Disputes Between Iran And Saudi Arabia: Will They Affect Oil Prices? – Analysis

By CCEE

By Agha Bayramov *

The first week of 2016 saw a sharp escalation of religious and diplomatic tensions in the Middle East. On January 2, Saudi Arabia announced the execution of 47 people, including the famous Shia cleric, Sheikh Nimr al-Nimr. The Iranian government condemned Nimr al-Nimr’s execution, and protestors burned down the Saudi embassy in Tehran. Both sides suspended diplomatic relations.

Initially, the diplomatic crisis between two large OPEC producers caused fears in the oil market that further escalation could spark another conflict, putting oil production locations and transportation routes in the Middle East under possible military threat. If that were to happen, oil prices would sharply increase due to the disruption in production. However, despite the dispute, oil prices continued to decrease in the days following the outbreak of the crisis. This article explains why conflict between Saudi Arabia and Iran may not affect long term oil prices.

Analysis

In early February, the diplomatic confrontation between Iran and Saudi Arabia escalated when Riyadh offered for the first time to send ground troops to Syria to fight ISIS. This posed an open challenge to its regional rival in Syrian context. Despite this oil prices continued to decline. Prices are still fluctuating at below 40 USD per barrel. Various political analysts are now asking the question at the heart of this: why is the global oil market ignoring the geopolitical tension between Iran and Saudi Arabia?

There are several reasons why oil traders are not worried about this new disruption in the region. Firstly, despite the diplomatic tensions, there is no military threat to the locations of oil production and transportation routes in either country.

In the past, geopolitical conflicts in the Middle East could have increased the price of oil by a few dollars due to the risk of direct attacks on centers of oil production (consider, for instance, Iraq’s invasion of Kuwait). However, in the case of Saudi Arabia and Iran, the chance of direct military conflict between the two countries remains minimal. There would be a noticeable change in oil prices if there were a direct threat to production and transportation routes, but this is simply not the case at present. The global oil market is primarily concerned about other issues such as oversupply, demand market and disunity between OPEC members.

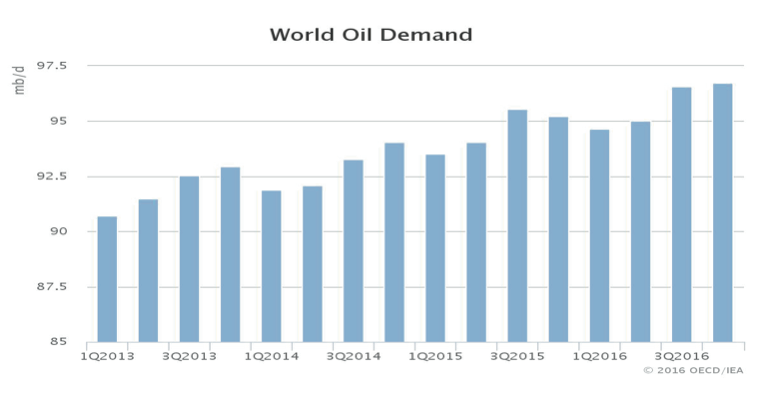

The second reason for the steady decline in oil prices is a global oil glut. Currently, supply exceeds demand, which puts heavy downward pressure on prices. In recent decades, the number of non-OPEC producers has gradually increased. According to data from the International Energy Agency, global oil production has increased from 90.5 to 96.88 mb/d since 2013. At present, the gap between supply and demand is approximately 1.5 million barrels per day. Moreover, the US “shale revolution” has reinforced the global energy market and has made it less vulnerable to possible disruption. Nevertheless, its longer term capacity to balance the market is questionable; shale oil production at current prices is hardly cost-effective.

In the same vein, despite its high costs, renewable energy has extended its market share in the West. According to figures from Eurostat, the total percentage of renewable energy within Europe in 2015 was 15.3%; an increase from 8.7% in 2005. These developments have intensified energy diversification and reduced anxiety about disruption in the Middle East.

These developments have intensified energy diversification and reduced anxiety about disruption in the Middle East.

Thirdly, there is a strong correlation between oil demand and economic change. In recent years, oil prices have depended on developments that are more economic than political. Any negative news from demand markets, namely Asia and the Eurozone, would significantly influence oil prices. An important example of a demand market is China, due to its growing economic power and oil consumption. The Chinese market has been a major area of rapid economic growth. In this regard, any news of a slowdown from the Chinese market will lead to a drop in demand for oil, which could in turn put heavy pressure on oil prices. Meanwhile, it could also undermine future expectations for oil sales. The Chinese stock market is thus more important factor than the diplomatic tensions between Iran and Saudi Arabia to oil investors.

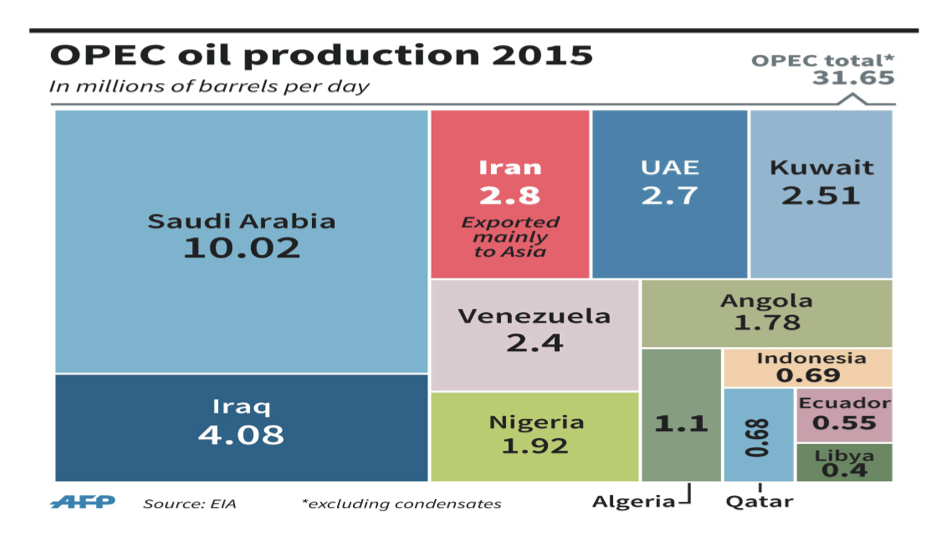

Finally, the disagreement between the OPEC members makes oil investors feel less anxious. This is because they anticipate that the diplomatic dispute between Saudi Arabia and Iran will strengthen the existing disunity between the OPEC countries and prevent them from finding a common strategy for low oil prices in the near future. In the past, OPEC members were more willing to rescue oil prices due to their unified stance. They sought to balance production when oil prices were too low or high. However, this time they are struggling to find a common solution to the global oil glut. On the February 16, oil experts from Russia, Venezuela, Qatar and Saudi Arabia came together to discuss the growing oversupply. However, Iran was not present, and despite the falling oil prices, Iran seemed determined to increase its oil production – after international sanctions were lifted, Tehran has been keen to boost its energy sector. Oil investors would be anxious if Iran and Saudi Arabia were to come together to discuss oil prices as opposed to suspending diplomatic relations.

Conclusion:

The regional confrontation between Iran and Saudi Arabia has had a limited impact on the global oil market in terms of price. But their political competition does increase the likelihood of overproduction by both sides. This study has identified three major findings.

Firstly, Iranian and Saudi oil supply points and transportation routes are not under direct military threat. Secondly, the lifting of international sanctions allows Iran to step up production in the forthcoming months. Thirdly, energy supply diversification has significantly increased in recent years. Therefore, although the Middle East is the biggest oil supplier in the world, oil investors know that the market is not as weak as in the 1970’s. Finally, the growing Asian economy, especially China, maintains a major influence over current prices, and therefore a slowdown in those markets is a greater source of stress for oil investors than any political news. If Iran, Saudi Arabia, and Russia do not come to an agreement on decreasing production, oil prices will remain below 35-40 USD per barrel.

About the author:

*Agha Bayramov is a Ph.D. candidate at the University of Groningen in Netherlands.

Source:

This article was published by CCEE as Policy Brief 25. (PDF)