US Hourly Wages Fall To November 2009 Levels As CPI Edges Up 0.5% – Analysis

By David Rosnick

The US Consumer Price Index rose 0.5 percent in February and 5.6 percent annualized over the last three months. While food prices have risen in line with prices generally (4.7 percent annualized since November) energy prices continue to drive headline inflation. Core (non-food, non-energy) prices rose only 0.2 percent in the month.

Energy constitutes less than 10 percent of the consumer basket, but the rise in energy prices is overwhelmingly responsible for recent increases in inflation. In February, energy prices rose 3.4 percent and have grown at a 45.1 percent annualized rate in the last three months. By comparison, non-energy prices have been growing far more modestly at a 2.2 percent rate.

Food prices have also risen faster than core, but in comparison to energy have added relatively little to inflation despite its greater weight in the CPI. While energy added 3.4 percentage points to annualized inflation since November, food prices added only 0.4.

Apparel prices fell 0.9 percent after last month’s 1.0 percent rise. These prices are particularly erratic, but over the last year have grown by 1.5 percent. Medical care prices rose 0.4 percent in February with jumps in both commodities (0.7 percent) and services (0.4 percent.) Though medical prices have accelerated in the last few months, the rate since November stands at 3.1 percent, compared with 3.7 percent in the previous three months.

Housing prices rose 0.3 percent in February—the largest jump since July of 2008. However, this was due to a rapid rise in the price of fuels and utilities, which rose 1.2 percent (15.6 percent annualized.) The price of rent on primary residences and owners’ equivalent rent—which together make up 40 percent of the core index—each rose only 0.1 percent. Even relative to other core prices, inflation in rent continues to be very low, indicating that the bubble-driven housing glut persists.

In February, transportation prices rose 1.9 percent. Again, the relatively high rate of inflation in these prices continue to be concentrated in energy as the price of motor fuel rose 4.8 percent in the month. The price of new vehicles rose 1.0 percent, but had been falling in recent months. New vehicle prices stand only one-quarter of 1 percent above their price in November 2009.

The real, broad dollar index fell to a new record low in February and has now fallen 15 percent in the last two years. In the short run, a 15 percent fall in the dollar means that goods traded at worldwide prices cost 15 percent more when measured in dollar terms. Traders may choose to raise prices by somewhat lesser amounts in order to increase sales, but the dollar price of both imports and exports should rise as the dollar becomes less valuable internationally.

The real, broad dollar index fell to a new record low in February and has now fallen 15 percent in the last two years. In the short run, a 15 percent fall in the dollar means that goods traded at worldwide prices cost 15 percent more when measured in dollar terms. Traders may choose to raise prices by somewhat lesser amounts in order to increase sales, but the dollar price of both imports and exports should rise as the dollar becomes less valuable internationally.

Thus, it is not surprising that the price of imports has risen 6.9 percent over the last year, while that of exports has risen 8.6 percent.

The producer price of finished goods rose 1.6 percent in February and at a 13.8 percent annualized rate since November. Again, these large gains are driven almost entirely by food and energy prices. Core finished goods have seen inflation of 4.0 percent annualized over the last three months.

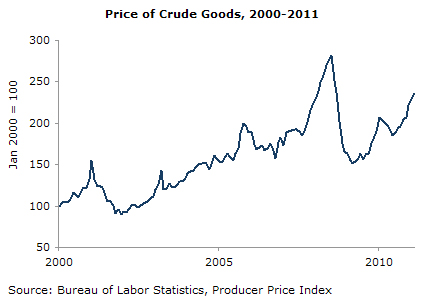

The producer price of crude goods rose 3.4 percent last month and 15.9 percent in the last 12 months. However, the price of these goods had fallen sharply in 2008 and are still 16 percent below their peak in July 2008. Despite the rapid inflation leading up the the 2008 peak, prices are still below the 2002-2007 trend.

The real hourly wage fell $0.05 in February and is now equal to that of November 2009. Relative to core prices, wages have grown less than one-quarter of one percent in 15 months.

Despite some erratic price jumps in February, core inflation remains subdued. Core commodity prices have fallen at a 0.2 percent rate over the last six months while non-energy services have grown at a 1.7 percent rate of inflation. Even with crude prices returning to trend, there continues to be little sign of core inflation outside of medical services.

David Rosnick is an economist at the Center for Economic and Policy Research in Washington, D.C. He received his Ph.D. in Computer Science from North Carolina State University and his M.A. in Economics from George Washington University.