Brussels To Lay Out Banking Union Plan By Early September

By EurActiv

(EurActiv) — The European Commission is aiming to present its banking union plan by September 11, in a bid to contain the euro crisis that has prompted several EU countries to seek bailout to finance their banks, EU officials reportedly said on Monday (6 August).

EU leaders agreed at the last EU summit in June that a blueprint for banking integration was urgently required to break the link between bad banks and indebted governments, with the worsening situation in Spain an immediate concern.

The proposal should include details to set out a single European banking supervisor, a common EU deposit-guarantee scheme and a single bank-resolution fund to wind down the region’s bad bank.

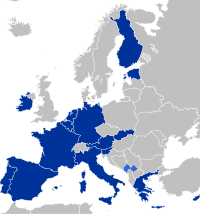

The official reportedly said that under the plan the European Banking Authority, which currently oversees all 27 EU members, will lose control over the euro-zone nations that would come under the remit of the European banking supervisor. The new body would be an agency of the European Central Bank.

The EU needs a banking union to allow the European Stability Mechanism, the permanent recue fund, to recapitalise banks directly.

“Allowing the ESM to directly recapitalise banks, once the conditions are met, is a cornerstone of our efforts to break the vicious circle between banks and sovereigns. Once in place, this will be a powerful tool to ease pressure on sovereigns in the euro area,” explained recently Economic and Monetary Affairs Commissioner Olli Rehn.

Details for a banking union plan are being discussed by the European Commission and the ECB and a high-level meeting will probably take place this month, with both European Commission president José Manuel Barroso and ECB president Mario Draghi.

The EU executive aims to iron out the new plan in the autumn and have it approved at the next EU leaders’ summit on 13-14 December, so that the banking supervisor could start operations as early as January 2013.

Hot September

In September, the German constitutional court is also expected to rule on the legality of the ESM, and the ECB is expected to present its plans to provide support to peripheral bond markets.

Last week, the European Central Bank disappointed markets as it said that it was prepared to buy Italian and Spanish bonds on the open market but only after eurozone governments have activated bailout funds to do the same.

ECB President Mario Draghi indicated that any ECB intervention would start at the earliest in September and would depend on countries in trouble on bond markets making a request and accepting strict conditions and supervision.