Colombia Energy Profile: South America’s Largest Coal Producer And Third-Largest Oil Producer – Analysis

By EIA

Colombia is South America’s largest coal producer, and the region’s third-largest oil producer after Venezuela and Brazil. In 2015, Colombia was the world’s fifth-largest coal exporter. The country is also a significant oil exporter, ranking as the fifth-largest crude oil exporter to the United States in 2015. A series of regulatory reforms enacted in 2003 makes the oil and natural gas sector more attractive to foreign investors led to an increase in Colombian oil and natural gas production. The Colombian government implemented a partial privatization of state oil company Ecopetrol (formerly known as Empresa Colombiana de Petróleos S.A.) in an attempt to revive its upstream oil industry.

Favorable investment terms led to Colombia’s crude oil production doubling within the past 10 years, reaching 1 million barrels per day (b/d) in 2013. However, the drop in global crude oil prices since mid-2014 has led to a slowdown in drilling activity and in new investments. As a result, Colombia’s oil production has been stagnant at 1 million b/d in recent years, and its production is expected to remain flat in upcoming years. In addition, persistent attacks on oil and natural gas pipelines by militant groups in Colombia have led to ongoing supply disruptions. In 2015, the attacks disrupted about 41,000 b/d of oil supply. Future growth in oil production will require greater exploration and oil discoveries to replenish and increase Colombia’s reserves, along with improvements to infrastructure security.

Colombia consumed 1.539 quadrillion British thermal units (Btu) of energy in 2014, according to the 2015 BP Statistical Review of World Energy.1 Oil consumption accounted for 37% of total consumption, followed by hydroelectric (26%), natural gas (25%), coal (11%), and other renewables (<1%).2 The country relies on hydropower for most of its electricity needs and uses very little coal domestically. Colombia exported 85% of the 94.3 million short tons (MMst) of coal it produced in 2015.3 Natural gas consumption in Colombia has grown, rising by more than 60% in the past decade.

Oil

Colombia’s oil production increased rapidly from 2007 to 2013 because of increased exploration and development. New exploration and development were spurred by the regulatory reforms of 2003.

According to the Oil & Gas Journal, Colombia had 2.3 billion barrels of proved crude oil reserves at the end of 2015, down 5.6% from the prior year.4 Colombia has fewer proved oil reserves than Argentina and Ecuador, even though it produces more oil than either country. Although exploration continues and discoveries have been announced, Colombian officials estimate that current reserves will only last about six more years.5

Much of Colombia’s crude oil production occurs in the Andes foothills and in the eastern Amazonian jungles.6 Meta Department, in central Colombia, is also an important production area, of predominately heavy crude oil. The area’s Llanos basin contains the Rubiales oilfield, the largest producing oil field in the country. 7

Sector organization

Until 2003, Ecopetrol, the national oil company of Colombia, controlled the development of all hydrocarbon resources. However, Colombia decided reforms were needed as a result of declining reserves and production, and in 2003, President Álvaro Uribe enacted energy sector reforms. President Uribe moved administrative and regulatory responsibility for the country’s hydrocarbon resources from Ecopetrol to a new regulatory agency, Agencia Nacional de Hidrocarburos (ANH).8 In 2012, additional restructuring consolidated responsibility for upstream and downstream planning and oversight in the Ministry of Mines and Energy.9

Colombia’s government has taken measures to make the investment climate more attractive to foreign oil companies. Upstream sector initiatives give foreign oil companies the right to own 100% stakes in oil ventures and to compete with Ecopetrol.10 In addition, the government has sold shares of Ecopetrol to private investors, reducing its ownership to roughly 90%. According to the Colombian central bank, the oil sector received $4.8 billion in foreign direct investment (FDI) in 2014, accounting for 30% of total FDI in Colombia.11

In August 2014, ANH concluded a bid round of 90 exploration blocks that included both onshore and offshore blocks. About 20% of the available blocks are believed to contain shale or coalbed methane gas, but only one of those blocks received a bid. Fifteen companies were awarded blocks.12

Exploration, production, and consumption

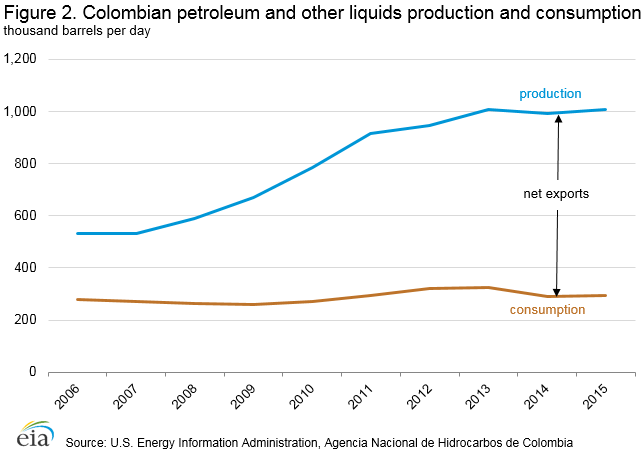

Colombia produced 1 million b/d of petroleum and other liquids in 2015, which includes crude oil, condensate, natural gas plant liquids, other liquids, and refinery processing gain. Colombia’s oil production increased by an annual average of 11% from 2008 to 2013, but growth has slowed in recent years, and production was relatively flat after 2013 (Figure 2). Colombia consumed 293,000 b/d in 2015, allowing the country to export most of its oil production.

Before 2008, Colombia’s oil production had been largely flat for many years, following a period of steady decline that started in 1999 when Colombia’s oil production peaked at 830,000 b/d. The principal causes of the fall in oil production were natural declines at existing oil fields and a lack of new discoveries. However, changes to the regulatory framework led to more investment from international oil companies.

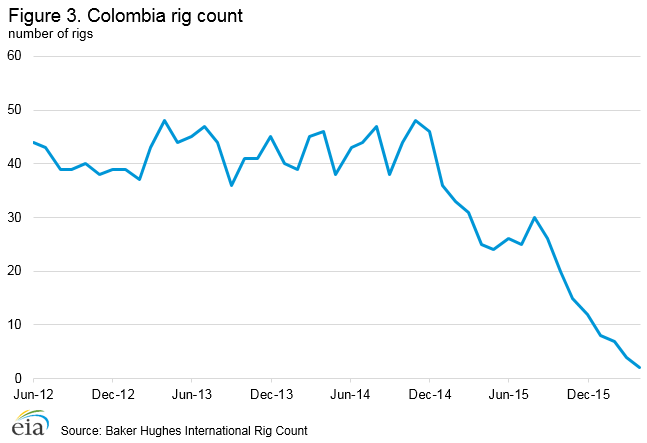

As a result of these investments, Colombia experienced rapid growth in oil production between 2008 and 2013. However, increased rebel attacks on oil infrastructure and a lower world oil price led to a leveling off of production in 2014 and 2015. Falling oil revenues have led producers to focus on optimizing existing production to maintain current levels rather than exploring for new petroleum reserves. According to Baker Hughes, the total rig count in Colombia, which hovered around 45 from 2012 to 2014, has fallen to two active rigs (Figure 3).13 In the May 2016 edition of the Short-Term Energy Outlook, EIA projected that Colombian oil production will remain steady over the next two years, averaging 1 million b/d in 2016 and 2017.

The largest producing oil field in Colombia is the Rubiales heavy oil field, located in Meta department. Low levels of production began at Rubiales in the late 1980s, but increasing investment and the completion of a new pipeline allowed production rates to rise from 96,000 b/d in 2009 to 212,000 b/d by August 2013.14 Since 2013, however, production at Rubiales has fallen, averaging 164,000 b/d in 2015.15 In August 2015, Ecopetrol elected not to extend their production agreement with Pacific Rubiales, opting instead to maintain the field alone.16

Oil exports

The United States is the top destination for Colombia’s oil exports.

In 2015, the United States was Colombia’s top oil export destination, followed by Panama. In that year, Colombia exported 370,000 b/d of crude oil to the United States. China expressed interest in financing new infrastructure projects in Colombia to transport oil to the Pacific coast for export.

Pipelines

Colombia has seven major oil pipelines, five of which connect production fields to the Caribbean export terminal at Coveñas. These include the 520-mile Ocensa pipeline, which has the capacity to transport 590,000 b/d from the Cusiana/Cupiagua area; and the 485 mile, 220,000 b/d capacity Cano Limon pipeline; and the smaller Alto Magdalena (9,200 b/d) and Colombia Oil (15,000 b/d) pipelines, which were sold to Perenco by Petrobas in 2013.17 The Llanos Orientales pipeline (also known as ODL) came online in late 2009, linking the Rubiales field to the Ocensa pipeline, with a capacity of 340,000 b/d.18 The 190 mile Trasandino pipeline has a capacity of 85,000 b/d and transports crude oil from Colombia’s Orito field in the Putumayo basin to Colombia’s Pacific port at Tumaco.19

In November 2010, Ecopetrol announced that it would partner with an international consortium to develop the Oleoducto Bicentenario pipeline.20 This $4.2 billion project will have a peak capacity of 450,000 b/d. The first phase (110,000 b/d) began operations in late 2013, transporting hydrocarbons from Araguaney to Banadia, where it connects to the Cano Limon pipeline. The Oleoducto Bicentenario will eventually connect to the export terminal in Coveñas; however, the second and third phases of the project are currently suspended.21

Pipelines and other energy infrastructure in Colombia remain the targets of attacks by anti-government guerrillas. Pipeline attacks declined significantly from 155 attacks in 2005 to 31 in 2010, according to Colombia’s Ministry of Defense.22 Since 2010, however, the number of attacks has increased substantially, reaching 259 attacks in 2013, 141 in 2014, and 80 in 2015.23 This rise in the number of attacks has led to significant increases in unplanned production disruptions in Colombia. EIA estimates Colombia averaged 41,000 b/d of unplanned production disruption in 2015. After several military setbacks in recent years, anti-government fighters may have increased their attacks to strengthen their negotiating position as part of Colombia’s ongoing peace talks.24

Downstream

According to the Oil & Gas Journal, at the end of 2015 Colombia had 290,850 b/d of crude oil refining capacity at five refineries, all owned by Ecopetrol, (Table 1).25 The 205,000 b/d Barrancabermeja-Santander facility and the 80,000 b/d Cartagena refinery hold most of the country’s crude oil distillation capacity.

Although Colombia is a net oil exporter, it must import some refined products, especially diesel fuel. As a result, Ecopetrol has begun efforts to expand refining capacity in the country. The expansion of the Cartagena refinery, scheduled to be completed in 2016, will more than double its current capacity to 165,000 b/d.26 Ecopetrol is also expanding the Barrancabermeja refinery, which will increase capacity to 300,000 b/d and improve the refinery’s ability to process heavier crude oils.27 The expansion, currently under construction, is expected to be completed in 2018.

| Refinery | Location (department) | Current capacity (b/d) | Additional capacity under construction (b/d) |

|---|---|---|---|

| Barrancabermeja | Santander | 205,000 | 95,000 |

| Cartagena | Bolivar | 80,000 | 85,000 |

| Apiay | Meta | 2,250 | |

| Tibu | Norte de Santander | 1,800 | |

| Orito | Putumayor | 1,800 | |

| Source: U.S. Energy Information Administration, Oil & Gas Journal | |||

Natural gas

Colombia is self-sufficient in natural gas supply and recently began exporting to neighboring Venezuela.

Colombia had proved natural gas reserves of nearly 4.8 trillion cubic feet (Tcf) at the end of 2015.28 Most of Colombia’s natural gas reserves are in the Llanos basin, although the Guajira basin accounts for most current production. Natural gas production, like oil production, has risen substantially in the past few years because of increasing international investment in exploration and development.

Exploration and production

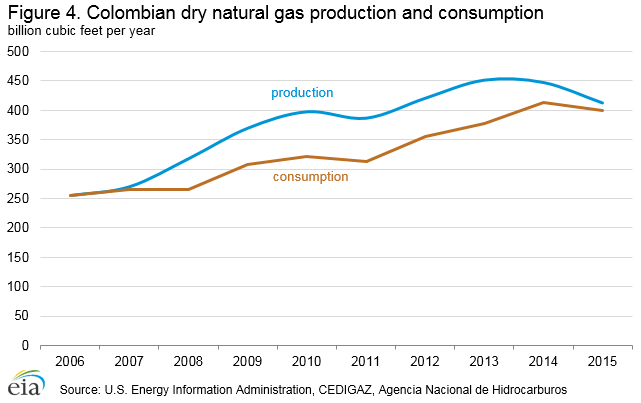

According to the Colombian energy ministry, Colombia produced 413 billion cubic feet (Bcf) of dry natural gas in 2015, while preliminary estimates show that the country consumed about 400 Bcf (Figure 4). Of the country’s total gross natural gas production, about half was reinjected to aid in enhanced oil recovery. In 2007, natural gas production began to exceed consumption, which allowed for exports.

Three companies—Ecopetrol, Equion Energia (a partnership between Ecopetrol and Talisman Energy), and Chevron—account for most of Colombia’s natural gas production.29 Ecopetrol operates the Cupiagua and Cupiagua Sur fields in the large Llanos Basin in eastern Colombia. Equion Energia, formed after Ecopetrol and Talisman Energy acquired BP’s Colombian assets in 2010, operates the Cusiana, Cusiana Norte, and Cupiagua Liria fields, also in the Llanos Basin.30 Chevron, in partnership with Ecopetrol, operates the Caribbean Chuchupa offshore field in the Guajira basin, the largest nonassociated natural gas field in the country.31 The company also operates the nearby onshore Ballena and Riohacha fields.32

The Colombian government published a decree in March 2011 outlining a plan to increase domestic natural gas production, including production from shale or coalbed methane gas fields. Policies aimed at increasing domestic natural gas consumption and exports, combined with increased demand from the power sector as a result of weather-related hydroelectric shortages, have made expanding natural gas production a priority for the government.

Pipelines

There are about 3,100 miles of natural gas pipelines in Colombia.33 Transportadora de Gas Internacional (TGI), a subsidiary of Grupo Energia de Bogota, is the largest operator of natural gas pipelines in Colombia, with a network of approximately 2,300 miles.34 TGI was formed after Grupo Energia de Bogota acquired the state-owned Empresa Colombiana de Gas (Ecogás) at auction in 2006.35

Colombia has three main pipelines that transport natural gas: the Ballena-Barrancabermeja, with a capacity of 260 million cubic feet per day (MMcf/d), which links Chevron’s Ballena field on the northeast coast to Barrancabermeja in central Colombia;36 the Barrancabermeja-Nevia-Bogota line, which connects the Colombian capital to the transmission network; and the Mariquita-Cali line through the western Andean foothills.37

Export pipeline

In 2007, the Trans-Caribbean Gas Pipeline, also known as the Antonio Ricaurte Pipeline, came online, linking fields in northeastern Colombia’s Guajira department with western Venezuela.38 Venezuela’s Petróleos de Venezuela S.A. (PdVSA) financed the $335 million pipeline. In November 2011, an agreement was signed to extend the Ricaute Pipeline across Colombia to Panama and Ecuador. Although initial contracted volumes for export from Colombia ranged from 80-150 million cubic feet per day (MMcf/d), actual exports to Venezuela have often exceeded these levels because of rising Venezuelan demand for natural gas for power generation and reinjection. Natural gas exports through the pipeline, which had reached 250 MMcf/d were stopped in May 2014 amid fears that Colombia’s power supply, derived primarily from hydroelectric facilities, would be affected by drought.39 Since then, Colombia has resumed exports, albeit at a lower level, averaging 91 MMcf/d in 2014.40

Coalbed methane

Coalbed methane (CBM) is a gaseous hydrocarbon that occurs alongside coal resources. This source of natural gas is transported and used in the same way as natural gas found in shale or other deposits. CBM has the potential to increase significantly Colombia’s proved natural gas reserves and eventually its production, which would provide additional natural gas to export to neighboring countries. Estimates of Colombia’s total potential coalbed methane resources range from 11 to 35 Tcf; however, only some of those reserves may ultimately be economically recoverable.41

Coal

Colombia was the fifth-largest coal exporter in the world in 2015.

Colombia had more than 6.7 trillion tons (or 7.4 trillion short tons) of probable coal reserves (mostly bituminous coal) in 2014, the largest in South America, according to the 2015 BP Statistical Review of World Energy.41 These deposits are concentrated in the Guajira peninsula bordering the Caribbean and in the Andean foothills. Most of Colombia’s coal production and export infrastructure is located on the Caribbean coast. Colombia’s coal is relatively clean-burning, with a sulfur content of less than 1%. The country exports most of the coal it produces and was the fifth-largest coal exporter in the world in 2015 after Indonesia, Australia, Russia, and the United States.43

Production

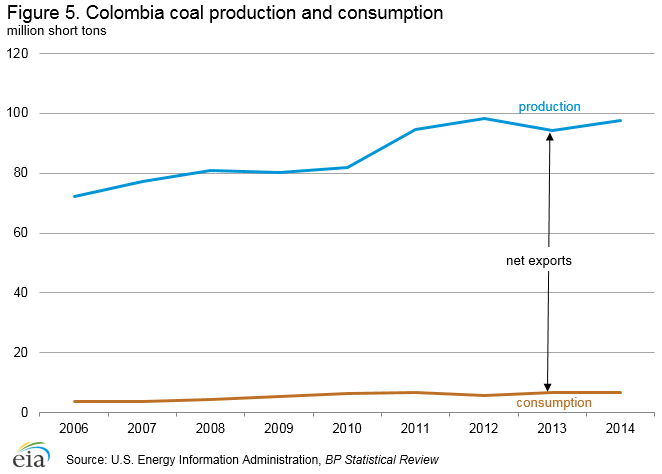

Colombia produced 97.6 million short tons (MMst) of coal in 2014, while 6.7 MMst was consumed domestically (Figure 5). Colombian coal production is exclusively managed by private companies and has doubled since 2002.

The largest coal producer in Colombia is the Carbones del Cerrejon (Cerrejon) consortium, composed of Anglo-American, BHP Billiton, and Xstrata.44 The consortium operates the Cerrejon Zona Norte (CZN) project, the largest coal mine in Latin America and one of the largest open-pit coal mines in the world.45 CZN is an integrated system connecting the mine, railroad, and a Caribbean coast export terminal.

U.S.-based Drummond Company, the second-largest coal producer in Colombia, operates two mines near La Loma, in the Cesar Basin.46 In June 2011, Drummond entered into an 80%–20% partnership with Japan’s Itochu Corporation, known as Drummond International, which now owns and operates its Colombia interests.47 Itochu’s initial investment of $1.5 billion enabled expansion construction of a new export facility, increasing Drummond’s export capacity to 60 MMst per year. The partnership aims to increase coal exports to Japan and other Asian countries.48

Exports

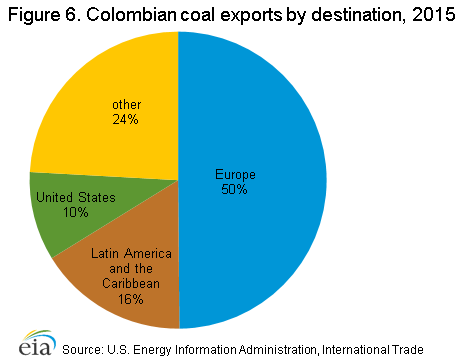

According to International Trade Centre, Colombia exported 80 MMst of coal in 2015, mainly to Europe, other South American countries, and the United States (Figure 6).49 Coal exports are an important part of the Colombian economy. Coal is the country’s second-largest export after oil and petroleum products. The United States and Colombia have an important trading relationship in this sector, and in 2015, Colombian coal represented about 79% of U.S. coal imports, or 8.9 MMst.50

Electricity

In September 2015, Colombia had 15.7 gigawatts (GW) of installed electricity generation capacity, almost 70% derived from hydropower, according to the Unidad de Planeación Minero Energética (UPME), which is the federal special administrative unit responsible for the sustainable development of the mining and energy sectors of Colombia.51

Of the electricity generated in Colombia in 2015, hydroelectric plants accounted for 70%, natural gas accounted for 12%, coal accounted for 7%, petroleum accounted for 10%, and the remaining electricity was from other sources.52

Exports

Colombia is a net exporter of electricity. According to the UPME, Colombia exported a net total of 457 gigawatt hours (GWh) of electricity in 2015, down from 824 GWh the year before.53 In 2013, most of Colombia’s exports were to Venezuela; however, in 2014, nearly all electricity exports were to Ecuador.54 In September 2014, Colombia imported 3.6 GWh of electricity from Ecuador.55

Notes:

- Data presented in the text are the most recent available as of June 29, 2016.

- Data are EIA estimates unless otherwise noted.

Endnotes:

2Ibid.

3International Trade Centre, Accessed May 12, 2016.

4Oil & Gas Journal, Worldwide Reserves, January 1, 2016.

5Ministerio de Minas and Energia, Colombian oil reserves grew by 2.86% during the year 2013, Press Release: 987.

6Agencia Nacional de Hidrocarburos, Mapa de Tierras, December 29, 2014.

7Agencia Nacional de Hidrocarburos, Produccion fiscalizada de crudo 2014.

8Ministerio de Minas and Energia, Decreto Numero 1760 de 26 Junio de 2003.

9Ministerio de Minas and Energia, Ministry Responsibilities.

10Viscidi, Lisa, Colombia’s Energy Renaissance, Americas Society and Council of the Americas, December 2010.

11Colombia Reports, Accessed April 3, 2015

12Deloitte, Colombia 2014 Licensing Round preliminary results and second call for offers, August 2014.

13Baker Hughes, International Rig Count, Accessed May 2016.

14Pacific Rubiales, Investor Presentation, November 2009; Agencia Nacional de Hidrocarburos, Produccion fiscalizada de crudo 2013.

15Agencia Nacional de Hidrocarburos, Produccion fiscalizada de crudo 2015.

16Reuters, Pacific Rubiales to change name ahead of Rubiales contract loss, August 14, 2015.

17Darby Private Equity, Darby closes $385 million acquisition of a stake in Ocensa, Colombia’s largest oil pipeline, Darby Private Equity Press Release, April 1, 2014; Murphy, Peter and Luis Jaime Acosta, Ecopetrol’s Cano Limon oil pipeline in Colombia shut after attacks, Reuters, November 28, 2014; Reuters, Petrobras sells Colombian pipelines, blocks to Perenco for $380 mln, September 13, 2013.

18Pacific Rubiales Energy, Information for Media, March 14, 2012.

19Acosta, Luis Jaime and Peter Murphy, Colombia’s Trasandino oil pipeline shut by rebel bomb attack, Reuters, December 17, 2014.

20Velez, Patricia and Marco Aquino, Colombiana Ecopetrol definiria esta semana socio para oleoducto, Reuters, November 10, 2010.

21Delgado, Diana, Colombia’s Bicentenario pipeline to startup in late 2015, Argus Media, April 24, 2013; BN Americas.

22Ministerio de Defensa Nacional, Logros de la Politica Integral de Seguridad y Defensa para la Prosperidad, February 2016, Page 37.

23Ibid.

24Beittel, June. Peace Talks in Colombia, Congressional Research Service, April 3, 2014.

25Oil & Gas Journal, 2015 Worldwide Refining Survey, January 1, 2016.

26Oil & Gas Journal, Ecopetrol advances Cartagena refinery expansion, October 27, 2015.

27Oil & Gas Journal, Ecopetrol’s Cartagena refinery revamp still under way, April 30, 2014.

28Oil & Gas Journal, Worldwide Reserves, January 1, 2016.

29Agencia Nacional de Hidrocarburos, Produccion fiscalizada-gravable de gas 2014, Accessed March 5, 2015.

30PRNewswire, Ecopetrol and Talisman Energy Finalize the Purchase of BP in Colombia and Announce Change of Company Name, January 24, 2011; Agencia Nacional de Hidrocarburos, Produccion fiscalizada-gravable de gas 2014.

31Agencia Nacional de Hidrocarburos, Produccion fiscalizada-gravable de gas 2014.

32Ibid.

33Central Intelligence Agency, The World Factbook, Accessed May 12, 2016.

34Business Wire, Fitch: EEB Regains Full Control of TGI; Neutral to Ratings, April 8, 2014.

35Camacho, Carlos, Fitch: EEB wins bid to buy Ecogas for US$1.43bn, BNAmericas, December 6, 2006.

36Transportadora de Gas Internacional, Gasoducto Ballena-Barrancabermeja, Accessed May 12, 2016.

37Transportadora de Gas Internacional, Mapa Red Nacional de Gasoductos, Accessed March 5, 2015.

38MercoPress, Colombia gas-links with Venezuela and joins Bank of the South, October 12, 2007.

39Platts, Colombia to suspend natural gas exports to Venezuela next week, May 2, 2014.

40CEDIGAZ, September 2015.

41Guzman, Rudolfo, Potential Resources of Unconventional Hydrocarbons in Colombia, ANH Unconventional Hydrocarbons Workshop, June 8, 2011.

42BP Statistical Review of World Energy 2015, Accessed May 12, 2016.

43International Trade Centre, Accessed May 12, 2016.

44Cerrejon, Neustra Empresa, Accessed March 5, 2015; Cerrejon, Neustra Historia.

45Cerrejon, Neustra Empresa, Accessed March 5, 2015; Mining-Technology.com, The 10 biggest coal mines in the world, October 21, 2013.

46Drummond Ltd, Mines, Accessed March 5, 2015.

47Inoue, Yuko and Jackie Cowhig, Itochu-Drummond deal opens Asia to Colombian coal, Reuters, June 16, 2011.

48Ibid; Drummond Ltd, Timeline.

49International Trade Centre, Accessed May 12, 2016.

50U.S. Energy Information Administration, Quarterly Coal Report, Table 18, May 12, 2016.

51UPME, Plan de Expansion de Referencia Generacion – Transmision 2015-2029, page 113.

52Ibid.

53XM, Accessed May 31, 2016.

54UPME, Plan de Expansion de Referencia Generacion – Transmision 2014-2028, Grafica 3-10 and 3-11.

55UPME, Plan de Expansion de Referencia Generacion – Transmision 2014-2028, Tabla 3-3.