The European Union: Lessons From A Crisis – Analysis

By IPRIS

By Aníbal António Cavaco Silva, President of Portugal

The European Union is living decisive moments for its future. What is at stake is the greatest asset that the European peoples have available to face the challenges of the present and the uncertainties of the future: European integration. It is against this background that I propose some thoughts that are the result of my experience and of my academic education, the interrogations that have been crossing my mind concerning the European project, and particularly the crisis of the euro.

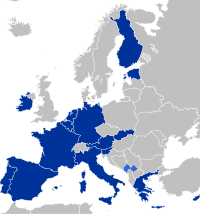

To start with, it is imperative that we recall the fantastic success of the European integration process that, over more than five decades, has guaranteed a cycle of peace and prosperity without any precedent in the History of Europe. Borders were eliminated, the free circulation of people was established, a single market was built that is the largest economic block in the world, links of solidarity were strengthened on the basis of the economic and social cohesion principle, a single currency was created, common policies were defined, cooperation was fostered in multiple areas, Europe was projected in the world, and, from six founding States, the European Union was enlarged to the current 27 members.

Several crises and obstacles had to be faced along the way, but Europe proved to be able to answer them. National interests were framed around a common interest strengthening the union and the sense of community. This is how it will have to be again, in the face of the current crisis, undoubtedly one of the most grievous in the history of European construction. It is necessary to clear up certain inaccurate opinions and beliefs that have emerged related to this crisis.

First of all, the euro is not the cause of the crisis. The causes are rooted, on the one hand, in erroneous policies, specifically budgetary and macroeconomic, adopted by the member States and, on the other hand, by an inadequate supervision from the European institutions. The responsibility for this crisis is clearly shared by the member States and the European institutions.

Some criticize the Treaty of the European Union whose signing I had the privilege to preside, in Maastricht, in 1992, as President of the European Council. They say that the current difficulties arise from the insufficiencies of that Treaty. First, these critics seem to forget the circumstances of the time: the Treaty of the European Union was negotiated 20 years ago, globalization was still emerging, the EU had 12 members, the Berlin wall had fallen only two years before, and the new economic drivers of the global era were yet to assert themselves. The world was a different place. They also seem to forget that the Treaty of Maastricht, in addition to setting rules for multilateral supervision, did not ignore the need for the coordination of national economic policies between member States.

No doubt, the Treaty reflected, as is always the case in such negotiations, the compromise that proved possible between different positions. Notwithstanding, it was a great step ahead in European integration. It is however true that at the time, many of us, headed by Jacques Delors, were aware that the Economic and Monetary Union, set up in Maastricht, was more consistent in what concerned its monetary basis rather than its economic component.

On the monetary side, we had a design based upon a federal logic. Economic governance, however, was of a different shape, largely dependent upon the responsibility of the States, upon the conduction and transparency of their policies, and upon the effectiveness of supervision by the Commission and by the Council of Ministers.

Still, it is not the Treaty later complemented by the Stability and Growth Pact that are to blame but rather the implementation of its principles, due to the lack of responsibility in the States’ governance practices and to the lack of effectiveness of the European institutions. A decisive factor was particularly responsible for the unleashing of the crisis: the incompetent scrutiny of the course of public finance in several member States. The Commission and the Council did not carry out all their duties to correct the excess deficit situations. And the failure of the Council to defend the credibility of the Stability and Growth Pact should well be recalled, when it ensured that the infringement of the limits of the budgetary deficits by Germany and France, in the first years of this century, should go by unmolested.

It was a bad sign for the markets that the European Union was ready to renounce the strictness of its criteria on behalf of political concepts and circumstances imposed by national interests. As some will recall, there were certain people who, in order to justify the adjustment to the Pact’s rules, even called it “stupid”. Do not thus attribute the fault of the crisis of the Euro Zone only to the Treaty and the member States that lacked financial discipline.

It is equally important to recognize that the crisis involving the euro zone is not confined to a specific member State. In the current situation, and minding the high degree of economic and financial interdependency, any negative development in a euro zone State will always have a negative impact in all the other States. And it is this risk of contagion that must be adequately forestalled and must not be minimized.

In the face of the evidence of the crisis, the Union was late in recognizing its nature and its size as well as in providing the adequate answer. Tangled in a political rhetoric of mutual recriminations, avoiding to recognize the shared responsibility, ignoring the evidence of the risks of contagion, hesitating in issues of solidarity, inconsistent as to the instruments to be used, promoting an intergovernmental drift, the European Union fuelled growing speculation over the euro zone, giving rise to uncertainties as to the single currency’s own future. It thus happens that what the markets are testing is precisely the existence of a true and consistent Economic and Monetary Union.

I recall Jean Monet’s words. I quote: “We only have one choice: between the changes which we will be dragged into or those that we are willing to carry out”. Today we are faced with exactly the same choice: we either face the crisis with the required measures or it will drag us towards unforeseeable and uncontrollable changes that place at risk the European Union itself.

What we are facing nowadays requires action, swift action. The markets do not wait for labyrinthine and interminable discussions. It is difficult to understand, for instance, that the positive decisions of the Council of Europe taken on July 21st are still imprisoned by political and formal obstacles. As inadmissible is the daily happening of divergent speeches by the European leaders. Today’s demands are, more than ever, convergence, solidarity and responsibility, without fail.

At last, there is a point where it seems there is a trend towards a broad convergence of views: a euro zone State in difficulties must not be allowed to fall into uncontrolled default, if we want to avoid a domino effect with unforeseeable consequences for the European integration project itself. The failure of the euro would place the internal market at risk, would nourish the return of nationalisms and protectionisms, and would seriously weaken Europe in the international stage.

On the contrary, it is necessary to reassert that the European Union has the resources, the instruments and the institutional means to overcome this crisis. What has been wanting is the political will to use them effectively and swiftly. In brief, the answer to the crisis must be European, systemic and effective in the short term. Within this framework, I believe there are compelling measures that cannot wait. Starting with the strengthening of the European Financial Stability Facility (EFSF), a fundamental instrument to assist States in difficulties. Its dimension must be able to cope with the speculative risks that have been identified already.

Another intervention that is immediately required is the responsibility of the European Central Bank (ECB) that, throughout its 12 years existence, has had an extremely positive action. It has fulfilled its mandate, ensuring price stability, and has contributed to combat the financial crisis in the euro zone. I render my tribute to Wim Duisenberg and to Jean- Claude Trichet for the way they have carried out the difficult office of President of the European Central Bank.

However, the exceptional situation of real emergency that we have reached requires more from the ECB. A wider and more foreseeable intervention is necessary in the sovereign debt market of the solvent countries that face problems of liquidity, including the availability for an unlimited intervention in the secondary market, such as argued by Paul de Grauwe. This is not in the sense of operating an uncontrolled intervention with an unmeasured risk. It is a credible commitment to repel speculation and guarantee, in this way, the conditions for the operation of the sovereign debt markets within a framework of stability and confidence. This is a function to be exercised as a last resource, as is now the case when the pressure of the markets reaches unbearable proportions. In general, anyway, economists recognize that once speculation is done away with, this function does not need to be materialized, and is usually merely kept on a suppletive basis The threats to the euro zone do not recommend that we remain tied to restrictive interpretations of the regulations of the Economic and Monetary Union.

It is abundantly clear that the ECB’s intervention in the sovereign debt market, as well as that of the EFSF, have to be associated to strict conditions that guarantee the’ compliance of the States in difficulties with the appropriate budgetary and structural policies. The solidarity/responsibility interface must be assumed by all, member States and European institutions.

The recapitalization and financing of the European banks is another urgent measure, which demands intense consultation and broad agreement as well as the mustering of instruments of European level in nature and size. The strengthening of the banks’ capital funds is a generalized need in Europe, such as the need to guarantee liquidity through instruments that overcome the difficulties to access the markets. Here again the European Union, specifically through the EFSF and the ECB must act as the promoter and catalyst of the measures to be agreed at the euro zone level.

Without capital funds that guarantee the capacity to face the crisis, without liquidity to maintain credit, the banks will be unable to ensure the financing of the economy, with dramatic economic and social effects that will only accentuate the crisis, in a spiral with unforeseeable consequences.

I have been closely following the controversy on the issue of Eurobonds. I do not doubt that they could be a powerful answer to this crisis. However, its implementation would imply the need to overcome such a lack of definitions, both political and technical, that it would be impossible to bring into practice within a period compatible with the current difficulties. It is my belief, however, that the so called Eurobonds should remain on the European agenda, requiring a quick clarification of the concept and of the requisites concerning the necessary transfer of sovereignty to the European institutions as well as the changes to be introduced in the institutional design of the Economic and Monetary Union.

Furthermore, an effective answer to the crisis implies the deepening of the European economic governance. The European Semester and the Pact Plus are a step in that direction. But a lot more is required, as argued by the Commission and by the European Parliament. This point must be made very clear: the strengthening of the EFSF and the intervention of the ECB may only be carried out within a framework in which the budgets and macroeconomic policies of the States respect a balanced and sustainable course which can be adequately scrutinized.

However, this does not imply the setting up of new structures to compete with already existing ones, but just the strengthening of the latter, starting with the central role of the European Commission. I thus cannot hide the concern with which I have been witnessing, in the last few years, the perversion of the community method. The intergovernmental drift is contaminating the institutional functioning of the European Union. Instead of a mustering convergence, and of a common responsibility, we are seeing the emergence of a “Directoire”, not recognized, without a mandate, that overlaps the community institutions and limits its operational margin. This is an unwise and dangerous course. Unwise because it is ineffective. Dangerous because it generates mistrust and uncertainties that undermine the spirit of the Union.

The right course is the community method, as the history of European integration so amply demonstrates. It was with the community method that European integration was deepened and asserted itself. With the Commission as the centre of gravity for initiative, the executive arm of the common policies and actions, and the guardian of the Treaties. The political guidance is the responsibility of the Council, and not of a “Directoire” constituted by some countries, and it is the responsibility of the Council of Ministers to take the decisions that frame the community action. This is the institutional formula that will guarantee the union of Europe.

I once again repeat: the economic governance of the euro zone must be more imperative, strict and effective. But it is the European Commission that must be the institutional hinge to carry out this mission, in a balanced and effective way. One may ask whether it will be necessary to review the Treaty of Lisbon. The European Union has always combined federal, community and mere intergovernmental cooperation components. It is one of its original labels. I believe it is to be expected and also desirable that, within time, the monetary union be accompanied by a true Economic and Financial Union, in order not just to guarantee monetary stability, but also financial stability and economic growth.

Therefore, a review of the Treaties in the medium or long term must be considered. I repeat, in the medium or long run, because the crisis will not wait for a review of the Treaties which, as is well known, will be inevitably slow and complex. But the fight against the financial crisis has to include an agenda for the promotion of economic growth and employment. The restructuring of public finance will have a socially unbearable result if not accompanied by an economic recovery that leads to job creation. The European Union has a central role in the promotion of this objective, strengthening the instruments for the support of innovation and competitiveness, encouraging economic initiative and entrepreneurship.

I am particularly concerned with the extremely high levels of youth unemployment in the European Union, resulting from an anaemic and uncompetitive economy and from the measures of strong budgetary containment.

The austerity policies and lack of liquidity faced by countries with greater levels of indebtedness must be compensated by wilful growth and employment policies promoted by the European Union, by expansionist policies by countries enjoying surplus and by a prudent reduction in the ECB reference interest rate. This is the course that will allow, in this difficult stage, a horizon of hope and confidence for all European citizens, without exception.

As is well known, Portugal signed a financing assistance programme with the EU and the IMF. This programme benefits from the support of a very large majority in the Portuguese Parliament and will without any doubt be fully complied with by the Portuguese Government. Portugal will fully honour its commitments, will re-establish the balance of its public finances and will go ahead with the structural reforms required to strengthen the competitiveness of its economy.

Great sacrifices are being demanded from the Portuguese, who have answered with a great sense of responsibility. It is important, for the European Union as well, that Portugal’s demanding effort is successfully carried out. For this purpose, it is necessary that the European Union faces the financial crisis with adequate and timely measures, and that it takes the systemic decisions that are necessary to ensure the stabilization of the euro zone, the strengthening of the financial system and the promotion of economic growth. “Concerned, but confident”, is how I define my state of mind. Above all, I want, once again, to emphasize that Europe has the capacity and the resources to overcome the crisis. If there is political drive and responsible solidarity the Union will demonstrate, once more, its strength.

In 1946, immediately after the II World War, in the renowned speech of Zurich, Churchill stated that there was only “one effective remedy for the European tragedy: to recreate the European Family”. This remedy continues effective. It must be used without restrictions to avoid that European integration recedes and becomes just a melancholic utopia.

In the first half of last century, the great Portuguese poet Fernando Pessoa, ill-content with his country’s situation, where “no one knew what they wanted, not even what soul they had”, called on his country and its people, with a cry that echoes, still today, in the hearts of the Portuguese in difficult hours: “Oh Portugal … it is Time!”.

In this difficult moment in the life of Europe and of the Europeans, this appeal comes often to my mind. I sincerely hope that also Europe will be able to recognize that this “is the Time!”

This article is based on the speech delivered by the President of the Republic at the “Debating Europe” series, in the European University Institute, Florence, Italy, October 2011.

Source:

This article was published by the Portuguese Institute of International Relations and Security (IPRIS) and may be found here (PDF).