The Time Is Now: We Must Step Up Support For The Poorest Countries – OpEd

When finance ministers and central bankers arrive in Washington next week for the IMF-World Bank Spring Meetings, they will have much to discuss, from the global economy’s fragile recovery to the risk of financial instability, from fragmentation to the fallout from Russia’s war in Ukraine.

But it is imperative that they don’t forget the increasing needs of the world’s poorest nations. In particular, the IMF’s tried-and-tested instrument to assist these countries—thePoverty Reduction and Growth Trust—is in urgent need of replenishment.

Since the pandemic, the IMF has supported more than 50 low-income countries with some $24 billion in interest-free loans via the PRGT—thus helping to stave off instability in a wide range of the world’s poorest nations, from the Democratic Republic of Congo to Chad and Nepal.

Now the PRGT must be adequately funded and subsidized so that this vital source of interest-free financing can continue. It is a matter of utmost priority. Why?

The challenges facing low-income countries have grown immensely in recent years. They have suffered from the pandemic as well as a succession of economic shocks. And today they face additional challenges from scarcer financing, high inflation, persistent food insecurity, rising debt vulnerabilities and sociopolitical tensions, especially in fragile and conflict-affected states.

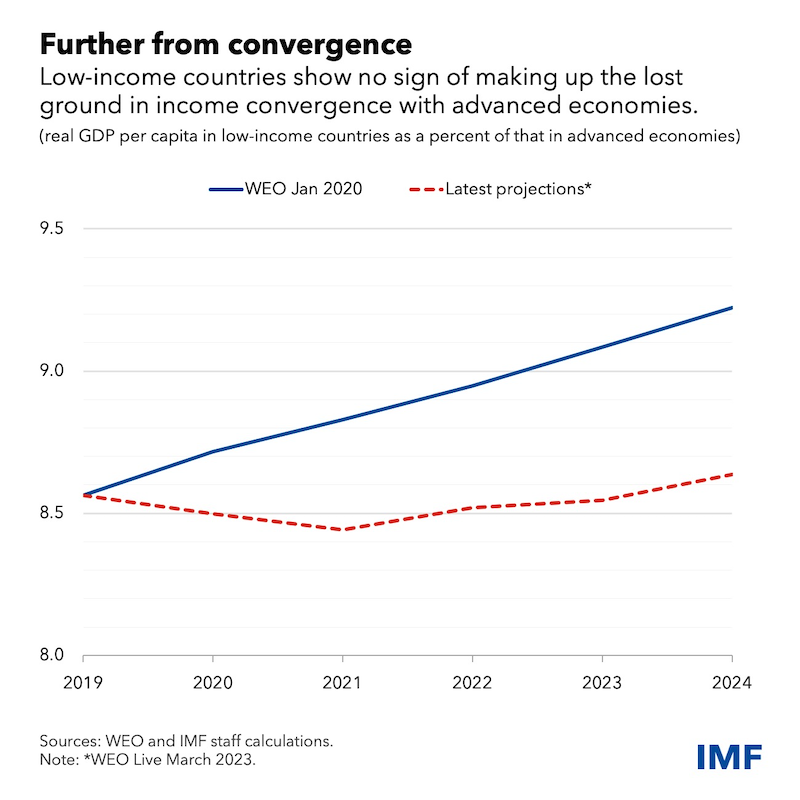

We have revised down our growth projections for low-income countries, whose per capita income growth is falling further behind the rates needed to catch up with advanced economies. This threatens to reverse a decades-long trend of steadily converging living standards.

Without urgent action and more support, there is little chance of them making up the lost ground.

In fact, we estimate low-income countries’ additional financing needs—to accelerate growth and put them back on a path to income convergence with advanced economies—to be about $440 billion over the five years through 2026.

Domestic reforms to boost growth, strengthen public finances and raise more domestic revenue should help address this financing need. But, as we will spotlight during a special Spring Meetings session of donors and recipients on concessional financing on April 12, more international support is also needed—especially as official development assistance continues to fall short of the United Nations’ target of 0.7 percent of gross national income.

Richer nations can assist poorer ones by pooling their resources and funding the work of the IMF, World Bank and other multilateral agencies, as well as through their own bilateral development programs. And the IMF will continue to work with all its development partners to build economic and financial stability in poorer countries.

The PRGT is integral to this effort. It provides interest-free loans to support well-designed economic programs that help catalyze additional financing from donors, development institutions, and the private sector. PRGT-supported programs also play a central role in creating the environment for successful debt resolution in distressed countries. And—as seen during the pandemic—the PRGT can also provide rapid emergency support when shocks hit.

At the onset of COVID, the IMF rapidly scaled up emergency financing and program support through the PRGT, with new commitments reaching almost $9 billion (6.5 billionspecial drawing rights) in 2020 alone. And with low-income countries’ financing needs rising fast, demand for PRGT lending is projected to reach nearly $40 billion (SDR 30 billion) in 2020-24, more than four times the historical average.

Funding shortfall

The success of our 2021 landmark reforms to the PRGT to speed low-income countries’ recovery from the pandemic depends on a funding strategy that identified a need to raise about $16.9 billion (SDR 12.6 billion) in loan resources and $3.1 billion (SDR 2.3 billion) in subsidy resources. So far, pledges amount to around three-quarters of the target for loan resources but less than half that for subsidy resources.

PRGT subsidy resource needs have since risen further on account of record demand for Fund support and sharply higher interest rates.

Additional pledges are thus urgently needed to meet the agreed fundraising target by the time of this October’s Annual Meetings in Morocco—the first meetings to be held in Africa for 50 years. The Meetings are a historic opportunity for donor countries to show commitment to the continent by reaching agreement on a medium-term strategy to place the PRGT’s finances on a solid footing.

A failure to secure these resources would jeopardize the IMF’s ability to provide much-needed support to low-income countries as they seek to stabilize their economies in an increasingly shock-prone world. The message is clear: Our membership must come together and step up support for these vulnerable countries.

Funding the PRGT is the best way to do it.

International cooperation

Just as international cooperation can address the fundraising shortfall, so it can also help break the debt deadlock that is preventing some countries from accessing concessional financing.

Although debt ratios are still lower than before the Heavily Indebted Poor Countries (HIPC) initiative of the mid-1990s, vulnerabilities in low-income countries have risen significantly and the trend is worrying. About 15 percent of low-income countries are already in debt distress and another 45 percent face high debt vulnerabilities. As international interest rates rise, this creates even greater risks and restricts fiscal space.

Meanwhile, changes to the creditor landscape make it more difficult for countries to restructure debts they cannot pay. Creditors are more diverse than in the past and coordination mechanisms are largely imperfect. Geopolitical fragmentation is adding to the plight faced by poorer countries by making it harder to forge international consensus on areas of common interest, including debt.

Accelerating implementation of the Group of Twenty Common Framework for debt treatment is essential to ensure coordination and confidence among creditors and debtors. Early lessons from the successful case of Chad could be applied to Ghana and Zambia to speed up progress.

The Global Sovereign Debt Roundtable, initiated in February by the IMF, World Bank and India (as president of the G20) holds the potential to reach greater consensus among key stakeholders. We are working hard to achieve further progress when all roundtable participants—creditors and debtors—sit down together on April 12, during the Spring Meetings.

Clearly, when the finance ministers and central bank governors of our 190 member countries arrive in Washington next week, there will be plenty to discuss. But these leaders must not allow other challenges to crowd out the pressing needs of the world’s poorest nations.

Supporting the PRGT is an excellent way to keep this issue at the top of the global agenda.

—This article reflects research contributions by Guillaume Chabert, Kangni Roland Kpodar and Xin Tang, and was published by IMF Blog.