China’s BRI ‘Go’ Game Aid Trap – OpEd

By Patial RC

China’s Belt and Road Initiative (BRI) has left a large number of poor income countries burdened with heavy ‘hidden debts’ totaling $385 billion, according to new findings of a report published by AidData, based in Virginia. American statesman John Adams, who served as president from 1797 to 1801; “There are two ways to conquer and enslave a country: One is by the sword; the other is by debt.”

According to this report, China has used debt rather than aid to establish a dominant position in the international finance market. President Xi Jinping’s BRI plan, launched in 2013, has changed China’s overseas lending. The big difference between China and other sources of financing is that Chinese banks have used ‘Debt rather than Aid’ to establish a dominant position in the Global finance market”. BRI is part of a grand strategy to build alliances, project influence, and reshape the international balance of power in Beijing’s favour in all spheres.

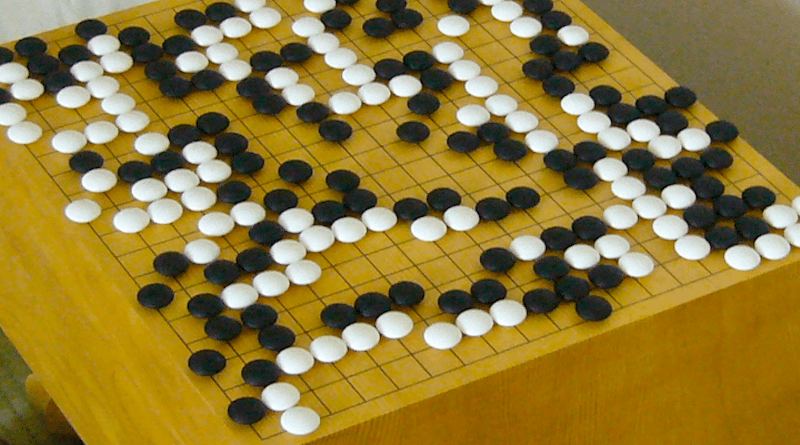

The Chinese ‘Go’ game is played like Chess. It has white and black pieces called stones. The objective of ‘Go’ is to surround a larger territory on the board with one’s stones whereas Chess which originated in India is a game of manoeuvres and the objective is to capture or “kill” the opponent’s king.BRI is like a Chinese ‘Go’ game capturing economic territories on the world map board canvas.

The study found that earlier most overseas lending involved central government institutions, now nearly 70% of China’s overseas lending is now directed to state-owned companies, joint ventures and private sector institutions leading to lesser bureaucratic delays. BRI is central to its ‘Debt-Trap Diplomacy’. China often begins as an economic partner with an economically weak country and then gradually enlarges its footprint to become its master. Sri Lanka’s Hambantota port, along with more than 6,000 hectares of land transfer to Beijing on a 99-year lease is the most glaring example of this policy.

China has now eclipsed traditional lenders, including the World Bank, the International Monetary Fund (IMF) and all the creditor nations of the Organization for Economic Cooperation and Development put together.

Highlights of the AidData report on China’s BRI:

China since the beginning of the BRI has overtaken the US. It is loan debts rather than aid and most of these loan interests are near commercial rates.

It has also been revealed that the governments are underreporting the potential repayment obligations to China. These costs are opaque and some are hidden by the establishments for various reasons.42 countries are believed to be now having debts due to China exceeding 10 percent of GDP.

There are growing signs of ‘Disenchantment’ among so called BRI aided countries. A large number of the BRI infrastructure projects have encountered major implementation problems like corruption scandals, quality, labour violations, environmental hazards, and public protests. Project suspensions and cancellations are on the rise. Lately in Gwadar hundreds of Baloch women came out in huge numbers to protest. Baloch women have been at the forefront of the struggle for the recovery of Baloch missing persons but this was the first time that so many women stepped out to protest against issues like the demand to ban on trawling by the Chinese and other trade issues. Pakistan has given China exclusive rights to run Gwadar Port for the next four decades. The fear is Gwadar port may finally go Sri Lanka’s Hambantota port way.

The cost of the China-Pakistan Economic Corridor (CPEC) has become more expensive than expected. Pakistan’s has finally admitted it needs help and the local media has revealed that the country has had to pay over ₹ 26 billion in interest cost to China to repay a maturing debt in the fiscal year 2020-21. Pakistan had repaid the $6.2 billion loan to Saudi after taking a loan from China.

Any Foreign aid should be considered a curse but for Pakistan it is always a ‘Bailout Victory’ in the light of a nod from the IMF for a $1 billion bailout plan for the country’s flagging economy. Since its independence, Pakistan has taken 20 bailout packages from the IMF and has sought financial aid from almost all friendly states. Now, the debt level has jumped to almost 80 percent of the total GDP. Pakistan cannot deny the fact that the country is on the edge of an economic disaster and Imran Khan has himself publicly announced that “There is No money to run the country and 70 per cent of our country is under 30, every day more young people enter the job market but there are no jobs for them.”

Pakistan Planning and Development Minister Asad Umar has said that details of all Chinese loans had been shared with the IMF and these were more economical than all other loans, including those obtained from multilateral and other western lenders!

It seems that the IMF did not budge from its stiff position during the negotiations, leaving Pakistan no other option but to concede to its shortfalls and agree to the tough conditions to revive its financial bailout. “Pak-China friendship is higher than Himalayas, deeper than ocean, sweeter than honey, and stronger than steel.” Wonder why this Pak-China friendship is not coming to their rescue. However, it is certain that the Chinese through back door influence on the UN and IMF must be exerting pressure for a Pakistan bailout plan. If this is the situation in Pakistan with their traditional strategic ally friend one can imagine the situation of other countries that have got trapped into Chinese BRI debt traps.

BRI Debt-Trap Diplomacy offers projects or loans on terms that end up being too difficult for countries to repay, eventually compelling them to accept political or economic concessions. China’s BRI has resulted in several such unsustainable debt-for-infrastructure deals resulting in expanding Beijing’s geostrategic interests and increasing its global presence influence through economic expansion. The existingBRI participating countries and the ones likely to be part of this white elephant initiative should exercise caution on terms and conditions before taking a plunge into the BRI.

Refrence:

China’s debt-trap diplomacy By Brahma Chellaney