US-ASEAN Connect Holds Promise Of Deepening Relations – Analysis

By ISEAS - Yusof Ishak Institute

By Tham Siew Yean*

Economic cooperation between the US and ASEAN has been advancing steadily since the former became a Dialog Partner in 1977. A Trade and Investment Agreement (TIFA) was inked in 2006 to strengthen economic links between the two, and in 2012, the US-ASEAN Expanded Economic Engagement (E3) initiative was launched under the TIFA to strengthen trade and investment ties, and to create business opportunities and jobs.1 The latest initiative – the US-ASEAN Connect – announced in February 2016 by President Obama at the US- ASEAN Summit in Sunnylands, CA, is poised to take US-ASEAN relations to new heights.

The US-ASEAN Connect has four strategic thrusts, or pillars.2 The first is the Business Connect that aims to support commercial links between the US and ASEAN in key sectors, and to assist ASEAN in its ASEAN Economic Community (AEC) implementation measures. The Energy Connect focusses on the development of power sectors in ASEAN and the connectivity, clean energy as well as energy security goals of ASEAN. The Innovation Connect uses policy support and direct engagement with entrepreneurs to develop Southeast Asia’s entrepreneurial ecosystem while the last pillar, the Policy Connect supports the development of a policy environment conducive to the promoting of trade, investment, innovation and sustainable and equitable economic growth.

This article reviews ASEAN-US economic ties before analysing the impact of the US- ASEAN Connect on ASEAN and the US in terms of economic rebalancing. It further examines the implications of this new initiative on the Trans-Pacific Partnership Agreement (TPPA), and on economic integration within ASEAN.

THE CONTEXT

ASEAN member countries are far from homogeneous and there are also substantial disparities between them, ranging from different stages of economic development, size, resource endowments, political systems, colonial/non-colonial past, to religious diversities and socio-cultural complexities.3 Given these differences, fostering consensus within ASEAN understandably takes time. Economic linkages in the early years were mainly led by market forces through the trade-investment nexus that evolved as different ASEAN economies progressively opened up to Foreign Direct Investment (FDI).

Trade within ASEAN was cultivated by regional production networks, especially in the electrical and electronics sector, leading to growing intra-industry trade or two-way trade in intermediate goods within the region.

The establishment of the ASEAN Free Trade Area (AFTA) in 1992 raised the pace of regional economic integration as tariff barriers were progressively reduced. This initiative which was subsequently replaced by the ASEAN Trade in Goods Agreement (ATIGA) proved to be the most successful of all the AEC Blueprint goals that were targeted for the establishment of an ASEAN Economic Community (AEC) by 2015. By 2014, the share of tariff lines at the ATIGA rate of 0% was reported to stand at 99.2% for the ASEAN-64 and at 72.6% for the CLMV5 countries.6

Despite this success and the pronouncement of an AEC in January 2016, not all the stated goals were achieved by the end of 2015.7 The AEC therefore remains very much a community in the making. This is implicitly acknowledged in the new ASEAN 2025 Vision that specifically highlights the need to address the unfinished business of 2015.8 The 2025 Vision continues the 2015 Vision of deepening integration in order to achieve “an integrated and highly cohesive, competitive, innovative and dynamic community, with enhanced connectivity and sectoral cooperation,” which is also at the same time, a “more resilient, inclusive, and people-oriented, people-centred community integrated with the global economy.”9

INVESTMENT AND TRADE TIES BETWEEN ASEAN AND US

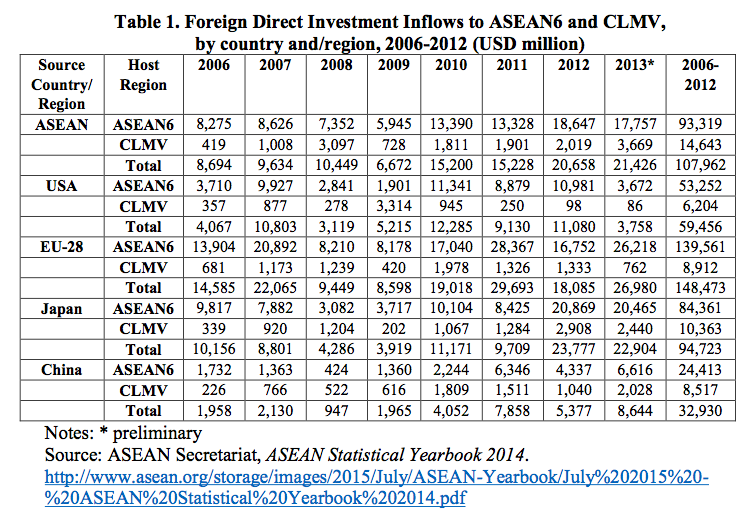

Based on inflows of FDI into ASEAN, the US is the fourth largest investor for the period 2006-2013 – after the EU28, ASEAN and Japan (Table 1). The bulk of these investments are to the older ASEAN member countries (90%). This contrasts sharply with China’s FDI in ASEAN, where slightly more than a quarter are invested in the CLMV countries. Although Singapore is the largest recipient of US FDI as an immediate destination, it is probably not the ultimate destination of all of these flows, functioning as it does as a regional financial centre.10 There is unfortunately no data on the ultimate destinations of FDI. After services, manufacturing is the largest sector for US FDI, especially in computer and electronic products manufacturing.

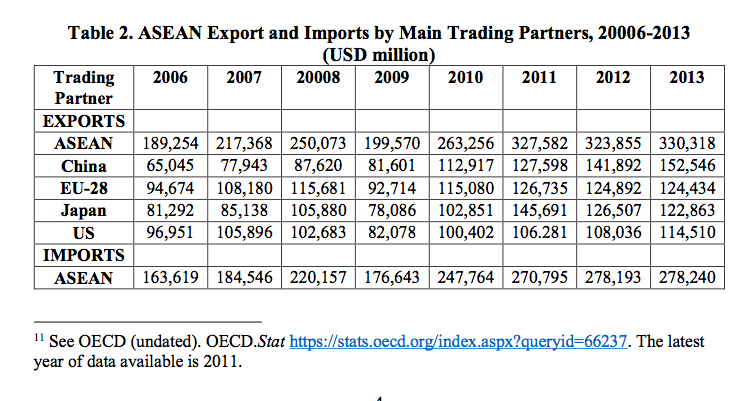

In 2006, the US was ASEAN’s largest export partner outside ASEAN (Table 2). But between 2006 and 2013, it was consistently in fourth place, after China, the EU and Japan. However, given the importance of global value chains in the manufacturing sector, especially in electronics where US investment is important, the gross value of exports is increasingly considered to be less important than the value added content in exports. The OECD’s Trade in Value-Added data shows that in 2011, the domestic content of ASEAN’s exports to the US stands at 55% while it accounts for 50% of ASEAN’s exports to China.11

The brief review above therefore shows that the US remains an important investor and trade partner for ASEAN.

POTENTIAL IMPACT OF US-ASEAN CONNECT

1. Rebalancing Economic Ties: ASEAN, China and the US

a) ASEAN

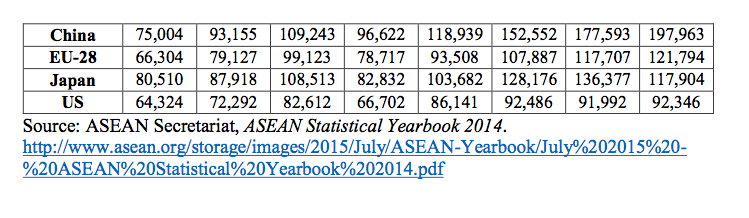

Based on Table 3, China is ASEAN’s largest trading partner (outside ASEAN). Although it already has a free trade agreement with ASEAN, another in the form of the Regional Comprehensive Economic Partnership (RCEP) is being negotiated. In contrast, the US does not have any with ASEAN. The US-ASEAN Connect therefore offers a potential remedy to that lack by enhancing trade and investment links between the US and ASEAN. This can conceivably change the relative position of the US and China as trading partners of ASEAN and their respective economic footprints in the region.

For ASEAN, diversifying its trade away from China may be timely for several reasons. First, China’s economy is slowing down as it restructures from its old model of growth that was based on FDI, exports and cheap labour. That model created overproduction, excess capacity as well as considerable environmental damage, making it increasingly unsustainable as the resource gap narrowed and environmental costs escalated. The GFC further magnified the imbalances. Consequently, China is shifting to a new development model that focusses on domestic consumption rather than just exports, promotes added value and concentrates also on services development and not just manufacturing.12

Second, economic restructuring takes time and the growth rate of China has slowed down considerably from its heady days of double-digit growth. Instead, China’s growth rate has trended downwards since 2010 and its growth rate of 7.4% in 2014 was its lowest in 24 years. It also remains to be seen whether China can successfully undertake the economic reforms needed for rebalancing growth. The US economy, on the other hand, is recovering from the GFC, with a modest expansion in growth rates and employment.13

Finally, China’s growth in the last three decades was accompanied by substantial industrial upgrading. Homegrown firms have gone from strength to strength, especially in the high-tech sector. This has enabled China to increase the domestic content of its exports resulting in a falling share of imported parts and components in China’s merchandise exports, from a peak of 60% in the mid-1990s to 35% in 2012.14 Substituting domestic inputs for imported ones will affect China’s trade with ASEAN, especially in the electronics segment where parts and components are the major traded manufactured goods.

b) China Plus Strategies for Corporate America

Low wages in China has long dissipated with its rapid growth, thereby eroding its previous competitive advantage in labour-intensive manufacturing. Reportedly, the average daily wage of a factory worker in China today is USD27.50, while it is merely USD8.60 in Indonesia and USD6.70 in Vietnam.15 This, coupled with increasing labour unrest and an ageing population has prompted MNCs to consider alternative strategies such as relocation to the inner parts of China, and reshoring and moving to Southeast Asia.

The 2015 A.T. Kearney US Reshoring Index dropped substantially, representing the largest year-over-year decrease in the last 10 years, while offshoring continues to gather steam.16 Relocation to Southeast Asia is increasingly part of a China Plus One Strategy to reduce costs, diversify risks and explore new growing markets that promise better demographic dividends. Here, the diversity in ASEAN is a plus as it allows American businesses to locate different segments of their operations in different ASEAN economies based their respective comparative advantage.

There is the added attraction of an expanding middle class in larger economies of ASEAN like Indonesia and Vietnam and in the not-too-distant future, Myanmar. ASEAN will no longer be just a production platform but will increasingly serve as an important consumption base for the goods produced by corporate America within ASEAN and for the ASEAN market.

2. Expansion of TPP Membership

The agreement on the Trans-Pacific Partnership (TPPA) was signed on 4 February 2016 and is in the process of being ratified. It is extensive and reaches far beyond issues of mere market access into trade governance, much further than any existing ASEAN and ASEAN Plus agreements.

It is however perceived to divide ASEAN as only four ASEAN member states (Brunei, Malaysia, Singapore and Vietnam) are parties to this 12-member country agreement. But, the agreement is open to other countries to join which are willing to meet TPP Disciplines.

Three other ASEAN member states have expressed interest in joining – Indonesia, the Philippines and Thailand. Keeping ASEAN intact is equally important to the US as the TPP is a key economic component of the US ‘pivot’ to Asia. But having only four ASEAN member countries on board weakens the credibility of it having central significance in that ‘pivot’. Hence it is critical for the US to extend membership of the TPPA to other ASEAN member countries as well, including Cambodia, Laos PDR and Myanmar.

In this regard, the US-ASEAN Connect can serve to prepare Indonesia, the Philippines and Thailand in embracing the liberalization commitments of the TPPA and in carrying out the domestic reforms needed to align their respective regulatory structures to the governance aspects in the agreement. The often quoted example is the need for the Philippines to amend the foreign ownership restrictions found in its constitution.17 This aspect of capacity building in the US-ASEAN Connect can help bridge the regulatory gap between what is aspired to in the TPP and what is now place in the member countries of ASEAN.

3. Deepening integration within ASEAN: Towards ASEAN 2025

It is ultimately an integrated ASEAN market that holds the most promise in facilitating what investors desire, which is the seamless movement of goods, services and people across Southeast Asia. The formal establishment of the AEC in 2015 is a step in the right direction while the ASEAN 2025 vision as mentioned above, keeps ASEAN heading towards the same goals.

US interest in ASEAN can be seen in the fact that it is the first non-ASEAN country to name an Ambassador to ASEAN, which it did in 2008, and to establish a dedicated Mission in Jakarta, which it did in 2010. A resident Ambassador was appointed in 2011.18 Numerous initiatives focussing for example, on capacity building in technology, education, disaster management, food security, and trade facilitation have been launched to assist in ASEAN’s integration process. The US-ASEAN Connect aims to build on these existing efforts, which is something that is especially welcomed for ASEAN.

Although both the US-ASEAN Connect and the ASEAN 2025 Vision are sparse on details about implementation, the former can nevertheless be seen to support the latter in several ways. First, the Policy Connect promises to assist ASEAN member countries in developing a policy environment conducive to trade and investment. In the case of investment, for example, the ASEAN 2025 Vision aims to “enhance further its attractiveness as an investment destination globally through the establishment of an open, transparent and predictable investment regime in the region.”19

ASEAN member countries that do not as yet have in place transparent investment laws, regulations and administrative guidelines stand to learn much from the investors themselves and from best practices in the region in facilitating the entry of foreign businesses. The Policy Connect can conceivably contribute towards the development of an environment in ASEAN that is conducive to investments. Second, technical support provided through the Energy and Innovation Connect can also contribute towards enhancing the goals of connectivity and sectoral cooperation as mentioned in the ASEAN 2025 Vision. Technical support, especially if channelled towards the newer ASEAN member countries, can also help to bridge the development divide in ASEAN, thereby assisting ASEAN integration. All in all, the US-ASEAN Connect is potentially a win-win initiative, meeting both investors needs and ASEAN’s goals for deepening integration.

CONCLUSION

The US-ASEAN Connect holds tremendous promise for strengthening economic ties between the US and ASEAN. But the realization of this potential needs much more concrete measures to be undertaken than what has been revealed in the February 2016 announcement. While the formal announcement provides the much-needed policy nod for strengthening ties, there is the unanswered question about how this can be achieved.

The US-ASEAN Connect merely states that the U.S. government is establishing a network of three Connect Centers – in Jakarta, Singapore, and Bangkok, which will be responsible for focussing and coordinating US government resources for this initiative. To move forward, Washington will need to provide a great deal more detail about their plan, such as the budget allocated, work plans, the implementation schedule, monitoring and evaluation

mechanisms, and more importantly, the provision for ASEAN input.

About the author:

* Tham Siew Yean is Senior Fellow at ISEAS-Yusof Ishak Institute.

Source:

This article was published by ISEAS as Perspective 2016 No. 17 (PDF)

Notes:

1 See https://ustr.gov/issue-areas/trade-organizations/association-southeast-asian-nations-asean

2 See http://asean.usmission.gov/factsheet02172016.html for additional details.

3 See Ito, T., Kojima. A., Mckenzie, C. and Urata, S. (2011). ‘ASEAN Economy: Diversities, Disparities, and Dynamics’: Editors Overview’, Asian Economic Policy Review, 6 (1): 1-21. 10.1111/j.1748-3131.2011.01192.x

4 This refers to Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand.

5 This refers to Cambodia, Lao PR, Myanmar and Vietnam.

6 See ASEAN Secretariat (2015). ‘ASEAN Integration Report 2015.’ Jakarta: ASEAN Secretariat. http://www.asean.org/asean-integration-report-2015-4/

7 For further details on the specific goals and achievements of each, see ASEAN Secretariat (2015). ‘A Blueprint for Growth ASEAN Economic Community 2015: Progress and Key Achievements.’ Jakarta; ASEAN Secretariat. http://www.asean.org/storage/images/2015/November/aec-page/AEC-2015-Progress-and-Key- Achievements.pdf

8 See ASEAN Secretariat (2015), ‘ASEAN 2025: Forging Ahead Together’, where it is stated in page 59, “The immediate priority is to complete the implementation of measures unfinished under the AEC Blueprint 2015 by end-2016.” http://www.asean.org/storage/2015/12/ASEAN-2025- Forging-Ahead-Together-final.pdf

9 See Daily Express, 17 November 2015. http://www.dailyexpress.com.my/news.cfm?NewsID=104536

10 United States Government Accountability Office (GAO) (2015). ‘Southeast Asia: Trends in US and Chinese Economic Engagement. Report to Congressional Requesters’. GAO-15-724. http://gao.gov/assets/680/671988.pdf

11 See OECD (undated). OECD.Stat https://stats.oecd.org/index.aspx?queryid=66237. The latest year of data available is 2011.

12 Yue, Pan and Evenett, Simon (2010). ‘Moving up the Value Chain: Upgrading China’s Manufacturing Sector.’ International Institute for Sustainable Development (IISD). http://www.iisd.org

13 See further details on the economic rebound in the US in Tang, S. M. and Basu Das, S. (2015). ‘The Significance of the 2015 Us-Sate of Union Address for Southeast Asia’. ISEAS Perspective No. 16. 17 March 2015.

14 Cristina Constantinescu, Aaditya Mattoo, and Michele Ruta (2015). ‘The Global Trade Slowdown: Cyclical or Structural?’ IMF Working Paper WP/15/6. https://www.imf.org/external/pubs/ft/wp/2015/wp1506.pdf

15 JiaXing and Yangon (2015). ‘The Future of Factory Asia: A Tightening Grip’. The Economist, 14 March 2015. http://www.economist.com/news/briefing/21646180-rising-chinese-wages-will- only-strengthen-asias-hold-manufacturing-tightening-grip

16 https://www.atkearney.com/documents/10192/7070019/US+Reshoring.pdf/14777afa-0c14- 460e-937b-11233be340b6

17 http://www.scmp.com/news/asia/diplomacy/article/1912527/us-president-barack-obama-likely- promote-virtues-tpp-and

18 See US Engagement with ASEAN, http://asean.usmission.gov/mission/participation.html

19 See page 7 of the AEC Blueprint 2025, http://www.asean.org/storage/images/2015/November/aec-page/AEC-Blueprint-2025-FINAL.pdf