Eurozone Crisis: Time Out Or Turning Point? – OpEd

By VOR

By Mamonov Roman

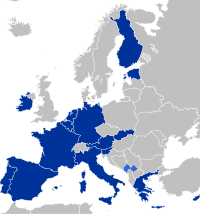

The world financial markets have ended the week on a positive note following the European Central Bank’s much-awaited decision to buy the short-term bonds of Spain, Italy, and Greece. However, the week started with a negative outlook.

Moody’s downgraded the outlook for the EU’s long-term AAA credit rating from ‘stable’ to ‘negative’. Even though the rating itself remained at a high level, the agency’s decision came as a warning for investors. Alexander Apokin of the Center for Macroeconomic Analysis and Short-Term Forecasting, comments.

“Undoubtedly, Moody’s warning sent a negative signal, though not very strong. It was clear that sooner or later the EU’s rating would suffer, largely because of the recent developments within its space, and amid rating agencies’ reports downgrading credit ratings of the EU’s major economies. Given that the recent decision by the European Central Bank could have changed the situation, the EU rating could no longer be under threat. Judging by the recent reports, market players deem negative news as providing an incentive for the European Central Bank to substantially soften its monetary policy in the future.”

The European Central Bank’s decision concerning the repurchase of short-term bonds was announced at the end of the week. Published by the Bank’s Chairman Mario Draghi, it envisages repurchase of Spanish, Italian, and Greek bonds that mature in one to three years. Draghi pledged to do everything necessary to save the euro. Markets responded by taking a jump with Dow Jones hitting a four-year high at New York trading on Thursday. Investors remained unperturbed even following Draghi’s acknowledgement that he had lost control of the cost of borrowing in the eurozone. Such openness cheered up market players as everybody is holding their breath over further developments involving Spain and Greece, Investcafe’s Anna Bodrova says.

“The European Central Bank’s acknowledgement that the situation has got out of control doesn’t suggest that the crisis is worsening. It didn’t happen yesterday or today. The European Central Bank lost a lot of time considering measures it could take to bring things back to normal. Now, there are all grounds to believe that the Bank will quickly introduce the measures it outlined before. European stock markets will achieve stability by the end of September. The EU is supposed to produce a decision on Greece’s frozen tranche, while investors will have to think of a solution for Spain, which sits idle hoping that someone will come and rescue it.”

The reports published this week revealed that the eurozone’s GDP dropped 0.2% in the second quarter, as compared to the previous one, and is the decline is set to continue. Greece’s GDP shrank by 6.3% in the second quarter of the year. Portugal’s economy shrank by 1.2%, Finland’s – by 1%, Cyprus’ by 0.8%, and Italy’s and Britain’s by 0.7% each. Even Switzerland, commonly seen as a financial paradise, reported a 0.1% dip in the GDP in the second quarter. Even though the decline is not significant, given that GDP declines for two consecutive quarters, a technical recession is in place.