US Job Growth Slows Sharply In May As Unemployment Hits New Low – Analysis

By Dean Baker

The US unemployment rate fell to 4.3 percent in May, a new low for the recovery and the lowest level since 2001. However, this decline in employment was the result of people leaving the labor market, as the number of people reported as employed in the household survey actually fell, with the overall employment-to-population ratio (EPOP) dropping from 60.2 percent in April to 60.0 percent in May.

The establishment survey showed further evidence of a weakening labor market as the pace of job growth slowed in May to 138,000. There were also substantial downward revisions to the prior two months’ job growth numbers, which brought the average for the last three months to just 121,000.

The big job gainers were restaurants (30,300) and health care (24,300), together the two sectors accounted for 40 percent of job growth in May. While the job growth in restaurants is somewhat above the 22,000 average for the last year, it appears that the pace of employment growth in health care is slowing. It averaged 30,000 a month in 2016, compared with just 21,000 so far in 2017.

Other job gainers were education services, which added 14,700; temporary employment, which added 12,900; and professional and technical services, which added 10,900 jobs. Employment growth in education services is erratic, so the May number is likely to be followed by a decline next month. The temp job growth is in line with past figures, it certainly does not suggest a hiring boom. The weak employment growth in professional and technical services is disappointing. These tend to be higher paying jobs requiring considerable skills. Job growth in the sector averaged 23,000 a month over the last year.

Retail trade shed another 6,100 jobs, its fourth consecutive drop. The job loss is concentrated in the department store sector. This is likely to continue. Construction employment rose by 11,000 in May after losing a total of 1,000 jobs in the prior two months. This is likely a weather story with the warm winter pulling employment growth forward. Nonetheless, with non-residential construction falling and residential construction flattening, growth in the sector is likely to be weak going forward.

There is a similar story in manufacturing, which lost 1,000 jobs in May, after adding 11,000 in each of the prior two months. The sector is not likely to be a big source of job gains, especially if the jump in the trade deficit reported for April is not reversed.

In addition to the weak job growth, wage growth appears to be moderating rather than accelerating. The year-over-year increase in the average hourly wage is just 2.5 percent. Taking the average of the last three months compared with the average of the prior three months, wages are rising at just a 2.2 percent annual rate.

The situation in the household survey was mixed. The drop in employment was among prime-age workers, with the EPOP falling from 78.6 percent to 78.4 percent, with both men and women seeing small declines. On the plus side, the unemployment rate for African American men over 20 fell 0.8 percentage points to 6.5 percent, the lowest level since April of 2000. However this was entirely due to men dropping out of the labor force as employment actually fell.

All the duration measures of unemployment rose modestly in May. The quit rate rose modestly to 11.7 percent, which is still below pre-recession peaks and well below the peaks hit in 2000. Involuntary part-time employment fell for the fourth consecutive month to a new low for the recovery. It is now only slightly larger relative to the size of the labor force than before the recession. Voluntary part-time rose by 320,000 but is still slightly below the peak hit in November.

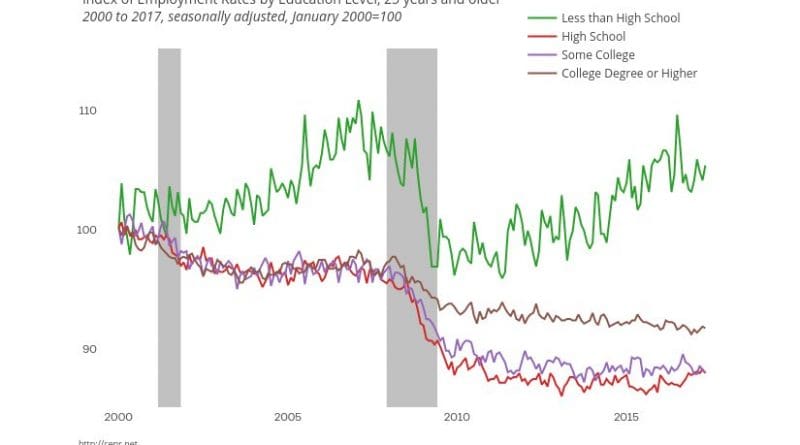

The summary data continue to show little evidence for the story that the labor market is increasingly benefiting the most educated workers. While the unemployment rate for college educated workers edged down by 0.1 percentage point, so did the EPOP. It now stands 0.4 percentage points below its year-ago level. In terms of EPOPs, those with high school degrees and less than high school were the biggest gainers in the last year.

There is certainly little evidence in this report that the labor market is overheating or is likely to do so any time in the foreseeable future.