US: Falling Investment And Rising Trade Deficit Lead To Weak First Quarter – Analysis

By Dean Baker

GDP grew at just a 0.5 percent annual rate in the first quarter. This weak quarter, combined with the 1.4 percent growth rate in the 4th quarter, gave the weakest two quarter performance since the 3rd and 4th quarters of 2012 when the economy grew at just a 0.3 percent annual rate.

Growth was held down by both a sharp drop in non-residential investment and a further rise in the trade deficit. Equipment investment fell at an 8.6 percent annual rate, while construction investment dropped at a 10.7 percent annual rate. The latter is not a surprise, given the overbuilding in many areas of the country. The drop in equipment investment was undoubtedly in part driven by the worsening trade situation, as many factories curtailed investment plans as U.S.-made products lost out to foreign competition, weakening demand growth. There was also a drop in information processing equipment, indicating that those who are expecting that robots will replace us all will have to wait a bit longer.

The rise in the trade deficit was due to a 2.6 percent drop in exports, as imports were nearly flat for the quarter. Trade subtracted 0.34 percentage points from growth for the quarter.

Consumption continued to grow at a modest 1.9 percent annual rate, adding 1.27 percentage points to growth. Consumption growth was held down in part by weaker demand for new cars, which subtracted 0.33 percentage points from growth for the quarter. This was the second consecutive decline in the sector. It is likely that car purchases will be up somewhat in future quarters.

The savings rate for the quarter was 5.2 percent, which is up slightly from the 5.0 percent from the prior three quarters and the 4.8 percent rates from 2013 and 2014, before people started saving their oil dividends. But seriously, there may be some modest room for this rate to decline, but for the most part consumption growth will depend on income growth going forward.

Health care services added 0.26 percentage points to growth, its smallest contribution since a reported decline in the first quarter of 2014. Spending in the sector remains well contained, growing at just a 3.8 percent annual rate over the last quarter and by 4.4 percent over the last year in nominal spending.

Housing grew at a 14.8 percent annual rate, adding 0.49 percentage points to growth. Housing has being growing at a double digit rate since the fourth quarter of 2014. While the sector is likely to continue to grow in subsequent quarters, the pace is almost certain to slow.

The government sector was a modest positive in the quarter, growing at a 1.2 percent rate. State and local spending increased at a 2.9 percent annual rate, more than offsetting a 1.6 percent drop in federal spending, all of it on the military side. Future quarters are likely to show comparable growth, although the composition may be somewhat different.

A slower rate of inventory accumulation reduced growth by 0.33 percentage points, as final sales of domestic product grew at a 0.9 percent rate. This is the third consecutive quarter in which the pace of inventory accumulation slowed, although the current pace is not especially low. It is likely that inventories will grow somewhat more quickly in the rest of the year, being at least a small positive in the growth story.

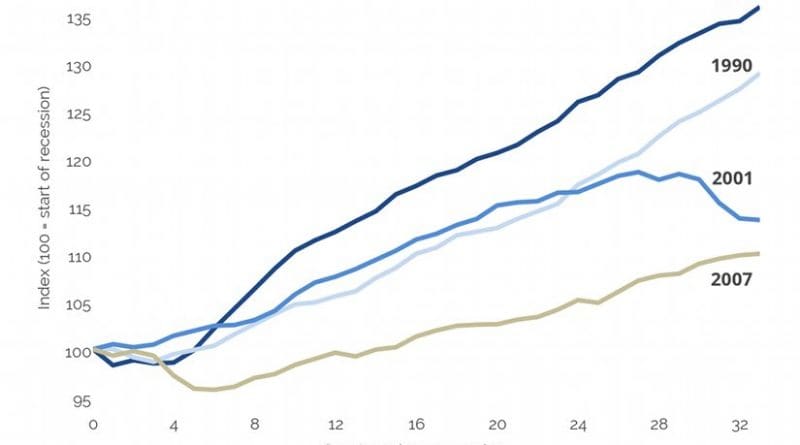

The weak growth for the quarter puts this recovery even further behind any prior recovery at the same stage. After eight and a quarter years, the economy is only 10.1 percent larger than its pre-recession level of output. A more typical recovery would have seen at least twice as much growth.

On the whole this is a weak report. The headline 0.5 percent figure probably overstates the weakness somewhat, but it is not a good sign when two consecutive quarters have an average growth rate of less than 1.0 percent. Inflation remains well under control, although there was a modest uptick in the rate of inflation shown by the core personal consumption expenditure deflator to 1.7 percent over the last year. Nonetheless, with an economy barely growing and an inflation rate that remains below target, it is difficult to envision the Fed raising interest rates further any time soon.