Weakness In Retail And Construction Lead To Slow US Job Growth In April – Analysis

By Dean Baker

Job growth slowed to 160,000 in April from a revised 208,000 in March. The slowdown was fully explained by weakness in construction, which added just 1,000 jobs in April, and retail, which shed 3,100 jobs. The two sectors together added 80,000 jobs in March. The household survey showed a mixed picture — while the unemployment rate remained at 5.0 percent, the employment-to-population ratio (EPOP) fell by 0.2 percentage points to 59.7 percent.

A slower pace of job growth should not be surprising. Economic growth has remained close to 2.0 percent for most of the recovery. However, employment has been growing at a pace of close to 240,000 per month for the last two years. This combination of weak GDP growth and strong employment growth was associated with a collapse in productivity growth that had been completely unanticipated. With economic growth slowing further in the last two quarters, productivity growth had actually turned negative.

For this reason, it is not surprising that job growth would slow, as was reported for April. The 160,000 pace for April, combined with modest downward revisions for the prior two months brought the three-month average to 200,000. Even the April pace of 160,000 jobs would be exceptionally rapid for an economy growing at a 2.0 percent annual rate.

The strongest job growth in April was in health care, which added 44,200 jobs. Professional and technical services added 31,100 jobs, finance added 20,000, and restaurants added 18,200 jobs. Manufacturing added 4,000 jobs, but employment is still down by 39,000 from the peak reached last July. Government employment fell 11,000 in April, but most of the decline was due to a loss of 7,900 jobs in the postal service. Mining continues to be hard hit, losing another 7,100 jobs. Employment in the sector is down by 190,900 from its peak of 852,500 in September of 2014.

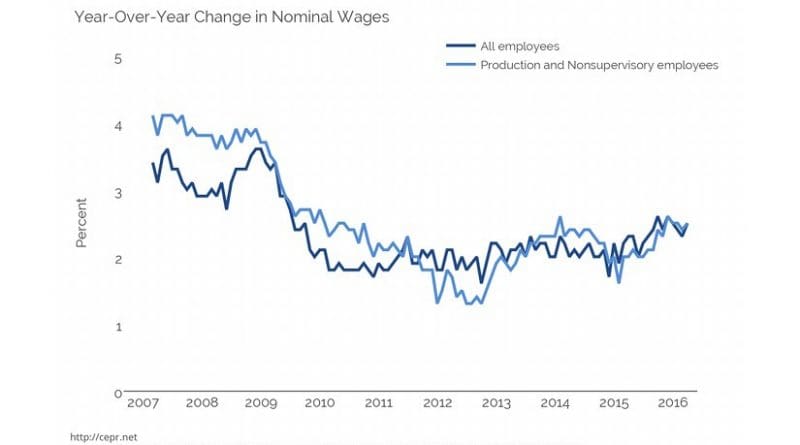

There continues to be little evidence that the tightening of the labor market is leading to more rapid wage growth. The average hourly wage increased at annual rate of 2.45 percent in the last three months compared with the average for the prior three months. This is down slightly from a 2.49 percent increase over the last year. The situation is virtually identical for production and nonsupervisory workers, with increases of 2.40 percent over the last three months compared with 2.48 percent over the last year.

The drop in the EPOP was due to prime-age workers (ages 25–54) leaving thelabor force as the EPOP for prime-age workers fell by 0.3 percentage points from 78.0 to 77.7. The monthly data are erratic, but this drop is discouraging. Prime-age workers had been returning to the workforce in large numbers in recent months.

There was a sharp reported decline in the EPOP of Hispanics by 0.9 percentage points accompanied by a rise of 0.5 percentage points. Hispanic women were especially hard hit with a drop in EPOPs of 1.1 percentage points and a rise in unemployment of 1.0 percentage points. These numbers are erratic, but this is a large change. There was also a rise of 0.8 percentage points in the unemployment rate of black men to 9.5 percent, which could be cause for concern.

Some of the news in the household survey was positive. Most of the duration measures of unemployment fell, with the percentage of long-term unemployed falling to 25.7 percent, tying the November figure for the lowest level of the recovery. The share of unemployment due to voluntary quits rose to 10.8 percent. This is another high for the recovery, although it is still far below the pre-recession level. Also, the number of workers involuntarily working part-time fell by 161,000, more than reversing a jump in March. The number of involuntary part-time workers is still more than 1.5 million above the pre-recession lows.

The April job growth figure is lower than most economists had expected, but still quite fast given the pace of economic growth. Unless there is a marked speed up in the recovery to a pace of more than 2.0 percent, it is likely that job growth will slow further. It seems implausible that productivity growth will remain below 1.0 percent.