Transportation Of Compressed Natural Gas Across Caspian Sea: Pros And Cons – Analysis

By CCEE

By Prof. Dr. Rovshan Ibrahimov*

Dr. Vassilios Sitaras recently published a policy brief for CCEE titled “Transporting Gas Across the Caspian: A New Option”, proposing an alternative method for delivering natural gas from Turkmenistan across the Caspian Sea to Azerbaijan and European markets. This proposal was based on the assumption that the current geopolitical challenges and barriers will make it impossible to build the Trans- Caspian gas pipeline between Turkmenistan and Azerbaijan. The realization of the Trans-Caspian gas pipeline is opposed by Russia and Iran.

Dr. Sitaras puts forth a very non-conventional option for transporting natural gas, namely, CNG (compressed natural gas), with the help of specially designed tankers.

It is worth noting that the very idea of transporting Turkmen gas in the form of CNG in Azerbaijan is not new. In 2010, Enex Group SA, a Belgian company, had plans to build the infrastructure required to start CNG transportation from Turkmenistan to Azerbaijan. At that time, it was envisions that this gas would then flow into the proposed Nabucco pipeline; at that time there was not yet a final decision about the transportation of Azerbaijani gas to European markets.

With this proposal, Enex asked the government of Turkmenistan for further discussions of the possibilities. Around the same time, the Azerbaijani government was negotiating with Italian company Eni S.p.A.

Rather than CNG, Eni was interested in transporting Turkmen gas in four tankers, in which the natural gas would be compressed into LNG. The budget for the project included 700 million USD for the tankers and 100 million USD for the initial infrastructure, in order to transport 4-5 bcm a year.

It is worth mentioning that neither Enex nor ENI were able to develop their proposals further, and in 2010, a new route for Azerbaijani gas exports also entered discussions. The new route would see Azerbaijani gas transported from the Georgian port of Kulevi to Romania, and then further to European markets.

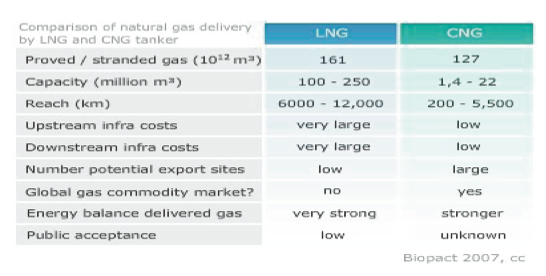

This context shows that both LNG and CNG were at various points both on the table. It should also be noted that in comparison with LNG, a well-established method, the transportation of CNG is still not developed. Therefore there is no data about its relative cost-effectiveness. However, CNG transportation does offer some benefits when compared to LNG.

This is primarily due to the fact that CNG transportation requires relatively small capital investments to build the infrastructure (i.e. berths for loading and unloading). The cost of compression stations is also fairly low. A modern LNG plant may cost 3-4 billion US dollars. Furthermore, CNG ship design and construction materials are much simpler – and potentially cheaper – than LNG vessels. The CNG production cycle includes a compression plant for gas tankers for CNG transportation, and a warehouse terminal for decompressing the gas. The cost of the production and storage of CNG is lower than LNG, since the production does not require an expensive process and the cooling cryogenic tank. Also in favor of CNG is that a higher level of security can be provided against possible accidents on tankers and natural gas leakages, which risk environmental harm. Russia and Iran both state that they oppose the implementation of the Trans-Caspian gas pipeline on the basis of potential environmental harm. In addition, it is believed that losses via CNG transportation may be as low as 2-5%, compared with 2-8% via pipeline transport, and 8-10% via LNG.

As demonstrated, CNG offers clear advantages against the transportation of natural gas by pipeline or in the form of LNG. In this case the benefits are not limited to economic dividends; CNG also offers geopolitical benefits. Transportation via CNG tankers does not require agreement on the contested status of the Caspian Sea, nor the delimitation of maritime boundaries between littoral states.

Despite these various benefits, there are things that still need to be clarified in order to introduce CNG as a realistic option for transportation of natural gas. Although transportation by CNG tankers has been widely discussed over the past ten years, and several design options have been proposed, tanker construction is still ongoing. Therefore, there is still no concrete practice of CNG transportation on world markets, which means that there is no possibility for comparative analysis. It is unlikely that the Caspian littoral countries want to pioneer the application of new technologies. In addition, despite the general perception that CNG is more competitive than LNG specific calculations of profitability have not yet been made. This remains unknown, especially in the context of the recent sharp decline in oil prices, and hence natural gas.

Additionally, it may be the case that Turkmenistan may not have the necessary additional volumes of natural gas for export via the Caspian Sea. At present, Turkmenistan is actively collaborating with China in this field. The two countries have built gas pipelines in Turkmenistan; China has been developing major fields and building the necessary infrastructure. By 2017, the total capacity of the pipeline system from Turkmenistan to China is set to reach 80 billion cubic meters of gas. According to bilateral agreements, Turkmenistan has pledged to supply China with 65 billion cubic meters of gas annually by the end of 2021.

At the same time, there is a very high demand for natural gas in Turkmenistan’s domestic market. For example, in 2014 more than 76 billion cubic meters of natural gas were produced in Turkmenistan. Only 45 billion cubic meters were exported, while the rest of the gas was consumed domestically. In 2015, natural gas production in the country reached 83.8 billion cubic meters, of which 48 billion cubic meters were exported. Thus, in order to start exporting gas westwards, Turkmenistan needs to dramatically increase its gas production. This is theoretically possible, but requires substantial investments. It will also require a guarantee that there will be sustainable and stable access to the gas transportation system to the west.

However, even in this regard there are problems. At the moment, the infrastructure for transporting natural gas has been designed to accommodate the volumes coming from the Azerbaijani Shah Deniz 2 offshore field. This infrastructure is part of the Southern Gas Corridor (SGC). Under the aegis of the SGC, the South Caucasus pipeline (Baku-Tbili- si-Erzurum) will be expanded, and construction of TANAP in Turkey, and TAP in Greece, Albania and Italy will be started. Azerbaijani gas is expected to be transported by these routes by 2018. Initially, it is expected that the volume of natural gas will be 16 billion cubic meters. The gas pipeline will be expanded to export 23 billion cubic meters by 2023, and 31 billion cubic meters from 2026 years. All volumes are calculated for export of Azerbaijani gas. Volumes from other gas fields such as Absheron, Umid, Babek will also become avail- able for export. In other words, pipelines may not actually be available to carry Turkmen gas.

There may be a way of transporting small volumes of Turkmen natural gas, or for Azerbaijan to create the necessary infrastructure for the use of CNG at the domestic level. However, Turkmenistan may not be very interested in exporting small volumes, as its goal is not only to enter Western markets, but also to create a fully diversified export transport system.

Conclusion

Thus despite the advantages of CNG transportation in comparison to pipeline transportation, there remain geopolitical challenges. Russian and Iranian opposition to the construction of the Trans-Caspian pipeline is based on their alleged concerns about environmental protection in the Caspian Sea. These countries are against the creation of a new corridor for gas exports from Central Asia; they want all gas exports from this region to European markets to pass through their territories, for both geopolitical and geo-economic reasons. There- fore, these countries can put pressure both on Azerbaijan and Turkmenistan, in order to prevent the introduction of a new Caspian transportation option.

In general, this idea is interesting and warrants discussion. It is very important to develop and consider new opportunities both in and of themselves, as well as in combination with other proposals. The possibility of CNG transportation via the Caspian Sea is one such opportunity.

About the author:

*Assoc. Prof. Dr. Rovshan Ibrahimov is a faculty member at the Hankuk University of Foreign Studies. He is an expert in energy policy and security of Black Sea/Caspian region, natural gas markets and foreign policy of Azerbaijan.

Source:

This article was published by CCEE as Policy Brief 24 (PDF).