (b/d) for the week ending October 30, to 36,000 b/d for the week ending November 20 (Figure 3). As LA CARBOB prices averaged a 40 cent/gal premium over Nymex RBOB in December, imports are likely now en route.

In addition, the seasonal change in gasoline specifications from higher Reid Vapor Pressure (RVP) winter gasoline to lower-RVP summer gasoline may further complicate supply availability. California pipelines require the RVP of gasoline shipped on their systems to transition from the December-January specification of 15 pounds per square inch (psi) to 13.5 psi in February and March. Refineries typically produce and begin to stock the lower-RVP gasoline one to two months in advance of a specification change, depending on distribution throughput. As refineries return from outages and turnarounds in the coming weeks they will likely be producing the lower-RVP gasoline.

U.S. average retail regular gasoline and diesel fuel prices decrease

The U.S. average regular gasoline retail price decreased less than a penny to remain $2.03 per gallon on January 4, 2016, down 19 cents from the same time last year. The West Coast price was the only increase, up three cents to $2.66 per gallon. The East Coast price decreased two cents to $2.00 per gallon. The Midwest, Gulf Coast, and Rocky Mountain prices each fell one cent to $1.86 per gallon, $1.75 per gallon, and $1.96 per gallon, respectively.

The U.S. average diesel fuel price decreased two cents to $2.21 per gallon, down 93 cents from the same time last year. The Rocky Mountain price decreased four cents to $2.19 per gallon. The Midwest and Gulf Coast prices each fell three cents to $2.13 per gallon and $2.11 per gallon, respectively. The East Coast price was down two cents to $2.26 per gallon. The West Coast price fell less than a penny to remain $2.46 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 1.4 million barrels last week to 96.3 million barrels as of January 1, 2016, 20.7 million barrels (27.4%) higher than a year ago. Midwest inventories decreased by 0.6 million barrels while Rocky Mountain/West Coast and Gulf Coast inventories each decreased by 0.4 million barrels. East Coast inventories dropped modestly, remaining essentially unchanged. Propylene non-fuel-use inventories represented 3.3% of total propane inventories.

Residential heating fuel prices increase

As of January 4, 2016, residential heating oil prices averaged $2.18 per gallon, almost 1 cent per gallon higher than last week and 79 cents lower than one year ago. The average wholesale heating oil price this week is just shy of $1.19 per gallon, 3 cents higher than last week and nearly 73 cents per gallon lower than a year ago.

Residential propane prices averaged $2.00 per gallon, almost 1 cent per gallon more than last week’s price and nearly 36 cents lower than one year ago. Wholesale propane prices averaged nearly 48 cents per gallon, almost 3 cents per gallon higher than last week and 11 cents lower than last year’s price for the same week.