US Inflation Still Modest In October, Continues To Be Driven By Rent – Analysis

By Dean Baker

The US inflation rate in the Consumer Price Index (CPI) fell to 0.1 percent in October after an energy driven 0.5 percent rise in September. That increase was largely the result of temporary shortages due to Hurricane Harvey shutting down refineries in Texas. With these refineries coming back online, the price of gas fell by 2.4 percent, partially reversing the 13.1 percent jump in September.

The core inflation in October was 0.2 percent, bringing its increase over the last year to 1.8 percent. The annualized rate comparing the last three months (August, September, October) with the prior three months (May, June, July) has been a slightly more rapid 2.1 percent, although this is not much of an acceleration.

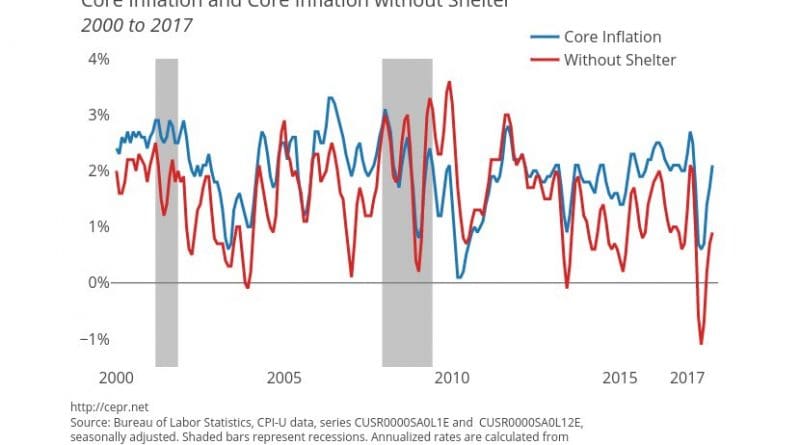

It remains the case that rent is the main source of the core inflation. Rent proper increased by 0.3 percent in October and is up 3.7 percent for the last year. Owners’ equivalent rent has risen by 0.3 percent and is up 3.2 percent for the last year. The main reason for the difference is that the rent proper index often includes utilities, which have risen more rapidly in price than rent itself. A core CPI, that excludes rent, rose just 0.1 percent in October and is up 0.7 percent over the last year.

There were few surprises in this month’s data. The drop in gas prices was predictable as refineries came back online. There is likely to be a somewhat further decline in November, although a rise in world oil prices since the summer may mean that some of the increase sticks.

One other area likely seeing a hurricane effect is used car prices. These jumped 0.7 percent in October, although they are still down by 2.9 percent over the last year. This can be explained by people who had their cars destroyed by the flooding and are looking to replace them. There was no noticeable effect on new car prices, which fell 0.2 percent in October and are down 1.4 percent over the last year.

Inflation in the historic problem areas of medical care and education continues to be under control. Both the medical care and education indices rose by 0.3 percent in October. In the case of medical care, this followed a decline of 0.1 percent in September, bringing the rate of increase over the last year to just 1.7 percent. Within health care, hospital services are a problem, rising 0.5 percent in October and 4.9 percent over the last year.

The October rise was the second consecutive 0.3 percent rise in the education index, although it did fall by 0.1 percent in August. Over the last year, it is up by 2.1 percent.

One important area where inflation slowed in October was auto insurance. Prices rose by just 0.1 percent in October. Even with this figure, prices are up 8.2 percent over the last year. This component accounts for 2.56 percent of the overall index and 3.25 percent of the core CPI.

Another area driving core inflation is tobacco prices. These rose 1.6 percent in October and have risen by 7.6 percent over the last year. This is deliberate policy as states continue to increase tobacco taxes to raise revenue and discourage smoking. This component accounts for 0.68 percent of the overall CPI and 0.87 percent of the core index.

The producer price indices also show little evidence of accelerating inflation. The overall final demand index rose 0.4 percent in October, but this was driven by a 1.1 percent jump in the trade index. The core index rose by just 0.2 percent and is up 2.3 percent over the last year.

The overall price picture in October remains little changed. Inflation is very much under control, with no real evidence of acceleration. The one major problem area is rents. While there had been some weak evidence of slowing rental increases in the summer, now that’s not the case. Apart from rents, inflation shows no evidence of acceleration whatsoever, in spite of the low unemployment rate.