Who’s Keeping Europe Afloat? Is Eurozone Collapse Beginning Of Second Great Depression? – Analysis

By Isida Tushe

It was in the 1930s that Europe experienced one of the deepest recessions of all times and that era’s problems have resurfaced again today with the Eurozone1 crisis. Although similar in many ways, the one key component that these two eras share is the macroeconomic fluctuations to extreme amplitude. The 1907-1908, 1929-1935, and 2007-2009 crises occurred after a sustained boom, where money and credit expansion, rising asset prices, high investor confidence, and over-optimistic risk taking were all triggered, but later spread to affect the world economy. In 1907, there was a build-up of credit and rise in asset prices driven by uncontrolled expansion of the banking system. At the peak of the panic, liquidity played a critical role. By the 1920s, the world economy had not recovered from the destruction of trade and financial components linked to World War I. Although, the transformation in two industries, electricity and combustion engine were the boost the economy needed2.

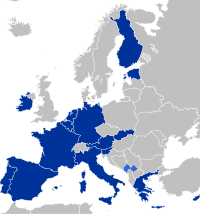

The recession of the 1930s caused failure in banks both in the U.S. and Europe to the point where the exchange rate adjustments made affected world trade and the international capital flow which turned into a global depression; loses in GDP and industrial production. Every day people witnessed mass unemployment to unprecedented scale similar to today’s Greece and Spain situation. Like the 1930s events, today’s event show a fall in resource utilization. The one difference is that it took years for these catastrophic events to happen in the 1930s. In just a few years, Europe has seen a degree of sudden financial stress, sharpness of the fall in the world trade, economic activity, and asset prices. The world monetary standard was gold, and today the European monetary standard is the euro. The EU has managed to establish a single market across its members, where now the Eurozone compromises of 17 member states. Synchronous to the 1930s, today’s collapse in trade, downturn in the economy, and fall in asset prices calls for a serious concern by the EU leaders.

Numerous articles point the finger at several factors such as the American and European banks, and Gordon Brown & Swervyn Mervyn King, and Angela Merkel for the Eurozone crisis. These companies and individuals have lost sight of reality while simultaneously forgetting what history has taught us. When the EU was formed, it was looked upon as the example for European countries to aspire to. The EU gave financial support and aid to Central and Eastern European countries so they could boost their economies in order to possibly one day join the Eurozone. This monetary union meant that sovereign governments could not print money, only the European Central Bank (“ECB”) , which made the countries vulnerable and put them in the same predicament as the individual borrowers could. ECB is in charge of the monetary policy which is the volume of currency. It decides to print or purchase Euros from the market leading to either an expansion or contraction to the money supply. These European countries like Greece, Italy, and Spain were borrowing far more than they could afford and in order to control and at times reduce their debt and still compete economically

The Eurozone is based on the euro. When euro was first launched, EU saw a period of high growth, stable and low inflation, large movements of capital and labour across borders and slight exchange rate stability. This caused the EU countries with small economies to give up their currency and implement the euro currency. However, the interwar reconstructed euro-exchange standard would never perform as smoothly as the original currency of these countries, due to imbalances in the world economy and an internal economic constraints that each country faces like a high unemployment rate, bad debt, and foreign investments. The EU focuses on external stability, protecting the euro parities as their prime policy goal, and acts upon the belief that manipulating interest rates to influence domestic economic prosperity will fix problems. Foreign investors began to withdraw and became persistent in their restrictive fiscal stance, and reluctant to expand expenditures. The interwar euro standard became a mechanism that continues to spread and deepen the European economy while slowly affecting the world.

The euro rules forced the member countries to have no control over setting interest rates. Instead the ECB implements fixed exchange rates and controls the money supply and interest rates. When the ECB tightens its monetary policy, it is done with the aim to constrain the inflationary market. The Eurozone crisis is causing a downtown spiral in economic activity and the EU authorities are allowing the development of a prolonged crisis in the banking and financial system by not taking sufficient expansionary measures in due time. The actions of the EU leaders when discussing Greece’s problem were simply contractionary; expanding the problems with the bail out of the financial institutions more than otherwise would have been the case. By providing the financial bailout for the country, they allowed bad debt to be bought with good money. The crisis spread to the real economy of Greece, contributing to falling production and employment, and to deflation, making the crisis in the Greek financial sector deeper via adverse feedback loops. The rest of Europe is following in the steps of Greece. Instead of changing the approach and stopping the bailing out of these financial institutions, the European leaders are taking the same approach. Buying bad debt with good money. Europe is now under severe stress from falling prices, lack of demand and accelerating unemployment.

In European countries, the banks have a close relationship with the industries of these countries. In fact, one could argue that when industry collapses ,the banks collapse and vice versa. Rising indebtedness and deflationary pressure threaten the solvency of the industries of these European countries. The Eurozone crisis is a classical debt trap; public debt soaring beyond the economic growth of a country. The latest occurrences have pointed out one of the biggest problems with the economy of the European countries. Europe has a market economy where every decision is based on a supply and demand need; decisions regarding investment, production, and distribution. This causes the supply and demand to determine the prices. Realistically, society and the government regulate the market economy in varying degrees. When discussing economics, a high GDP and high living standards are key for a country to provide for its people. These two components are as important as a country’s sovereignty.

European countries operate on a limited economy internally, where there is a lack of economic growth. Problems, such as unemployment, decline in infrastructure, lack of innovation have been surfacing for a while in European countries. Unemployment in the workforce has lead to a permanent loss of skills; decline in infrastructure has become obsolete due to lower investments; lack of innovation caused by cut-backs during recession. Countries like Greece are plagued by corruption and a lot of tax evasion, and it is known to live beyond its means. As financial markets grew across borders, these countries’ leaders thought that the credit would be cheaper and efficiently allocated. As banks became globally linked, they would be less risky. For example, an Italian bank would no longer be stuck with Italian deposits and loans. In reality, the European Central Bank is the central key player. Banks in the Eurozone country have cut back on lending due to fears that they won’t get repaid. National regulators are acting in the best interest of their country. In layman’s terms countries like Greece should have spent money on infrastructure, job creation, and social programs instead of buying debt and other financial products that have had no impact on the economy of the country, other than causing its economic deterioration. You can see Greece’s debt money in lavish real estate expansions in the Caribbean spots like Nassau and The Grand Bahamas.

In 2007, European countries with no stable economic growth began borrowing at extremely high rates and instead of using these loans to build their economy internally by creating jobs and businesses and rebuilding their infrastructure, they started investing in very complex and opaque and overpriced financial products. This caused the interbank market to close and the premiums on interbank loans soared to an extreme. This caused liquidity to come into play which prevented the banks from rolling over their short-term debt. The government of these countries started to panic, which led to people panicking, and investors pulling back. Both consumers and businesses lost confidence in each other. When Greece’s economy collapsed, the EU bailed Greece out by pouring money into the banks and that money went back out into investments and liquidating their creditors. The country has yet to see the benefits from EU’s actions.

The monetary policy the EU has implemented, if you can even call this a policy is by lowering the rates, which has led to budget deficits soaring like we have never seen before during peacetime. If Greece’s banks had withheld their debt on their own, they would have defaulted a long time ago. This would have led to the government nationalizing its banks wiping their debts and starting all over again. The foreign banks of France and Germany jumped in to “help” and their bail out money has gone straight to the Greek banks. Banks do not represent Greece; they are merely a business that has no direct impact on the economy. It started to affect the economy, when these saviors asked for fiscal austerity3 in return for bailing the banks out. Austerity is the only way to preserve the euro and that is what the EU’s main goal is, alongside making their claims known and oppressing the poor European countries. The weak and counterproductive policy the EU has unleashed is one without support or coordination for the macroeconomic and financial system.

As of June 2012, Europe remains in a catastrophic economic state. The European policymakers debate whether to keep the currency uniform or allow these problematic European countries to leave the financial market. Banks were first created to stabilize and improve a nation’s credit through handling of the financial businesses. Banks were not created to be an institution that destroys a country’s economy or the global economy. Banks are a business. Businesses start small and grow big. Businesses also fail and don’t live the end of time as history has shown. It is the government that must create the right channels for the economy to grow. The governments of Greece and Spain are under too much pressure from the EU that all they do is take bailout money without looking at their situation from a realistic point of view. When politicians pursue the interests of their own countries at the expense of the rest, there can be no unity towards a common cause.

The European leaders met on June 19, 2012 and they came out with a solution to bail out Spain and Italy. A solution that consists of 60 billion euros bailout deal like the first 12 bailouts, but this one is foolproof. The money will not be given to the government but it will instead be used to buy up debts on the financial markets. Economics consists of more than just money keeping a country afloat. It consists of production, distribution, and consumption of goods and services. Besides monetary value, there are no real factors considered when these leaders are making decisions. If this bail out money went directly to building the infrastructure, increasing trade, bettering education opportunities, and just ultimately giving people more opportunities, you would see these European countries’ flourish.

Germany, Europe’s largest economy, contributes almost half of the Eurozone’s 440 billion euros ($586.08 billion) bailout fund. Chancellor Angela Merkel tried to rally forces and urge the world’s largest economies to play a part in helping Europe.4 But European leaders like Chancellor Angela Merkel have forgotten how each European country came to exist. Italy, Greece, France, Portugal, and every country in Europe wasn’t built through a debt transaction but through the sweat of these countries’ own people. It is every day people, the fishermen, farmers, and engineers that move Greece’s economy even in the worst of times. It is the local supermarket owners and small businesses that keep it prospering. It is the same people that care enough to protest about what Greece’s next reforms should be. They know it best. It is the 10 million barrels of oil reserves and Hellenic Petroleum and Motor Oil Hellas, Greece’s own companies that have allowed for Greece to flourish. In Spain, it is the automobile and the refinery industry that accounts for the Spanish GDP.

The solution to the Eurozone crisis is not bailing out the financial institutions nor is the solution pouring money into projects that don’t benefit the people. In December 2009, Greece admitted that its debts had reached 300billion euros. The country is burdened with debt amounting to 113% of GDP. In February 2011, the EU promised to help with the debt but Greece must make further spending cuts. The Eurozone and IMF pledged a total of 22 billion euros to help Greece, but no “more loans”, but in April Eurozone agreed to provide up to 30billion euros in emergency loans. On May 2, 2011, the bailout package for Greece reaches 110 billion euros. In April 2011, Portugal asks the EU for help to deal with its finances. A month later, the Eurozone and IMF agreed on a 78 billion euro bailout for Portugal. In October 2011, the U.S. Treasury Secretary Timothy Geithner asked that “Europe create a firewall” to stop the crisis from spreading. By “firewall”, he meant “more bailouts” since that is what the United States did when hits financial institutions began to fail, the government bailed them out, only to keep them in business and then in due time raised interest rates on loans in order to cover the costs of loss. The United States used people’s taxes to pay bad debt that private companies had created. On October 21, 2011, 8 billion more euros went to bailout Greece alone. At the end of January 2012, the EU signed the fiscal pact making it harder for countries to break the budget deficits. On March 13, 2012, another 130bn euros went to Greece bailout. The Eurozone rescue fund reached 1trillion euros at the end of March 2012. In April, Italy borrowing costs increased and investors started to become concerned. A day after, Spain’s economy became the center of worry. A month later, Spain’s Bankia asks the government for a bailout in the amount of 19bn euros; this amount later increases to 100 billion euros. June 15, 2012 UK Chancellor fears that France and Italy may need a bailout.

While trillions of euros are loaned to Greece and Spain, there are no jobs, no new businesses are being built, no infrastructure, and no improvements on education. JP Morgan estimates that only 15 billion euros of 410 billion euros total ‘aid” to Greece went into the economy, the rest to creditors. Greece’s adult unemployment rate is about 20%, while their youth unemployment rate is over 50%. Germany’s jobless rate in March 2012 reached 6.7%. In Portugal, it is 15.2 %, while in Italy, it has reached 10.2%. Germany, the voice of the Eurozone, continues to push for austerity, a principle very problematic for European countries that don’t have much left to tax. Taxes are meant to be a means for the government to better a country; that money is meant to go into the country and help improve situations for its citizens, not to be used for bailing out banks so they can use the money to pay off creditors for investments made on frivolous projects. This austerity approach makes it more difficult for high-debt nations to dig themselves out. The austerity approach makes getting out of debt impossible.

It is the reckless lending that has brought the Eurozone to its knees. The Euro may be blamed for the trade imbalances within the Eurozone, and the ECB for the deflation that is causing recession, but the banks created the debt crisis and it continues because of the self-embedded interest of the Eurozone. How can these leaders continue to keep institutions afloat while the unemployment rate in the country has reached catastrophic levels? The last time this happened was in the 1930s.

The solution to the Eurozone crisis is not to bail out the financial institutions nor is the solution to pour money into projects that don’t benefit the people. Debt isn’t created overnight and it won’t be dissolved overnight. Debt is a disease that continues to spread and it will spread through every country in Europe that isn’t stable enough economically. Most countries in Europe are not. The economies of most European countries are industrial and tourism based and this limits them to how they can expand their opportunities for growth. Greece’s solution was to cut spending and raise taxes, but Greece isn’t providing opportunities for the people. Spain’s unemployment rate continues to drop and so does Portugal’s. This will lead to long term implications such as corruption, increased crime rates, and lowered education levels.

As European countries, continue to fall into debt, the Eurozone continues to bail them out while they in return implement a policy of austerity. They keep bailing countries out of debt while simultaneously setting regulations for the countries to follow. These European countries are pawns in the Eurozone game. They can’t say no to the “bailouts” because they are drowning in debt and aren’t in a position to make demands. The leaders of Greece, Portugal, Spain, and Italy can’t see past their next reelection to make decisions that will benefit the people and their country. The leaders of these countries don’t seem to be worried about the long–term debt crisis and that regrettable mistake rests on the shoulders of the citizens. Not only are the people burdened by the long term debt, but the short term solutions implemented burden them even more. The Eurozone is gambling with people’s lives and the country’s sovereignty. In countries, that have gambling, there is a common saying “The house always wins”. But in Europe “The house of Rothschild always wins”. When the EU limited the participation of these small and poor member countries in the governance of their own economy and left it to the hands of the most corrupt leaders, who had an interest in keeping themselves afloat and looking out for their own countries; there was the potential for bad things to happen. Bad things happened and a small sovereign default turned into a continent-wide debt crisis and banking collapse….this is the cold hard truth.

Isida Tushe is a guest scholar.

Notes:

1. A currency union launched in 1999, each member country uses a shared currency, which is known as the Euro.

2. Albers and De Jong (1994)

3. Higher taxes and lower spending

4. http://online.wsj.com/article/capital.html#project%3DEURODASH1111%26articleTabs%3Dinteractive