Palladium And The World’s Approaching Geoeconomic Ride – Analysis

Palladium is a rare earth element and strategic resource. Russia is the world’s largest producer of this key substance, which is used in multiple electronic applications and advanced computing. With sanctions from the West rushing fast upon Moscow due to its invasion of Ukraine, there are questions emerging about the impact of a shortage of palladium on finance and industry on a regional and global scale.

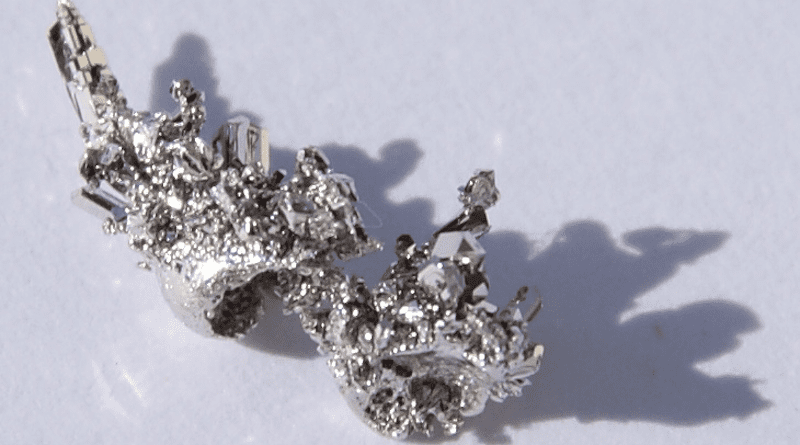

Palladium in the Earth’s crust is said to be 30 times rarer than gold. It is an element with multiple applications, from the automotive industry to jewelry, photography and dental crowns. Its best-known use today is in catalytic converters, which reduce toxic emissions from car engines.

Thirty-nine percent of the global supply of refined palladium comes from Russia. The country also accounts for about 11 percent of global platinum. But palladium is already in short supply, with the EU dependent on imports from Russia for 40 percent of its supply.

Meanwhile, the price of palladium is soaring due to the lack of supply, topping $3,000 an ounce last week. It has been in this price range before, in May 2021, but under different circumstances. The point is how palladium has become part of an international struggle over precious and strategic minerals.

A particular point of impact is the climate. Research shows that palladium — one of six platinum-group metals alongside ruthenium, rhodium, osmium, iridium and platinum — is the main element that reduces the amount of harmful emissions released into the atmosphere by cars and trucks. In Europe, palladium is also used in the advanced tech industry and in computing. Meanwhile, India and China not only import palladium for their respective advanced electronics industry, but also for their automotive industry. Here, the import and use of palladium is related to reducing smog and thus creates an intersection between climate change requirements and geoeconomics and vicious politics.

Catalytic converters account for about 80 percent of global demand for palladium, which makes it part of the element base for creating a cleaner environment. The argument goes that, as emissions regulations continue to tighten around the world, the demand for catalytic converters — and therefore palladium — will only increase. But its uses vary from country to country and are context-dependent.

As the world moves toward electric vehicles, palladium will not be required because they do not emit exhaust fumes. But hybrid vehicles, which operate using both an internal combustion engine and an electric motor, require a higher amount of palladium. Despite the nature of the reasons for palladium’s dramatic recent price increase, there is speculation that similar movement could also occur in the markets of other metals that have important roles in achieving environmental sustainability.

Going forward, it is not politicians that are important, but leading mining companies, which need to step up their transparency on what is required to boost supply chain stability. The leading mining companies will need to be more creative as the potential for shockwaves moves through the global economy, such as when high palladium prices combine with logistical supply chain disruptions or oscillation causes a slowdown in production. What is happening is that key minerals like palladium, which are so desperately required in the Fourth Industrial Revolution, are becoming prohibitively costly and perhaps holding back human knowledge and health security because of the ultimate impact on the environment.

Palladium performs a specific purpose in the global economy and is a necessary component in helping society. Because of global geopolitics and the emergence of greater supply disruptions — due to the approaching end of the COVID-19 pandemic and the rise of a European war — interrupting palladium supply is almost an appalling act in itself. Countries’ behavior over what comes next regarding commodity markets, including the purchase and distribution of palladium, can be a marker of emerging problems regarding the creation of products that contain palladium. Clearly, more problems are afoot for already slow supply chains that are becoming increasingly interrupted or rewired by geoeconomic requirements. This issue is not about electric vehicles, but a wider set of products that rely on a very rare mineral.

Overall, there is a requirement for social and ethical responsibility within the mining company community as it works with policymakers while the global community considers what comes next in regard to commodities such as palladium. To be sure, the race for control of national resources accelerates as a result of catastrophes, such as after dam bursts or political and social tensions. Now Russia is experiencing sanctions strangulation unseen in a Fourth Industrial Revolution environment. Palladium, its supply and its price are in for a wild geoeconomic ride.