Las Vegas Apartments: Gambling On The Future, Using Today’s Numbers – OpEd

By MISES

By Doug French*

Millennials are the focus of everyone’s attention in the housing business. With birthdates from the early 1980’s to the mid-1990’s up to the early 2000’s, this is the group sandwiched between Generations X and Z, the sons and daughters of Baby Boomers. Wikipedia (what else?) claims, “the generation has been generally marked by an increased use and familiarity with communications, media and digital technologies.”

After seeing their parents hammered by the 2008 housing crash, the belief has been, these young folks had sworn off home ownership, car ownership, marriage and all of America’s societal norms. Their parents, once house poor, then underwater poor, told them going to college was the path to success. Borrowed up to their eyeballs in student debt, they are now, gulp, doing what’s called, adulting. It’s so hard.

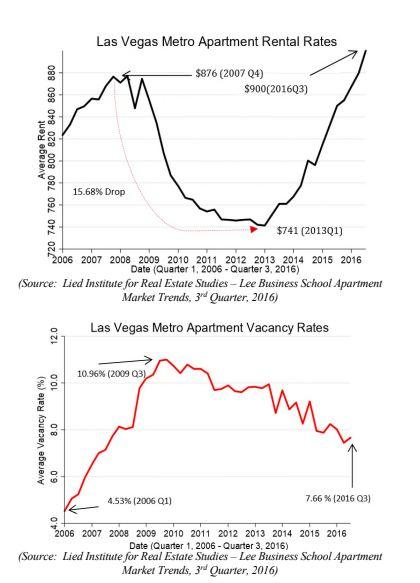

Apartment developers’ tea leaves tell them Millennials will always be renters, willing to pay handsomely for cool creature comforts: climbing walls, coffee bars, and concierge service. Average rents in Las Vegas rose from $900 in Q3 2016 to $1,059 in Q4 2018. On Sunday, the local paper featured a new mid-rise project with successful Millennial written all over it.

Eli Segall interviewed developer Tim Deter, who at 48 would be a Gen Xer, with the horsepower and razzle dazzle to talk Goldman Sachs into lending him $41.5 million to build 210 apartment units atop 21,600 square feet of commercial space way south of the Las Vegas Strip in desert suburbia.

There seem to be apartment projects going up everywhere and I’m told there are at least 5 years worth on the drawing board. Segall begins his reporting with, “Developers have packed the Las Vegas suburbs with apartments in recent years.”

Of course, entrepreneurship is about forecasting the future, not the present. As Murray Rothbard explained, “The entrepreneur is not simply ‘alert’; he forecasts; he appraises; he meets and bears risk and uncertainty by questing for profits and risking losses.”

Asked if he was worried about all the apartment construction and potential competition, Deter said, “It’s an easy test: What’s the absorption? When you see projects throughout the valley leasing 40, 50 units a month, it tells you the demand is heavy.”

However, that’s is today’s demand, at today’s rents. The successful entrepreneur, not to mention the lender, must see into the future. Will Mr. Deter be able to charge his proposed $1,600 to $1,700 a month for a one-bedroom apartment at Kaktus Life forever?

Rumor has it, Picerne, a multi-state apartment builder with 17 projects in Las Vegas, is hitting the brakes. The company line is rents have risen beyond what’s affordable for the average Vegas worker bee.

The National Association of Home Builders met in Las Vegas last week and Mollie Carmichael from Meyers Research gave the builders some good news. The common wisdom that Millennials will always rent is completely false, her team of researchers found. Owning a home is a high Millennial priority.

So, those Echo Boomers, who were supposed to always rent and Uber their way everywhere, are buying houses. “Millennials Have Officially Entered the Housing Market” shouts the headline on HousingWire.com. Alcynna Lloyd writes,

According to Realtor.com, in January 2017, Millennials surpassed Generation X as the group that was responsible for the most new mortgages. Since then, Millennials’ share of the mortgage market has continued to rise. By the end of 2018, Millennials represented 45% of all new mortgages, compared to 36% for Generation X, and 17% for Baby Boomers.

“The stereotype that Millennials primarily choose to buy homes and live in large metro areas isn’t the reality,” Javier Vivas said. “Results show Millennials’ expansion is more heavily conditioned by affordability than in prior years, so their eyes are set on less traditional secondary markets where homes and jobs are now available and plentiful.”

When asked by Segall about apartments being overbuilt going into the ‘08 crash and now another bubble may be forming, Deter said, “apartments were pretty full throughout the worst of times in Vegas. That gives me a lot of confidence.”

Yes, entrepreneurs must be long on confidence. However, a look at the chart below provides some realism: rents and occupancy both plunged during the worst of times. The payment to Goldman Sachs will likely stay the same, crash. or no crash.

*About the author: Douglas French is former president of the Mises Institute, author of Early Speculative Bubbles & Increases in the Money Supply , and author of Walk Away: The Rise and Fall of the Home-Ownership Myth. He received his master’s degree in economics from UNLV, studying under both Professor Murray Rothbard and Professor Hans-Hermann Hoppe.

Source: This article was published by the MISES Institute