US Economy Adds 201,000 Jobs In August, Unemployment Steady At 3.9 Percent – Analysis

By Dean Baker

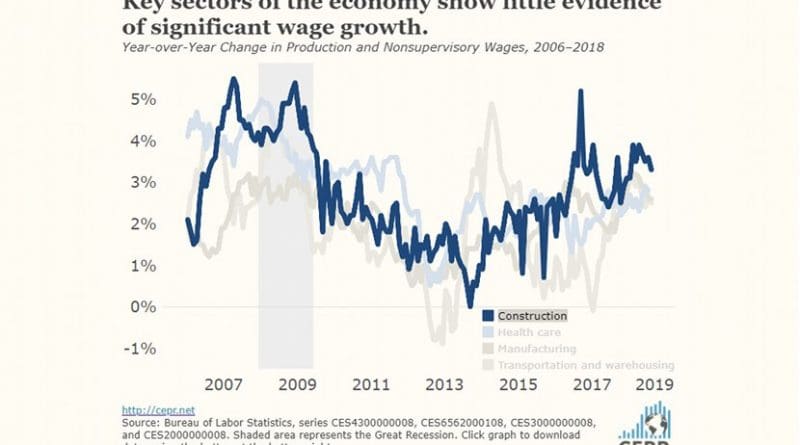

There is some evidence of accelerating wage growth in the August report.

The Bureau of Labor Statistics reported the economy added 201,000 jobs in August; although downward revisions of 50,000 to the prior two months’ data brought the three-month average to 185,000. The unemployment rate remained at 3.9 percent, but the overall employment-to-population (EPOP) fell by 0.2 percentage points to 60.3 percent.

This 0.2 percentage point drop also showed up for prime-age workers (ages 25 to 54), although the EPOP for prime-age workers is still 0.9 percentage points above its year-ago level. For men, the year-over-year increase is 1.1 percentage points, while for women it is 0.8 percent. In both cases, EPOPs remain below prerecession peaks and well below the peaks hit in 2000.

Perhaps the most encouraging news in the report is evidence of a modest acceleration in wage growth. The average hourly wage increased by 2.9 percent over the last year. That compares to a 2.7 percent year-over-year rise in July, but it is too early to assume a clear trend. The year-over-year increase was 2.8 percent in July of 2016. The rate of increase, taking the average of the last three months compared with the prior three months, is slightly more rapid at 3.06 percent.

Interestingly, the pay gains are not especially strong in areas where employers have been complaining about labor shortages. The average hourly wage in construction was up 3.3 percent over the last year, but the gain was 3.5 percent back in September of 2016. Wages in manufacturing have risen by just 1.8 percent over the last year.

The hourly wage in leisure and hospitality (largely restaurants) has risen by 3.2 percent over the last year. This compares to increases of over 4.0 percent in the second half of 2016.

The job gains in the establishment survey were concentrated in a small number of sectors. Health care added 33,200 jobs, slightly more than its average of 25,100 over the last year. Professional and technical services added 27,600 jobs, while construction added 23,000. Restaurants added 17,500 jobs, almost exactly in line with its 17,800 average over the last year. Retail lost 5,900 jobs, but employment is still 62,000 above its year-ago level.

After increasing for 12 consecutive months, manufacturing employment fell by 3,000 in August. The decline was all in manufacturing of durables, which lost 4,000 jobs. Employment in non-durable manufacturing rose by 1,000. The auto industry was the biggest loser, giving up 4,900 jobs after losing 3,500 jobs in July.

The weakness also shows up in the index of hours, which dropped 0.3 percent for durable manufacturing in August. The manufacturing one-month employment diffusion index, which shows the percentage of employers intending to add workers, also weakened in August. It stands at 52.6 percent, the lowest reading since January of 2017 when it stood at 50.0 percent, down from a high of 72.4 percent in February. While it is too early to determine if the Trump administration’s trade policy accounts for this weakness, it seems clear that the policy is not showing obvious benefits.

Most of the news in the household survey was positive. The duration measures of unemployment all fell in August. The percentage of unemployment due to voluntary quits rose to 14.0 percent, a new high for the recovery. The number of people involuntarily working part-time fell by 188,000 to a new low for the recovery, while the number of people choosing to work part-time rose by 249,000 to a new high for the recovery.

One somewhat disturbing item in the household survey is a drop in the employment rate of black teens by 3.8 percentage points to 20.3 percent, the lowest since June of 2016. These data are highly erratic, but this is still a large decline.

The overall picture in the August jobs report is overwhelmingly positive. The economy continues to create jobs at a very healthy pace, and there is some modest evidence that wage growth may be accelerating so that wages at least slightly outpace the rate of inflation. The one noteworthy negative in this report is the evidence of weakness in the manufacturing sector. This could indicate that the Trump administration’s trade policy is backfiring.