G20 Must Build On G7 Five-Point Plan For Critical Minerals – Analysis

By Dr. Kapil Narula and Dr. Andrew DeWit*

The G7, formed in 1975, is an intergovernmental political forum of seven member states of Canada, France, Germany, Italy, Japan, the United Kingdom, the United States and the European Union (EU). Historically, these countries are amongst the most influential ones, with significant political, economic, and military power. Japan assumed the G7 Presidency for 2023 and the 49th G7 Summit is scheduled to be held from 19-21 May 23 at Hiroshima.

Considering the increasing role of other countries in global politics, the G20 (Group of Twenty) was created which included emerging economies such as Argentina, Australia, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, South Korea and Turkey, along with the countries of the G7. Though the G20 was formed in 1999, initially it was attended only by finance ministers and central bank governors. The G20 represents over 80% of global GDP and two-thirds of the world’s population and provides a platform for both advanced and emerging economies to discuss and implement coordinated international responses on globally important issues, making it the premier forum for economic cooperation. India assumed the G20 Presidency for 2023 and the 18th G20 Heads of State and Government Summit will be held in New Delhi in September 2023.

Importance of critical minerals

Critical minerals are those non-fuel minerals that are essential for the economic and national security of a country, but are vulnerable to supply chain disruption. These include lithium, cobalt, graphite, copper, rare earth elements, and platinum group metals, amongst others. These minerals are essential for clean energy technologies such as wind turbines, solar PV panels, storage batteries and electric vehicles. Therefore, their availability plays an important role in the sustainable energy transition.

The supply-demand gap of critical minerals in widening. The IEA forecasts that, driven by increasing deployment of clean energy technologies, the overall demand for critical minerals could increase by as much as six times by 2040, with the demand for lithium, graphite, cobalt and nickel increasing between 24-50 times, in certain scenarios. Forecasts also show that yearly production of these minerals will increase by 5-6 times, growing to over US$250 billion by 2040, surpassing the annual production value of coal, which will gradually be phased out. The increase in the price of cobalt and lithium, by 3x and 12x respectively between 2020-22, is proof of this market imbalance.

G7 ministers’ communiqué

The G7 Ministers’ Meeting on Climate, Energy and Environment was held from 15-16 April 2023 at Sapporo, Japan. A 36-page communiqué was also released where G7 countries pledged to accelerate the phase-out of unabated fossil fuels to achieve 2050 net-zero goals and holistically address the climate, energy, and environment crisis. The following key decisions were adopted, which will be significant drivers of future demand for critical minerals:

- A collective increase in offshore wind capacity of 150 gigawatt and a collective increase of solar photovoltaic to more than one terawatt by 2030.

- Achieving a fully or predominantly decarbonised power sector by 2035.

- Achieving 100% or the overwhelming penetration of sales of light duty vehicles (LDVs) as zero emission vehicles (ZEV) by 2035 and beyond; and to achieve 100 percent electrified vehicles in new passenger car sales by 2035.

- To collectively reduce by at least 50% CO2 emissions from G7 vehicle stock by 2035 or earlier, relative to 2000 levels, as a halfway point to achieving net zero.

The communiqué acknowledged the growing importance of critical minerals and raw materials for a net-zero economy and for meeting the above ambitions. It also highlighted the threats and risks to critical mineral supply chain disruption caused by monopolization and lack of diversification of existing suppliers. The need for creating responsible and resilient critical minerals supply chains, supporting open, transparent, rules- and market-based trade in critical minerals with traceability, opposing market-distorting measures and monopolistic policies for critical minerals was recognized.

The commitment to strong environmental social and governance (ESG) standards, ensuring benefit to local communities, respecting human rights, minimizing environmental footprint, promoting circularity in supply chains, enhancing recovery and recycling, advancing innovation and competitiveness, substitution with alternate materials, and promoting dialogues between extraction, producer, and consumer countries were all points of emphasis.

Building on the five-point plan

To enable the clean energy transition, the G7 communiqué also proposed a “Five-Point Plan for Critical Mineral Security”. This included the need for long-term supply and demand forecasting, creating responsible mineral supply chains, developing recycling capabilities, promoting innovation for developing substitute materials, and preparing for short-term supply disruptions.

The G20 needs to build on this five-point plan to overcome the existing challenges and provide a broader base to strengthen mineral supply chains. G20 group includes countries such as Australia (Lithium), Brazil (Niobium), China (Gallium, Vanadium, Rare earths), India (Rare earths), Indonesia (Nickel), Russia (Palladium) and South Africa (Platinum), which are well positioned to supply critical minerals, develop refining and processing capabilities, and are also likely to be high consumers.

Supply-demand forecasting

Flagship reports such as ‘The role of critical minerals in clean energy transitions’ by the IEA and the World Bank Group study on “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition” are useful starting points for demand estimation. A focused task force to analyse supply-demand forecasts at the IEA, as proposed in the five-point plan, is an important step.

The G20 must build parallel research capacity in an institution in an emerging economy to conduct detailed studies on the demand of individual minerals, tracing their supply chains, mapping of existing mineral resources and reserves, identifying capacity of mining companies, along with estimating the investment required in the short- to medium-term. This joint research effort will complement the efforts of the IEA and would be helpful to guide future development of the critical mineral sector.

Responsible supply chains

The G7 agreed to develop new mines with high ESG standards and promote responsible supply chains. They also committed to consolidate mineral cooperation through Partnership for Global Infrastructure and Investment (PGII), Mineral Security Partnership (MSP), supported the ‘Sustainable Critical Minerals Alliance’, and European Commission’s proposal to establish a “Critical Raw Materials Club” to facilitate investment in materials supply chains. The importance of private investment and support of public financial institutions was affirmed. It was highlighted that fiscal support measures of $13 billion have been provided for domestic and foreign projects in critical minerals across G7 countries.

Multilateral strategic and trade partnerships allow diversification of suppliers and lowers supply chain vulnerabilities. The G20 needs to work on expanding the membership of critical mineral partnerships which are now restricted to selected high income countries. The ‘Critical Minerals Mapping Initiative’ (2019) between three countries; MSP (2022), between eleven OECD countries; and ‘Sustainable Critical Minerals Alliance’ (2022) between seven developed countries are recent coalitions which do not include emerging economies. A high-level forum for minerals with a balanced representation from all continents, would be more inclusive and could play an important role in ensuring access to critical minerals while strengthening coordinated responses and standardisation of ESG criteria.

Recycling and circular economy

Recycling of lithium-ion batteries and neodymium magnets, establishing domestic recycling facilities and collection of e-waste and its environmentally sound processing, was highlighted by the G7.

The G20 could go further by committing to adopting mandatory standards, guidelines and legislation for collection and recycling of e-waste and annual reporting by manufacturers. Better collection processes, efficient sorting, and material recovery by smelting of waste electrical and electronic equipment (WEEE) can increase urban mining, which can ease pressures on existing supply chains, while lowering the environmental impact of mining. Extended Producer Responsibility (EPR) for collection and recycling by manufacturers of solar PV panels, magnets and EV batteries and incentivising in recycling through tax breaks and grants can help in creating recycling capacity. Development of central e-waste collection hubs, new technologies for cost-efficient recovery, co-location of recycling facilities with production hubs can enhance synergies and lead to an ecosystem of recycling.

Innovations and resource efficiency

Development of substitute materials, technologies and resource saving processes was agreed. Expanding the membership of the intergovernmental ‘Conference on Critical Materials and Minerals’ beyond policy makers from Japan, the US, the EU, Australia, and Canada to other G7 countries for exchange of information, policies, research and development (R&D) activities, supporting innovation, and to advance collaborative efforts was proposed.

The G20 needs to strengthen initiatives to share best practices, must collectively work on developing low-cost technologies through frugal innovations and undertake capacity-building by technical collaboration, technology transfer, and training of human resources. Promoting profitable business models and increasing consumer awareness are essential components which need to be given due attention. They must also commit to redesign of products which completely eliminates or lowers the use of critical minerals. Participation in events such as the first-ever ‘African Critical Minerals Summit’ in Johannesburg, South Africa on 6-7 November will also help in building support and collaborating with resource rich countries.

Planning for supply chain disruption

The G7 has supported an IEA proposal to create a “Voluntary Critical Mineral Security Program” to prepare for short-term supply disruptions. The G20 must ensure that there is equal representation from all countries and this does not become an ‘exclusive’ club with high entry barriers, which prohibits the participation of low- and lower-middle income countries. Stockpiles of critical minerals are officially maintained by the governments of US and Japan, and collective actions by governments and other market actors could be considered for sharing information and data on stockpiles for coordinated action.

Conclusion

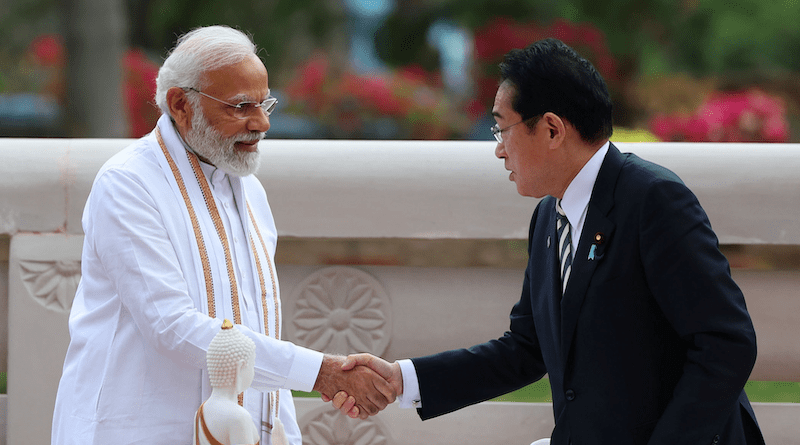

The importance of critical minerals is growing by the day and this is evident in the flurry of activities in the past couple of years. These include the adoption and updating of critical mineral strategies by several countries, incentives to support domestic supply and production of critical minerals in the US through Inflation Reduction Act(IRA) of 2022, and measures undertaken under the Green Deal Industrial Plan in the EU, including the European Critical Raw Materials Act. The development of discourse on critical minerals in T7 and T20 forums which inform G7 and G20 discussions is also notable. The Indian Prime Minister Modi was invited to the G7 Hiroshima Summit by the Japanese Prime Minister Kishida and both leaders confirmed to cooperate in the lead up to the G7 and the G20 summits. Considering the robust partnership and the G7 and G20 Presidency of Japan and India respectively, this is a unique opportunity to consolidate action on critical minerals.

*About the authors:

- Dr. Kapil Narula is a Consultant at the United Nations and a co-author of T7 and T20 policy briefs on critical minerals.

- Dr. Andrew DeWit is a Full Professor at the School of Economic Policy Studies, Rikkyo University, Japan

Source: This article was published by Geopolitical Monitor.com