The United States Withdraws From The TPP – Analysis

By CRS

By Brock R. Williams and Ian F. Fergusson*

On January 23, President Trump directed the United States Trade Representative (USTR) to withdraw the United States as a signatory to the Trans-Pacific Partnership (TPP) agreement; the acting USTR gave notification to that effect on January 30.

The TPP is a proposed free trade agreement (FTA), signed by the United States and 11 Asia-Pacific countries on February 4, 2016. The agreement requires ratification by the member countries before it can become effective. Implementing legislation, the vehicle for U.S. ratification, was not submitted by the President or considered by Congress, in part due to the contentious debate over the agreement.

TPP supporters argue that the withdrawal could damage U.S. negotiating credibility, undermine U.S. economic leadership in the region, hurt U.S. firms’ competitiveness abroad, and give China greater leverage to set regional trade rules. TPP opponents see the withdrawal as preventing greater U.S. import competition and potential job losses.

Beyond the trade realm, some analysts also argue the withdrawal may signal declining U.S. engagement in the region and inability to assert leadership, at a time when China’s rise and North Korea’s growing nuclear and missile capabilities are testing the U.S.-led rules system and challenging U.S. influence.

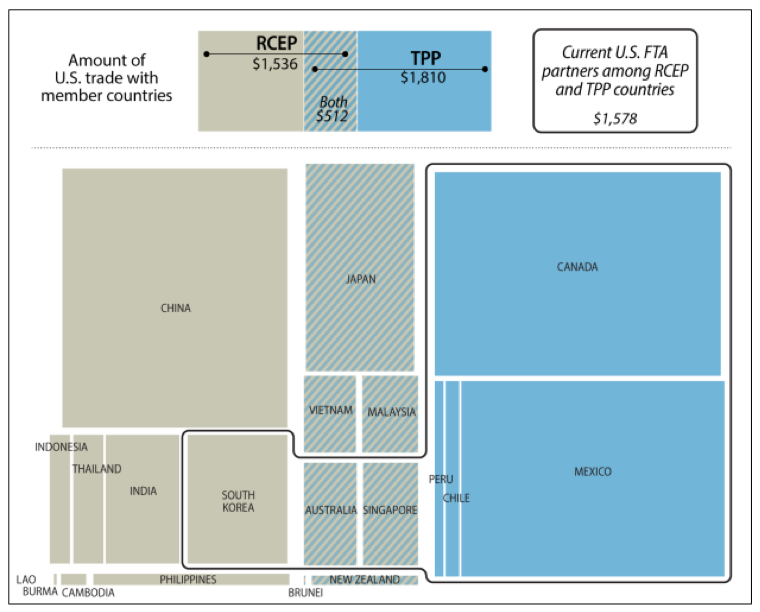

Because the TPP had not taken effect, U.S. withdrawal does not immediately affect U.S. tariffs or other trade commitments. The United States also has existing FTAs with six of the TPP countries (Australia, Canada, Chile, Mexico, Peru, and Singapore), which this announcement does not affect. However, the withdrawal represents a shift in U.S. trade policy, with implications for U.S. trade relations with the Asia-Pacific region and beyond. In particular, it is the Administration’s first step in its stated movement from multi-party to bilateral FTA negotiations.

What happens to the TPP now?

As currently written, TPP cannot take effect without U.S. participation. TPP requires ratification by at least 6 countries representing 85% of the original 12 members’ collective GDP, requiring both U.S. and Japanese participation to become effective.

Given the size of the U.S. market relative to the other TPP countries (U.S. GDP accounts for about 65% of the group’s total), the U.S. withdrawal reduces the economic value of the pact for the other members, especially countries without an existing U.S. FTA, such as Japan. Nonetheless, the remaining TPP countries could move forward with a similar agreement. TPP ratification bills have already passed the Japanese and New Zealand legislatures, and some of the TPP participants, including Australia, would like to move forward with or without U.S. involvement.

Chile plans to host a meeting in mid-March to discuss the future of the agreement, and has invited the 12 original signatories, including the United States, as well as China, Colombia, and South Korea.

The White House has stated that it may instead explore bilateral deals with the various TPP countries. Japan represents the largest market among the TPP countries without an existing U.S. FTA. At their recent summit, Prime Minister Abe and President Trump announced a new bilateral commercial dialogue, which some argue could be the first step toward FTA negotiations. The U.S.-Japan negotiations were a critical aspect of the TPP, which included provisions on autos, insurance, and other issues applicable only to the two countries. Economically, Malaysia and Vietnam, also represent significant candidates for bilateral negotiations given their quickly growing economies and existing trade barriers (e.g., relatively higher average tariffs).

How could other regional negotiations impact the United States?

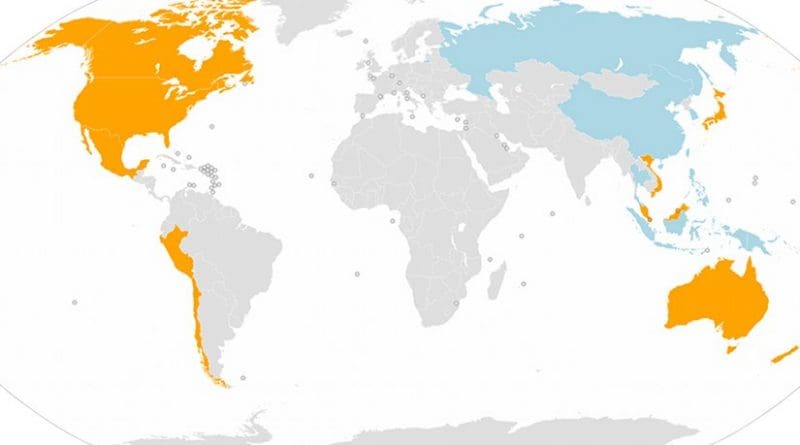

TPP was, in part, a U.S. response to recent growth in regional trade agreement negotiations, many of which do not include the United States and could put U.S. firms at a disadvantage in export markets. The Regional Comprehensive Economic Partnership (RCEP), a trade negotiation among the 10 Association of Southeast Asian Nations, as well as Australia, China, India, Japan, New Zealand, and South Korea, has garnered significant attention, largely because it includes China and several major U.S. trading partners, but not the United States.

Should RCEP move forward in its current form, the United States would face higher tariffs in RCEP markets (excluding existing U.S. FTA partners) vis-à-vis other RCEP countries. This tariff disadvantage could spur other nations to seek RCEP membership, and could give RCEP members outsized influence in establishing the region’s trade rules and disciplines. The extent to which those rules align with U.S. interests in the region remains an open question as RCEP negotiations are ongoing, but most analysts expect RCEP to be less comprehensive in its tariff coverage than TPP and unlikely to include commitments as strong on issues from intellectual property rights to labor and environmental protections.

What are the implications of the shift to bilateral negotiations?

Whether or not bilateral or regional trade deals result in a better outcome for the United States is subject to debate, and likely depends on a number of factors, including the countries involved, the level of trade restrictions, and their existing trade and economic relationship with the United States. The Trump Administration argues that the bilateral approach allows the United States to use its economic leverage and focus on U.S. priorities.

Meanwhile, former USTR Michael Froman suggests that multi-party negotiations can provide more options for mutually beneficial tradeoffs, and can allow countries to make politically challenging concessions that might not be possible in one-on-one negotiations with the United States. Others contend multi-party agreements are more efficient, helping to avoid more overlapping rules in the increasingly complex web of existing agreements. The United States has negotiated and implemented agreements of both types—of the 14 existing U.S. FTAs, 12 are bilateral, and 2 (NAFTA and DR-CAFTA) are multi-party.

What will future U.S. trade negotiations look like?

The Trump Administration has said it plans to reexamine existing U.S. FTAs, and take a new approach to future negotiations. Congress, however, has set U.S. negotiating objectives under Trade Promotion Authority (TPA). Under TPA, U.S. trade agreements must make progress toward achieving these objectives for their implementing legislation to receive expedited legislative consideration.

Based on these objectives, the United States has been negotiating broad-based FTAs since the 1980’s to reciprocally reduce and eliminate tariff and nontariff barriers in goods, services, and agriculture, and establish trade rules and disciplines. These commitments expand on WTO obligations and address new issues. For example, TPP included new provisions on digital trade and state-owned enterprises, viewed by many as critical components of the agreement. Going forward, the Trump Administration’s FTA negotiations may be the primary vehicle through which the United States can address these emerging aspects of trade policy.

*About the authors:

Brock R. Williams, Analyst in International Trade and Finance and Ian F. Fergusson, Specialist in International Trade and Finance

Source:

This article was published by CRS as CRS Insight IN10646