Ecuador Energy Profile: Smallest Oil Producing Member Of OPEC – Analysis

By EIA

In Ecuador, the oil sector accounts for more than half of the country’s export earnings and approximately two-fifths of public sector revenues.1 Resource nationalism and debates about the economic, strategic, and environmental implications of oil sector development are prominent issues in the politics of Ecuador and the policies of its government.

Ecuador is the smallest producer in the Organization of the Petroleum Exporting Countries (OPEC) and it produced 556,000 barrels per day (bbl/d) of petroleum and other liquids in 2014, of which crude oil production was 555,000 bbl/d. A lack of sufficient domestic refining capacity to meet local demand has forced Ecuador to import refined products, limiting net oil revenue.

In 1992, Ecuador left OPEC owing a debt of more than U.S. $5 Billion. Ecuador rejoined the organization following a near 15-year hiatus in 2007.2 Ecuador has a challenging investment environment prompted by government initiatives to increase the share of crude oil revenue for the state, which has contributed to near-stagnant oil production as output has stayed within a close range over the past 10 years.

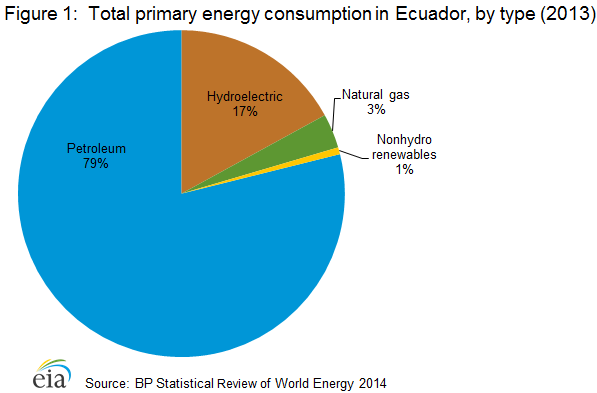

Ecuador’s energy mix is largely dependent on oil, which represented 79% of the country’s total energy consumption in 2013 (see Figure 1).3 Hydroelectric power was the second-largest energy source. Natural gas and nonhydro renewable fuels are also important to Ecuador’s energy mix.

Oil

Ecuador has the third-largest oil reserves in South America.

As of January 2015, Ecuador had 8.8 billion barrels of proved crude oil reserves, which is a year-over-year increase of 7%. Ecuador has the third-largest oil reserves in South America, following Venezuela and Brazil. Most of Ecuador’s oil reserves are in the Oriente Basin, which is located physically under the Amazon.

Sector organization

Ecuador’s hydrocarbon resources are exclusively owned by the state, and changes to Ecuador’s legal framework continue a trend toward policies of resource nationalism.

National oil companies (NOCs) Petroecuador, Petroamazonas, and Operaciones Rio Napo, a joint venture between Petroecuador and Petroleos de Venezuela, account for most of the oil production in Ecuador. The remaining production is attributed to fields operated by international oil companies (IOCs), Repsol (Spain), Eni (Italy), Tecpetrol (Argentina’s state-owned company), and Andes Petroleum, which is a consortium of the China National Petroleum Corporation (CNPC, 55% share) and the China Petrochemical Corporation (Sinopec, 45% share). Ecuador’s Ministry of Non-renewable Natural Resources is responsible for energy policy decisions, while the Hydrocarbons Regulation and Control Agency regulates the oil sector.

Hydrocarbon resources are exclusively owned by the state. Ecuador limits foreign investment in the sector. Foreign oil and natural gas companies are allowed to enter into service contracts that offer a fixed per-barrel fee for their exploration and production activities. The move away from production-sharing agreements to service contracts has increased the governmentâs share of revenue and state oil production, but it has deterred the interest of private sector participants including Noble Energy, Petrobas, and Canada Grande.

The changes to Ecuador’s legal framework continue a trend toward policies of resource nationalism in the oil sector. In 2006, Petroecuador took over the production assets of Occidental Petroleum after contracts expired. In 2009, following a tax dispute, the Ecuador government also expropriated two blocks assigned to Perenco. Chevron’s lengthy legal battle with Ecuadorean plaintiffs also raises questions about the potential costs of investing in Ecuador. In February 2011, an $18 billion judgment—later reduced to $9.5 billionâwas rendered against Chevron by a court in Lago Agrio, Ecuador, for alleged contamination resulting from crude oil production in the region by Texaco’s operations in Ecuador between 1964 and 1990 (the company was later acquired by Chevron). On March 4, 2014, the U.S. District Court for the Southern District of New York ruled that the $9.5 billion Ecuadorian judgment was the product of fraud and racketeering activity, finding it unenforceable.4

Since 2009, Ecuador has agreed to multiple oil-for-loan deals with China that explicitly guarantee oil exports to China in exchange for loans. The loans also require Ecuador to invest a share of the loaned amount into projects involving Chinese companies and have been applied to the development of hydroelectric complexes and other energy-related projects. China has also made large-scale loans to Ecuador at times that coincide with oil supply agreements.5

Exploration and production

Ecuador is the fifth-largest oil producer in South America. The country’s oil production has been mostly stagnant over the past ten years, although it has increased slightly in recent years. Substantial oil reserves are located in the Ishpingo-Tambococha-Tiputini (ITT) fields in Yasunà National Park. The fields were under moratorium from oil extraction between 2007 and the summer of 2013, an effort by the Ecuadorean government to protect biodiversity and avoid dislocation of two isolated indigenous cultures.

Ecuador’s most productive oil blocks are located in the northeastern part of the country. Shushufindi and Auca are the country’s two most prolific fields. Ecuador produces two grades of oil: Oriente, which accounts for two-thirds of total exports, and Napo, which is a heavier grade.

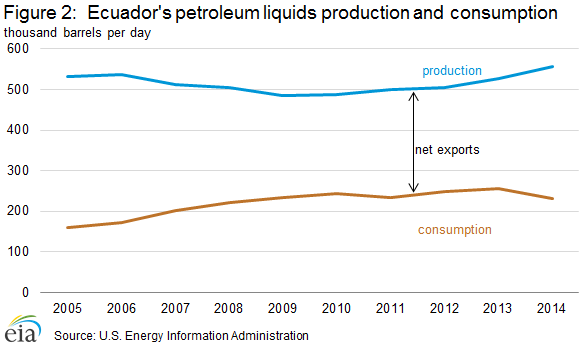

Crude oil production increased sizably in 2004 shortly after the opening of the Oleoducto de Crudos Pesados (OCP) pipeline, which removed a chokepoint on heavy crude oil transportation in the country. However, production has leveled off in recent years as the result of natural decline, the lack of new project development, and operating difficulties at existing, mature oil fields. The inauguration of the Panacocha field in the Ecuadorean Amazon, the first new production expansion since the current government took office in 2007, is one reason for slight increases in production over the past two years. Ecuador’s production averaged 556,000 bbl/d in 2014, 20,000 bbl/d more than the country’s previous peak level in 2006 (see Figure 2).

The Ishpingo-Tambococha-Tiputini (ITT) fields in Yasuní National Park hold an estimated 846 million barrels of reserves.6 The fields were under moratorium from oil extraction between 2007 and the summer of 2013, an effort by the Ecuadorean government to protect biodiversity and avoid dislocation of two isolated indigenous cultures. However, on August 15, 2013, Ecuador’s president Rafael Correa announced an end to the moratorium as a result of failed efforts to raise contributions from the international community. Subsequently, the development of hydrocarbon resources in the ITT fields was deemed of national interest.

Development of the ITT region could be challenging and costly. To minimize cost and environmental damage, ITT projects require foreign investment and expertise for horizontal drilling. Attaining both investment and expertise seems unlikely given the current Ecuadorean government’s pro-nationalism stance. Resistance to the development by indigenous groups also poses operational challenges.

Trade

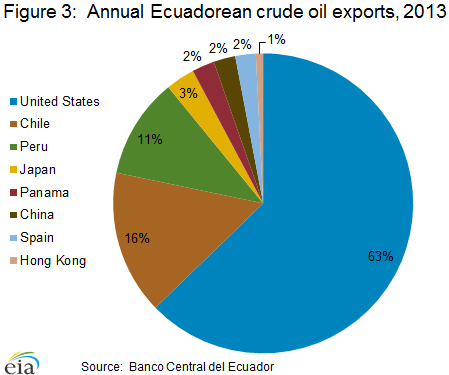

Ecuador exports roughly 70% of the crude oil it produces, and it is a leading source of crude oil imports to the U.S. West Coast. In 2014, the United States imported 210,000 bbl/d of Ecuadorean crude oil. Other leading destinations for Ecuadorean crude are Chile, Peru, and Panama.

Ecuador was the third-largest source of foreign oil for the U.S. West Coast (Petroleum Administration for Defense District V), which was the destination of most Ecuadorean oil exports to the United States. Consequently, Ecuador is a more regionally significant source of supply for the U.S. West Coast, which is relatively isolated from other parts of the continental United States because of relatively few overland pipelines.

To diversify, Ecuador began exporting crude oil to China in 2012. In 2013, the United States received roughly 63% of all Ecuardorean crude oil exports (see Figure 3) and remained the largest importer of Ecuadorean crude oil in 2014. Chile, Peru, Panama, and India were also among the top five importers of Ecuadorean crude oil in 2014.

Despite its status as a crude oil exporter, Ecuador is a net importer of refined oil products. In general, Ecuador exports heavy refined products, such as fuel oil, and imports lighter products, including gasoline, diesel, and liquefied petroleum gas (LPG). According to the latest annual data available from the Banco Central del Ecuador, Ecuador exported 20,000 bbl/d and imported approximately 133,000 bbl/d of refined products in 2013.7 Of the refined products imported by Ecuador in 2014, 101,000 bbl/d was from the United States.

Pipelines

Ecuador’s domestic pipeline infrastructure is old and limited. Ecuador has one international pipeline, the TransAndino. The 50,000 bbl/d TransAndino pipeline connects Ecuador’s oil fields with the Colombian port of Tumaco.

Ecuador has two major oil pipeline systems. The older and more widely used pipeline is the Sistema Oleducto Trans-Ecuatoriano (SOTE), which was built in the early 1970s. The 310 mile, 400,000 bbl/d SOTE runs from Lago Agrio, Ecuador to the Balao oil terminal on the Pacific coast. Ecuadorâs second oil pipeline is the Oleducto de Crudos Pesados (OCP). The 300 mile, 450,000 bbl/d OCP flows mostly parallel to the route of the SOTE. The OCP began operations in September 2003, and its completion immediately doubled Ecuador’s oil pipeline capacity and facilitated increased production. Ecuador also uses one transnational pipeline, the TransAndino. The 50,000 bbl/d pipeline connects Ecuador’s oil fields with the Colombian port of Tumaco. Approximately 70% of the countryâs crude travels through SOTE, with the remainder transported through OCP.

Downstream

Ecuador has three commercial oil refineries, with a combined capacity of 176,000 bbl/d. Ecuador and Venezuela have been in discussions to construct a new refinery, and China’s Sinopec and/or CNPC might fund a portion of the project.

According to Oil & Gas Journal, Ecuador had three commercial oil refineries, with a combined capacity of 176,000 bbl/d as of January 2015. All three refineries are operated by Petroindustrial, a subsidiary of Petroecuador (see Table 1).8

The Esmeraldas refinery operates below capacity and is slated to be upgraded to process heavier Ecuador Oriente crude. Ecuador and Venezuela have been in discussions to construct a new refinery with a crude distillation capacity of 300,000 bbl/d in the Manabí province of Ecuador. According to recent industry reports, China’s Sinopec and/or CNPC might fund a portion of the project.9

In 2014, Ecuador consumed 230,000 bbl/d of oil according to the U.S. Energy Information Administration (EIA). According to the most recent consumption data available from the International Energy Agency (IEA), roughly one-third of Ecuadorâs oil consumption is diesel fuel and another one-fourth is motor gasoline. Fuel prices are controlled by the central government.

| Refinery | Capacity (000 bbl/d) | Location |

|---|---|---|

| Esmeraldas | 110 | Esmeraldas |

| La Libertad | 46 | Santa Elena Peninsula |

| Shushufindi | 20 | Sucumbíos |

| Total Capacity | 176 | |

| Source: Oil & Gas Journal, January 1, 2015 | ||

Natural gas

Ecuador has relatively small proved natural gas reserves and a limited natural gas market.

As of January 2015, Ecuador had an estimated 212 billion cubic feet (Bcf) of proved natural gas reserves. The country’s gross natural gas production was 54 Bcf in 2013, of which 37 Bcf was marketed and the remaining amount was flared and vented. Dry natural gas production (occurring when associated liquid hydrocarbons are removed) was 18 Bcf, of which all was domestically consumed. Ecuador’s low natural gas utilization rates are mainly result of a lack of infrastructure needed to capture and market natural gas.

Located in the Gulf of Guayaquil, the Amistad field is Ecuador’s primary natural gas project. The field is operated by Petroamazonas and produced an estimated 48 million cubic feet per day (MMcf/d) between January 2014 and September 2014.10 Amistad’s natural gas production flows to the Machala facility, a 130-megawatt (MW) onshore, gas-fired power plant that supplies electricity to the Guayaquil region.

Exploration activities are done mostly by Petroamazonas, although, Andes Petroleum, ENAP, and PdVSA also participate in exploration.

Electricity

In 2014, hydroelectricity accounted for more than 45% of the country’s electricity generation. The other large source of electricity supply is a group of oil-powered conventional thermal power plants.11

There are more than 200 power plants operating in Ecuador, of which 89 provide power to the National Interconnected System. In 2014, Ecuador generated 24,309 gigawatt-hours (GWh) of electricity from approximately 5.3 gigawatts (GW) of capacity. Hydroelectricity accounted for 11,459 GWh of the country’s generation, or 47% of total generation, but a somewhat smaller share of total nameplate capacity because of hydro’s high capacity utilization rates (See Table 2). The other large source of electricity supply is Ecuador’s suite of conventional thermal power plants, which in Ecuador are mostly equipped to burn oil.

Most of Ecuador’s hydro capacity is located in Azuay province, in the south-central highlands. Paute-Molino is the country’s single-largest hydroelectric complex at almost 1.1 GW of capacity. To address capacity shortages, Ecuador plans to build additional hydroelectric power plants with a total generating capacity of 2.8 GW in the coming decade (see Table 3).

Of the nonhydro renewable fuels, bagasse, a fibrous residue of processed sugarcane, is used in industry, and traditional biomass is used in rural households. However, estimates of traditional biomass consumption are imprecise because biomass sources (fuel wood, charcoal, manure, and crop residues) are not typically traded in easily observable commercial markets. Ecuador also has limited wind and solar capacity, which are supported through feed-in tariffs.

Ecuador has transmission grid interconnections with Colombia and Peru, and the country is a small net importer of electricity. The countryâs electricity grid, however, does not reach all Ecuadoreans. Of total demand, residential users are responsible for approximately one-third of electricity demand, similar to the industrial sector.12

| Fuel type | Gross generation (GWh) | |

|---|---|---|

| Hydro | 11,459 | |

| Thermal | 12,354 | |

| Renewable | 496 | |

| Total gross generation | 24,309 | |

| Source: Conelec | ||

| Plant | Expected start date | Generating capacity (MW) |

|---|---|---|

| Mazar Dudas | 2014 | 21 |

| Toachi Pilaton | 2015 | 253 |

| Minas San Francisco | 2015 | 270 |

| Coca Codo Sinclair | 2016 | 1,500 |

| Other | tba | 712 |

| Total | 2,756 | |

| Source: Oil & Gas Journal, January 1, 2015 | ||

Notes:

- Data presented in the text are the most recent available as of March 17, 2015.

- Data are EIA estimates unless otherwise noted.

Endnotes:

- 1Central Intelligence Agency, “The World Factbook: Ecuador,” (accessed September 23, 2014).

- 2BBC News, “Ecuador seeking a return to OPEC,” (April 5, 2007).

- 3British Petroleum, “Statistical Review of World Energy 2014,” (June 2014).

- 4Chevron: Human Energy, “Judge Rules in RICO Trial” (accessed February 18, 2015).

- 5Reuters, “SPECIAL REPORT-How China took control of an OPEC country’s oil” (November 26, 2013).

- 6Convention on Biological Diversity, “Resource Mobilization Information Digest: The Yasuni-ITT Initiative in Ecuador,” page 2 (accessed February 18, 2015).

- 7Banco Central del Ecuador, “Reporte del Sector Petrolero: IV Trimestre de 2013,” page 27.

- 8Oil & Gas Journal, “Worldwide Refining Capacity Detail,” (January 1, 2015).

- 9Oil & Gas Journal, “Ecuador, China advance refinery plans,” (January 24, 2014).

- 10Petroamazonas EP, “Campo Amistad en el Golfo de Guayaquil,” (accessed February 2015).

- 11Consejo Nacional de Electricidad, “PRODUCCIÓN annual,” (accessed September 2014).

- 12Consejo Nacional de Electricidad, “DEMANDA annual,” (accessed September 2014).

Table and chart sources:

Table 1: Oil refineries in Ecuador. Worldwide Refining Capacity Detail from the Oil and Gas Journal.

Table 2: Electricity generation, by fuel type (2014). PRODUCCIÓN annual from Consejo Nacional de Electricidad.

Table 3: New planned hydroelectric power plant projects. Power Generation Projects from the Ecuador’s Ministry of Electricity and Renewable Energy.

Figure 1: Total primary energy consumption in Ecuador, by type (2013). Consumption by fuel from BP Statistical Review of World Energy 2014.

Figure 3: Annual Ecuadorean crude oil exports, 2013. REPORTE DEL SECTOR PETROLERO Octubre-Diciembre 2013 from Banco Central del Ecuador.