How Dollar Hegemony Fuels US Twin Deficit And Produces An Ineffective Federal Reserve – OpEd

By Dee Woo

The recent US debt crisis and ensuing S&P downgrade has brought the whole world to a standstill. The scariest part is nobody knows how to react to a possible US default.

The whole world has taken the US’s solvency for granted for way too long. The booming global trade has been so heavily collateralized against the US deficit that we really don’t know how it’s going to function otherwise.

World trade is now a game in which the US produces dollars and the rest of the world produces things that dollars can buy. All the central banks need to accumulate dollars to sustain their undervalued currency and comparative advantage in trade. So what happens if the federal government goes bankrupted and the dollars become worthless?

This is really a wake up call to all. The world needs to decouple its well being from the US deficit. We can’t delay the inevitable for ever, or else next time it will be more than just a close call.

We need to be prepared for a world without the dollar as the dominant reserve currency and global vehicle currency, and without the US consumption economy as the vital export growth engine. We need the Euro to step up and take more responsibilities over from the dollar, we need China to unleash a consumer economy to help solve the grievous global imbalance.

Otherwise the world economy will continue functioning by inertia until the dollar and the US consumeer economy won’t support the weight placed on them no more.

The world has prospered on the debt-fueled credit binge in the US for decades. All good things come to an end.

The dollar hegemony is a curse even to the US

The dollar hegemony has become the US’s biggest disincentive to maintain its fiscal and monetary discipline. According to a report by the Division of Monetary Affairs from the federal reserve, since 1990 the US monetary expansion has been driven by the dominant external demand for the dollar. Hundred-dollar notes are the largest denomination now issued by the Federal Reserve,which make up 60 percent of the dollar value of all the U.S. currency outstanding.

The data on the use of $100 notes suggests that the net new demand for them is coming predominantly from abroad. On average over the 1990s,the overseas stock of dollars has been growing about three times faster than the domestic stock. Empirically, the amount of currency outstanding typically grows in sync with,or even a little more slowly than, consumption in the United States.

Indeed, this was the pattern until 1990. However, in the decade after 1990, in tune with the growing external demand for dollars,The US currency has grown about 3.5 percentage points more rapidly than consumption in nominal terms. Some may be inclined to suggest these overseas dollars will probably be used to buy the US goods and service and therefore boost the US job markets. Nothing can be further from the truth. The majority of the overseas dollars are parked in treasuries and other dollar-denominated securities and assets by courtesy of the official foreign exchange holdings and Eurodollar market. They are fueling the debt-financed domestic demand in the US, which explains the self-enforcing mechanism of the US twin deficit(trade deficit and fiscal deficit).

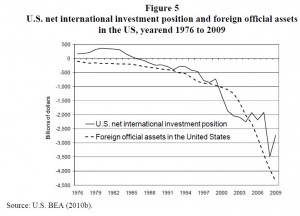

According to Professor Robert A. Blecker’s research, by the end of 2009,foreign central banks have assets of $4.4 trillion in the U.S ,which were 60% higher than the overall U.S. net debtor position of $2.7 trillion. (see figure 5) That is to say, excluding this colossal debt to foreign central banks, the U.S. was still a net creditor country to the tune of about $1.7 trillion in all of its other unofficial(i.e., non-central bank) international financial activities as of yearend 2009 (See figure 5).

Hence the expanding foreign accumulation of U.S. assets after 2000 was not primarily driven by the increased confidence in the U.S. economy or U.S. assets by private-sector agents abroad, as contemplated in the models of “capital market imperfections.” On the contrary, it was mainly foreign central bank intervention that financed the growing U.S. twin deficits. The dollar’s dominance has done the US a huge disservice when it struggles to maintain its fiscal and monetary discipline and facilitated a vicious circle of twin deficits and weak dollar policy by the federal reserve. We all can see clearly the nature of self-destruction down this path.

Second, The fact that the US’s money multiplier and velocity are greatly dictated by foreign agents because of the dollar hegemony has rendered the federal reserve increasingly ineffective as a domestic central bank,especially in the time of recovery.

Second, The fact that the US’s money multiplier and velocity are greatly dictated by foreign agents because of the dollar hegemony has rendered the federal reserve increasingly ineffective as a domestic central bank,especially in the time of recovery.

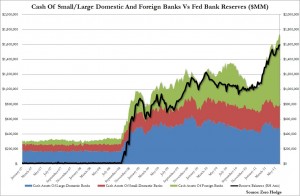

As Zerohedge’s research notes (through the Fed’s Bloomberg FOIA release),the majority of the dollars generated by QE2 were funneled to foreign banks (especially European banks) instead of U.S. banks. Among the 20 Primary Dealers currently recognized by the New York Fed, 12 are foreign. The Eurodollar market — which accounted for nearly 90 percent of all international loans by 1997 — enables a skewing of reserve balances towards foreign banks operating in the U.S.

Foreign banks operating in the U.S. often lend reserves to home offices or other banks operating outside the U.S., and do not comprise a large percentage of consumer or real estate loans. Foreign banks represent about 16 percent of commercial bank assets and only about 9 percent of bank credit, adding far less value to the average American than domestic banks — yet obtaining a disproportionate amount of assistance — directly or indirectly — from the USG(the U.S. government ). Thus, the notion that excess reserves enhance lending activities and money growth is greatly diminished by the skewing of excess reserve balances toward foreign banks. The truth is, cash assets held by foreign banks operating in the U.S. grew more than six times between the fourth quarter of 2008 and the third quarter of 2010, and have more than tripled again this year.

Regarding the mystery of why U.S. bank lending remains stagnant even though the Fed has pumped so much money into the system, Stone McCarthy’s research notes that affiliated foreign branches of U.S. banks tend to borrow dollars in the Eurodollar market. Given that a Eurodollar is nothing more than a dollar denominated deposit at a bank outside the U.S., the bank holding the Eurodollar deposit will ultimately have a dollar denominated claim against a bank domiciled in the US. That U.S. bank in turn holds reserve balances at their local Federal Reserve banks, so when Eurodollar deposits move from one foreign bank to another, the claim against the original U.S. bank follows the Eurodollar deposit.

Regarding the mystery of why U.S. bank lending remains stagnant even though the Fed has pumped so much money into the system, Stone McCarthy’s research notes that affiliated foreign branches of U.S. banks tend to borrow dollars in the Eurodollar market. Given that a Eurodollar is nothing more than a dollar denominated deposit at a bank outside the U.S., the bank holding the Eurodollar deposit will ultimately have a dollar denominated claim against a bank domiciled in the US. That U.S. bank in turn holds reserve balances at their local Federal Reserve banks, so when Eurodollar deposits move from one foreign bank to another, the claim against the original U.S. bank follows the Eurodollar deposit.

If a bank domiciled in the U.S. borrows dollars from a bank outside the U.S., effectively what happens is that the reserve balance of the U.S. bank underpinning the Eurodollar account is reduced, and the reserve account of the borrowing bank in the U.S. is increased. Overall, U.S. bank reserves are left unchanged, but the distribution of those reserves is changed from one bank in the U.S. to another, possibly even from the books of one Federal Reserve Bank to another.

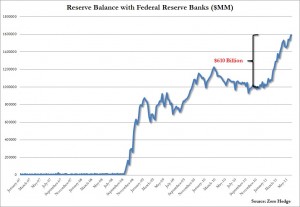

There was a $630 billion increase in foreign bank cash balances in the U.S. between November 2010 and May 2011 — which coincides neatly with the date when the Fed commenced QE2. During the same period, Fed reserves saw a $610 billion increase.

There was a $630 billion increase in foreign bank cash balances in the U.S. between November 2010 and May 2011 — which coincides neatly with the date when the Fed commenced QE2. During the same period, Fed reserves saw a $610 billion increase.

Below are the chart of the total cash holdings of Foreign-related banks in the US using weekly H.8 data.

The $630 billion increase in foreign bank cash balances since November 3, which just so happens to be the date when the Fed commenced QE2 operations in the form of adding excess reserves to the liability side of its balance sheet. Here is the change in Fed reserves during QE2 (from the Fed’s H.4.1 statement, ending with the week of June 1).

Above, note that Fed reserves increased by $610 billion for the duration of QE2 through the week ending June 1 (and by another $70 billion in the week ending June 8, although since we only have bank cash data through June 1, we use the former number, although we are certain that the bulk of this incremental cash once again went to foreign financial institutions).

Above, note that Fed reserves increased by $610 billion for the duration of QE2 through the week ending June 1 (and by another $70 billion in the week ending June 8, although since we only have bank cash data through June 1, we use the former number, although we are certain that the bulk of this incremental cash once again went to foreign financial institutions).

By comparison, how did cash held by U.S. banks fare as a result of QE2? Not well.

Cash balances at small and large U.S. domestic banks did not increase to the same extent as cash at foreign banks; as was the case with QE1, most of the dollars created by QE2 went to foreign banks. This is the curse of the dollar as the world reserve currency.

With the powerful Eurodollar market and near-zero domestic interest rates, the Federal Reserve has become a rather impotent domestic central bank as the recovering U.S. economy continues to struggle in a liquidity trap and the dollar chases yield elsewhere.

With the powerful Eurodollar market and near-zero domestic interest rates, the Federal Reserve has become a rather impotent domestic central bank as the recovering U.S. economy continues to struggle in a liquidity trap and the dollar chases yield elsewhere.

The dollar hegemony has become increasingly fiscally and monetarily unsustainable to the US itself.

The dollar hegemony will come to an end by either a forceful market correction or a knowingly gradual reconstruction of global reserve currency system. The best candidate in this reconstruction is Euro.

It is of course possible that Europe will survive its current sovereign debt crisis, but it is difficult to imagine that the currency of a continent so battered will be strong enough to replace the dollar at the world’s reserve currency any time in the near- or medium-term — though stranger things have happened.

For the foreseeable future, RMB has no way joined in the race to be a world reserve currency in a foreseeable future and at best it can act as a regional invoicing currency among trading partners, because China has some insurmountable flaws when it comes to the candidacy of a world reserve currency: a political structure sharing no aspiration with the democratic economies, powerful state control on the economic issues, over-manipulated exchange rate, impotent law system to protect property rights, and fragile diplomatic relationships with many trading partners.

For the foreseeable future, RMB has no way joined in the race to be a world reserve currency in a foreseeable future and at best it can act as a regional invoicing currency among trading partners, because China has some insurmountable flaws when it comes to the candidacy of a world reserve currency: a political structure sharing no aspiration with the democratic economies, powerful state control on the economic issues, over-manipulated exchange rate, impotent law system to protect property rights, and fragile diplomatic relationships with many trading partners.

In the absence of a meaningful alternative, the global currency system will in all likelihood continue to hobble along using the wounded dollar until the final day of reckoning.