Trump-Abe Convergence To Make America Great: India To Gain From Synergy – OpEd

A new era of US-Japan relations will emerge under the Trump Presidency of USA. Economic dynamism between the two nations will shift more to bilateral, instead of a multilateral mode. Bilateral bondage will be the prime challenge for the Trump Administration to bring Japan in its fold. Trump’s main target is to make America Great and create more job opportunities for Americans, instead of wielding global political power through TPP (Trans-Pacific-Partnership).

Japan is a key ally for the USA and it was playing an important role to drive Obama’s Asia pivot policy. The main aim was to counter China’s hegemony in Asia. But, as Trump’s period begins, a turnaround in the Asia pivot policy is visible. Uncertainty looms with regard to the relations between the two countries with Trump being “unfriendly toward Japan,” according to The New Yorker. In his election campaign, Trump threatened to quash the fifty-six year old US security alliance with Japan. He said, “ You know we have a treaty with Japan, where if Japan is attacked we have to use the full force and might of United States”. But, “ If we are attacked, Japan does not have to do anything. They can sit home and watch Sony television.”

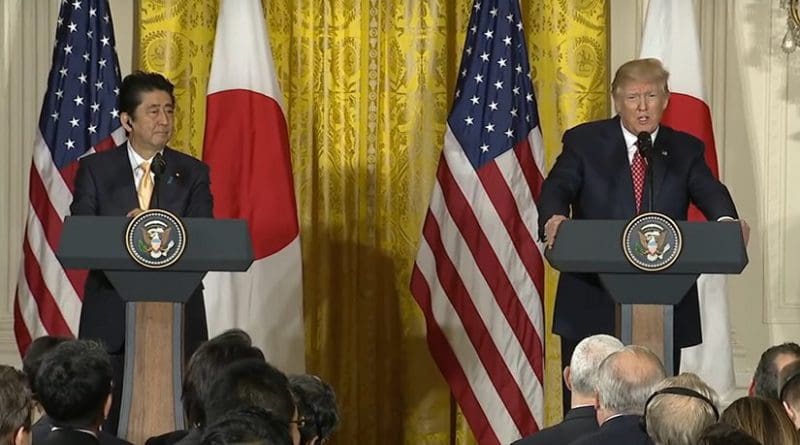

The situation has changed with the timely visit of Japanese Prime Minister Shinzo Abe to USA. Aanalysts said that his golf game with Trump mitigated the US President to spew ire and has helped to foster a personal relation with Trump, which eventually helped in molding his anemic postures towards US-Japan relations.

Historically, whenever the relations between the USA and Japan were stuck, Japan conceded more advantages to the USA as damage control measures. The Japan-US Textile Agreement in 1970 and the auto war in the 1980s were the precedence for settling the disputes between the two nations. In the wake of Trump’s nailing Japan for currency manipulation and cheap imports leading to American job extortion, the Abe Administration has been pushing Japanese companies to invest in USA. Prime Minister Shinzo Abe personally met the Chief Executive of Toyota to declare an investment of US $10 billion in the USA after the meeting, according to Financial Times. Ironically, this is in contradiction when at the same time Japan is vigorously propagating its “Invest In Japan” campaign to set off its hollow investment turf.

Given the past situations when Japan concedes more to USA, there are two outcomes that are benign to India. First, letting TPP go dormant with the USA exiting is viewed as a resurrection of India’s lost hopes for trade with the USA and luring Japanese investment in India and second, opening the eyes for Indian IT software to diversify their market from over-dependence on the USA to Japan for their survival.

Threats were looming large over India’s global trade, since the lead countries to accelerate India’s global trade are members of TPP. These countries are USA (no longer in the TPP), Singapore, Malaysia and Vietnam. Together these four countries account for one-fifth of India’s world exports. Analysts are spooked by threats of trade and investment diversion, due to preferential tariffs in the intra-region trade in TPP.

The biggest trade diversion would have been in India’s textile exports. Textile is the single major item of India’s exports, with the USA accounting for 40 percent of India’s total export of textiles. With duty preferences provided to TPP members in USA market, Vietnam would have been the main competitor to India’s export of textile to USA.

Vietnam is the second biggest exporter of ready-made garments to the USA (after China). It accounts for 12 percent of USA imports of garment. The spur in Vietnam competitiveness due to duty preference would have debilitated India’s export of garments and other textile products to the USA.

The dumping of TPP will be a shot in the arm to RCEP (Regional Cooperation of Economic Partnership). RCEP is a trade block of 16 countries – ASEAN +6 ( China, Japan, S. Korea, Australia, New Zealand and India). RCEP will be more stronger for intra-regional trade and investment, with the depletion of trade and investment diversion opportunities in TPP.

India is a member of RCEP. There are two important benefits to India. First, given RCEP becoming more stronger, it will supplement the strength of India’s FTA with ASEAN. So far, India-ASEAN FTA in goods could not make much headway in India’s export to ASEAN .

Second, a stronger RCEP will lure Japanese investors to invest in India. Japan is the third biggest foreign direct investor in India. The truth of the matter is that Japan is the second biggest investor in India after Singapore, if investment from Mauritius is excluded. FDI from Mauritius are mainly by foreign companies, other than Mauritius origin, because of tax heaven benefits. The spur in the Japanese investment in India is conspicuous, with continuous upswing since last three years. Now RCEP, which will provide a bigger market, with a special advantage of India having big domestic market, will leverage Japanese investment in India.

Trump’s outrage against outsourcing cheap human resources and warning to restrict HI B Visa policy will dampen India’s IT software market. Currently, India accounts for almost 85 percent of HI B Visa quota. Interestingly, while the USA will take protectionist measures to outsourcing of cheap foreign workers, Japan is to set off the losses. It is contemplating to liberalize immigration policy to attract more foreign investment in Japan. Japan is considering to introduce Green Card norm for highly skilled personnel. Japan can prove green-pastures for the new Indian IT software market. Today, Japan accounts for merely 2 per cent of India’s IT software world market t. The main competitors are China and Vietnam. Language is the main barrier. But, the barrier is abating with the growing Japanese investment in India. Introduction of Green card will spin off new opportunities for Indian IT software to enter Japanese market.

It is paradoxical that Japan’s conceding more to the US’ basket of advantages will prove a windfall to India.

( Views are personal)