The Conundrum Of Spain’s Recovering Economy And Stubbornly High Unemployment – Analysis

The Spanish economy has recovered from a deep crisis and is growing at more than 3% for the third year running, but the unemployment rate remains stubbornly high at 17.2%, though well down on the peak of 27.1% in 2013.

By William Chislett*

Spain’s traditionally high jobless rate dropped to 8% in 2007 at the height of its boom, a level regarded as steep in other developed countries such as the US and the UK. The recession that followed the bursting of a massive property bubble pushed the rate to 27% in 2013. Thanks to an economy growing at more than 3% for the third consecutive year (the pre-crisis GDP was not recovered in real terms until the second quarter of this year), the rate is down to 17%. Some 1.5 million more jobs are needed to regain the pre-crisis employment level. The government’s 2012 labour market reforms have made the firing end more flexible and lowered the GDP growth threshold for job creation. But most new jobs are on temporary not permanent contracts, and there is still a gulf between outsiders and insiders. Part of the problem of the high unemployment rate lies in the Spanish economic model, based on tourism (a seasonal industry) and construction, though the latter to a much lesser extent. The education system is also at fault: at one end, the early school leaving rate for 18-24 year-olds is still high at 22.7% (36.7% in 2006) and at the other end more than two-thirds of graduates say they are overqualified for the jobs they find.

Analysis

Background

Spain’s crisis, sparked by the bursting of a massive debt-fuelled property bubble, which was pushed by low interest rates, decimated jobs. The unemployment rate more than trebled between 2007 and 2013 to 27.3%, with the loss of 3.8 million jobs. High unemployment is not something new in Spain’s dysfunctional labour market. Apart from the real estate boom period (2002-08), Spain’s jobless rate since 1980 was at least 5 percentage points above that in Germany, France, Italy, the UK and the US, 10 points higher in the early 1990s and 15 points in 2013 and 2014. Even in 2007, at the height of the boom, Spain’s jobless rate was 8%, a disastrous level by the standards of other developed countries such as Germany and the UK.

Companies complained during the boom they could not find qualified workers to fill posts, which led some economists to put Spain’s structural unemployment at 8%, regardless of the economic cycle and particularly among women and young people.

There are several reasons for the high unemployment rate, which to a small extent is due to the statistical effect produced by the numerator (the number of jobless) remaining high while the denominator (the size of the labour force) has declined, as a result of emigration abroad since the crisis by native and naturalised Spaniards and immigrants returning to their country of origin.

The most worrying factor, particularly during the boom, was the large number of workers with low levels of education and hence a lack of basic skills, most of who left school 2006 at 16 to work on building sites or in tourism. There was a correlation between the real-estate boom and the early school-leaving rate –the more houses built, the higher the rate–. In 2006 the number of housing starts was a staggering 856,561 and the early school-leaving rate for 18-24 year-olds was 36.7%. By 2014, with the economy barely out of recession, the respective numbers were 34,873 and 25.6%.

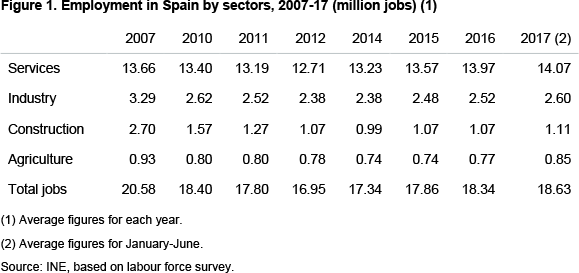

With wages for unskilled work rising faster than those for skilled work, many young people, particularly males, concluded that education did not pay. These low-skilled jobs in an economy excessively based on a labour-intensive but unsustainable construction sector were destroyed as soon as the economy ground to a halt. The number of construction jobs plummeted from 2.70 million in 2007 to just under 1 million in 2014 (see Figure 1).

The collapse of the construction sector also had a big knock-on effect on related industries, such as doors and windows, not to mention domestic appliances. Many of those who lost construction jobs were on temporary contracts as they were cheaper to sack than those on permanent contracts. These poorly qualified young adults formed a ‘lost generation’.

The bursting of the property bubble also hit those banks with large exposures to mortgages and property developers, particularly savings banks whose number fell from 45 to two (and seven of those became banks), largely as a result of mergers. This led to the closure of more than 9,000 branches and over 60,000 job losses.

Another factor was the influx of immigrants. Spain’s construction sector acted as a magnet for immigrants –their number soared from around 900,000 to more than 5 million in 2007–. In the decade before the crisis Spain received more immigrants proportional to its population of any EU country. They were particularly needed in the construction and agricultural sectors, as there were not enough Spaniards to work in them or prepared to work in them. At the peak of the boom in 2007, more than half of the 3.3-million non-EU immigrants in Spain, mainly from Latin America and North Africa, worked in the construction sector. When the economy went into recession, immigrants bore a large part of the surge in unemployment. The jobless rate among immigrants is still around 8 percentage points higher than that for Spaniards.

There is also a big regional divide in unemployment rates, varying between 25% in Andalusia and 10.5% in Navarre.

Labour market reforms

The conservative Popular Party (PP) tackled labour market reforms in February 2012, soon after coming into office. The aim was to make the market less rigid. The reforms were more ambitious than those in 2010 by the Socialist government (which led to a general strike) as they allowed companies to opt out of collective pay-setting agreements within industries and to make their own deals with workers. They also gave companies greater discretionary powers to adopt internal measures to limit job destruction. Dismissal regulations were also modified, redefining the conditions for fair dismissal and improving further on the greater clarity introduced by the 2010 reform, severance payments in the case of unfair dismissal for those on permanent contracts were reduced from 45 days per year worked with a maximum of 42 months to 33 days per year with a maximum of 24 months and the requirement of administrative authorisation in the case of collective redundancies was eliminated. Compensation for permanent contract termination in the case of redundancies for objective reasons was set at 20 days per year worked with a maximum of 12 months.

The reforms lowered the GDP growth rate needed to create jobs from around 2% to 1%-1.5%. Rafael Doménech of the research department of BBVA, Spain’s second-largest bank, estimated that if these reforms had been in place during the crisis, unemployment would have peaked at 20% instead of 27%, sparing a third of the rise in the jobless rate.

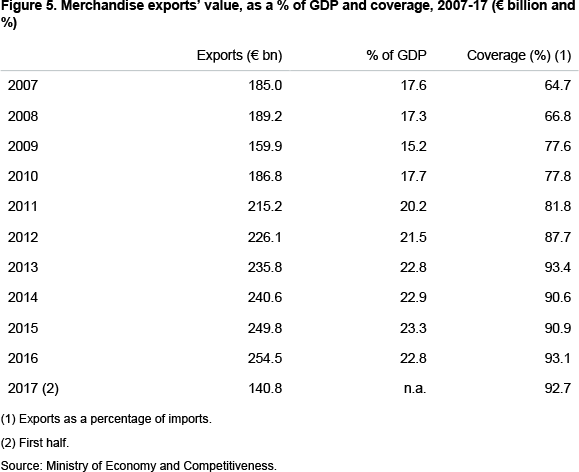

The measures contributed to wage moderation. The decline in unit labour costs since 2011 made Spanish goods more competitive on world markets, fuelling an export boom that helped pull Spain out of recession in 2013.

The current situation

It is difficult to gauge exactly how much of the job creation since 2012 is due to the reforms and how much to the recovery in the economy in the last few years. Some 3.8 million jobs have been lost since 2008 but only around half have been recovered. During its recession, Spain had the developed world’s highest Okun coefficient (ie, the greatest sensitivity of employment to changes in the GDP).

Luis de Guindos, the Economy Minister, says that not until 1.5 million more jobs are created, and with it Spain returns to the 20.7 million jobholders it had in 2007, can the country said to have really come out of its crisis.

International organisations such as the IMF and the OECD have made much of Spain’s growth in the last three years, one of the strongest in the EU, which has been quicker and faster than expected, but it should be borne in mind that the pre-crisis GDP was not regained in real terms until the second quarter of this year.

Spain has been helped by tailwinds in the form of low oil prices (Spain is a big importer of energy) and very low interest rates, thanks to the European Central Bank’s monetary policy accommodation, that are easing the country’s heavy debt burden (public debt has trebled in the last decade to 100% of GDP).

Today’s growth, furthermore, is more balanced than it was during the boom period, which, among other things, generated a huge current account deficit of 10% of GDP (such a level is generally always a sign of trouble). The current account has been in surplus for the last four years and inflation is low. The surplus in the first five months of this year was due to the very positive tourism balance: without this the current account would be in the red.

Domestic demand is back as the main motor of the economy. Of this year’s estimated growth of 3.1%, domestic demand is contributing 2.4 points and external demand 0.7. The sales of El Corte Inglés, Spain’s biggest department store and a good barometer of consumption, were the highest last year (€15.5 billion) in five years, though the level of 2007 (€17.3 billion) has yet to be regained.

Spain today is producing the same output (GDP) as before the crisis but with 1.9 million fewer people working, underscoring renewed competitiveness. The construction industry is slowly picking up, but is very far from the levels of activity during the boom, the tourism industry goes from strength to strength (forecast of 84 million tourists this year, almost 10 million more than in 2016) and exports have taken off (a record €140.8 billion in the first half of 2017). As jobs are created so consumption rises, which, in turn, spurs activity and creates a virtuous circle.

Jobs are being created at a faster pace than before but very many of them are seasonal and hence temporary, particularly in the tourism industry. For example, 172,900 of the 375,000 jobs created in the second quarter of this year (46% of the total) were in the tourism and hotel and catering trade. Including the 52,200 new jobs in construction and the 20,900 in commerce, 73% of the new jobholders were on precarious temporary contracts and hence unlikely to be sustained or subject to roll overs. Last year, 12.5% of the total contracts of almost 20 million signed were for waiters, just over half of which were for less than seven days.

The 2012 reforms have done little, however, to reduce the chasm between the conditions of temporary workers and those on permanent contracts. Temporary contracts were introduced in Spain in 1984 –when the unemployment rate was 20%– by the first Socialist government of Felipe González in order to make the labour market more flexible. Employers complained that the rigid and paternalistic labour market rules that continued after the end of the Franco regime in 1975 would put them at a disadvantage when Spain joined the European Community (1986) and became a fully-fledged free-market economy.

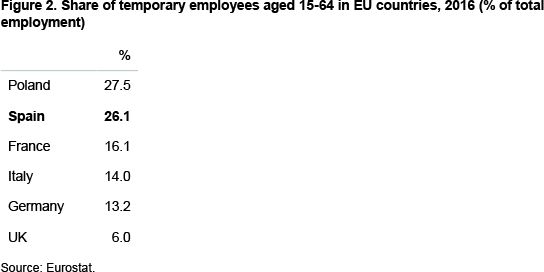

Employers were quick to use them and by 1997 around one-third of jobholders were on temporary contracts, three times the EU average and creating a two-tier system of insiders (those on permanent contracts) and outsiders (those on temporary ones). The proportion of jobholders on temporary contracts is particularly acute for those aged between 15 and 24. There was a decline in the temporary employment rate between 2008 and 2015 of more than 6 percentage points, but this was due to a sharp fall in temporary contracts (most notably in the construction industry) and not to an increase in open-ended contracts.

Greater job precariousness or flexibility, depending on how you view the situation, were graphically underscored on 30 June when a record 313,141 jobs were lost as contracts were not rolled over, while on 3 July a record 520,301 contracts were signed, mostly for the tourism industry. The number of Social Security contributors at the end of August, with the end of the main tourism season, dropped by 179,485 to 18.30 million, down from 18.48 million at the end of July, the highest figure since December 2008.

As contracts are for shorter and shorter periods, many more are being signed. The vast majority of the net employment increases since 2012 has been from temporary contracts. The 2010 and 2012 reforms have done little to encourage more employment on permanent contracts.

In 2016 the proportion of employee’s aged 15-64 with a contract of limited duration in Spain was 26.1% compared with an EU-28 average of 14.2% (see Figure 2). Ninety-one per cent of workers in Spain in 2016 took a temporary job because they could not find a permanent one, compared with an EU average of 62%.

Successive reforms to tackle the duality problem have failed. Generally speaking, neither the trade unions nor employers are really interested in changing the situation. Temporary contracts suit employers as it gives workers limited protection, while trade unions are mainly interested in defending the interests of insiders as they account for most of their members. One of the perverse effects of temporary contracts is that they discourage employers from training their workforce.

Ciudadanos, the centrist party which supports the minority PP government in parliament, promised to introduce a single employment contract to level the playing field between temporary and permanent workers, but nothing has happened.

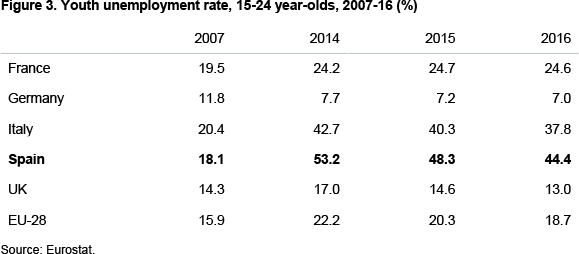

The two most serious labour market problems are youth and long-term unemployment. More than 40% of those under 25 are unemployed (see Figure 3), down from a peak of 53% in 2014, and close to 10% of those without work have been jobless for more than a year (in 2007, this rate in Spain was almost the lowest in the EU).

A factor at play in youth unemployment is that early school leavers can no longer bank on a job in the construction sector. This partly explains why the early school-leaving rate for 18-24 year-olds dropped to 22.7% in 2016 from 36.7% in 2006, though it is still double the EU average.

Solutions

According to a former executive director for Spain at the International Monetary Fund, Spain is the most over-diagnosed country in the world in terms of the labour market. What he told his colleagues seven years ago remains largely valid today. ‘One could talk for hours and one could fill this room with labour-law experts and economists, and they will have 150 solutions or 150,000 solutions for the troubles of the Spanish labour market. The Spanish labour market is a disaster in terms of efficiency. I have no trouble admitting this and neither do my authorities. It has produced a phenomenon that can be described in many ways, but basically, for the past 20 years, something between 40%-50% of the Spanish population has been either unemployed permanently or in precarious job conditions in fixed-term contracts’.

Spain also has the distinction of reportedly holding the world record in the number of labour-market reforms over a 35-year period. Fifty-two were enacted between the 1980 Statute of Workers’ Rights, which laid the foundations for post-Franco labour relations, and the end of 2015, and yet the labour market is still dysfunctional.

Making the labour market more and more flexible (the hiring end is already extremely flexible) has not produced the desired result. A large part of the problem, in this author’s view, is the Spanish economic model which is disproportionately based on tourism and construction, though less so in the latter’s case than during the boom. The Canary Islands is an extreme example: more than 13 million tourists went there in 2016 (more than six times the population) and yet the unemployment rate was 25%.

The most positive change in Spain’s productive model has been the surge in exports in the last eight years (see Figure 5), which has created sustained jobs and often permanent ones, but not enough to soak up the pool of unemployed.

Education is clearly an important issue. It has long been proven that the better educated a person the better the chance of a decent job. Spain, however, has a problem as 42% of university graduates believe they are overqualified for the job they hold, according to a recent report by the Fundación Europea Sociedad y Educación. The number of graduates increased from 2.9 million in 1992 to 9.6 million in 2017, but the number of jobs that require a university degree has risen at a much slower pace.

We are back again with the economic model: degrees are generally not needed to work in the construction and tourism industries and other sectors are not generating many jobs (banking and engineering, for example).

Part of the problem also lies with the conservatism of Spain’s universities and employers, according to Samuel Martín-Barbero, rector of the Camilo José Cela University, in an article published last month in the Times Higher Education.

‘Future-oriented degrees incorporating different disciplines may be common in the US and the UK, but they have no place in the Spanish sector, where most learning takes place in academic departments entirely disconnected from each other. Hidebound, siloed thinking is endemic in the Spanish academy. Innovation is extremely rare’, wrote Martín-Barbero. ‘If Spanish higher education is still reluctant to embrace interdisciplinarity, it is at least partly because Spanish employers continue to defend the preconceived idea that sciences and the arts are stand-alone areas of knowledge with nothing useful to say to each other’.

Relatively few graduates in Spain seek jobs outside the fields they majored in. For instance, only about 5% of humanities graduates in Spain go on to work in the corporate sector, compared with 37% in the US, according to the Everis Foundation. YouTube chief executive Susan Wojciki studied history and literature –such a background would be virtually unthinkable for a Spanish executive–.

Spain’s multinational companies, the most dynamic part of the economy, are beginning to be a case apart as they are starting to demand a different type of multilingual, multidisciplinary graduate.

Conclusions

Spain has made significant strides in reducing the unemployment rate but it will continue to be an albatross for governments.

About the author:

*William Chislett,Associate Analyst, Elcano Royal Institute | @WilliamChislet3

Source:

This article was published by Elcano Royal Institute