OPEC Production Cuts Reflected In EIA Forecast; HGL Production Grows Through 2017 – Analysis

By EIA

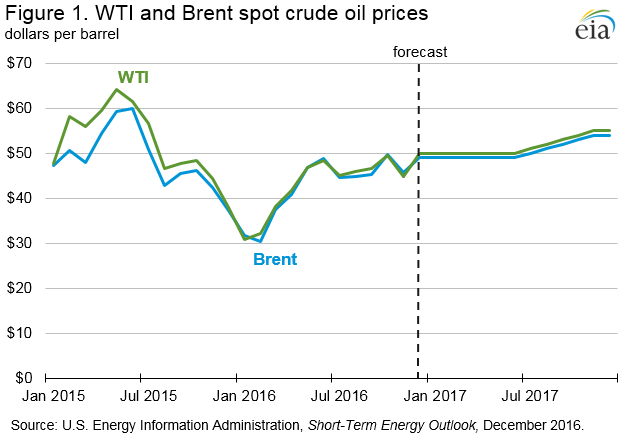

In EIA’s December Short-Term Energy Outlook (STEO), both the West Texas Intermediate (WTI) and Brent crude oil 2017 price forecasts increased by about one dollar per barrel (b) from the November STEO, with prices expected to average $51/b and $52/b, respectively.

The WTI price is forecast to average $49/b in the first half of 2017 and end the year at $54/b, while the Brent price is forecast to average $50/b in the first-half of 2017 and end the year at $55/b (Figure 1).

The forecast includes consideration of the Organization of the Petroleum Exporting Countries’ (OPEC) recent announcement to reduce production. However, the agreement only resulted in small changes to the STEO forecast. Notably, OPEC’s agreed upon output levels for early 2017 were similar to EIA’s November forecast, and already included some expectation of production constraint in 2017. EIA’s assessment of the non-OPEC contribution to production cuts may change based on announcements made after the meeting set for early December. Finally, recent improvements in global economic data may result in upward demand adjustments. All of this points to inventory rebalancing changes that offer support to crude oil prices.

At the November 30 OPEC meeting, member countries agreed to reduce production by approximately 1.2 million barrels per day (b/d) from an October baseline and lower OPEC’s production ceiling to 32.5 million b/d beginning January 1, 2017. EIA adjusted the December STEO by reducing OPEC’s crude oil production by 100,000 b/d in the first quarter of 2017 to 32.8 million b/d. The difference between OPEC’s and EIA’s production estimates likely reflects differences in production in Indonesia, Libya, and Nigeria, which are not participating in the agreement.

The agreement is meant to last six months with an option to extend for an additional six months. Saudi Arabia agreed to make the largest production cuts (approximately 40% of total cuts) and reduce production by 486,000 b/d to 10.1 million b/d. Iraq, the United Arab Emirates, and Kuwait agreed to cut production by 210,000 b/d, 139,000 b/d, and 131,000 b/d, respectively. Iran agreed to cap its production at approximately 3.8 million b/d, giving it room to increase production by about 90,000 b/d from October levels, according to trade press.

Several non-OPEC producers also announced their intention to freeze or reduce production, with the agreement stating that non-OPEC countries will reduce production by a total of 600,000 b/d. Trade press indicates that Russia will account for 300,000 b/d, staged over the first quarter of 2017, but it is currently unclear where the other 300,000 b/d will come from other than modest amounts from some Gulf nations such as Oman.

Oil prices rose as the OPEC agreement came together and was then announced; however, the extent to which the plans will be carried out and actually reduce supply below levels that would have occurred in its absence remains uncertain. If the agreement contributes to prices rising above $50/b in the coming months, it could encourage a return to supply growth in U.S. tight oil more quickly than currently expected. Crude oil prices near $50/b have led to increased investment by some U.S. production companies, particularly in the Permian Basin. A price recovery above $50/b could contribute to supply growth in other U.S. tight oil regions and in other non-OPEC producing countries that do not participate in the OPEC-led supply reductions.

EIA now expects modestly tighter balances than previously forecast. Total global oil inventories are now expected to build by 400,000 b/d in 2017, 100,000 b/d less than in the November forecast.

Continued supply growth in 2017 is expected to contribute to increases in global inventories. Petroleum and other liquids production is up in 2017 compared with 2016, with total world production increasing 1.3 million b/d to 97.4 million b/d in the current forecast. Despite the downward revision of OPEC production in the first quarter of 2017, total 2017 OPEC production (including both crude oil and other liquids, other liquids are not subject to the November 30 agreement) is still forecast to increase from 39.3 million b/d in 2016 to 40.2 million b/d in 2017. In addition to EIA’s inclusion of Indonesia, Libya, and Nigeria (which were excluded from OPEC’s production cuts), the increase in total OPEC production is influenced by expected seasonal demand growth and the return of some currently disrupted volumes. Non-OPEC 2017 production is forecast to increase by 350,000 b/d with the U.S. accounting for 210,000 b/d of that increase.

Despite new oil production coming online when global oil inventories are already at high levels, economic data have been better than previous expectations, and increases in oil demand growth could help to support prices in the coming quarters. Demand for global crude oil and other liquid fuels in the December STEO has been revised modestly upward from the November STEO with global demand now expected to grow by 1.4 million b/d in 2016 and 1.6 million b/d in 2017. U.S. consumption is expected to increase by approximately 1%, or 240,000 b/d, in 2017. Much of the growth in U.S. consumption is driven by consumption of ethane/ethylene, a hydrocarbon gas liquid (HGL), which is forecast to increase over 13% in 2017 from 2016 levels. The consumption increase is driven by an increase in the number of ethane crackers in the U.S.

The December STEO forecasts an increase in U.S. production of all HGL—a group of products including ethane, propane, normal butane, isobutane, natural gasoline, and refinery olefins—of 8.7% in 2017, but production of ethane accounts for nearly 80% of this growth. While HGL production happens at both natural gas processing plants and petroleum refineries, almost all of the growth in HGL production between 2008 and 2016 occurred at natural gas processing plants as a by-product of the growing supply of natural gas from shale gas and tight oil formations; this trend is expected to continue into 2017.

The December STEO forecasts U.S. ethane production to increase by 240,000 b/d to 1.5 million b/d for 2017. The increase is driven by additional ethane crackers coming online, providing a more economic use for ethane than ethane rejection (when ethane is left or reintroduced into the natural gas supply stream and is not accounted for as a petroleum product).

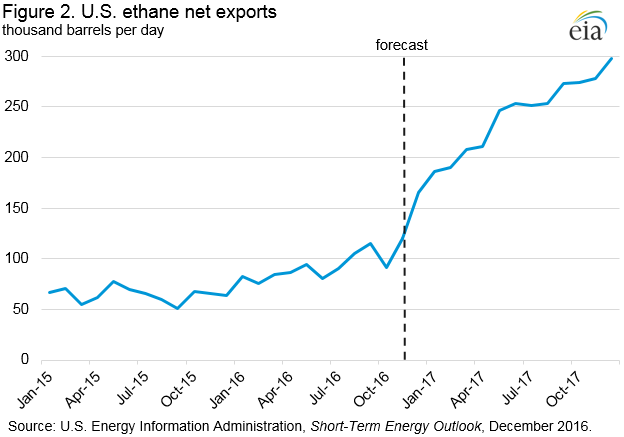

U.S. ethane exports are also forecast to increase in 2017. The December STEO forecasts net exports of ethane to rise over 145%, averaging 240,000 b/d in 2017 (Figure 2). This is partially driven by increased demand in the United Kingdom where an ethane cracker is expected to come online in 2017.

U.S. average regular gasoline and diesel retail prices climb

The U.S. average regular gasoline retail price rose five cents from the previous week to $2.21 per gallon on December 5, up nearly 16 cents from the same time last year. The East Coast, Midwest, and Gulf Coast prices each rose seven cents to $2.23 per gallon, $2.11 per gallon, and $1.98 per gallon, respectively. The Rocky Mountain price fell nearly three cents to $2.12 per gallon, while the West Coast price remained virtually unchanged at $2.57 per gallon.

The U.S. average diesel fuel price rose six cents to $2.48 per gallon on December 5, ten cents higher than a year ago. The Midwest price rose eight cents to $2.43 per gallon, the Gulf Coast price rose seven cents to $2.36 per gallon, the East Coast price rose five cents to $2.50 per gallon, the West Coast price rose four cents to $2.77 per gallon, and the Rocky Mountain price rose one cent to $2.46 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 1.5 million barrels last week to 99.3 million barrels as of December 2, 2016, 1.4 million barrels (1.4%) lower than a year ago. Gulf Coast and Midwest inventories decreased by 1.0 million barrels and 0.6 million barrels, respectively, while Rocky Mountain/West Coast inventories dipped slightly, remaining virtually unchanged. East Coast inventories increased by 0.1 million barrels. Propylene non-fuel-use inventories represented 4.6% of total propane inventories.

Residential heating fuel prices increase

As of December 5, 2016, residential heating oil prices averaged $2.49 per gallon, nine cents per gallon more than last week and 16 cents per gallon higher than last year at this time. The average wholesale heating oil price is just over $1.72 per gallon, up nearly 14 cents per gallon from last week and 37 cents per gallon higher than a year ago.

Residential propane prices averaged nearly $2.12 per gallon, four cents per gallon more than last week and almost 15 cents per gallon higher than a year ago. Wholesale propane prices averaged $0.71 per gallon, just under seven cents per gallon more than last week and nearly 22 cents per gallon higher than last year’s price.