Bankers Cheer As IMF Head Faces Sexual Assault Charges – OpEd

By Mike Whitney

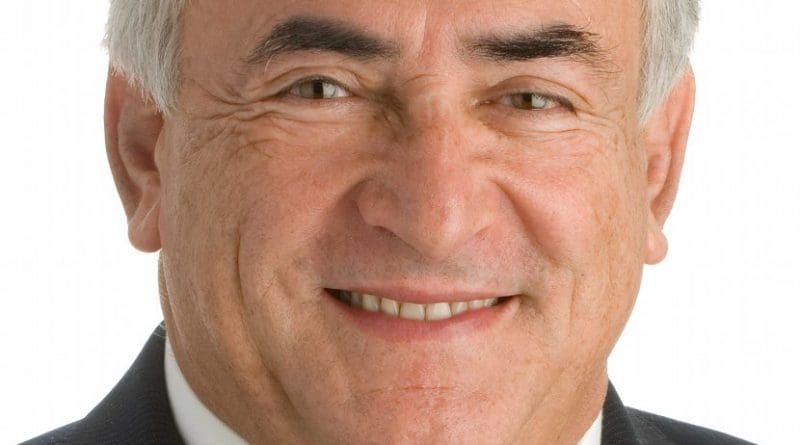

Dominique Strauss-Kahn is effectively finished as a political force, even if he doesn’t draw a guilty verdict in New York, where a 32-year-old maid says she was attacked and forced to perform oral sex on him.

He’s finished as IMF chief and his candidacy against Sarkozy also looks to be in ruins.

The IMF chief certainly has enemies in high places who will be cheering his predicament. He had recently broke-free from the “party line” and was changing the direction of the IMF. His road to Damascus conversion was championed by progressive economist Joesph Stiglitz in a recent article titled “The IMF’s Switch in Time”. Here’s an excerpt:

“The annual spring meeting of the International Monetary Fund was notable in marking the Fund’s effort to distance itself from its own long-standing tenets on capital controls and labor-market flexibility. It appears that a new IMF has gradually, and cautiously, emerged under the leadership of Dominique Strauss-Kahn.

Slightly more than 13 years earlier, at the IMF’s Hong Kong meeting in 1997, the Fund had attempted to amend its charter in order to gain more leeway to push countries towards capital-market liberalization. The timing could not have been worse: the East Asia crisis was just brewing – a crisis that was largely the result of capital-market liberalization in a region that, given its high savings rate, had no need for it.

That push had been advocated by Western financial markets – and the Western finance ministries that serve them so loyally. Financial deregulation in the United States was a prime cause of the global crisis that erupted in 2008, and financial and capital-market liberalization elsewhere helped spread that “made in the USA” trauma around the world….The crisis showed that free and unfettered markets are neither efficient nor stable.” (“The IMF’s Switch in Time”, Joseph Stiglitz, Project Syndicate)

So, Strauss-Kahn was trying to move the bank in a more positive direction, a direction that didn’t require that countries leave their economies open to the ravages of foreign capital that moves in swiftly–pushing up prices and creating bubbles–and departs just as fast, leaving behind the scourge of high unemployment, plunging demand, hobbled industries, and deep recession.

Strauss-Kahn had set out on a “kinder and gentler” path, one that would not force foreign leaders to privatize their state-owned industries or crush their labor unions. Naturally, his actions were not warmly received by the bankers and corporatists who look to the IMF to provide legitimacy to their ongoing plunder of the rest of the world. These are the people who think that the current policies are “just fine” because they produce the results they’re looking for, which is bigger profits for themselves and deeper poverty for everyone else.

Here’s Stiglitz again:

“Strauss-Kahn is proving himself a sagacious leader of the IMF…. As Strauss-Kahn concluded in his speech to the Brookings Institution shortly before the Fund’s recent meeting: ‘Ultimately, employment and equity are building blocks of economic stability and prosperity, of political stability and peace. This goes to the heart of the IMF’s mandate. It must be placed at the heart of the policy agenda.’

Right. So, now the IMF is going to be an agent for the redistribution of wealth…. (for) ‘strengthening collective bargaining, restructuring mortgages, restructuring tax and spending policies to stimulate the economy now through long-term investments, and implementing social policies that ensure opportunity for all’”? (according to Stiglitz)

Good luck with that.

Check this out from World Campaign and judge for yourself whether Strauss-Kahn had become a “liability” that had to be eliminated so the business of extracting wealth from the poorest people on earth could continue apace:

“For decades, the International Monetary Fund (IMF) has been associated among anti-poverty, hunger and development activists as the poster child of everything wrong with the rich world’s fiscal management of the rest of the world, particularly of poor nations, with its seemingly one-dimensional focus on belt-tightening fiscal policies as the price of its loans, and a trickle-down economic philosophy that has helped traditional wealthy elites maintain the status quo while the majority stayed poor and powerless. With a world increasingly in revolution because of such realities, and after the global financial crisis in the wake of regulatory and other policies that had worked after the Great Depression being largely abandoned, IMF managing director Dominique Strauss-Kahn has made nothing less than stunning observations about how the IMF and the world need to change policies.

“In an article today in the Washington Post, Howard Schneider writes that after the 2008 crash led toward regulation again of financial companies and government involvement in the economy, for Strauss-Khan ‘the job is only half done, as he has been leading the fund through a fundamental rethinking of its economic theory. In recent remarks, he has provided a broad summary of the conclusions: State regulation of markets needs to be more extensive; global policies need to create a more even distribution of income; central banks need to do more to prevent lending and asset prices from expanding too fast. ‘The pendulum will swing from the market to the state,’ Strauss-Kahn said in an address at George Washington University last week. ‘Globalization has delivered a lot . . . but it also has a dark side, a large and growing chasm between the rich and the poor. Clearly we need a new form of globalization’ to prevent the ‘invisible hand’ of loosely regulated markets from becoming ‘an invisible fist.’”

Repeat: “…a fundamental rethinking of economic theory”…. (a greater) “distribution of income”…(more) “regulation of financial companies”, “central banks need to do more to prevent lending and asset prices from expanding too fast”.

There’s not going to be any revolution at the IMF. That’s baloney. The institution was created with the clear intention of ripping poor nations off and it’s done an impressive job in that regard. There’s not going to be any change of policy either. Why would there be? Have the bankers and corporate bilge-rats suddenly grown a conscience and decided to lend a helping hand to long-suffering humanity? Get real.

Strauss-Kahn has been replaced by the IMF’s number 2 guy, John Lipsky, former Vice Chairman of the JPMorgan Investment Bank. How’s that for “change you can believe in”?