China’s Sinopec Said To Support Trans-Caspian Plan – Analysis

By RFA

By Michael Lelyveld

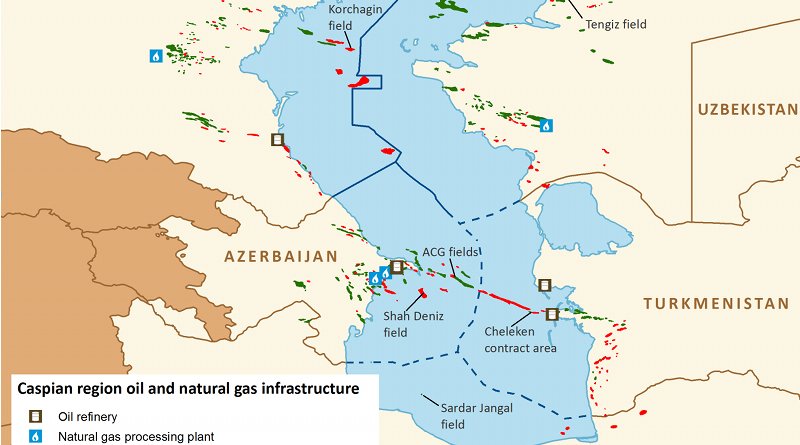

A plan to build a gas pipeline across the Caspian Sea would hardly be unusual. Western countries have been promoting a Trans-Caspian route for energy supplies from Central Asia for the past 25 years.

But the latest push for a Trans-Caspian Gas Pipeline (TCGP) may be unprecedented because one of the members of a consortium behind the new proposal is reported to be a subsidiary of a Chinese national oil company.

Until now, China’s only interest in Central Asian gas was in east-bound deliveries through pipelines to the Chinese market. But now, one of China’s major state-owned enterprises is said to be backing plans to pump gas west from Turkmenistan across the Caspian through Azerbaijan and on to Europe.

Reports of China’s support for a TCGP project surfaced last month at an economic forum in Turkmenistan’s Awaza tourist center, marking the first anniversary of the convention on the legal status of the Caspian. The agreement was reached after decades of negotiation by the shoreline states of Azerbaijan, Iran, Kazakhstan, Russia, and Turkmenistan.

According to an Aug. 13 report by Turkmenistan’s Orient News Agency, representatives of a European-Chinese consortium expressed “readiness to implement the Trans-Caspian Gas Pipeline project” at a meeting with Deputy Prime Minister Myratgeldi Meredov and energy adviser Yagshigeldy Kakaev.

Members of the consortium were identified as Edison Technologies GmbH of Germany, MMEC Mannesmann GmbH, Air Liquide Global E&C Solutions of France, and Sinopec Engineering Group (SEG), the construction arm of China Petroleum & Chemical Corp. (Sinopec).

Speaking for the consortium, Edison Technologies CEO Edison Kasapoglu cited the group’s capabilities to build a 300-kilometer (186-mile) pipeline on the Caspian seabed, along with required gas wells, purification plants and compressor stations.

“The European market is interested in it, and we consider it a great step to return to the promising Caspian region,” Edison said.

Despite the attractions, reports by Azerbaijan’s Turan Information Agency and other news sources saw little chance that a TCGP project would overcome objections from Russia and Iran.

Although Turkmenistan and Azerbaijan have theoretical rights to build a pipeline across their contiguous subsea sectors, Moscow and Tehran have the power to stop them under the convention’s terms.

The key Article 14 allows parties to “lay trunk submarine pipelines on the bed of the Caspian Sea, on the condition that their projects comply with environmental standards and requirements embodied in the international agreements to which they are parties,” including a framework convention that gives Russia and Iran effective vetoes.

For western nations that have been calling for a TCGP project since the 1990s, the provision blocks a breakthrough that the Caspian convention was supposed to achieve.

In comments on last month’s Caspian forum, Russian and Iranian officials were quick to douse any sign of progress on a TCGP plan, raising environmental concerns to protect their own competitive gas routes.

“The interests of preserving the unique ecosystem of the Caspian have an absolute priority over any hypothetical economic projects,” said Sergei Prikhodko, the Russian government’s first deputy chief of staff, according to Turan.

“Iran is against any trans-Caspian pipelines,” said Behrouz Namdari of Iran’s National Gas Company, as quoted by Radio Free Europe/Radio Liberty.

But the intransigence on the trans-Caspian issue makes it all the more remarkable that a Chinese national oil company would lend its name to a project that Moscow firmly opposes.

On its face, the entire notion that a little-known consortium could accomplish a goal that has eluded Western governments seems far-fetched.

“Our competences are in the project management and the technical guidance for industrial and institutional customers,” Edison Technologies says on its website.

The company lists SEG as a partner on the site but shows no information on the Caspian proposal. SEG made no mention of the Caspian announcement on its website at www.segroup.cn.

Air Liquide has denied the report of its involvement in a consortium planning for a TCGP project, naturalgasworld.com said on Aug. 21.

‘Only half the problem’

Edward Chow, a senior associate for energy and national security at the Center for Strategic and International Studies in Washington, said that a TCGP project would also face economic obstacles.

“Getting across the Caspian is only half the problem. How does one economically justify the new infrastructure needed to get gas the rest of the way to Europe, since existing infrastructure is either full and/or controlled by others?” Chow said.

The doubts are compounded by the current glut of gas on global markets, he said.

How then to explain China’s reported involvement in a TCGP proposal that would challenge Russia’s Caspian interests?

The potential clash could raise doubts about whether relations between China and Russia are as close as both countries claim.

In 2014, President Vladimir Putin famously said that Russia had “no disagreements” with China.

In the past year, Russia and China have said that their strategic partnership and mutual trust have risen to new heights.

“Our relations with China have a depth and breadth like with no other country of the world today,” Putin said during President Xi Jinping’s visit to St. Petersburg in June, Interfax reported. “We really are strategic partners in the full sense of this word.”

On the eve of the visit, Xi referred to Putin as “my best and bosom friend,” said The Washington Post.

But Sinopec’s reported support for a trans-Caspian project may raise questions, particularly with regard to energy interests in former Soviet states.

The implied competition has been especially active in Turkmenistan for well over a decade.

In the 1990s, Russia used its control over the Soviet-era Central Asia-Center (CAC) pipeline network to monopolize Turkmenistan’s gas exports and limit access to cash-paying customers in the West.

In 2006, China stepped in with an agreement to build the Central Asia Gas Pipeline (CAGP) system from Turkmenistan through Uzbekistan and Kazakhstan to the Chinese border, giving Ashgabat an eastern alternative.

Thanks to state-owned China National Petroleum Corp. (CNPC) and billions of dollars of loans for gas field development, Turkmenistan has become China’s biggest single source of imported gas with estimated supplies of 34 billion cubic meters (1.2 trillion cubic feet) last year.

Competition for Turkmenistan’s resources became evident this year, when Russia’s Gazprom struck an agreement to restart imports from Turkmenistan for the first time since a complete cutoff at the start of 2016.

The resumption in April came months before the expected startup of Russian gas flows to China through Gazprom’s massive Power of Siberia pipeline, expected in December.

Gazprom’s imports of Turkmen gas are seen as reducing the volumes that would otherwise be available to China. A shortfall would make China more reliant on Russian gas from the new Power of Siberia line.

In July, Gazprom signed a five-year contract to buy up to 5.5 billion cubic meters (bcm) of gas annually from Turkmenistan, Interfax reported, although Russia has little need for more gas.

Gazprom recently lowered its export target for the year as the result of weaker European demand.

Although the volumes of Russian purchases are relatively small, they may already be having an effect.

Turkmenistan’s supplies of gas to China fell 8.6 percent year-on-year in July. In the first seven months, deliveries to China dropped 2.6 percent, Platts Commodity News said.

Two explanations

Chow suggested two possible explanations for a Sinopec role in the TCGP proposal.

One is that a local Central Asian branch of SEG is only seeking an opportunity to do some work on a feasibility study for the project.

The other is that Beijing may be testing the waters to find out whether Turkmen gas has any future in Europe or not.

“If it does, then China wants a piece of the action as a way to obtain a larger upstream stake in Turkmenistan,” Chow said.

“If it does not, then China can toughen its negotiating position on Turkmen gas to China,” he said.

Sinopec’s reported support for a TCGP project could also be sending a competitive message to Russia at a sensitive time when Gazprom is rushing to complete two pipeline projects for gas supplies to Europe. Western nations are concerned that the projects could isolate Ukraine by bypassing the major trunk lines through the country.

In the north, Gazprom’s Nord Stream 2 twin-pipeline project to carry 55 bcm per year across the Baltic Sea to Germany is 75-percent complete but still faces misgivings from the European Union over the Ukraine issue and the threat of U.S. sanctions.

In the south, two pipelines of Russia’s TurkStream project would each carry 15.75 bcm across the Black Sea to Turkey with extensions to Bulgaria and other European markets.

But profitability and EU policy remain uncertain with potential competition with gas from Azerbaijan along the Western-backed Southern Gas Corridor. Russia expects to complete both of its projects by the end of the year.

The announcement of Sinopec’s support for a TCGP project may suggest a nearly-symmetrical strategy, countering Russia’s attempt to undercut Turkmenistan’s gas supplies to China.

Beijing may be telling Moscow, “Two can play at this game.”