Fiscal Destruction: Confiscatory Taxation Of Jewish Property And Income In Nazi Germany – Analysis

By VoxEU.org

Germany’s Jewish population share in 1933 was less than 1%. Nevertheless, Nazi propaganda believed in the existence of fabulous riches, with some estimates rising as high as 20% of national wealth. This column uses taxation data collected for the Allied military governments after 1945 to revisit these claims. Under plausible assumptions, the Jewish-owned share of Germany’s private real capital stock broadly matched the population share, with an upper-bound estimate of 1.6%.

By Albrecht Ritschl*

The Nazis got to power in 1933 with the explicitly stated goal of destroying the livelihood of Germany’s Jews. According to Fremdling (2016), Nazi officials believed that Germany’s Jewish minority – some 500 000 people in 1933, or 0.77% of the population – owned up to 20% of Germany’s wealth at the time. Such beliefs seem to have informed policy decisions by the Nazi regime in 1936 to stop subsidising Jewish emigration and instead embark on a strategy of expropriation, hoping to use the spoils to help finance war preparation. Similar beliefs have induced later scholars to interpret the Holocaust as economically motivated (Aly 2007).

In this column, I use information from a collection of tax data on the proceeds of confiscation put together by former ministry officials for the Allied occupation authorities in 1947. The source provides an overview of the fiscal instruments used in the confiscatory taxation of Germany’s Jews since the Nazis got to power in 1933. It suggests that the spoils were actually very limited and fell short of expectations.

Three forms of confiscatory taxation

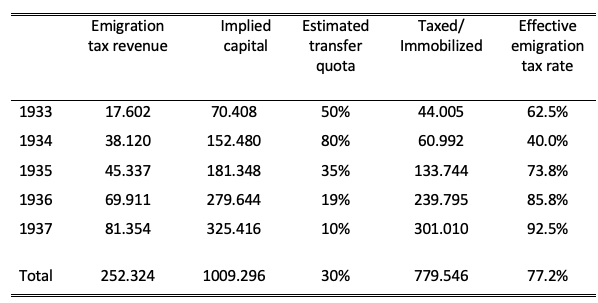

Confiscatory taxation of Jewish property took mainly three forms. The first was a tax on migration. Introduced already before 1933 to stem capital flight, it was changed in 1933 to impose a 25% wealth tax on all wealth transfers out of Germany beyond a lowered threshold. Furthermore, large parts of a migrant’s remaining domestic assets were credited to a blocked account at an affiliate of the Reichsbank, Germany’s central bank at the time, and only a fraction would be converted into foreign exchange (e.g. Drecoll 2011). Jews applying to emigrate would automatically be treated as being suspicious of attempted tax avoidance, creating the strongest incentives not to understate declared asset values (Bajohr 2001). This could also imply that assets sold to non-Jews under duress at below-market prices were still assessed at book values for the purpose of calculating the migration tax. Table 1 collects the data and calculates an effective tax rate on migration, which combines the nominal tax rate and the transfer quota until March 1938.

Table 1 Fiscal dispossession of migrants, 1933/34-1937/38 (millions of Reichsmarks)

Source: Ritschl (2019).

The second form of confiscatory taxation was a capital levy on Jewish wealth imposed in 1938 after the annexation of Austria. Earlier the same year, all Jewish assets had been registered with the local tax office. As with the migration tax, assessment was at book values according to the tax code to prevent undervaluation. The capital levy was first set at 20% and later increased retroactively to 25%, as the intended revenue target was originally not met. Based on its revenue, the implied net value of Jewish assets in 1938 would be 4.5 billion Reichsmarks, a value also cited in the 1947 source underlying Table 1. In a study of Jewish dispossession in Austria, Junz (2002) finds a slightly lower value of 4.3 billion Reichsmarks.

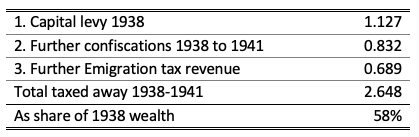

A third form of confiscatory taxation consisted two further levies. The first targeted the proceeds from the foreclosure of remaining Jewish businesses, imposed after the Kristallnacht pogroms of November 1938. The second consisted in the final transfer of all previously confiscated liquid assets to the central government budget under an executive order of November, 1941. Table 2 lists all fiscal dispossession in Germany excluding Austria after March 1938.

Table 2 Fiscal dispossession, 1938-1944 (billions of Reichsmarks)

Of the 4.5 billion Reichsmarks registered as Jewish owned assets in early 1938, the Nazis directed 2.65 billion Reichsmarks, or 58%, into the state coffers. This is less than the estimated 78% confiscation rate we obtain for Jewish emigrants before 1938. Largely this is due to the destruction of the economic livelihood of Germany’s Jewish minority in mid-1938, with most of Germany’s Jews reduced to receiving welfare support financed out of confiscated assets (see the contributions in Kreutzmüller and Zatlin 2019).

Estimating the Jewish wealth share

The implied asset values in the previous tables sum up to 5.5 billion Reichsmarks. The 1947 source underlying the above tables adds a roughly guessed 1 billion Reichsmarks in wild confiscations of Jewish property before 1938, and arrives at a total of 6.5 billion Reichsmarks. Fremdling (2016) cites internal guesstimates from Germany’s Statistical Office in 1936 that put Jewish wealth anywhere between 2.2 and 8 billion RM Reichsmarks with a midpoint estimate of 4-4.5 billion Reichsmarks. In her study of Jewish dispossession after the German occupation of Austria, Junz (2002) ventures a guess rising to 8-16 billion Reichsmarks.

How much is much? Fremdling (2016) cites a contemporary estimate of taxable wealth in the German economy of 100 billion Reichsmarks for 1928. Calculating the above asset totals into that, one would easily arrive at Jewish wealth shares of 7-8%, or perhaps even 16% if Junz’s (2002) upper-bound guesstimate is to be believed. However, the taxable wealth estimate must be seriously flawed. Nominal GDP was 89 billion Reichsmarks in 1928 and 79 billion Reichsmarks in 1936. According to the Kaldor stylised facts, an economy’s real capital stock should be about five times its GDP. Even allowing for shortfalls in capital stock levels due to postwar hyperinflation and the Great Depression after 1929, the aggregate capital stock should be expected to be upwards of 300-400 billion Reichsmarks, not 100 billion Reichsmarks. Estimates by Gehrig (1961) and Hoffmann (1965) indeed value Germany’s capital stock in 1936 at around 400 billion Reichsmarks. Private-sector real capital stock in the mid-1930s would be roughly 300 billion Reichsmarks.

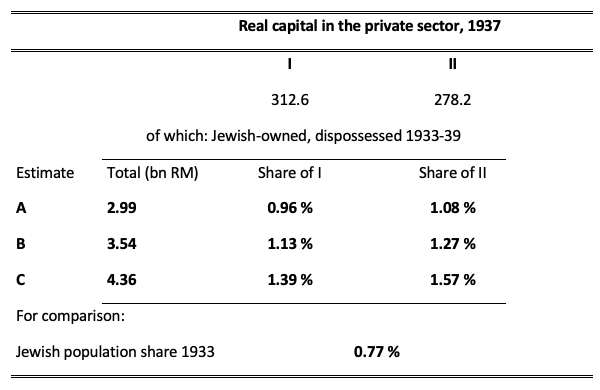

Using the shares of real capital among Jewish 1938 assets in Junz (2002), Table 3 calculates a range of estimated Jewish shares in German private-sector real capital.

Table 3 Real capital stock and the Jewish population share (billions of Reichsmarks)

Estimate A is a lower bound, assuming 5.5 billion Reichsmarks of Jewish assets, of which 2.99 billion Reichsmarks were real capital. Estimate B follows the 1947 document in adding 1 billion Reichsmarks for wild confis¬cations before 1938, assuming a total 6.5 billion Reichsmarks, of which 3.54 billion Reichsmarks would be real capital. Estimate C follows the upper-bound estimate of the Statistical Office cited in Fremdling (2016), which coincides with the lower-bound guess in Junz (2002), assuming 8 billion Reichsmarks of Jewish assets. Of these, 4.36 billion Reichsmarks would have been real capital.

Over the range of estimates going into Table 3, we find the Jewish share in German real capital to have been well in line with the Jewish population share, not disproportionately higher. All estimates lie in a band between 0.9% and 1.6% of private sector capital, with a plausible midpoint around 1.2%. Germany’s Jews in the 1930s were better educated than the average German, but not massively richer.

*About the author: Albrecht Ritschl, Professor of Economic History, LSE

References

Aly, G (2007), Hitler’s Beneficiaries: How the Nazis Bought the German People, Verso.

Bajohr, F (2001), ‘Aryanisation’ in Hamburg: the Economic Exclusion of Jews and the Confis-cat¬ion of their Property in Nazi Germany, Berghahn.

Barkai, A (1989), From Boycott to Annihilation: the Economic Struggle of German Jews, 1933-1943, University Press of New England.

Drecoll, A (2011), Der Fiskus als Verfolger. Die steuerliche Diskriminierung der Juden in Bayern 1933-1941/42, Oldenbourg.

Fremdling, R (2016), “Wirtschaftsstatistik 1933-1945“, in A Ritschl (ed.), Das Reichswirt-schaftsministerium im Dritten Reich, de Gruyter Oldenbourg, pp. 233-318.

Gehrig, G (1961), “Eine Zeitreihe für den Sachkapitalbestand und die Investitionen“, in G Gehrig (ed.), Bestimmungsfaktoren der deutschen Produktion, Ifo-Studien 7, pp. 7-60.

Hoffmann, W et al. (1965), Das Wachstum der deutschen Wirtschaft seit der Mitte des 19. Jahrhunderts, Springer.

Junz, H (2002), Where Did All the Money Go? The Pre-Nazi Era Wealth of European Jewry, Stuempfli.

Kreutzmüller, C and J Zatlin (eds), Dispossession: Plundering German Jewry, 1933-1945, University of Michigan Press, forthcoming.

Ritschl, A (2019), “Fiscal Destruction: Confiscatory Taxation of Jewish Property and Income in Nazi Germany”, in C Kreutzmüller and J Zatlin (eds) Dispossession: Plundering German Jewry, 1933-1945, University of Michigan Press, forthcoming; also CEPR Discussion Paper 13594.