Stories Of Resilience: What Can Small Businesses Teach Us? – OpEd

After listening to Vimeo video stories (1) about eight resilient small businesses during the pandemic, I could not stop thinking about what made them so resilient:

- “doing something kind and responsible”(a bike repair shop owner)

- “adapting to changing demand” (a fisherman)

- “staying connected with real life” (a restaurant owner)

- “being creative” (a flower shop owner)

- “getting out of my comfort zone” (a dance class teacher)

- “fighting for my team and their living” (a restaurant owner)

- “being loyal to my customers” (a barber shop owner)

Resilience is defined as “the ability to recover from setbacks, adapt well to change, and keep going in the face of adversity” (2). I have seen similar stories on various crowdfunding and social media platforms, where customers have either supported their favorite local business or small businesses are reaching out and seeking to survive or limit disruption in creative ways. As a small business co-owner, we have gone through our own process of panic and reactive response, more recently rethinking and developing a recovery plan with our team members, partners, vendors, clients, and customers. It has not been easy. I still do not know where we will land, but after hearing the stories of others, I feel inspired by their messages of optimism, creativity and agility that are key features of a resilient business.

Messages from these heroes can also be translated into these three characteristics of resilient people and organizations, as described by Diane Coutu in her “How Resilience Works” article, “Resilient people and companies face reality with staunchness, make meaning of hardship instead of crying out in despair, and improvise solutions from thin air. Others do not.” (3).

Small Businesses as the Backbone of an Economy

The World Bank estimates that there are more than 150 million small and mid-sized businesses globally that employ 60% of the world’s working population, in turn, generating almost 50% of the world’s GDP (4). According to the U.S. Small Business Administration, 30.7 million small businesses make-up 99.7% of U.S. employer firms and account for 61.8% of net new jobs from the first quarter of 1993 until the third quarter of 2016 (5).

“Small businesses are the backbone of the economy and vital for communities to thrive.”

To bring immediate relief and business continuity, national and local governments throughout the world are providing resources for small businesses to survive this pandemic. These resources, although limited, include payroll protection programs, immediate cash to cover key expenses, tax relief programs, a wide range of disaster response loans, and grants offered by national, state and city governments.

Resilience Framework for Small Businesses

Despite support from the government, communities and other stakeholders, unfortunately, an estimated 25% of businesses do not reopen after a major disaster, according to the Institute for Business and Home Safety (6). The COVID-19 pandemic has been a unique disaster for small businesses with great uncertainty about the future. Thus, this number might be much higher than the estimates of the Institute. The impacts on society from the demise of small businesses are also higher as people working in small businesses are usually low-wage people and more vulnerable.

For small businesses to recover from the pandemic, Weick and Sutcliffe (7) suggest these success tests in the following four categories :

- Resourcefulness: the capacity of managers to identify potential problems, establish priorities and mobilize resources to avoid damage or disruption;

- Technical: the ability of managers to ensure that organizational systems perform to high levels when subject to extreme stress;

- Organizational: the preparedness of managers to make decisions (however counter-intuitive these might sound initially) and to take actions to reduce disaster vulnerability and impacts; and

- Rapidity: the capacity of managers to make decisions on threats without undue delay.

Resource Constraints and Skills Gap

Access to resources has been the biggest challenge for small businesses so far. Limited government support and internal resources increases the vulnerability of small companies in any disruption. The type of disruption we are facing will sharply increase the vulnerability of small businesses given the uncertainty and long recovery time of a pandemic.

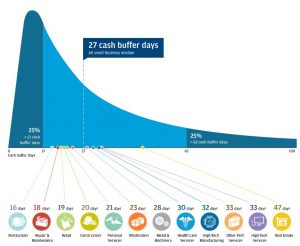

As a small company, when we reached out to one of our largest vendors for partial payment deferral, they were surprised that we did not have 3-6 months liquidity to get through the crisis. The reality is that many small businesses are in constant “daily survival” and/or “growth” mode and they use their savings/personal funds for business continuity. We do not have the liquidity and luxury of large credit lines to sit back and wait for the crisis to be over. The median small business holds 27 cash buffer days in reserve, according to JP Morgan (8) and half of all small businesses hold a cash buffer of less than one month (Figure 1). With this limited cash buffer and uncertainty with the pandemic, most small businesses fail Weike and Sutcliffe’s resourcefulness test.

Resource constraints also limit small businesses with recovery planning. Implementing resilience practices is costly and requires designing, implementing, and evaluating different operational approaches.

With countries slowly re-opening on the horizon, there will be new best practices for social distancing within business operations, such as not bringing all employees to work at the same time or investing in social distancing infrastructure. All of these will increase the cost of business continuity.

When large companies put together special teams to manage their pandemic response, such as a “future team”, “plan-a-ahead team”, “recovery team”, and/or a “scenario B” team (either through management consulting firms or internal pool of experts), these teams do not have to worry about daily operations and revenue generation during the pandemic. However, small business owners and managers must focus both on daily operations and future planning. They have very limited financial resources to bring on board mentors, consultants, and coaches to provide support through this unique crisis. Government institutions and global institutions have not been equipped, available and up-to-speed with the pace of the crisis. The fact that a large group of small businesses were not able to submit timely stimulus applications and missed getting small business funds in the U.S., while large corporations utilized their capabilities to get these funds, is an indicator of the lack of capacity. These resource constraints, combined with limited capacity, result in more “muddling through” (7) strategies dominated by unsatisfactory swings between reactive and stagnant approaches to addressing problems.

Recovery through Adaptive Capacity and Optimism

Getting back to the stories of small businesses, we can observe that adaptive capacity along with the optimism and a willingness to improvise are critical features of these businesses’ resilience. A restaurant owner’s optimism and hope for a better future contributed to his creative use of a crowdfunding platform to prepare free food for hospitals.

As a small business, the Kapi Team has been working with our clients and partners in optimism that the recovery will provide opportunities for us to innovate and become stronger as a company. The collaboration and understanding demonstrated by some of our vendors and partners have been the main source of our resilience in this process. We are also exploring different business models to reinvent some of our services and identify new opportunities that emerged during this unique journey.

*About the author: Sarvat Maharramli is President of Kapi Residences

References:

- Vimeo Gives 8 Filmmakers Grants to Tell the Stories of Resilient Small Businesses by Ian Zelaya. https://www.adweek.com/creativity/vimeo-gives-8-filmmakers-grants-to-tell-the-stories-of-resilient-small-businesses

- What Resilience Means, and Why It Matters by Andrea Ovans. https://hbr.org/2015/01/what-resilience-means-and-why-it-matters?utm_campaign=hbr&utm_source=linkedin&utm_medium=social

- How Resilience Works, by Diane Coutu. https://hbr.org/2002/05/how-resilience-works.

- Small and Medium Enterprises Finance. https://www.worldbank.org/en/topic/smefinance

- Frequenty Asked Questions about Small Businesses. https://www.sba.gov/sites/default/files/advocacy/SB-FAQ-2017-WEB.pdf

- Small Business Resiliency Guide – Guide Keeping the Lights On. https://wsbdc.org/wp-content/uploads/2020/03/Business-Resiliency-Guide-Final.pdf

- Creating resilient SMEs: why one size might not fit all. Author(s): Bridgette Sullivan-Taylor & Layla Branicki. 2011

- Cash is King: Flows, Balances, and Buffer Days. Evidence from 600,000 Small Businesses. JP Morgan Chase Institute Report. https://institute.jpmorganchase.com/institute/research/small-business/report-cash-flows-balances-and-buffer-days.htm#infographic-text-version-uniqId1588278265219