Back In Business: Post-Deal Iran And India Back As Economic Partners – Analysis

Even as in the aftermath of the ‘Implementation Day’ of the Iran nuclear deal certain US sanctions are still in place, but the US Treasury Department has done away with some major restrictions on what US companies can do with Iran through their foreign subsidiaries. The list of individuals banned under the sanctions has been pruned, although there are still another 5,000 names that are on it. The UN sanctions could snap back into place if Iran defaults on its commitments under the nuclear agreement. Yet today, the trade potential of Iran is one of the few bright spots in the largely gloomy global economy.

As Iran opens-up for business and China and Iran agree to take their bilateral trade to a whopping USD 600 billion over next 10 years, this article look at the efforts being made by India and Iran to kick-start their development cooperation and trade relations.

India-Iran Efforts

The 18th session of the India-Iran Joint Commission was held in New Delhi on December 28, 2015. The session was co-chaired by External Affairs Minister of India (EAM) and H.E. Mr. Ali Tayebnia, Minister of Economic Affairs and Finance of the Islamic Republic of Iran. The Joint Commission Meeting (JCM) was preceded by meetings of the Joint Working Group (JWG) on Trade & Commerce (18th-19th November 2015), JWGs on Energy and Infrastructure on 26th December 2015.

At the JCM, EAM highlighted key areas where efforts were underway to enhance bilateral economic cooperation; these included energy, infrastructure, shipping, ports, railways and trade and commerce. The Iranian side suggested participation of India’s public and private sectors in development of Chahbahar port and Chahbahar Free Trade Zone (FTZ) and in setting up industrial units in the FTZ. EAM also emphasized the need for early completion of all necessary procedures for India’s participation in Farzad-B field besides other oil and gas explorations in Iran.

Farzad-B

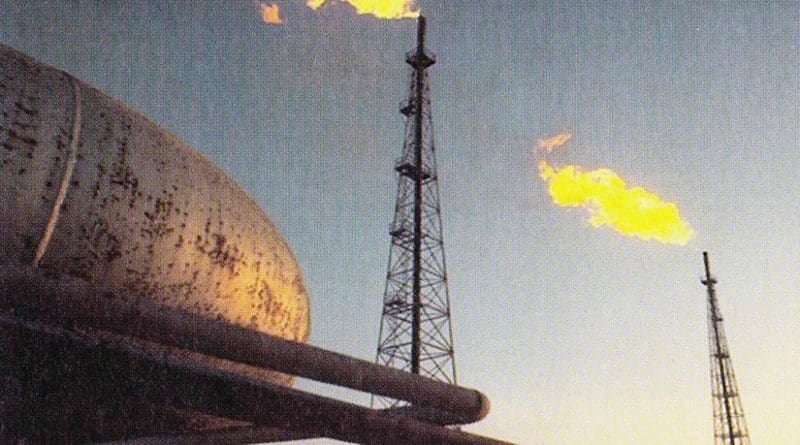

ONGC Videsh Ltd-led consortium is expected to win the USD 5 billion rights to develop Iran’s Farzad-B gas field and convert the gas produced from it into liquefied natural gas (LNG) for shipping to countries including India. The first development phase of Farzad-B is expected to require USD 3 billion in investment, another USD 2 billion would be required for setting up LNG train (liquefaction and purification facility) of 6 million tonnes a year. A consortium of OVL, Oil India Ltd (OIL) and Indian Oil Corp (IOC) had discovered 12.8 trillion cubic feet of gas reserves in the Farsi block in 2008. OVL in August/September 2010 had submitted a revised master development plan (MDP) for producing 60 per cent of the 21.68 trillion cubic feet of in-place gas reserves; the discovery was named Farzad-B. OVL and IOC hold 40 per cent interest each in the block, while the remaining 20 per cent is with OIL.

Iran and India have agreed to settle their outstanding crude oil dues in rupees in preparation for future trade in their national currencies. Since 2013, Indian refiners have been depositing 45 per cent of their oil payments for crude oil to Iran in rupees with UCO Bank and withholding the remainder which was to be cleared in USD. The dollar dues of $6.5 billion equalling 55 per cent of oil payment is now likely be deposited in National Iranian Oil Co account with Indian banks, in rupees. These are likely to be used by Iran for non-oil imports and by India, to provide a $150 million loan to Iran for the development of Chahbahar port. Iran has been offering India a 90-day credit and free shipping on oil purchases.

Chahbahar Free Trade Zone

India is looking to invest to the tune of Rs 2 trillion at Chahbahar in various infrastructure projects ranging from road and rail to shipping and agriculture. The investments, however, will depend on the outcome of the negotiations on gas price as Iran has offered to supply natural gas at $2.95 per million British thermal units (MBtu) while is negotiating for a price of $1.5 per MBtu. India wants to set up a gas-based urea plant at Chahbahar as it currently imports eight-nine million tonne of urea annually. The 1.3-million tonne per annum urea plant in the FTZ would cut down domestic urea prices by half.

IOC is seeking to build a USD 3 billion petrochemicals plant in Iran, to access cheap natural gas as feedstock. The petrochemicals plant will allow IOC to diversify from its existing projects that use oil products from its own refineries. National Aluminium Company NALCO will soon send a team to Iran to explore setting up of a gas-based 500,000-tonnes-per-year smelter complex worth about USD 2 billion and an associated power plant.

Oil and gas today are reflecting bearish trends, with prices of both these commodities at their lowest in recent years. While Iran needs financial and technical support to get its industry going, India at this point would have to take a call on a long-term partnership with Iran, against the interest who would like a delayed entry of the Iranian oil and gas into the global market.

Iranian Railways

At the JCM, the two Ministers had discussed the possibilities of cooperation in railways, including supply of rails, rolling stock, signalling and other works and India’s participation in Chahbahar-Zahedan-Mashhad railway line. Iran is planning to invest about USD 25 billion in modernization and expansion of its rail network. The expansion plans aim to increase the country’s track length from the current figure of about 15,000 kilometres to 25,000 kilometres by 2025.

In October 2014, India’s State Trading Corp (STC) had signed a $233 million contract to facilitate exports of rail tracks from SAIL Ltd and Jindal Steel and Power Ltd to Iranian railways. The value of the deal was later reduced by about 7.3 percent to $217 million after renegotiations by Iran because the euro had declined against the dollar and steel and iron ore prices had fallen significantly since the deal was first struck in 2014. SAIL is now supplying 100,000 tonnes of rails to Iran from its Bhilai Steel Plant. India will supply 250,000 tonnes of rails to Iran over 18 months through the STC.

Trade

The two countries are preparing a Preferential Trade Agreement (PTA) and working on increased connectivity in the banking sector. The JWG on Trade & Commerce in November 2015 had agreed to open up a channel of communications to start preliminary consultations on the PTA.

An Iranian team, which included officials from the Institute of Standards and Industrial Research of Iran, and the Health Ministry, recently visited India for an interaction which focused on quality and safety issues. This would facilitate trade in items such as rice and tea.

Assessment

Even after the nuclear deal, doing business with Iran comes with risks. The struggle between Riyadh and Tehran for political and religious influence has geopolitical implications that extend far beyond the placid waters of the Gulf and encompass nearly every major conflict zone in the Middle East.

Last October, Iran successfully test-fired Emad, a new precision-guided, long-range missile. Recently revolutionary guards (IRGC) vessels reportedly fired “several unguided rockets” at US and French ships. Iran had dismissed the claim as “psychological warfare.” Analysts feel these sorts of provocative run-ins are likely to continue in 2016 as hard-line forces in Iran exploit uneasy relations with the West. Iran’s expansion of its missile programme, its aggressive stance and policies towards both the US and Israel, and the current US Congress’s hostile position towards the Iranian establishment raises the possibility that at some point, the US may, unilaterally or in alliance with its partners, decide to confront some of Iran’s policies or actions.

There are other challenges in doing business with Iran; corruption is endemic, the IRGC controls certain economic activities and political hardliners threaten reforms as elections loom. However challenges that would constrain India would be its low appetite for risk, limited financial resources and sluggish bureaucratic decision making.

*Monish Gulati is the Associate Director (Strategic Affairs) at the Society for Policy Studies, New Delhi. He can be reached at: [email protected]. This article was published at South Asia Monitor.