European Commission Proposes Modern Insolvency Rules

Businesses hit by the economic crisis will be thrown a lifeline under a new proposal from the European Commission today to modernise Europe’s rules on cross-border business insolvency, helping to give otherwise viable businesses a ‘second chance’.

The Commission is proposing to modernise the current rules on cross border insolvency which date from 2000. Benefitting from ten years of experience, the new rules will shift focus away from liquidation and develop a new approach to helping businesses overcome financial difficulties, all the while protecting creditors’ right to get their money back.

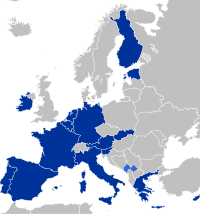

The new rules will increase the efficiency and effectiveness of cross-border insolvency proceedings, affecting an estimated 50 000 companies across the EU every year. This is a first step towards an EU “rescue and recovery” culture to help companies and individuals in financial difficulties; this is explored further in a policy communication adopted in parallel today which identifies those areas of national insolvency law which have the greatest potential to create an “unfriendly” business environment and to hamper the development of an efficient insolvency framework in the internal market.

“Businesses are essential to creating prosperity and jobs, but setting one up – and keeping it going – is tough, especially in today’s economic climate,” said Vice-President Viviane Reding, the EU’s Justice Commissioner. “Our current insolvency rules need updating to make it easier for viable businesses in financial difficulties to keep afloat rather than liquidating. 1.7 million jobs are lost to insolvencies every year – We want to give honest companies and the people they employ a second chance.”

Vice-President Antonio Tajani, Commission or Industry and Entrepreneurship added: “Research shows that ‘second starters’ are more successful and survive longer than average start-ups; they grow faster and employ more workers. Thus, a failure in entrepreneurship should not result in a “life sentence” prohibiting any future entrepreneurial activity but should be seen as an opportunity for learning and improving – a viewpoint that we already today fully accept as the basis of progress in scientific research.”

Insolvencies are a fact of life in a dynamic, modern economy. Around half of enterprises survive less than five years, and around 200 000 firms go bankrupt in the EU each year. This means that some 600 companies in Europe go bust every day. A quarter of these bankruptcies have a cross-border element. But evidence suggests that failed entrepreneurs learn from their mistakes and are generally more successful the second time around. Up to 18% of all entrepreneurs who go on to be successful have failed in their first venture. It is therefore essential to have modern laws and efficient procedures in place to help businesses, which have sufficient economic substance, overcome financial difficulties and to get a “second chance”.

The revision of the EU Insolvency Regulation seeks to modernise the existing rules so that they support restructuring of business in difficulties and create a business-friendly environment, especially in times of financial difficulties. It will bring the Regulation, which dates from 2000 up to date with developments in national insolvency laws, in particular in terms of highly indebted firms. Creditors’ interests can also be served by a restructuring, as it can mean that they are more likely to get back their money that might otherwise be lost in a winding-up.

It will also increase legal certainty, by providing clear rules to determine jurisdiction, and ensuring that when a debtor is faced with insolvency proceedings in several Member States, the courts handling the different proceedings work closely with one another. Information to creditors will be improved by obliging Member States to publish key decisions – about the opening of insolvency proceedings, for example. All in all, these changes will improve the efficiency and effectiveness of cross-border insolvency proceedings.

This proposal is also intended as a first step towards an EU “rescue and recovery” culture in cases of companies and individuals in financial difficulties more generally. The challenge is to address the debtor’s financial difficulties while protecting the creditor’s interests. In the future, there could be separate rules for honest entrepreneurs and for cases where the bankruptcy was fraudulent or irresponsible. In the case of honest bankruptcies, a shortened discharge period in relation to debts and the legal restrictions stemming from bankruptcy would make sure entrepreneurship does not end up as a “life-sentence” should a business go bust.

The proposal for a regulation will now pass to European Parliament and to the Council of the EU for negotiation and adoption.