Iraq Energy Profile: Second Largest Crude Oil Producer In OPEC – Analysis

By EIA

Iraq (Federal Iraq and Kurdistan Regional Government) is the second-largest crude oil producer in OPEC after Saudi Arabia. It holds the world’s fifth-largest proved crude oil reserves, at 145 billion barrels, representing 17% of proved reserves in the Middle East and 8% of global reserves.1 Most of Iraq’s major known fields—all of which are located onshore—are producing or are in development.2

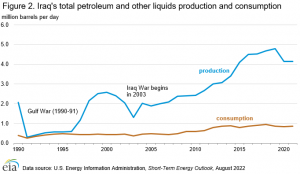

Iraq’s crude oil production grew by 1.7 million barrels per day (b/d) from 2013 through 2019, and it averaged 4.7 million b/d in 2019, an all-time high over a year. In 2020, Iraq’s crude oil output fell to less than 4.1 million b/d.3 Iraq voluntarily reduced crude oil output in the second quarter of 2020 to comply with the OPEC+ agreement. Because the OPEC+ members are reversing the significant production cuts made in 2020, Iraq’s crude oil production rose to an average of nearly 4.4 million b/d in the first half of 2022. These production estimates include crude oil produced in the semi-autonomous northeast region in Iraq governed by the Kurdistan Regional Government (KRG).

We estimate that Iraq’s crude oil production capacity was 4.6 million b/d as of mid-2022, down from 4.8 million b/d in 2020. Export infrastructure at the southern oil terminals is constrained, and midstream projects are often delayed because of insufficient investment and bureaucratic hurdles. Iraq’s rising oil production since the second half of 2020 depleted its spare capacity to less than 200,000 b/d by mid-2022.4

Crude oil export revenues account for a large part of Iraq’s economy. In 2019, crude oil export revenue accounted for an estimated 92% of Iraq’s total government revenues, according to the International Monetary Fund (IMF).5After falling to $42 billion in 2020, Iraq’s oil revenues rose to more than $75 billion in 2021, driven by higher oil prices.6 We expect that the further increases in oil prices in 2022 and higher crude oil production in Iraq, following the reversal of the OPEC+ agreement cuts, will significantly increase Iraq’s oil export revenues and offset some of the cost inflation of petroleum products and other goods and services.7

Federal Iraq held parliamentary elections in October 2021. Although the party of Moqtada al-Sadr won the general election, the party could not form a consensus government nor elect a president. As of August 2022, Federal Iraq still has no government in place, which it needs to pass the annual budget. Because it does not have a ratified federal budget, Iraq runs the risk that project financing and investment decisions it made with companies under the interim government could be delayed or overturned once a new government forms.8

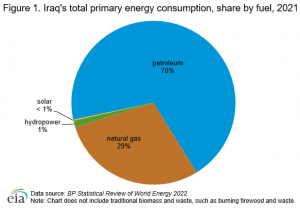

Iraq consumed an estimated 2 quadrillion British thermal units of total primary energy in 2021, making it the fourth-largest energy consumer in the Middle East behind Iran, Saudi Arabia, and the United Arab Emirates.9Natural gas and oil accounted for almost all of Iraq’s total primary energy consumption; hydropower and solar energy contributed marginally (Figure 1). Iraq will continue to mostly use oil to meet demand until it develops more natural gas processing capacity and pipeline infrastructure.

Kurdistan regional government and federal Iraq

Federal Iraq refers to the political entity that is governed by the central government of Iraq in Baghdad. KRG, the official ruling body of the semi-autonomous region in northern Iraq that is predominantly Kurdish, has been involved in disputes with the central government related to sovereignty. The KRG held a non-binding independence referendum on September 25, 2017, in which more than 90% of voters preferred independence.

In October 2017, following the referendum, Iraq’s central government forces took over some oil fields in the Kirkuk area, along with other vital infrastructure such as border crossings and airports. Subsequently, Federal Iraq’s North Oil Company (NOC) took over operations of the Avana Dome, Baba Dome, and Bai Hassan oil fields. The NOC continues to operate the Qubbet Baba, Jambour, and Khabaza oil fields located near Kirkuk.10

By the end of October 2017, northern Iraq production (including production from both the KRG and from Federal Iraq) had decreased to about half of the pre-referendum volume of nearly 600,000 b/d. Northern Iraq production has mostly returned to pre-referendum averages during the past few years because small oil firms increased production at existing fields and brought several small fields online in the KRG-controlled area. KRG oil production declined slightly after reaching nearly 470,000 b/d in 2019 because of a decline in international oil company (IOC) investment in exploration and field development and challenges resulting from the COVID-19 pandemic. ExxonMobil withdrew from its last license in Kurdistan in 2021.11

Control over rights to the reserves is a source of considerable controversy between the ethnic Kurds and other groups in the area. According to Rystad estimates, as of May 2022, the KRG-controlled areas held about 3.7 billion barrels of oil resources.12 The KRG estimate of 45 billion barrels is likely higher because they include both unproven reserves and the disputed Kirkuk area fields.13

In February 2022, Federal Iraq’s Supreme Court ruled that the KRG does not have the authority to produce or to market oil and natural gas and that all contracts the KRG signed with international oil companies and oil service companies are illegal. The KRG government rejected the ruling and asserted that it has a constitutional right to export oil produced in Kurdistan. The dispute is ongoing, and Federal Iraq has put legal pressure on several companies operating in Kurdistan.14 This legal conflict could slow Kurdistan’s oil and natural gas production if several oil companies decide to permanently halt their operations in the region in response to the court ruling.

Petroleum and other liquids

Iraq’s crude oil production (excluding condensates) averaged 4.1 million barrels per day (b/d) in 2020 and 2021, which was 600,000 b/d lower than in 2019 (Figure 2). More than 3.6 million b/d was produced under the central government in Baghdad, and about 445,000 b/d was produced at the northern fields currently operated by the KRG.15 Iraq created a fourth crude oil grade, Basra Medium, by separating it from the Basra Light grade in January 2021. Basra Light, which used to account for Iraq’s largest crude oil stream, accounted for nearly 1.2 million b/d of Iraq’s total production in 2021. Iraq’s state oil marketer ended exports of Basra Light in January 2022 and now produces the grade solely for domestic refineries.16

Iraq is a participant in the OPEC+ agreement. Under the April 2020 agreement, Iraq agreed to reduce its production to 3.6 million b/d from May to July 2020 and to 3.8 million b/d for the remainder of 2020. When the OPEC+ members began to reverse their production cuts in the latter half of 2020, Iraq gradually raised its crude oil production to 4.1 million b/d in 2021 and 4.4 million b/d in the first half of 2022.17

Iraq’s oil ministry intends to lift its crude oil production capacity to 8 million b/d by 2028 and will target several upstream expansion projects from fields in southern Iraq to boost the country’s output (Table 1).18 Some of these projects are likely to be delayed by Iraq’s political struggles in forming a government, the lack of a budget, and the international oil companies’ uncertainty about the investment climate.

Iraq’s oil production requires more water injection to maintain its reservoir pressures and increase oil production. TotalEnergies intends to invest in a 7.5 million b/d seawater conversion project as part of its energy deal with Iraq to bolster oil production from mature fields in southern Iraq.26 The seawater conversion project has been delayed for several years, and if the agreement with TotalEnergies is not finalized by the next government, it could incur further delays.

Iraq consumed about 850,000 b/d of petroleum and other liquids in 2021. Liquids consumption in Iraq has grown by an average 3% per year during the past decade. Domestic refineries meet most of Iraq’s petroleum product needs; however, Iraq imports some petroleum products, primarily gasoline and diesel.27 Iraq also uses crude oil for electric power generation.28

Iraq’s total effective refining capacity is about 900,000 b/d. The Iraqi government plans to reduce petroleum product imports by rehabilitating the refining sector and building new refineries, but the government has struggled in its efforts to attract the foreign investment needed in the downstream sector. Iraq’s refineries produce more heavy fuel oil than is needed domestically and not enough gasoline and diesel to meet domestic demand. Several new refineries are planned, along with capacity expansion and upgrades at a number of existing refineries, to alleviate domestic product shortages, reduce government import costs for oil products, and eventually increase exports of refined products. Iraq expects to commission two refinery projects by 2023. The South Refineries Company is expanding its Basra refinery by 70,000 b/d.29 Also, Iraq’s oil ministry may begin operations at the new 150,000 b/d Karbala refinery in central Iraq by 2023.30 Other refinery projects are still in the planning stages, although Iraq’s regulatory challenges and economic issues are hurdles for potential investors.

| Field name | Operator or project investor | Additional capacity (thousands of barrels per day) | Announced start date | Notes |

|---|---|---|---|---|

| Faihaa | China’s United Energy Group | 70 | 2024 | Located on the border with Iran. Plans include expanding field capacity to 130,000 barrels per day (b/d).19 |

| Missan Cluster (Bazergan, Fakka, and Abu Gharb fields) | China’s CNOOC | 100 | end of 2022 | Planned expansion of the Missan Cluster’s capacity to 300,000 b/d.20 |

| Majnoon | Basra Oil Company | 200 | 202521 | |

| West Qurna-1 | ExxonMobil and Basra Oil Company | 330 | 2027 | Iraq awarded a drilling contract to services firm, Schlumberger. Iraq’s dispute with ExxonMobil over the company’s exit of the field’s partnership and the uncertainty of Basra Oil Company’s ability to invest in the expansion are likely to delay this project.22 |

| West Qurna-2 | Russia’s Lukoil | 350 | 2027 | Capacity expansion plans announced in 2018 but no progress as of August 2022.23 |

| Ratawi | TotalEnergies | 125 | 2026 | Field expansion is part of TotalEnergies’ $27 billion deal signed in September 2021 with Iraq. Agreement is not finalized as of August 2022. Planned expansion of field capacity to 210,000 b/d.24 |

| Fields in the Dhi Qar province (Nasariya, Gharaf, and Subba) | Iraq National Oil Company (INOC) | ∼380 | 2028 | Iraq began negotiations with Chevron in 2020 to explore and develop more fields in the Dhi Qar province. These fields produced an aggregate of about 220,000 b/d at the end of 2021, and Iraq targets a total production of 600,000 b/d.25 |

| Data source: Middle East Economic Survey, FACTS Global Energy Services, Rystad Energy, Al Arabiya News, and company websites Note: NA=not available |

Crude oil exports

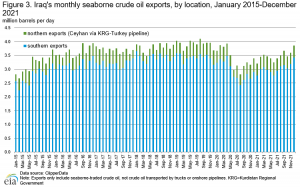

Iraq’s total seaborne-traded crude oil exports averaged nearly 3.5 million b/d in 2021, which was slightly higher than the previous year, based on tanker loadings data.31 During 2021, approximately 87% of Iraq’s seaborne exports were shipped from the southern terminals in the Persian Gulf, which exports Basra light, medium, and heavy crude oil grades (Figure 3).32 Crude oil from Iraq’s northern region is sent by pipeline to Ceyhan, Turkey, where it ships from the port of Ceyhan.

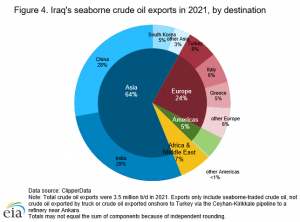

Asia (led by India, China, and South Korea) was the main regional destination for Iraq’s crude oil, importing 64% of Iraq’s crude oil exports in 2021 (Figure 4). China and India each imported almost 1 million b/d of crude oil from Iraq (more than half of Iraq’s total exports), making them the top buyers of Iraq’s crude oil during the year. Outside of Asia, Turkey and Italy imported the most crude oil from Iraq, at 217,000 b/d each (6% each of Iraq’s total exports). Collectively, European countries imported 24% of Iraq’s crude oil exports in 2021. Iraq’s oil exports to the United States have declined each year since 2017 because of higher U.S. crude oil production, higher U.S. imports from heavy oil sands in Canada, and a decline in U.S. 2020 oil consumption as a result of the COVID-19 pandemic.

Russia’s full-scale invasion of Ukraine and the partial sanctions on Russia’s oil supplies to Europe in 2022 have diverted a significant portion of Russia’s oil from Europe to Asia and created more opportunities for Middle Eastern crude oil suppliers to send more volumes to Europe. As a result, Iraq is likely to send more crude oil to Europe. Iraq significantly reduced the price of its crude oil loadings to Europe for July 2022. Some of Iraq’s crude oil exports to India and China are likely to be replaced by discounted volumes from Russia in 2022.33

Infrastructure export capacity at its southern ports in Basra remains constrained and requires investment to rebuild and restore. Iraq’s export capacity has declined over the past few years, which limits the country’s capacity to produce crude oil. Operational export capacity fell from 3.7 million b/d before 2020 to about 3.3 million b/d in early 2022.34 Oil exports in southern Iraq will likely be constrained in the second half of 2022, until Iraq can upgrade its infrastructure. SOMO, Federal Iraq’s oil marketer, announced that new pumping stations would add 250,000 b/d of export capacity to the Basra Oil Terminal in mid-2022. However, the project was delayed by several months.35

Iraq also intends to replace aging and malfunctioning subsea pipelines critical to oil export infrastructure offshore of Basra. Sealine 3, with a capacity of 700,000 b/d, is under construction and expected to come online by 2023. It will connect the new, fifth single mooring point to the Basra Oil Terminal. The Basra Oil Company plans to start operations of the pipeline leading to the Khor Al-Amaya Oil Terminal by 2023. This terminal halted operations in 2017 because of pipeline leaks. The repaired pipeline will be able to transport 600,000 b/d to the terminal, adding to the export capacity in southern Iraq. Two other pipelines are slated to replace existing and outdated pipelines by 2024.36

In addition to its seaborne shipments, Iraq also exports relatively small volumes of crude oil by truck to Jordan37 and by inland routes to Turkey via an onshore pipeline from the Ceyhan terminal to Turkey’s Kirikkale refinery, near Ankara. The Ceyhan-Kirikkale pipeline has a capacity of 145,000 b/d.38

The Federal Iraq government and the KRG signed an agreement in November 2018 that allows Iraq to transport up to 100,000 b/d of Federal Iraq’s crude oil through the KRG’s pipeline to Turkey and to export its crude oil from the Kirkuk fields through the Ceyhan port.39 Iraq exported nearly 100,000 b/d of crude oil from Kirkuk through the KRG pipeline in 2021.40

Another outlet that Federal Iraq established temporarily for its northern crude oil was a swap deal with Iran in 2017. Iraq trucked about 30,000 b/d of crude oil from its Kirkuk fields to Iran, and Iran shipped the equivalent volume of crude oil from the Kharg oil terminal to Basra. However, this arrangement ended by November 2018, when U.S. sanctions took effect on Iran.41

Natural gas

At nearly 131 trillion cubic feet (Tcf), Iraq’s proved natural gas reserves at the end of 2021 were the 12th largest in the world.42 The majority of Iraq’s natural gas reserves are associated with oil, and most of the associated natural gas is located in large oil fields in southern Iraq.43

After reaching a record-high 378 billion cubic feet (Bcf) in 2019, Iraq’s dry natural gas production fell to 328 Bcf in 2020. Production cuts from Iraq’s oil fields in early 2020, following the OPEC+ agreement, lowered associated natural gas output. In 2021, natural gas production returned to about 353 Bcf as Iraq’s associated gas began to return to production. Iraq consumed 650 Bcf of dry natural gas in 2021,44 much of which the electricity sector consumed.

According to the World Bank, Iraq flared nearly 630 Bcf of natural gas in 2021, ranking as the second-largest source country of flared natural gas in the world, behind Russia.45 Natural gas is flared because of insufficient pipeline capacity and other midstream infrastructure to move the natural gas from crude oil production areas. Iraq delayed its target to eliminate natural gas flaring to 2027.46 If Iraq can mobilize the investment for capturing its associated gas, it could reduce the use of crude oil and petroleum products for generating electricity, especially during the peak summer season, and reduce its natural gas imports from Iran.

Nearly all of Iraq’s natural gas output is associated natural gas, which is a byproduct of oil production. Iraq is pursuing several projects to capture its associated natural gas production and is negotiating several agreements with various companies to raise the country’s natural gas processing capacity from about 550 Bcf in 2021 to nearly 1.5 Tcf in 2027 (Table 2).47

Federal Iraq aims to not only capture and sell more associated gas but also to develop natural gas fields not associated with oil production (Table 2). The government is prioritizing the Akkas field in western Iraq and the Mansuriya field north of Baghdad as key nonassociated gas projects. Although Iraq is keen to develop these fields and the required natural gas processing infrastructure for them, these projects have encountered several delays over the past decade because of issues related to security, investment, contract terms, and commitment by international partners.

The KRG has one nonassociated gas field, Khor Mor, with an operational capacity of 164 Bcf/y, which supplies power plants in Kurdistan. UAE’s Dana Gas, the operator of Khor Mor, began work on an expansion project that is slated to provide natural gas for domestic use in the electric power sector. Once domestic power demand is satisfied, additional capacity from the project could be exported to Turkey and the European Union or sent to power plants in northern Federal Iraq. However, new natural gas pipelines would be required to send the natural gas outside of the KRG. A series of rocket attacks in the summer of 2022 has caused a temporary suspension of work on the expansion project.48

| Project | Operator or project investor | Additional capacity (billion cubic feet per year) | Announced start date | Notes |

|---|---|---|---|---|

| Associated gas projects | ||||

| Halfaya natural gas processing plant | China’s CNPC | 70 | 2023 | Expansion of the Halfaya natural gas processing facility from a capacity of nearly 30 billion cubic feet per year (Bcf/y) to 110 Bcf/y. Designed to capture flared gas from the large Halfaya oil field in Maysan province. Natural gas will replace all of the oil use in the region’s electric power sector.49 |

| Basra Natural Gas Liquids project | Basra Gas Company | 73 in Phase 1 and 73 in Phase 2 | 2023 and 2024 | The Basra Gas Company intends to add 73 Bcf/y each year in 2023 and 2024 at its BNGL project to process natural gas from the Majnoon, West Qurna-2, and Ratawi oil fields.50 |

| Nassariya and Gharraf natural gas project51 | South Gas Company and Baker Hughes | 73 | 2024 | |

| Gas Growth Integrated Project | TotalEnergies | 219 | 2027 | As part of TotalEnergies’ deal in Iraq, the company would build a natural gas facility in two phases to gather and treat natural gas from the West Qurna-2, Majnoon, Ratawi, Tuba and Luhais oil fields.52 |

| Nonassociated gas projects | ||||

| Khor Mor expansion project | UAE’s Dana Gas | 90 in Phase 1 and 100 in Phase 2 | 2023 and 2025 | The KRG’s sole nonassociated gas field, Khor Mor, has a capacity of 164 Bcf/y, which supplies power plants in Kurdistan. Dana Gas intends to expand capacity by 90 Bcf/y by mid-2023 in the first phase and 100 Bcf/y in phase 2.53 |

| Akkas gas field | INOC | 146 | 2027 | Located in the remote western province, Anbar. INOC is seeking a partner to develop the field and plans to conduct more reservoir assessments.54 |

| Mansuriya gas field | Sinopec | 110 | Sinopec and Iraq’s interim government agreed on contract for Mansuriya gas field in January 2022, but deal must be finalized by Iraq’s new government.55 | |

| Data source: Middle East Economic Survey, Argus Media, Rystad Energy, Reuters, and Shafaq News |

Iraq began importing natural gas from Iran in July 2017 to fuel electric power plants near Baghdad, including the Al-Besmaya, Al-Quds, Al-Mansuriyah, and Al-Sadr stations. Iraq opened a second natural gas pipeline from Iran in July 2018 to feed power plants near Basra. Annual natural gas imports averaged 297 Bcf in 2021, down from 331 Bcf in 2020.56 Iran limited natural gas exports to Iraq in 2021 because of high summer demand for natural gas in Iran, a regional drought causing low hydroelectric power and higher use of fossil fuels, and the challenge that Iraq faces in making payments to Iran.57

Electricity

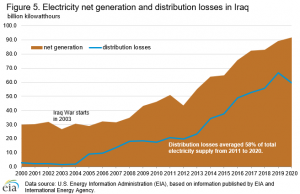

Iraq’s net electricity generation grew by an annual average of about 7% each year between 2010 and 2020, reaching an estimated 92 terawatthours (TWh) (Figure 5). Rising power demand from the oil sector, population growth, higher natural gas supply, and some improvements in generation capacity and transmission networks drove increases in electricity output through 2020.58 We expect that electricity output in 2021 will continue to increase due to economic recovery following the COVID-19 pandemic and higher demand from the oil industry because of the upturn in oil production after the OPEC+ production cuts expired.

Nearly all (almost 95%) of Iraq’s electricity generation is from oil and natural gas.59 According to the International Energy Agency, natural gas use in the electric power sector increased from 25% in 2016 to nearly 60% in 2020 because Iraq began importing natural gas from Iran to increase its own supplies. Hydroelectricity accounts for most of the remaining share of electricity production.60

Although solar generation accounted for an insignificant share of total power generation, Iraq plans to develop renewable energy projects to replace some of its oil and natural gas-fired capacity and to reduce natural gas and electricity imports from Iran. Iraq plans to install 12 GW of renewable energy capacity by 2030 and has signed agreements with several international companies to develop 4.5 gigawatts (GW) of utility-scale solar projects in 2021.61

Federal Iraq’s available peak electricity generation supply was 21 GW for 2021. The available supply in 2021 was much lower than the installed capacity of 37 GW and the 33 GW needed to meet peak summer demand.62Iraq’s electricity use is very seasonal and reaches peak capacity in the summer months. Generation plants run at low utilization rates, and the available or effective production capacity is much lower than installed capacity because of poor transmission infrastructure, inefficient or damaged power plants, and insufficient natural gas supply and infrastructure. Peak summer demand typically exceeds actual generation, resulting in power shortages that sparked protests in southern Iraq and Baghdad in the summers of 2020, 2021 and 2022.63

Distribution losses remain an issue in Iraq. From 2011 to 2020, distribution losses averaged 58% of total electricity supply, compared to an average of 8% for the world during this time period.64 High distribution losses are the result of inefficiencies on the grid, poor system design, and high rates of electricity theft.

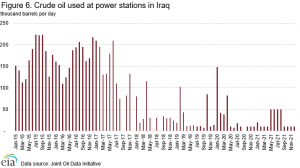

Iraq burns crude oil directly at power plants to make up for its limited feedstock of other power generation fuels. At its highest, direct use of crude oil reached more than 220,000 b/d in the summer of 2015 (Figure 6).65Reported average crude oil used at power stations fell from an average of 169,000 b/d in 2016 to an average of 24,000 barrels per day (b/d) in 2021 as a result of increased natural gas-fired electricity generation. Although Iraq’s official reports of crude oil burn have been low during the past few years, we estimate that much higher amounts of crude oil are used for power generation.66

Iraq’s electricity sector imports a significant amount of its supplies from Iran. In 2021, about 35% of Iraq’s electricity was generated by a combination of natural gas produced in Iran and electricity imported from Iran.67 Iran significantly reduced its natural gas exports to Iraq in 2021 and 2022 because of higher domestic demand in Iran, hotter than average summer temperatures, reduced natural gas production in Iran, and payment issues from Iraq. In addition, Iran has lowered its electricity exports to Iraq since summer 2021 because of its own power shortages.68

Iraq is looking for ways to diversify its sources of imported electricity. Sources under consideration include the Gulf Cooperation Council (GCC), Saudi Arabia, Turkey, and Jordan. Iraq finalized an agreement with the GCC, which will supply Iraq with 500 megawatts (MW) of electricity starting in mid-2024 from a power line from Kuwait. If realized, the project’s ultimate capacity will reach 1.8 GW.69 Two power lines with 500 MW of combined capacity from Turkey to Iraq were completed in the first half of 2022, and imports from Turkey expected to begin later in 2022.70 Jordan plans to begin exporting up to 150 MW of electricity to Iraq through a new transmission line in 2023, barring any project delays.71

Notes

- Data presented in the text are the most recent available as of August 2022.

- Data are EIA estimates unless otherwise noted.

Source: This article was published by EIA and Endnotes can be found here.