Rising Health Insurance Costs Push US Core CPI Higher – Analysis

By Dean Baker

The overall Consumer Price Index (CPI) rose just 0.1 percent in August, bringing its increase over the last year to 1.7 percent. However, the core index rose 0.3 percent in August, bringing its rise over the last year to 2.4 percent. The core index shows some real evidence of acceleration with an annual rate of increase in the last three months (June, July, August) compared with the prior three months (March, April, May) of 2.8 percent.

This acceleration is being driven overwhelmingly by medical care costs and within the medical care component, primarily by health care insurance. The medical care index increased by 0.7 percent in August. It is up by 3.5 percent over the last year. The annualized rate of inflation in the last three months compared with the prior three months is 4.8 percent.

Medical care added 0.2 percentage points to the rate of inflation in the overall CPI over the last year, with the overall CPI, excluding medical care, rising just 1.6 percent over the last year.

Within medical care, health care insurance is the primary driver of inflation. The index for health care insurance rose by 1.9 percent in August and is up by 18.6 percent over the last year. It is important to remember that this component is just measuring the administrative costs and profits of insurers, it is not measuring the change in premium prices.

Inflation in other components of medical care remains reasonably well contained. The price of professional medical services increased just 0.1 percent in August and are up 1.4 percent over the last year. The index for hospital services jumped 1.2 percent in August, but the monthly changes are erratic; over the last year hospital prices have risen just 2.2 percent.

Prescription drug prices fell 0.2 percent in August and are down 0.7 percent over the last year. Since this index only measures the change in the price of drugs already on the market, and doesn’t pick up the price of new drugs, it is not a useful measure of spending on drugs, which has continued to rise rapidly.

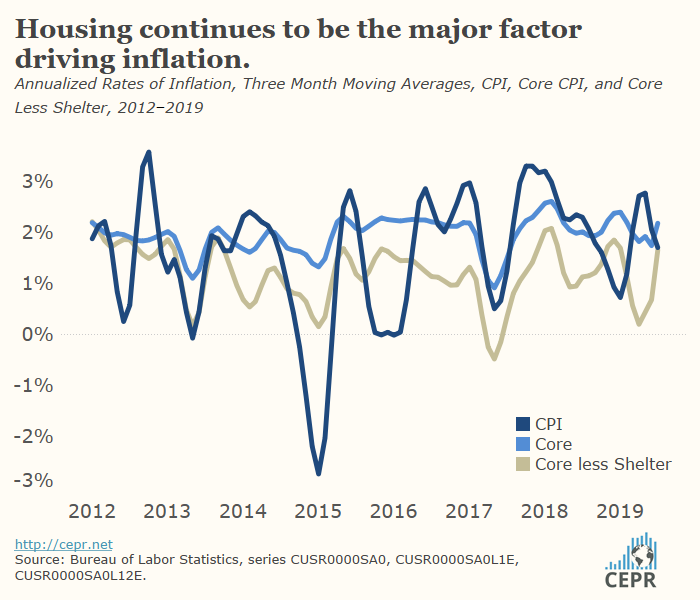

Rent continues to outpace the overall rate of inflation, but there is no evidence of acceleration. Owners’ equivalent rent increased by 0.2 percent in August and is up by 3.3 percent over the last year. The rent proper index also rose by 0.2 percent in August and has risen by 3.7 percent over the last year. The core inflation rate, excluding shelter, rose by 0.3 percent in August and 1.7 percent over the last year.

Inflation in most other areas continues to be well contained. Apparel prices, which had risen rapidly in June and July, rose just 0.2 percent in August, bringing their increase over the year to 1.0 percent. This increase has probably been driven in part by tariffs on imports from China.

New vehicle prices fell by 0.1 percent in August and are up by 0.2 percent over the last year. Used vehicle prices jumped by 1.1 percent last month and are now up by 2.1 percent over the year. The monthly data for this component are erratic, and this jump will almost certainly be reversed in future months.

The food at home index fell by -0.2 percent in August and was up 0.5 percent over the last year. The food away from home index increased somewhat more rapidly, up 0.2 percent in August and 3.2 percent over the last year. This gap is likely due to the rising pay in the restaurant sector. This is a peculiar report in that inflation in most areas of the CPI remains well contained, however medical care is showing substantial signs of rising costs driven almost entirely by enormous rises in the price of health care insurance. From the standpoint of the policy, it would not make sense to try to slow health insurance costs through interest rate hikes, but it does seem necessary to contain costs in this sector.