US CPI Rises 0.2 Percent In February, Core Up 1.8 Percent Over Last Year – Analysis

By Dean Baker

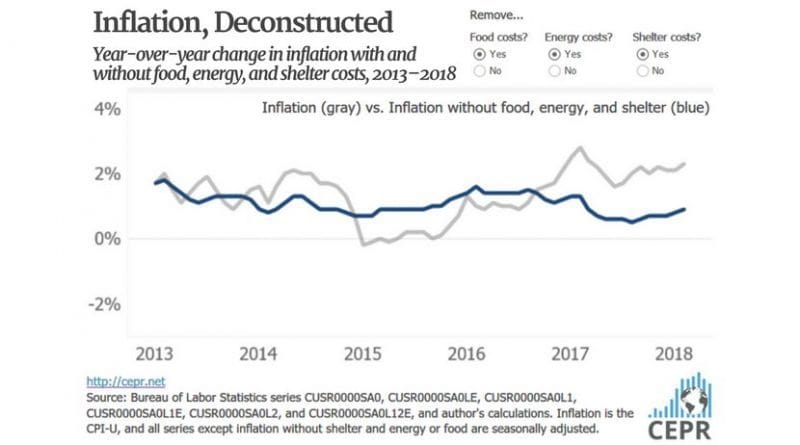

The big jump in the price of energy commodities in January was partially reversed in February with a 0.9 percent drop. This brought the overall inflation rate for the month to 0.2 percent, the same as the core rate in January. Over the last year, the overall CPI has risen by 2.2 percent, while the core rate has risen by 1.8 percent.

However, even this core rate is deceptive since rising rents continue to be an overwhelming factor. Excluding shelter, the core rate is up just 0.9 percent over the last year. There is zero evidence of any acceleration in this rate over the last year.

Housing inflation is, of course, driven primarily by a limited supply of housing. This has a different dynamic than inflation in other sectors. If the Federal Reserve raises interest rates, the near term effect is to reduce construction, possibly making the housing shortage worse and leading to higher inflation in the sector.

Inflation in most items continues to be well under control. Medical care commodity prices have risen by 1.6 percent over the last year. Prescription drugs prices, which are the bulk of this index, fell 0.4 percent in February, the second consecutive monthly decline. Medical care services were flat in February after a 0.6 percent jump in January. They are up 1.8 percent over the last year.

College tuition costs also remain under control. They were unchanged in February and are up 2.0 percent over the last year. Car insurance continues to be a major problem area. The cost rose 1.7 percent in February and is up 9.7 percent over the last year. Since the weight of this index in the overall CPI is 2.4 percent, the inflation in this category along adds almost 0.3 percentage points to the core inflation rate.

Both new and used vehicle prices fell in January, falling 0.5 percent and 0.3 percent, respectively. The latter’s drop follows four consecutive monthly increases, which was likely the result of increased demand due to the destruction of cars by the summer hurricanes. Over the last year, new vehicle prices are down 1.5 percent, while used vehicle prices are down 0.1 percent.

Apparel prices had another large jump in February, rising 1.5 percent after a 1.7 percent rise in January. Apparel prices are always erratic so it is likely that these increases will be reversed, in part or in whole, in coming months. Over the last year, they are up 0.4 percent.

There is nothing in this report to suggest that inflation is accelerating in spite of the low rate of unemployment and the rapid pace of job creation. This raises the question of why the Fed should be looking to raise interest rates when inflation remains well below its target rate.