Troubled Waters: The Geopolitics Of Deep-Sea Mining – Analysis

By Arman Sidhu

Following its decision to accept applications for deep-sea mining this July, the International Seabed Authority (ISA), a UN affiliate organization, has renewed interest in an emerging realm of geopolitical competition. Despite concerns over the lack of scientific research and the potential environmental impact, the momentum for deep-sea mining stems from global demand for “battery metals” to fulfill the intricate supply chain needs for manufacturers of Electric Vehicles (EVs) and clean energy infrastructure. Lucrative deposits of cobalt, nickel, manganese, and Rare Earth Elements (REEs) have all been linked to deep-sea mining, with China, Russia, and Norway representing some of the most eager of participants in the nascent and controversial industry.

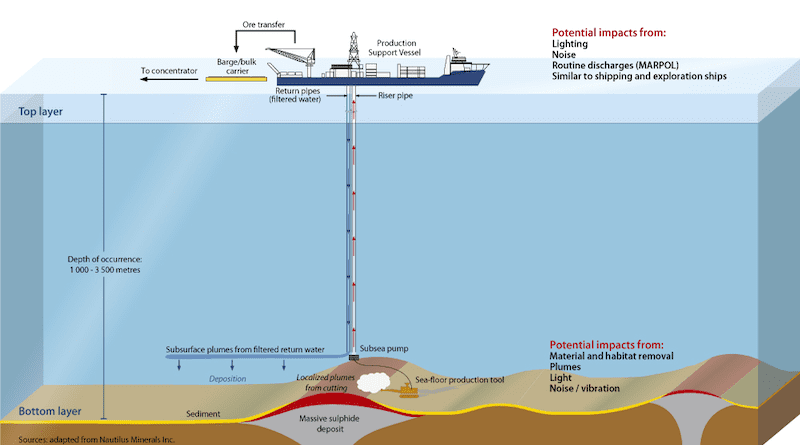

Deep-sea mining is the process of extracting minerals from the ocean floor. Unlike traditional forms of mining, which involve extracting minerals from the earth’s crust, deep-sea mining involves collecting nodules, crusts, and other deposits that have formed on the ocean floor over millions of years. These deposits are often found in areas known as polymetallic nodules, which cover large swaths of the ocean floor. These nodules are in areas that are thousands of meters deep, requiring significant capex spending and specialized technical equipment to bring the metals to surface for processing.

At present, research on the potential long-term implications of deep-sea mining is limited, prompting calls for a global moratorium on the practice from NGOs like Greenpeace, as well as several governments, including France, Germany, and Chile. The dearth of available scientific research led the ISA to take a gradual approach toward the development of standards and regulations for deep-sea mining. However, given current ISA provisions, the body is required to vet applications for deep-sea mining using whatever regulations currently exist by the time the application is received. The ISA also requires prospective mining contractors to obtain sponsorship by an ISA member, but with only three months remaining to develop regulations, the likelihood of resolving existing concerns from the ISA’s pro-mortarium members is low.

Compounding the concerns of the environmental impact are the potential geopolitical implications of deep-sea mining. Given the glacial pace of its regulatory framework, the industry is dominated by a handful of states that possess the capital, equipment, and technical knowledge required for seabed mining. The dominance of a few countries in the deep-sea mining industry could exacerbate existing geopolitical tensions, particularly in areas where there are competing claims over maritime boundaries and resource rights. At present, the industry’s most dominant players include Canada, China, Japan, South Korea, and Russia, with Norway emerging as a key investor within the space.

As one example, China’s expansive presence in the South China Sea has led to tensions with competing claimants like Vietnam and the Philippines. Similarly, Russia’s involvement in the industry and interest in the Arctic Ocean has spurred fears that the absence of international standards and resolutions could encourage Moscow to assert control over the region’s resources. Another area of particular concern is the Clarion-Clipperton Zone (CCZ), located in the Pacific Ocean between Mexico & Hawaii. The CCZ is estimated to hold 21 billion tonnes of nodules, making it the most appealing and competitive area for deep-sea mining, with the likes of Russia, China, and the US vying for control of the zone.

The expansion of deep-sea mining will undoubtedly influence the decision-making and strategy of naval forces from these countries. For the US, deep-sea mining offers an opportunity to reduce dependence on foreign sources of critical minerals and increase its domestic supply chain resilience. For China, deep-sea mining dovetails well with its “Made in China 2025” strategy, where an emphasis on indigenous innovation in highly specialized and technical fields is expected to principally guide economic decision-making by Chinese companies in the space.

Linkages between national security considerations and supply chain needs have encouraged both state-owned enterprises and private defense contractors alike to evaluate investment opportunities within the deep-sea mining industry. Yet the prohibitive level of overhead required for operations, in addition to the ambivalent regulatory framework, has already prompted early exits from the industry. Last month, US defense giant Lockheed Martin sold its seabed mining subsidiary, which holds multiple exploration contracts in the CCZ, to a Norwegian startup for an undisclosed amount and with little explanation.

In looking beyond its impact on great power competition, deep-sea mining is likely to increase the geopolitical relevance of island nations, most of whom have traditionally operated in the periphery of international politics. Within the ISA, smaller member-states lack a consensus on the subject of deep-sea mining, with countries like Papua New Guinea and Nauru indicating their desire to move forward in harnessing their mineral wealth, even as neighboring governments voice support for a moratorium. In the absence of international standards before July, the consequences for island countries could include weakened standards that leave these governments vulnerable to external pressures and influence by powerful nation-states and global mining corporations committed to starting operations in the next few years.

As deep-sea mining becomes more prevalent, it is likely that geopolitical conflicts will arise over extant issues like territorial boundaries, resource rights, and environmental regulation. Despite its reputation for consensus-based rule, the ISA will have to contend with an accelerated timeline to develop a deep-sea mining code, coupled with the need to overcome staunch internal opposition and dissension to the practice both internally from its member-states, and internationally. Whether the ISA can strike a compromise before the July deadline will be the organization’s most consequential test to date, with significant geopolitical implications at stake.

This article was published by Geopolitical Monitor.com