China’s Emerging Silicon Valley: How And Why Has Shenzhen Become A Global Innovation Center – Analysis

By Xiangming Chen and Taylor Lynch Ogan*

By Xiangming Chen and Taylor Lynch Ogan*

Shenzhen is China’s very own Silicon Valley. Find out how it has become innovative by tracing its rapid growth and strategic transition; what are the four of its most innovative companies, and what are the key factors that make it an innovative ecosystem in which companies have thrived.

Many informed people would have heard about Shenzhen, which has grown, at a breakneck pace, from a small village and China’s first special economic zone to a prosperous megacity and an emerging centre of innovation over three decades. Yet how many people, even in the global corporate community, have heard about BYD, which happens to have risen from Shenzhen to the world’s manufacturing leader in rechargeable batteries and electric vehicles in 20 years? Probably not many. Besides the tale of Shenzhen as a “miracle city”, there is a story to be told about how and why Shenzhen has also become a global hub for innovative companies like BYD. While our previous article in this magazine focused on the rise of BYD with Shenzhen,1 this article has two purposes. The first is to look at how Shenzhen has become innovative by tracing its rapid growth and strategic transition as a favourable backdrop and then profiling four of its most innovative companies. The second is to examine the key factors that make Shenzhen an innovative ecosystem in which companies have thrived.

Rapid Growth and Quality Transition

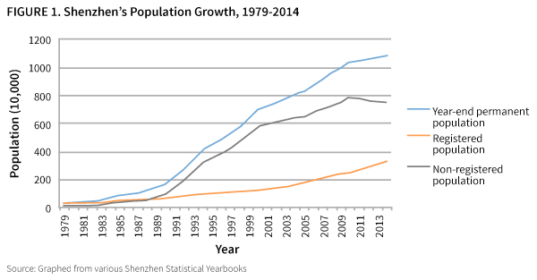

Few companies can perform well if their home city does not create and sustain healthy demographic and economic growth. This has not been a problem for Shenzhen, which has been one of the fastest growing cities in China and the world for the last 35 years. In fact, no other city anywhere in the world has gained more population than Shenzhen since 1980 (see Figure 1 below).

Unlike any other large city in China, Shenzhen has maintained a small proportion of its population (only about 30%) as officially registered with hukou. Besides the approximately 70% or eight million long-term residents included in Shenzhen’s total population, there are as many as another eight million short-term residents in Shenzhen today, bringing the total to around 18 million.2 This qualifies Shenzhen as China’s largest immigrant city. The inflow of human resources through the large influx of immigrants has contributed to Shenzhen’s innovative capacity (see later).

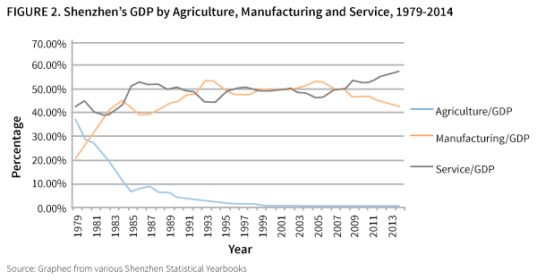

The rapid growth of Shenzhen’s economy has both paralleled and facilitated its structural shift favouring innovation. After averaging about 35% annually for its GDP growth through 1995, Shenzhen kept its annual growth at around 14% through 2014. As a result of this slowed but sustained high growth, Shenzhen’s GDP per capita in 2014 reached around $25,000, the highest of all Chinese cities. At this pace, Shenzhen’s GDP per capita is expected to hit $36,000 in 2020, equaling the 2012 figure for Hong Kong.3 Driving the more recent and future growth is the accelerated development of services and the relative contraction of manufacturing (see Figure 2 below).

The still substantial share of GDP in manufacturing is no longer produced by the labour-intensive and low-tech assembling industries that dominated the earlier phase of Shenzhen’s economic development. Instead Shenzhen’s manufacturing has become increasingly high-tech, new-tech, and clean-tech favouring such industries as new information technology, biotechnology, new energy, new materials, numerical control tools, and robotics. With this shift, the value added of these new industries as a share of GDP rose from 28.8% in 2010, to 35.6% in 2014.

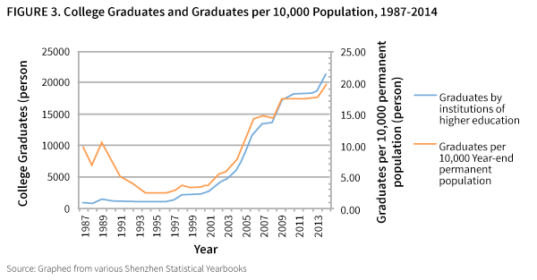

Shenzhen’s industrial upgrading has been accompanied and fostered by the continued growth of human capital. As Figure 3 on the next page shows, as the number of college graduates rose, the highly educated base of the population became stronger. In Shenzhen today, college educated talents relative to its permanent population stand at 37.1%, higher than 28.6% in Beijing, and 23.4% in the New Pudong district of Shanghai. Shenzhen’s expanded human capital has translated into a greater and more effective capacity of R&D at both the firm and aggregate levels. From 2009 to 2014, the firms’ share of Shenzhen’s R&D stayed over 90%, and Shenzhen’s R&D budget as a share of GDP stood at 4.2%, doubling the national average of 2% and far exceeding the 2.5%, which is regarded as the international norm for innovative economies. High levels of investment in R&D have paid off in the number of patents Shenzhen has applied for and been granted. In 2014, Shenzhen applied for 82,254 patents, up from 42,279 in 2009, and was granted 53,687 patents, up from 25,894 in 2009.4 Shenzhen-based companies also accounted for 46.9% of all Patent Cooperation Treaty (PCT) applications from China in 2015. By then Shenzhen led all large Chinese cities in the number of patents applied and grant for 12 years in a row. Through June 2016, Shenzhen accounted for 51.8% of all applied patents in China.5

*About the authors:

Xiangming Chen has been serving as the founding Dean and Director of the Center for Urban and Global Studies (CUGS) at Trinity College since July 1, 2007. Chen leads CUGS in developing and strengthening meaningful and synergistic linkages of teaching, research, and service in urban and global studies, broadly defined, between Trinity’s academic programs and its various forms of experiential learning on campus, in Hartford, and globally.

Taylor Lynch Ogan, Trinity College, Hartford Connecticut

Source:

This article appeared at The European Financial Review, and is reprinted with permission.