Sovereign Debt Sustainability In Spain And Italy – Analysis

By VoxEU.org

Interest rates on Italian and Spanish bonds are back up to their 2011 levels, raising alarm bells across Europe. But this column argues that the media’s hard-held belief that neither Italy nor Spain can withstand interest rates of 7% is wrong.

By William R. Cline

After a brief easing in sovereign interest rates for Italy and Spain following nearly €1 trillion in LTRO (long-term refinancing operation) lending to Eurozone banks by the ECB at the turn of the year, in the second quarter of 2012 these rates rebounded. As Spain in particular had to revise its fiscal target for the year and concern mounted about its banking cleanup costs, some influential economists escalated their concerns about a possible debt restructuring for Spain.1 Interest rates on ten-year bonds had fallen from peaks of 7.3% for Italy and 6.7% for Spain in late November 2011 to lows of 4.9% for both countries at the beginning of March 2012. By the third week in July, however, these rates had rebounded to 6.6% for Italy and 7.6% for Spain.2

The EU summit at the end of July agreed in principle on a banking union that could potentially relieve the Spanish sovereign of bank cleanup costs, and Mr Draghi pledged forceful ECB support for two-year bonds subject to policy conditionality. Interest rates facing the two large stressed economies moderated by about 80-100 basis points by mid-August. Ultimately, however, the prospects for managing debt in the two economies will depend on whether economic fundamentals enable them to consolidate solvency or will force them into some form of default and restructuring.

I have recently applied my European Debt Simulation Model (EDSM) to examine this question (Cline 2012c). In a new probabilistic approach, I examine debt ratios through 2020 under three scenarios (bad, baseline, good) for five key variables (economic growth, interest rate, primary surplus, bank recapitalisation, privatisation). Across the resulting 243 outcomes I focus on the 25th percentile of the debt/GDP ratio (favourable side), baseline, probability-weighted, and 75th percentile (unfavourable side). The results suggest that sovereign debt is sustainable in both Italy, where debt ratios are likely to decline because of a high primary surplus, and Spain, where the ratios rise but at a decelerating pace and from relatively low levels.

Table 1 reports the scenario assumptions, summarised as annual averages in 2012-14 and 2015-20. Growth outcomes for 2012-13 are based on IMF (2012) and the high and low ranges of private forecasts (Consensus 2012). Baseline growth thereafter is based on the IMF forecasts. Favourable growth after 2013 is set at the actual averages in 1990-2000, before the euro; adverse growth is set moderately below the baseline (by 0.67% in Spain and 0.5% in Italy). The primary surplus again reflects the IMF and private forecasts for 2012-2013. The baseline thereafter is set at the IMF forecast for Italy, a strong fiscal performance at about 5% primary surplus. The adverse case limits the primary surplus to 2.7% of GDP, the average in 1990-2000. For Spain the IMF appears overly pessimistic and its forecast is used as the adverse case; even the high variant is modest by international standards, at 1.5% of GDP. Market interest rates on new ten-year debt are set at equal rates for the two economies. The adverse scenario envisions interest rates that average 7% in 2012-14 and 7.5% in 2015-20. In the baseline these rates average about 5.5%-6%; and in the favourable case, they ease toward 5%. A key feature of the model is that it only applies the new interest rate to new debt; debt that has not yet matured continues to pay a more favourable legacy interest rate, a point often missed in simple comparisons of ‘the interest rate’ with growth. For the cost of bank recapitalisation (plus ‘discovered debt’ from provinces), Spain faces a range of €36 billion to €86 billion, all in 2012, depending on whether the Eurozone banking union or the government bears this debt. Italy is assumed not to face further bank recapitalisation costs. For privatisation, the Figures reflect in the optimistic case a three-year total of €15 billion in Spain and as much as €20 billion annually over five years in the case of Italy on the basis of recent statements by the Minister of Economy.

In the model, debt equals the previous year’s debt plus new borrowing to cover the fiscal deficit and bank clean-up costs, minus amounts received from privatisation. Interest payments are calculated separately for short-term debt, old debt not yet matured, and new debt. In this new probabilistic version of the model, attention is paid to the correlations between alternative states for the key variables. The good-good or bad-bad correlation is set at 1 for growth and the interest rate, on grounds that investors will provide the government with finance on more favourable terms when they have more confidence in view of higher growth performance. The correlation is set at 0.2 between growth and the primary surplus, positive because of the joint movement from positive (or negative) shocks, but moderate because there is an offsetting consideration that a higher primary surplus under conditions of unemployment may have negative multiplier effects on growth. The primary surplus is set at -0.5 correlation with the interest rate because the good state for interest rates (low rates) may reduce the pressure on the government to deliver high primary surpluses. The primary surplus has a correlation of -1 with privatisation because the two are basically substitute sources of non-debt financing. The good-good and bad-bad correlations are set at 0.5 for growth and bank recapitalisation (less than 1 because there are legacy skeletons) and +1 for bank recapitalisation costs and interest rates (better financing, lesser banking difficulties).

With the baseline probabilities set at 0.4 and the non-base states at 0.3 plus (minus) an increment based on the correlation coefficient when one variable is in the same (opposite) non-base state as another variable, the model then arrives at a probability for each of the 243 outcomes. The outcomes are then arrayed (from best, or lowest, debt/GDP ratio to worst, or highest), and the distribution can be considered by identifying the 25th and 75th percentiles in this array.

Figure 1 shows the resulting projections for Spain. In the baseline, the ratio of debt to GDP rises but stabilises at 89% of GDP by about 2016 and after, the same level as for France in 2012. The favourable 25th percentile debt ratio stabilises at 85%; the probability-weighted ratio reaches 92% of GDP by 2020, still far below the 120% level that has become seen as a critical benchmark in the Eurozone. Even the 75th (unfavourable) percentile still shows the debt ratio at slightly less than 100% of GDP by 2020.

For Italy, Figure 2 shows that the main field of results all indicate a declining debt ratio. The baseline indicates a decline from 123% in 2012-13 to 104% by 2020. This outcome is more favourable than the 110% estimate in Cline (2012a), which did not include any privatisation. The favourable 25th percentile places the ratio at 100% by then; the probability-weighted outcome, at 109%; and the unfavourable 75th percentile at 116%.

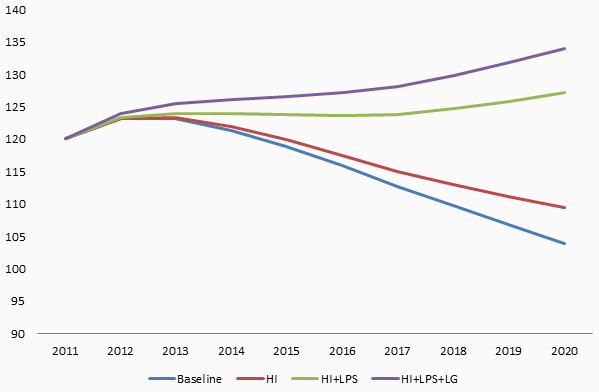

Because of the broad picture of improvement over time for Italy and persistence within a reasonable debt burden range for Spain, the broad diagnosis is one of solvency for both countries. It is important, nonetheless, to underscore the key role of fiscal adjustment in these outcomes. Figures 3 and 4 indicate debt paths for Spain and Italy in four cases with successive addition of the unfavourable case on a key variable: a) baseline; b) plus high interest rate; c) plus low primary surplus; and d) plus low growth. It is evident that for both countries the largest wedge between paths arises from poor fiscal performance. This result underscores the relevance of the emphasis on fiscal discipline in the various Eurozone cooperative efforts to date and in consideration of such future approaches as the use of Eurobonds. It is also important to recognise that in both cases the combination of adverse cases on all four major variables causes the debt ratio to escalate dangerously by 2020 (to 114% and still briskly rising for Spain, and to 134% by 2020 for Italy). However, these everything-goes-wrong cases are at the unfavourable 99th percentiles in the distributions. An important and much more encouraging message from Figures 3 and 4 is that even if the unfavourable interest rate scenario persists (at around 7½%), the debt paths are still quite manageable so long as the governments meet fiscal targets and growth is at the baseline levels. In this sense, the journalistic cliché that neither Italy nor Spain can withstand interest rates of 7% is wrong.

A central diagnosis of solvency for Italy and Spain suggests that the Eurozone would not be mistaken to pursue the approach of Eurobonds for these countries, because the central expectation would be that such bonds could be successfully honoured. I have suggested (Cline 2012b) that the Eurobond discussion could usefully add an approach of country-specific insurance premiums paid into a sinking fund. Thus (for example), Spain and Italy could borrow in Eurobonds jointly and severally guaranteed by Eurozone members but would be expected to pay into an insurance fund a premium of say 250 basis points that would be set aside in a sinking fund as a cushion in case of default. The total interest rate equivalent would be on the order of 5½% (3% to the investor, 2½% insurance premium), keeping the interest rate safely at the baseline level and averting a self-fulfilling prophecy of insolvency from an upward spiralling interest rate. This approach would help assure German and other taxpayers that they would not wind up shouldering the burden of losses on the bonds.

Author:

William R. Cline

Senior fellow, Peterson Institute for International Economics

References

Benoit, Angeline and Tom Keene (2012), “Spain’s Default Risk is Rising, Buiter Says: Tom Keene”, Bloomberg.com, 21 March.

Cline, William R (2012a), “Interest Rate Shock and Sustainability of Italy’s Sovereign Debt”, Policy Brief PB12-5.

Cline, William R (2012b), “A Better Euro Bond”, The Wall Street Journal, European Edition, 7 June.

Cline, William R (2012c), “Sovereign Debt Sustainability in Italy and Spain: A Probabilistic Approach”, Working Paper WP12-12.

Consensus (2012), “Consensus Economics”, Consensus Forecasts.

IMF (2012), International Monetary Fund, World Economic Outlook Database, April 2012.

1 Willem Buiter, chief economist of Citigroup, judged Spain to be “at greater risk of sovereign restructuring than ever before” (Benoit and Keene 2012).

2 Datastream.

Political and financial largesses of past were unsustainable, so now arrived the payment time for those…. may later need collaterals to borrow, as in real commercial life.