South Korea Energy Profile: Heavily Relies On Imports To Meet Total Primary Energy Consumption – Analysis

By EIA

South Korea was the world’s ninth-largest energy consumer in 2014, according to estimates from the BP Statistical Review of World Energy 2015.1 Korea is one of the top energy importers in the world and relies on fuel imports for about 97% of its primary energy consumption because the country lacks domestic energy reserves. South Korea ranks among the world’s top five importers of liquefied natural gas, coal, crude oil, and refined products.2

South Korea has no international oil or natural gas pipelines and relies exclusively on tanker shipments of LNG and crude oil. Despite its lack of domestic energy resources, South Korea is home to some of the largest and most advanced oil refineries in the world. In an effort to improve the nation’s energy security, oil and natural gas companies are aggressively seeking overseas exploration and production opportunities.

South Korea’s highly developed economy drives its energy consumption, and economic growth is fueled by exports, most notably exports of electronics and semiconductors. The country also contains one of the world’s top shipbuilding industries. Real gross domestic product (GDP) grew by 3.3% in 2014, up from 2.9% in 2013.3 South Korea’s economic growth following the 2008 global financial crisis was relatively resilient compared to growth in other developed country economies. However, South Korea’s growth is heavily dependent on export markets, which have experienced a slowdown in the past few years. Also, the country’s aging population is expected to dampen domestic demand for energy and the overall economic landscape.4

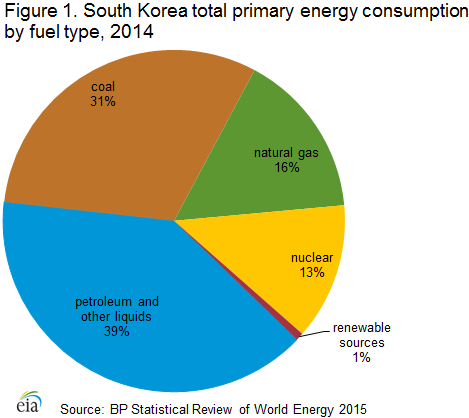

Although petroleum and other liquids, including biofuels, accounted for the largest portion (39%) of South Korea’s primary energy consumption in 2014, its share has been declining since the mid-1990s, when it reached a peak of 66%.5 This trend is attributed to the steady increase in natural gas, coal, and nuclear energy consumption which has reduced oil use in the power sector and the industrial sector. Increased vehicle efficiencies has also reduced oil consumption (Figure 1). Following Japan’s Fukushima disaster and South Korea’s problems with false safety certifications of nuclear parts in late 2012, the government scaled back its long-term reliance on nuclear power in the energy and electricity portfolios from its first plan in 2008 to the most recent plan unveiled in early 2014.6 South Korea is attempting to balance its fuel portfolio to meet higher energy consumption, to moderate its nuclear power generation, and to offset some fossil fuel imports. As part of this effort, the government is also promoting greater demand-side management, energy efficiency tactics, and use of renewable energy.

Petroleum and other liquids

South Korea has a large oil refining sector, but the country relies almost entirely on crude oil imports to fuel its refineries.

Overview

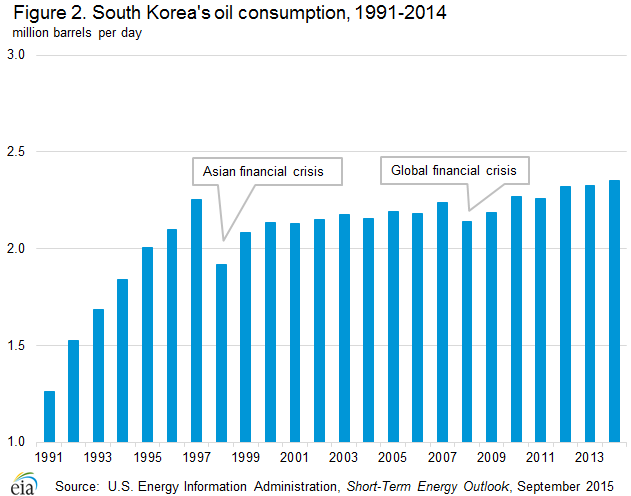

South Korea consumed nearly 2.4 million barrels per day (b/d) of petroleum and other liquids in 2014, making it the 10th largest consumer in the world (Figure 2). According to the Korea National Oil Company (KNOC), South Korea has a small amount of domestic oil reserves, but the country relies significantly on crude oil imports to meet its demand. Most of South Korea’s total oil production of 79,000 b/d is based on refinery processing gains and a small amount of biofuels production.

According to the Oil & Gas Journal (OGJ), South Korea maintains 3 of the 10 largest crude oil refineries in the world, allowing South Korea to be one of Asia’s largest petroleum product exporters.7 According to Facts Global Energy (FGE), South Korea exported about 1.1 million b/d of refined oil products in 2014, mostly in the form of middle distillates such as gasoil and jet fuel. Oil product imports were about 0.9 million b/d, consisting primarily of naphtha and residual fuel oil.8 Because of increased demand from Asia during the past decade, South Korea’s exports of refined products have grown at a rapid rate. The future growth rate of oil product exports will depend on demand from regional trading partners, which has been weak over the past two years, and on potential competition from new Asian and Middle Eastern refineries that could enter the market in the next several years.

South Korea’s oil consumption rates have fluctuated along with its economy. Oil consumption grew at a rapid pace with economic growth in the 1990s, but then it fell following the Asian Financial Crisis of 1997. Oil consumption then rose steadily until 2007, but it dipped during the global economic downturn in 2008. Oil demand gradually rose from 2008 to 2014. Naphtha, which is used for the country’s sizeable petrochemical and industrial sectors, accounts for about 46% of total oil product demand and is the primary driver of domestic demand growth, according to FGE.9 South Korea’s oil demand growth outside the petrochemical sector is limited in the long term because of its declining population growth and aging demographics, greater energy efficiency measures, and competition from other fuels such as natural gas, coal, and nuclear. According to the Korea Energy Economics Institute (KEEI), petroleum and other liquids will continue to decline in market share and account for nearly 34% of total primary energy consumption by 2018, lower than the current market share of nearly 40%.10

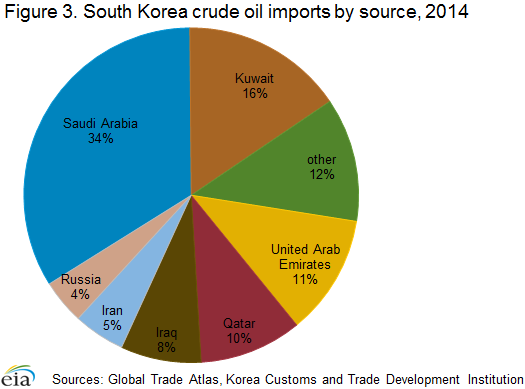

In 2014, South Korea imported nearly 2.5 million b/d of crude oil and condensate, making it the fifth-largest importer in the world. South Korea is highly dependent on the Middle East for its oil supply, and the region accounted for more than 84% of South Korea’s 2014 crude oil imports, according to Korea customs statistics. Saudi Arabia was the leading supplier and the source of more than one-third of South Korea’s imports, followed by Kuwait at 16% of total crude oil imports (Figure 3). South Korea reduced its crude oil purchases from Iran from 10% in 2011 to 5% in 2013 and 2014. South Korea halted shipments from Iran for two months in 2012 to comply with sanctions imposed by the United States that impeded Iran’s ability to sell crude oil. After showing a good faith effort to reduce their volumes, South Korea was granted a waiver in mid-2012 and resumed imports from Iran, but at a much lower level than before the sanctions. South Korea has expressed interest in increasing imports of crude oil and condensates from Iran once the Western sanctions have been lifted and the July 2015 nuclear deal is implemented.11 Other Middle Eastern suppliers and Russia have made up for South Korea’s lost imports from Iran.

Sector organization

The Korea National Oil Corporation (KNOC) is a state-owned oil company and the largest entity in South Korea’s upstream sector. In addition, KNOC, through both acquisitions of overseas companies and investments with major international and national oil companies, produced 207,000 b/d of oil and held 1.3 billion barrels of oil equivalent of oil and natural gas reserves from overseas assets in 2014.12

Korea’s downstream sector includes several large international oil companies including SK Energy, the nation’s largest international oil company (IOC). SK Energy is the largest marketer of petroleum products, followed by GS Caltex, S-Oil, and Hyundai Oilbank. These corporations have historically focused on refining, but of these corporations some have put increasing emphasis on crude oil extraction projects in other countries. SK Energy also owns the largest stake in the Daehan Oil Pipeline Corporation (DOPCO), which exclusively owns and manages South Korea’s oil pipelines, although most of the country’s oil is distributed by tankers or tank trucks.

To compensate for the lack of domestic oil reserves and to secure more crude oil, both South Korea’s state-owned and private oil companies engage in many overseas exploration and production (E&P) projects. The Korea Petroleum Association (KPA) started the Korea-Oil Producing Nations Exchange (KOPEX) in 2006 to maintain good relations with oil-producing countries and to offer technology training to producing countries in the downstream sector. In addition, the South Korean government has provided financial support for the country’s upstream companies to win bids overseas through the Special Accounts for Energy and Resources (SAER), administered by KNOC, for support on E&P projects.

To be less dependent on foreign energy imports, the Ministry of Knowledge Economy (MKE) has set energy self-sufficiency targets based on domestic and overseas production levels each year since 2008 for South Korean companies. Almost none of South Korea’s overseas production has been shipped back to South Korea. South Korea received its first crude oil delivery from overseas production at the end of 2013. The NOC’s purchases in the past decade have accumulated massive debt, and the government reversed its energy policy.

Since early 2013, the government’s energy policy has moved away from the self-sufficiency targets and set reduction targets for its debt-to-equity ratio (total debt to total assets). Also, South Korea is imposing targets to reduce overall debt ratios for key state-owned companies such as KNOC, KOGAS, and KEPCO by 2017. KNOC has discussed divesting some of its recently purchased global oil assets.13

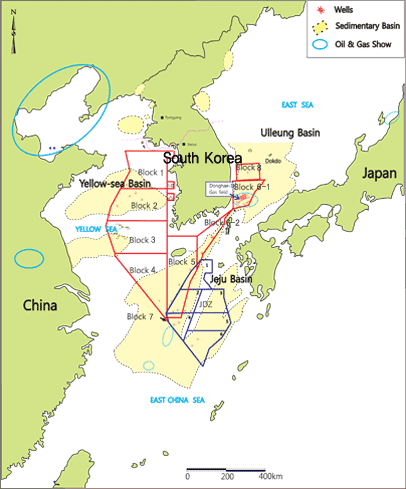

Exploration and production

Since exploration began in the 1970s, South Korea has discovered one commercially producing field among its Ulleung Basin, Yellow Basin, and Jeju Basin so far. Discovered in 1998, Donghae-1, Block 6-1 in the Ulleung Basin, has total proved reserves of 3.2 million barrels of ultra-light crude (condensates).14 Although natural gas production from Donghae-1 began in November 2004, oil production did not begin until 2010 after further exploration and discovery. On average, KNOC has produced 1,000 b/d of ultra-light crude (condensates) from the Donghae-1 natural gas field, representing a negligible portion of its 2.4 million b/d total petroleum consumption, nearly all of which was imported.15

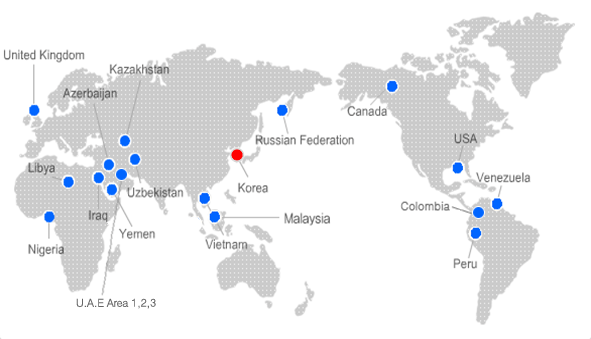

Although new discoveries might improve domestic oil prospects, overseas E&P plays a more essential role in South Korea’s oil industry. The Korean government has encouraged private E&P overseas through tax benefits and through the extension of credit lines to IOCs by the Korea Export-Import bank. South Korea has also provided diplomatic aid in overseas negotiations. As of December 2014, KNOC was invested in 29 producing blocks, 7 fields under development, and 14 fields under exploration in several countries.16

KNOC’s global exploration projects

Source: Korea National Oil Corporation

Downstream and refining

According to OGJ, South Korea had about 3 million b/d of crude oil refining capacity at six facilities as of the end of 2014 (Table 1). South Korea has the sixth-largest refining capacity in the world. The country’s three largest refineries are owned by SK Energy, GS Caltex, and S-Oil Corporation, the latter of which is partially owned by Saudi Aramco.

| Owner | Location | Capacity (barrels per day) |

|---|---|---|

| SK Energy | Ulsan | 840,000 |

| GS Caltex Corp. | Yeosu | 785,000 |

| S-Oil Corp. | Onsan | 669,000 |

| Hyundai Oil Refinery Co. | Daesan | 390,000 |

| SK Energy | Inchon | 275,000 |

| Hyundai Lube Oil | Daesan | 9,500 |

| Total | 2,958,500 | |

| Source: Oil & Gas Journal | ||

Korean refineries are increasingly producing light, clean oil products as a result of refinery upgrades that have taken place in recent years. The increased sophistication of the South Korean refining market is likely to increase capacity utilization, which is already high for some refineries. As a result, South Korea is expected to remain a leading refiner in Asia, with significant exports to China, Singapore, Japan, and Indonesia. South Korean refiners are using their expertise in capacity expansion and teaming up with other oil companies to construct plants in other regions of the world, especially in the Middle East.

In 2014, SK Energy and Samsung commissioned two condensate splitters, refinery units that convert condensate oil into naphtha, bringing South Korea’s total condensate splitting capacity to 339,000 b/d. Hyundai Oilbank and Lotte Chemical are jointly constructing another 140,000 b/d splitter slated to become operational in 2016. Most of the condensate imports have been sourced from Qatar. South Korea’s refiners have expressed interest in importing more condensate from the United States and Iran.17

Petroleum and other liquids storage

As part of South Korea’s goal to reduce volatility from oil supply disruptions and price fluctuations, the country holds strategic and commercial oil reserves. KNOC held 92 million barrels of strategic crude oil and petroleum products inventories, plus international joint stockpiles, at nine storage facilities with 146 million barrels of capacity in June 2015. Other companies such as SK Energy, GS Caltex, S-Oil, and Hyundai Oilbank also held 130 million barrels in stocks for industrial operations, according to the International Energy Agency.18

In response to South Korea’s diversification of its energy portfolio over the past few decades, oil companies not only upgraded refining facilities and increased upstream investment, but they also began investing in alternative energy projects. As part of South Korea’s efforts to become a major liquids storage and trading hub in Asia, KNOC, through joint ventures with other firms, is in the process of building the country’s first three commercial oil storage facilities, which will hold a total capacity of 36.6 million barrels. The first facility, located in Yeosu in the southwestern region, came online in 2013 with 8.2 million barrels of capacity. The other two facilities will be built in Ulsan in the southeastern region of South Korea and will come online in 2017 and 2020, respectively.19

Natural gas

South Korea is the second-largest importer of liquefied natural gas in the world behind Japan.

South Korea relies on imports to satisfy nearly all of its natural gas demand, which has nearly doubled over the past decade. Although the country possessed discovered proved reserves of 250 billion cubic feet (Bcf) as of the end of December 2014, according to OGJ, domestic natural gas production is negligible and accounts for less than 1% of total consumption.20 South Korea does not have any international natural gas pipeline connections and must therefore import all gas via LNG tankers. As a result, although South Korea is not among the group of top natural gas-consuming nations, it is the second-largest importer of LNG in the world after Japan.

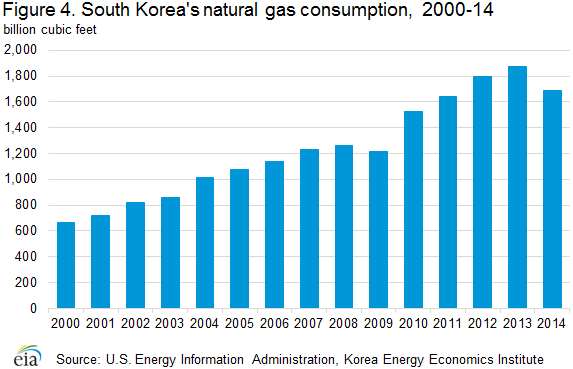

Consumption

South Korea consumed an estimated 1.7 trillion cubic feet (Tcf) of dry natural gas in 2014, more than double the amount in 2000 (Figure 4). KEEI estimates that after strong natural gas consumption growth each year following 2009, natural gas consumption fell by 10% in 2014. Also, preliminary data from the first few months of 2015 show an average annual decline. Power generators used more coal and nuclear power starting in 2014 as nuclear facilities returned to service following a shutdown because of safety problems and as coal prices dropped. Industries also chose to use less expensive coal. The city gas network, serving residential, commercial, and industrial consumers, accounted for about half of the natural gas sales, while power generation companies made up nearly all the remaining share in 2014. For the past decade, power generation has increasingly required a larger share of South Korea’s natural gas supply.21 Despite recent lower natural gas demand, the fuel remains a significant source of cleaner energy for the country.

Sector organization

Korea Gas Corporation (KOGAS) dominates South Korea’s wholesale natural gas sector, and the company is the largest single LNG importer in the world. In spite of recent efforts by the government to liberalize the LNG import market and allow other local importers to resell their LNG cargoes, KOGAS maintains an effective monopoly over the purchase, import, and wholesale distribution of natural gas. In addition to operating three of Korea’s five LNG receiving terminals, KOGAS owns and operates the 2,640-mile national pipeline network as of July 2015, and it sells regasified LNG to power generation companies and private natural gas distribution companies. The company intends to add another 442 miles of pipeline by 2019.22

The South Korean central government is the largest KOGAS shareholder with 26.15% direct equity, 20.47% share via the Korean Electric Power Company (KEPCO), 7.94% from local governments, and the remainder from indirect government shares.23 South Korea has more than 30 private distribution companies, but each company has monopoly control in its region. These local companies purchase wholesale natural gas from KOGAS at a government-approved price, and sell gas to end-users.24

In the upstream sector, KOGAS has focused primarily on overseas LNG liquefaction projects, while the KNOC has handled most exploration and production-related activities. However, as KOGAS seeks new opportunities for growth, its focus on overseas upstream activities has increased. As part of the effort to develop into a global integrated energy company, KOGAS has participated in E&P projects around the world and has invested in foreign gas companies with LNG supply. Previously, KOGAS had a mid-term goal to secure 25% of LNG imports from equity production sources by 2017, up from 9% in 2012. Meanwhile, both KNOC and KOGAS have recently announced intentions to divest certain assets as a result of mounting debt levels, cost overruns at certain overseas projects, and pressure from the Korean government to reduce expenditures. The government’s plan is for KNOC and KOGAS to focus on upstream exploration and divest some of their oil and natural gas projects to private South Korean companies.25

Exploration and production

South Korea produced about 11 Bcf of natural gas in 2014 from the domestic natural gas field Donghae-1 in the Ulleung Basin. KNOC plans to continue production operations until 2018, when the project will be converted into an offshore storage facility. KNOC and Woodside Energy (Australia) are jointly exploring deepwater blocks of the Ulleung Basin and began drilling in 2012.26

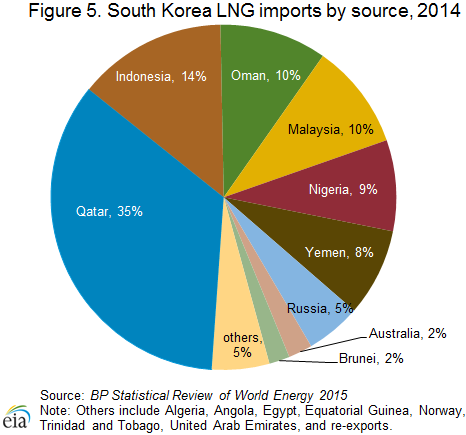

Liquefied natural gas

In 2014, South Korea imported 1.8 Tcf of LNG, which was 15% of the global LNG trade, according to BP Statistical Review of World Energy 2015.27 South Korea currently has five LNG regasification facilities, with a total capacity of 4.7 Tcf per year and a 38% utilization rate. KOGAS operates four of these facilities (Pyongtaek, Incheon, Tong-Yeong, and Samcheok), accounting for about 98% of current capacity. The Samcheok terminal, located on the northwest coast, is KOGAS’s smallest terminal and was added in 2014. Pohang Iron and Steel Corporation (POSCO) and Mitsubishi Japan jointly own the only private regasification facility in Korea, located on the southern coast in Gwangyang. KOGAS is constructing a second privately owned regasification facility at Boryeong in the Northeast. The terminal’s capacity is 145 Bcf per year, and the facility is scheduled to begin operations in 2017.

KOGAS purchases most of its LNG through long-term supply contracts, and the company uses spot cargos primarily to correct small market imbalances. Almost two-thirds of 2014 LNG imports came from Qatar, Indonesia, Malaysia, and Oman (Figure 5). Indonesia was South Korea’s first source of LNG and supplied more than half of South Korea’s LNG imports before 2000. As South Korea diversified its LNG imports in the past 15 years to secure more gas to meet its growing demand, Indonesia lost some market share to countries including Qatar, Oman, Nigeria, and Russia.

South Korea continues to diversify its sources and to take advantage of new natural gas developments in Australia, the United States, and the Middle East. KOGAS has signed several short-term natural gas import agreements for LNG supply from various sources. Also, the company is taking advantage of the shale gas developments in North America and new natural gas plays in Australia. KOGAS plans to import natural gas from the Sabine Pass liquefaction terminal in the Gulf Coast of the United States for 20 years starting in 2017 and import gas from new liquefaction projects such as Prelude LNG and Gladstone LNG coming online in Australia in the next few years. Also, SK Energy signed an offtake agreement with Freeport LNG, located in the U.S. Gulf Coast, to import gas in 2019.28

Coal

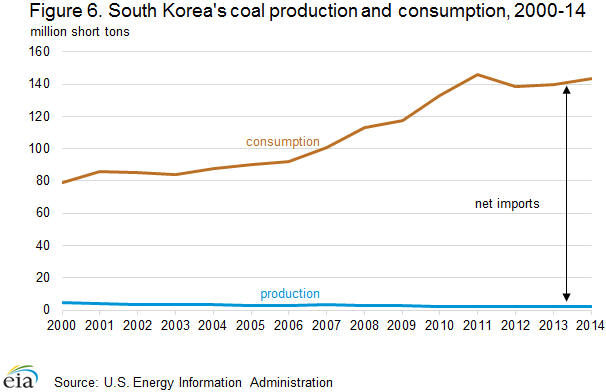

Rising coal consumption in South Korea and negligible domestic production resulted in the country having to rely heavily on coal imports over the past several years. In 2014, South Korea was the fourth-largest global coal importer.

South Korea held only 139 million short tons (MMst) of recoverable coal reserves in 2014, according to the BP Statistical Review of World Energy 2015. The country’s coal production of an estimated 2.2 MMst was all from anthracite reserves and was a fraction of its 144 MMst total coal consumption in 2014 (Figure 6).29

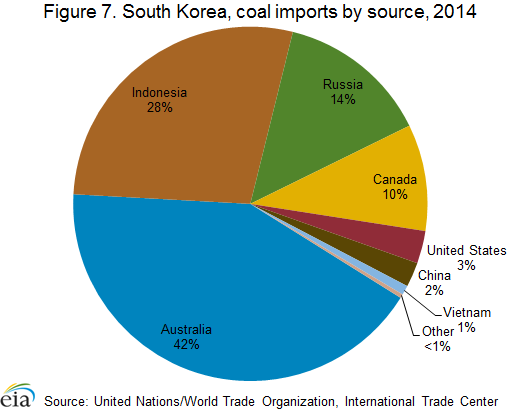

As a result, South Korea is the fourth-largest importer of coal in the world, following China, India, and Japan. Imports have risen substantially in the past few years from 131 MMst in 2010 to 144 MMst in 2014 as a result of the forced shutdowns of some nuclear plants in late 2012 because of safety issues.30 Australia and Indonesia account for the majority of South Korea’s coal imports. Russia and Canada are notable sources as well (Figure 7). Coal consumption in South Korea increased by 59% between 2005 and 2014, driven primarily by growing demand from the electric power sector. The electric power sector accounted for about 60% of the country’s coal consumption, while the industrial sector made up for most of the remaining amount in 2014, according to KEEI.31

Electricity

Fossil fuel sources account for nearly two-thirds of South Korea’s electricity generation, while nuclear accounts for 30%.

South Korea generated almost 522 terawatthours (TWh) of gross electricity in 2014, according to KEEI estimates. South Korea’s power generation has increased by an average of 4% annually since 2000, although in the past two years, generation growth rates have dropped below 2%. This drop is attributed to weaker economic demand and more temperate weather.

Fossil fuels accounted for 66% of total 2014 electricity generation, while 30% came from nuclear power, and 4% came from renewable sources, including hydroelectricity.32 Coal-fired generation makes up the bulk of fossil fuel generation. Although fossil fuel-fired capacity is dominant in South Korea at present, nuclear power is a baseload power source, and South Korea plans to increase nuclear generation capacity in the long term. In 2014, about 55% of electricity consumption came from industries, 25% from commercial and service enterprises, 13% from the residential sector, and 6% from other sectors like transportation and agriculture, according to KEEI.33

Under its seventh basic power supply plan, the Korean government lowered its anticipated electricity demand growth to 2.2% annually to 2029 as the country strives to cut its greenhouse gas emissions through energy conservation measures and through the use of cleaner energy from nuclear and renewable energy sources.

Sector organization

The state-owned Korea Electric Power Corporation (KEPCO) controls all aspects of electricity generation, retail sales, transmission, and distribution. In 2001, KEPCO’s generation assets were spun off into six separate subsidiary power generation companies. Although the initial restructuring included plans to subsequently divest KEPCO of these generation companies (excluding the Korea Hydro & Nuclear Power Company), KEPCO still owns each of the subsidiaries. KEPCO also owns majority shares of KEPCO Engineering and Construction, Korea Nuclear Fuel, Korea Plant Service and Engineering, and Korea Electric Power Data Network.

The Korea Electric Power Exchange (KPX), also established in 2001 as part of the electricity sector reform efforts, serves as the system operator and coordinates the wholesale electric power market. KEPCO continues to act as the electricity retailer, and it controls transmission and distribution.

KPX regulates the cost-based bidding-pool market and determines prices sold between generators and the KEPCO grid. An electricity tariff pricing system, designed to protect low-income residents and industrial consumers, historically has not reflected the true costs of generation and distribution, and the pricing system has not provided incentives to conserve electricity. MKE must approve all changes in end-use electricity prices. End-user consumer prices remain far below the levels of other economically developed countries, which has contributed to high overall electricity demand and power shortages during peak seasons over the past five years.

According to KEEI, reserve ratios–the ratio of peak capacity to peak electricity demand–have fallen below 10% on an annual basis between 2007 and 2013. These low margins were the result of delays in installed capacity additions, low electricity prices, high peak demand during certain years as a result of weather, and insufficient investment in renewable energy and energy efficiency projects until recently. In 2014, the reserve ratio recovered to 11.5% because power generation growth decelerated, more natural gas-fired and renewable plant capacity came online, and nuclear facilities affected by the safety problems in 2012 returned to service.34

Generation structure

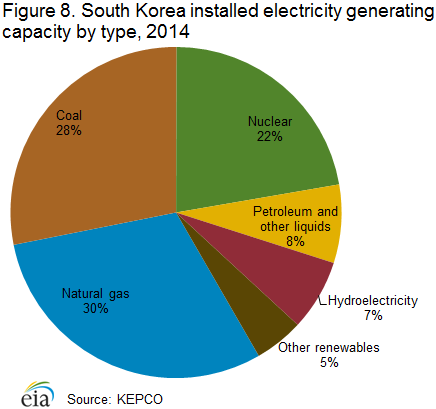

Most of South Korea’s installed generation capacity is fossil fuel-based, although nuclear power has played a significant role in the past decade. Baseload generation stems mainly from coal and nuclear power, while peak demand is generally met by the country’s LNG imports. According to KEPCO, Korea’s capacity at the end of 2014 was 93.2 gigawatts (GW) consisting primarily of natural gas (30%), coal (28%), and nuclear generation (22%).35 Oil, hydroelectricity, and other renewables made up smaller shares (Figure 8). South Korea intends to reduce its greenhouse gas emission levels and its dependence on fossil fuel imports by increasing the share of nuclear energy capacity to 29% by 2029.36

Fossil fuel-fired power plants make up a significant portion of the country’s installed capacity, of which coal power plants consisted of about 26.3 GW in 2014, or about 28% of the total capacity. According to the proposed new electricity plan, South Korea plans to raise the share of coal capacity to 32.2% in 2029. The electricity plan eliminates about 3.7 GW of coal-fired capacity from four power plants that were included in the prior plan, consistent with the country’s goal to incorporate cleaner sources of fuel into the generation portfolio.37 According to IHS Energy, about 10 GW of coal-fired capacity projects are in various stages of planning and are scheduled to enter service by 2020, which could boost coal-fired generation above natural gas-fired power.38 Natural gas-fired power plants are also expected to contribute more to electricity generation with capacity additions, although the share of gas-fired capacity could decline compared with other fuels.39 Currently, natural gas competes with less-expensive coal and nuclear sources of power, and the future power generation portfolio depends on fuel costs, the government’s nuclear capacity designs, emphasis on clean energy, and the level of investment in power capacity.

South Korea has the sixth-highest nuclear generation capacity in the world, as of mid-2015, and was surpassed by China in the past year. The country’s first nuclear power plant was completed in 1978, and over the following three decades, South Korea directed significant resources towards developing its nuclear power industry. The latest reactor came online in mid-2015.40 South Korea imports all of the uranium needed to fuel its nuclear power plants and does not reprocess or enrich uranium as a result of a 30-year nuclear cooperation agreement with the United States. The countries extended the agreement by 20 years in June 2015, although the new deal still does not allow South Korea to produce its own nuclear fuel.

Nuclear generation utilization rates in South Korea are typically more than 90%, and the fuel serves as a baseload source for power generation. In 2013 and 2014, capacity factors were 75% and 85%, respectively, as a result of a few nuclear facilities being closed for safety reasons in late 2012.41

Korea Hydro & Nuclear Power Company currently operates South Korea’s four nuclear power stations, which have 24 individual reactors with a power generation capacity of 21.7 GW. Ten additional reactors are scheduled for completion by 2029, and four reactors with 5.4 GW of capacity are already under construction and scheduled to come online by 2018. Meanwhile, four of the country’s oldest reactors are scheduled to close by 2025, unless the government extends their licenses.42

In late 2012, South Korea experienced several incidents of falsified certificates for components of some of its existing nuclear power plants, adding to the industry’s distress following neighboring Japan’s Fukushima nuclear disaster in 2011. The South Korean government shut down four reactors temporarily, and another six were offline for maintenance, removing up to 40% of the nuclear capacity from service until the government inspected all reactors. Nuclear power generation fell by 10% from 155 terawatthours in 2011 to 139 TWh in 2013 before rebounding to 156 TWh in 2014.43 The country’s current long-term energy plan, released in early 2014, lowered the share of nuclear capacity to 29% of total generating capacity by 2035 from the previous goal of 41% by 2030.

South Korea plans to promote renewable energy to reduce its carbon dioxide emissions by 37% from business-as-usual projected levels (projections of emission levels absent any carbon price scheme) in 2030.44 A renewable portfolio standard for South Korea became effective in 2012. Renewable sources remain a small share of South Korea’s electricity generation (4% according to KEEI in 2014), although renewable capacity and generation, apart from hydropower, are rising.

- Data presented in the text are the most recent available as of October 5, 2015.

- Data are EIA estimates unless otherwise noted.

Endnotes:

2EIA estimates, Global Trade Information Service, and IHS Energy.

3World Bank data: GDP growth (accessed September 2015).

4International Monetary Fund, “Staff Report for the 2015 Article IV Consultation,” April 23, 2015.

5BP Statistical Review of World Energy 2015 and EIA estimates.

6Reuters, “South Korea cuts future reliance on nuclear power, but new plants likely,” January 13, 2014.

7Oil & Gas Journal, Refining Capacity Detail, December 1, 2014.

8FGE, Asia Pacific Databook 3, Spring 2015, pages 52-54.

9FACTS Global Energy Services, Databook 3: Spring 2015.

10KEEI, Mid-Term Korea Energy Outlook (2013-2018), May 2014, page 35.

11Newsbase AsianOil, “South Kora may hike Iran oil imports once sanctions lifted,” September 2, 2015.

12KNOC, Investor Relations (website accessed September 2015).

13Platts McGraw Hill Financial, “Wild swings in South Korean energy policy raises concerns,” August 6, 2014.

14KNOC, Operations (website accessed September 2015).

15KNOC, Investor Relations (website accessed September 2015).

16KNOC Investor Relations, Overseas E&P and Operations, E&P Worldwide websites (accessed September 2015).

17Platts McGraw Hill Financial, “South Korea seeks to import more US condensate after testing route in 2014,” January 5, 2015.

18IEA, Monthly Oil Data Service (accessed September 2015); and IEA, Energy Supply Security 2014, South Korea, chapter 4, page 295; and KNOC, Investor Relations (accessed September 2015).

19Platts McGraw Hill Financial, “KNOC forms joint venture with Vopak, S-Oil to build oil storage terminal in South Korea’s Ulsan,” January 8, 2014.

20OGJ, Worldwide Production by Field, December 1, 2014.

21KEEI, Monthly Energy Statistics, August 2015, page 56.

22KOGAS, Investor Presentation, Results of 1H 2015, page 21.

23KOGAS, Investor Presentation, Results of 1H 2015, page 17.

24IEA Energy Supply Security 2014, South Korea, page 299.

25Platts McGraw Hill, “Wild swings in South Korean energy policy raises concerns,” August 6, 2014; and BusinessKorea, “Preparation for Exploration KOGAS Sharpens Overseas Competitiveness through Reorganization,” July 27, 2015.

26IHS Energy, “South Korea Market Profile,” April 1, 2015, page 24 and KNOC Operations (website accessed September 2015).

27BP Statistical Review of World Energy 2015; and International Gas Union, IGU World LNG Report 2015 Edition, page 49.

28Platts McGraw Hill Financial, “South Korea’s SK Group to make big push into N. America shale gas development: source,” November 8, 2013.

29EIA estimates and Korea Energy Economics Institute, Monthly Energy Statistics, August 2015, page 7.

30United Nations/World Trade Organization, International Trade Center website (accessed September 2015).

31Korea Energy Economics Institute, Monthly Energy Statistics, August 2015, pages 61-64.

32Korea Energy Economics Institute, Monthly Energy Statistics, August 2015, pages 69.

33Korea Energy Economics Institute, Monthly Energy Statistics, August 2015, pages 71.

34Korea Energy Economics Institute, Monthly Energy Statistics, August 2015, page 67.

35KEPCO Annual Report, 2015, page 62.

36The Korea Herald, “Korea to build two new nuclear reactors by 2029,” June 8, 2015.

37Reuters, “UPDATE 1-S.Korea axes four coal plants, plans two new nuclear units,” June 8, 2015.

38IHS Energy, “South Korea Coal Profile,” July 2015, pages 4 and 14.

39Platts McGraw Hill Financial, “Dismal outlook for LNG in S Korea’s power market as coal, nuclear gain favor: KPX,” March 20, 2015.

40International Atomic Energy Agency, Power Reactor Information System (accessed September 2015).

41IHS Energy, “South Korea’s falling LNG imports exacerbate global oversupply,” September 3, 2015, page 2.

42World Nuclear Association, “Nuclear Power in South Korea,” September 2015; International Atomic Energy Agency, Power Reactor Information System (accessed September 2015).

43Korea Energy Economics Institute, Monthly Energy Statistics, March 2015, page 67.

44World Nuclear Association, “Nuclear Power in South Korea,” September 2015.