The Little Known Story Of Spain’s Export Success: But How Long Will It Last? – Analysis

Every crisis has a silver lining. Spain’s four-year recession, apart from anaemic growth in 2011, has produced an unprecedented surge in exports, helping to lower the trade deficit and contributing to a turnaround in the current account. But for how long can this be sustained?

By William Chislett

Summary

Export growth, much more than the decline in imports, has reduced the trade deficit and prevented the country’s recession from being deeper. Whereas in the past, when the peseta existed, Spain could boost its competitiveness by devaluing the currency, as a euro member it can only do so through productivity gains and improving the price/quality relationship. Exporters have so far been remarkably successful. The challenge is to maintain the momentum when the economy starts to grow again.

Analysis

Spain is not a major exporting country and yet between 2009 and 2011 exports of goods rose by €54.6 billion to €214.5 billion, an improvement equivalent to 5.1% of GDP and a faster pace of growth than Germany, France and Italy, albeit from a smaller volume. Given the weakness of most markets in the EU, Spain’s principal export destiny, the export performance is remarkable and shows what companies can do in order to survive when the chips are down.

The number of companies that exported last year was a record 122,987, 14% more than in 2009. While the US, the UK, Germany, France and Italy have lost global market share to varying degrees over the last decade, mainly to China and other emerging countries, Spain’s share of world merchandise exports has remained virtually unchanged at around 1.7% (see Figure 1), according to the World Trade Organisation (WTO). Spain, in 2010, only lost 0.4 pp of its global share since its peak of 2.0% in 2004 compared with Germany’s 0.7 pp since 2004, France’s 1.6 pp and Italy’s 1.1 pp. The 2011 WTO figures to be released later this year are expected to show Spain still holding steady.

Merchandise exports grew 15.4% in 2011 compared with 11.4% in Germany and Italy and 7.5% in France, and increased 3.4% in the first half of 2012 to €110 billion compared to the same period of 2011. This showed that the performance is consolidating for the third year running.

But for the positive contribution of external demand (negative for domestic demand), Spain’s recession, which is officially forecast to last until 2014, would have been deeper. Spain’s structural problem is that external demand is only ever positive when the economy is in the doldrums, as Figure 2 shows. Between 1988 and 2012, the contribution of external demand to GDP growth was positive in only seven years. Its largest contribution was in 1993, when Spain suffered its last recession, mild and short-lived compared to the current one.

The comparison with 1993, however, is tenuous because until Spain joined the euro in 2002 it could resort to the policy option of devaluing its currency, the peseta, in order to restore or boost export competitiveness. The peseta was devalued seven times between 1959 and 1993 (three of them in the 1990s). This option disappeared with entry into the euro and since then competitiveness can only be enhanced through internal devaluation, essentially by lowering wage costs and profit margins, increasing productivity and improving the price/quality relationship.

While the Spanish economy as a whole lost competitiveness during its more than a decade long economic boom, this affected the export sector less as it always has to be more efficient than the purely domestic sector in order to compete. The current account deficit reached 10% of GDP in 2008 at the end of the boom, the largest in the euro zone and much bigger proportionately than the US deficit at its peak. This year the deficit is forecast at less than 2% of GDP.

The economy’s external competitiveness continued to improve in the first half of 2012. The Competitive Trend Index (CTI), calculated on the basis of consumer price inflation as well as on the unit value of exports, registered gains.

As a result of the export growth, to a greater extent than the fall in imports (-1.4%), the trade deficit for the first half was 22.5% lower year-on-year at €18.6 billion. A substantial part of the trade deficit is due to energy imports (from non-EU countries). Exports covered 85.5% of imports in the first half, up from 81.5% in the same period of 2011 and 67% in 2008 before the country went into recession.

The export performance is best judged by looking at trade with the EU, which took 64% of exports and supplied 50.6% of imports. Spain achieved a rare surplus of €5.5 billion with the EU, compared with deficits of €10.8 billion with Asia, €6.7 billion with Africa and €3.4 billion with the Middle East.

Traditionally an exporter of vegetables, fruit and wine, Spain since joining the EU in 1986 exports an increasingly diversified range of products (see Figure 3), from oddities such as doughnuts to cars, information and air traffic control systems (Indra) and space navigation equipment (GMV). Sectors with a high technological component, however, are under-represented in the structure of exports. The automotive industry has generally been the number one exporter over the years (around 20% of the total), but with markets in virtually all European countries depressed exports of cars are substantially lower. All other sectors, however, boosted their exports in the first half, notably food (+9.5% year-on-year).

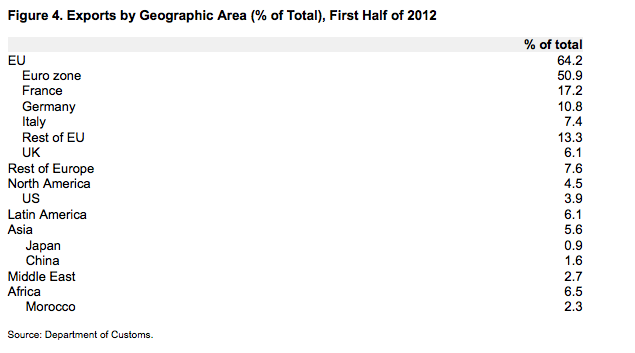

There has also been some success in increasing sales to non-EU countries, which is particularly important given the depth and duration of the EU’s crisis (see Figure 4). Exports to these countries (35.8% of the total) were 10.5% higher in the first half and those to relatively new markets such as China rose 10.5% and 27% to Africa (+21% to Morocco).

Despite its recent success Spain is still not a strong exporter, as Figure 5 shows. Per capita exports in 2010 (latest comparative figures) were US$5,339 compared with Germany’s US$15,474. Based on exports of US$298.2 billion and a population of 47.2 million, per capita exports in 2011 were US$6,317, almost US$1,000 more than in 2010 and only a little over US$1,000 less than Italy’s level in 2010.

Conclusion

The challenge for Spain is to achieve a better balance between the different components of its economy in which exports play a greater and strategic role, like Germany. It is no accident that Germany has recovered more quickly than the other large euro zone countries as its economy is much more export-oriented and internationalised than Spain’s in good times and not just in bad ones.

This must greater internationalisation goes some way towards explaining why Germany’s jobless rate is less than 7% as against Spain’s 25%. Germany’s rate, although cushioned by subsidies to companies to keep workers in employment while reducing their hours (a scheme known as kurzarbeit), is the lowest since records for a reunified Germany began in 1991, while Spain’s is the highest in 15 years.

The comparison is even more stark in absolute terms: Germany, with a population of 82 million and 30% of the euro zone’s GDP, has fewer than 3 million people out of work while Spain (population 47.2 million and 11% of the GDP) has more than 5.5 million (based on the quarterly household survey).

Spain’s future economic wellbeing depends to some extent on maintaining the momentum of exports when the economy starts to grow again as of 2014. Achieving this would be an excellent indicator of a healthier economy.

William Chislett, is an Associate Analyst of the Elcano Royal Institute, journalist and writer (his new book on Spain will be published in 2013 by Oxford University Press). This article was published by Elcano Royal Institute and may be accessed here (PDF).