Jump In US Gas Prices Raises Inflation In August, Core Rate Remains Stable – Analysis

By Dean Baker

An increase in world oil prices led to a 6.3 percent jump in gas prices in August. This increase pushed the overall Consumer Price Index (CPI) up by 0.4 percent for the month, bringing the year-over-year increase to 1.9 percent. The core index, which excludes food and energy, rose 0.2 percent, putting the year-over-year increase in the core at 1.7 percent.

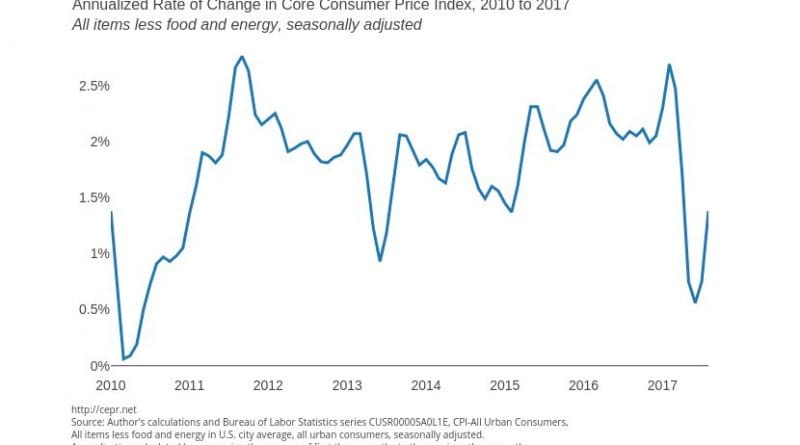

The core rate continues to show no evidence of accelerating. The annualized rate from taking the average price level over the last three months (June, July, and August) compared with the prior three months (March, April, and May) is just 1.4 percent.

Furthermore even this inflation is driven largely by shelter costs. If shelter costs are excluded from the core index, the annualized rate of inflation over the last three months compared to the prior three months is 0.2 percent. That compares to an increase of 0.5 percent in this measure over the last year.

While there had been some indication that rental inflation was slowing in recent months, the August data show higher inflation in both rent proper and owners’ equivalent rent. The former increased by 0.4 percent in August, bringing the increase over the last year to 3.9 percent. Owners’ equivalent rent rose by 0.3 percent in August for a year-over-year increase of 3.3 percent. The gap in the two measures is attributable to the fact that rent proper includes utilities in many cases, whereas owners’ equivalent only measures the cost of the unit itself.

There were some anomalies in the August data, but they were largely offsetting. The price of car insurance (which has a 2.6 percent weight in the index) rose by 1.0 percent. While the 1.0 percent rise is unusual, higher prices for car insurance have been an ongoing problem. Inflation in this component over the last year has been 8.1 percent, up from 6.5 percent the prior year, and 5.4 percent from August 2014 to August 2015.

Car insurance affects the overall inflation rate far more than college tuition, which only has a 1.8 percent weight in the index. These costs appear to be well under control, falling by 0.3 percent, bringing the year-over-year increase to 1.9 percent.

The other major anomaly was a 1.0 percent drop in airfares. These are down by 3.2 percent over the last year.

Inflation seems well-contained in other sectors. The price of medical care commodities fell by 0.1 percent after rising by 1.7 percent over the prior two months. Over the last year they are up by 2.4 percent. Medical care services rose by 0.2 percent in August, making the increase over the last year 1.6 percent.

New car prices were flat in August, while used car prices fell by 0.2 percent. Over the last year these prices are down 0.7 percent and 3.8 percent, respectively. The price of wireless telephone services, which the Fed had recently cited as anomalous factor temporarily depressing the rate of inflation, fell by 0.1 percent in August. It is down by 13.2 percent over the last year.

There is also no evidence of any acceleration of inflation at earlier stages of production. The overall final demand index in the Producer Price Index rose 0.2 percent in August, as did the core index. Over the last year, these indices have risen by 2.4 percent and 1.9 percent, respectively. The intermediate demand index is up 2.6 percent over the last year, but that is less than the 2.8 and 2.9 percent year-over-year increases reported for May and June, respectively.

In short, there is very little information in the August price reports that provides any indication of accelerating inflation. Education and health care costs, the components that have generally been major drivers of higher prices, both seem well under control. Auto insurance seems to have replaced these two as a major problem sector.

The biggest source of higher prices remains rising rents. This may be contained if construction continues at its current pace, reducing demand pressures in major markets. However rental prices do not follow the same pattern as most other components in the CPI and inflation in this sector is not easily addressed by higher interest rates.