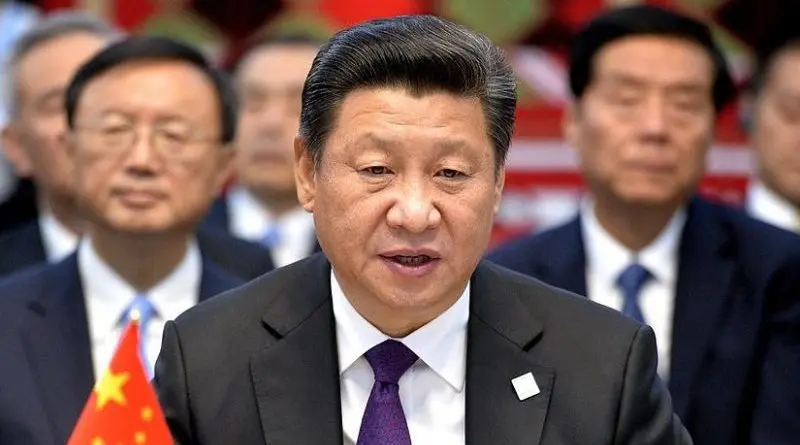

Europe Warms Up To China’s ‘One Belt, One Road’ Project – Analysis

By Observer Research Foundation

By Arun Mohan Sukumar

Europe’s gradual embrace of China’s Belt and Road initiative (OBOR) presents the most significant milestone in its history after President Xi Jinping pulled the drapes off the project three years ago. To the mercantilist, OBOR is not a connectivity project but an arrangement intended to maximise China’s exports, and help Beijing move up the global value chain. Given that Europe is China’s overseas biggest market — they currently trade over a billion dollars a day — and the one with the deepest pockets, the EU’s warming up to OBOR ensures the project is here to stay. After all, creating “transit economies” without a firm guarantee from the final trading destination makes little sense for China.

But the EU’s eventual endorsement of OBOR also comes with geopolitical consequences, all of which materially affect India’s interests.

- The Internationalisation of OBOR

- The institutionalisation of a connectivity “regime” around OBOR

- Reconfiguration of political relationships based on economic ties

OBOR goes global

What explains the EU’s interest in OBOR, if the project only seeks to satisfy China’s bulging export capacity? To start with, Brussels realises the primary source of capital for infrastructure projects in Eurasia over the next decade will be China. If European diplomats were reluctant to embrace the Belt and Road initiative for want of clarity, they now sense an opportunity to partner some of these projects. Among the EU’s top strategic priorities is a free trade agreement with China, with a focus on services. The Belt and Road project, many European interlocutors feel, is “mutually compatible” with the FTA proposal — in rooting for OBOR, the EU may be trying to attract Chinese investment in specific sectors.

Europe will also nudge Beijing into creating “sustainable” infrastructure along the Belt, and promote the use of green technologies in these economies. Most OBOR destinations, if not all, are parties to the Paris agreement, and the EU could see OBOR as a vehicle to project its climate leadership and ensure compliance with the agreement’s principles. And finally, participation in OBOR may be tied to the future of European influence: several Western European powers are founding members of the Asian Infrastructure Investment Bank, a likely conduit for OBOR financing, and would be interested in shaping these projects as well as the economies that are receptacles for them.

What does it mean for India?

Europe’s endorsement of OBOR will mark the “internationalisation” of what was previously perceived as a Chinese initiative. Unlike the AIIB, which has significant buy-in from the region, including from India, OBOR has been seen in Asia as Beijing’s project aimed at strengthening its lagging exports. Conversations on OBOR have been almost exclusively bilateral, with the Chinese political leadership reaching out to their counterparts in state capitals. This has been true of Europe as well – China-Europe negotiations on OBOR have taken place under the umbrella of the “16+1” framework, with the project itself eyeing limited European destinations. But the EU’s formal involvement will encourage countries that were wary of China’s grand plans for the region to join the initiative. Second, Europe’s interest in linking the project to the Sustainable Development Goals and Paris Agreement targets could result in the institutionalisation of an OBOR regime, specifying the terms for economic development along the Eurasian landmass. For instance, China-EU negotiations may determine ICT security and data protection standards in the region, which countries in Central and South East Asia find easier to adopt for the ease of doing business.

Such developments would have two potential consequences for India. Even if Beijing has not consulted India on the project, New Delhi has taken comfort from the fact that both countries are placed differently in regional and global supply chains. OBOR has not prevented India from continuing its neighbourhood infrastructure projects, and in any case, the country’s manufacturers have some way to go before satiating domestic demand. By linking to OBOR land and maritime routes, India could even benefit from the supply chains that will be created across the region, and offer products where it enjoys a comparative advantage. However, were OBOR to create an ecosystem of norms and standards, Indian businesses might find it difficult to compete in Asia with their Chinese/European counterparts especially in the services sector. It may also foreclose the future entry of Indian conglomerates into infrastructure projects. Most importantly, the reconfiguration of political relationships based on such economic linkages affects the balance of power in Asia.

China is not expected to pursue a radically different economic agenda for the region, but India should not discount the possibility that Beijing uses the political heft so accrued from OBOR to pursue exclusionary or preferential governance arrangements.