Inching Towards The Financial Transaction Tax – Analysis

By IDN

By Peter Wahl

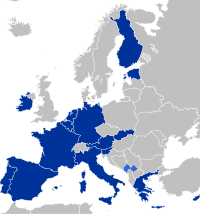

The tension around the Financial Transaction Tax (FTT) was growing before the March 13 Council meeting of European Ministers of Finance (ECOFIN). Finance ministers from nine EU countries – Austria, Belgium, Finland, France, Germany, Greece, Italy, Portugal and Spain – had written a letter applying substantial pressure on the Danish presidency. In EU diplomacy such a letter is quite a strong instrument.

The letter asked to speed up the Council’s decision-making process regarding the European Commission’s legislative proposal on FTT before June 2012. As it was known since December 2011 that the UK would under no circumstances accept a European FTT, the proponents of the tax did not want the process to be delayed. In addition, the next two incoming presidencies, Cyprus (second half of 2012) and Ireland (first half of 2013) are opposing the FTT, which will make it more difficult for the proponents to get a decision.

On March 13, 2012, the EU-27 Ministers of Finance failed to reach consensus at the ECOFIN meeting, and this did not come as a surprise. When UK Prime Minister Cameron visited Berlin in December 2011, he expressed the British opposition to the FTT in no uncertain terms. At the ECOFIN meeting the UK was joined by the Czech Republic, Ireland, Sweden, the Netherlands, Malta, Luxemburg and Cyprus.

Since EU rules require unanimity on issues of tax, a common EU initiative of all member states is failing. The communiqué of the March ECOFIN meeting “to further analyse the Commission’s proposal, whilst also exploring possible compromise solutions and alternative routes,” is therefore more the preparation of an exit option without the EC publicly losing face, than a serious attempt to find a common way to a European tax.

Between the Millstones

The main reason for opposing the FTT is of course the wish to protect the profits of the finance industry in the respective countries. But more than that, and particularly in the UK, there is a strong and growing opposition to any regulation coming from the EU, because this is seen as threat to British sovereignty. The Euro crisis has intensified the already existing anti-EU positions, not only among elites but also among a majority of the population. According to sources close to the German finance ministry, the British finance minister Osborne said they would not even accept the British Stamp duty if it would come as a European legislation.

No progress in the process is to be expected before June 2012. France will be absorbed by the presidential elections in the next two months. Germany is – as a result of its strategy in the Euro crisis – suspected of seeking general dominance over the others. This is why Berlin tries to avoid anything that could further nourish this impression and will strictly follow the formal procedures in Brussels. The June ECOFIN will first have to officially state that no consensus over the EC’s proposal or even a compromise version can be reached, before the proponents of the FTT move forward.

In the meantime the proponents might rhetorically move closer to the UK. For instance, Schaeuble has used the word Stamp Duty but if one looks closer to what he says, he includes derivatives and bonds in his version of a Stamp Duty. The usual euro-diplomatic blame game is to put the responsibility for failure on the shoulders of the others – in this case, and with good reason, on the UK.

Enhanced Cooperation

Once the EU-27 approach has been officially declared a failure, the way would be free for a coalition of the willing. The EU rules allow for such a procedure. It is called Enhanced Cooperation. If a minimum of nine member states agree on a common initiative it can be implemented within the legal framework of the EU. A well-known example is the Schengen Agreement, which regulates migration at the outside borders of the member countries that have signed the agreement.

Such an agreement on the FTT would take over the core elements of the Commission’s draft directive. The nine countries that have signed the letter to the Danish presidency would be the appropriate starting point. Probably some others would join in the near future, such as Denmark and Slovakia, where the social democrats recently won the elections.

The chances for Enhanced Cooperation are good:

- The European Parliament – although without legislative powers – has several times expressed its support for the FTT and continues to do so in its current debates about the FTT.

- The Committee of the Regions, a de facto second chamber representing regional and local authorities, explicitly supports Enhanced Cooperation if the EU-27 solution should fail.

- There are strong majorities among the populations of most EU countries.

- There is a strong need for fresh money to cover the costs of the crisis, in particular as the EU is entering a recession.

- Germany and France have officially been fighting so hard for the FTT in the last two years, that it would be very difficult for them to give up without losing prestige.

All in all, it might still take some time, but there is a good chance that the FTT will be realised with the support of a sufficient number of European countries.

Peter Wahl is a researcher at WEED, a German policy institute, where he works on issues of world trade and international finance. This article is extracted from the EU Financial Reforms Newsletter – March 2012 published by SOMO and WEED. It is part of a common project on EU regulation of financial markets. Other project partners that contribute to the newsletter series are: AITEC, Glopolis, New Economics Foundation and Vedegylet.