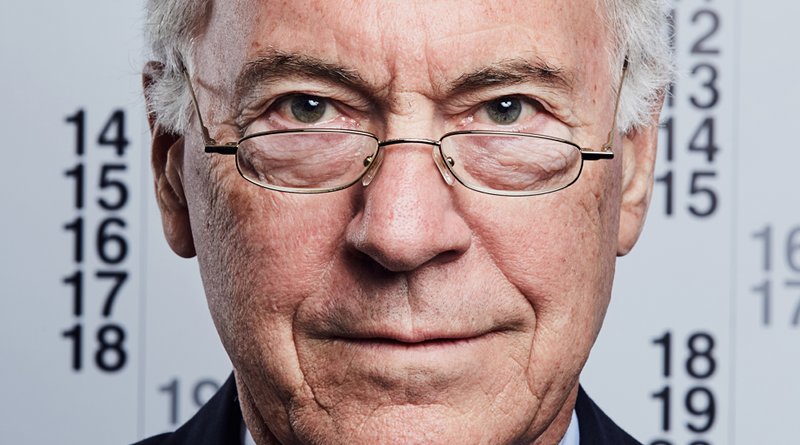

Steve Hanke: Government Statistics Fail To Capture Reality Of Inflation – OpEd

By Peter Tase

On May 6, 2021, Paris based freelance journalist David Whitehouse, PhD, conducted an extensive interview with Prof. Steve Hanke professor of applied economics at Johns Hopkins University in Baltimore.

In this unique interview, Prof. Hanke emphasized that “Developing countries facing increased risks of hyperinflation need to consider radical preventative measures including currency boards before it’s too late. For developing countries, the best way to eliminate the possibility of a hyperinflation would be to mothball their central banks and put them in museums.”

The following is a reproduction of what is published by Disruption Banking Magazine; text is prepared by David Whitehouse, PhD.

“Developing countries have two options, Hanke says. The first is to use a sound foreign currency and operate with no local currency, a solution often referred to as “dollarization.” Today, dollarized regimes exist in 37 countries, including Montenegro, where Hanke was an advisor in 1999, helping to engineer the replacement of the hyperinflating Yugoslav dinar with the German deutschemark.

The second option is to issue local currency via a currency board, he says. In this case, the local currency trades at an absolutely fixed exchange rate with a sound anchor currency, and is 100% backed with sound currency reserves. The local currency effectively becomes a “clone” of its anchor.

Hanke is the architect of currency boards in Estonia, Lithuania, Bulgaria, and Bosnia-Herzegovina. He became convinced of their merits as an economic adviser to the government of Yugoslavia in 1990. Descent into war prevented him from putting his solution for Yugoslavia’s raging inflation into action. He became chief advisor to Bulgarian president Petar Stoyanov in Bulgaria, where hyperinflation peaked at 242% in 1997.

Once hyperinflation broke out in Bulgaria in 1996, Hanke recalls, previous resistance to the ideal of currency boards vanished. Under either a “dollarized” or currency board regime, there are “no printing presses operated by a central bank that generate increases in the money supply”, which fuels runaway prices. “Bulgaria’s currency board immediately smashed the hyperinflation.”

“By 1998 the banking system was solvent, money-market interest rates had plunged from triple digits to an average of 2.4%, a massive fiscal deficit turned into a surplus, a deep depression became economic growth, and Bulgaria’s foreign-exchange reserves more than tripled.” Thanks to its currency board, Hanke argues, Bulgaria has the second-lowest debt-to-GDP ratio in the European Union, behind Estonia.

Lies, Damned Lies

Hanke subscribes to Milton Friedman’s dictum that inflation is “always and everywhere a monetary phenomenon”, resulting from a rise in the quantity of money relative to output. So, the only effective way to stop inflation is to restrain the rate of growth of money supply.

That priority has been pushed to the back of the queue in the context of COVID-19. “The response of most countries to COVID-19 has been to push the money supply accelerator to the floorboard,” Hanke says. With the exception of China and Japan, broad measures of money are still growing by more than 10% per year in all of the world’s major economies. In the US, he says, broadly measured money supply has soared to heights not seen since 1943.

“As a result, inflation is picking up speed, and contrary to what central bankers are telling us, the inflation won’t just be a temporary phenomenon.” Inflation will be “one of the many serious problems that accompany the post-pandemic era.”

Government statistics fail to capture the reality of inflation, Hanke argues. In August 2020, Turkey had an official annual inflation rate of 11.77%, compared with Hanke’s own measure of 27%. He argues that the biggest reason for the difference is that the basket of goods used by the government only includes 418 items, so excluding thousands of goods bought and sold in Turkey every day. Hanke’s own measure tries to capture high-frequency prices for everything that is traded in an economy, and then process the data into a Purchasing Power Parity (PPP) model.

The rarity of occurrences, he says, makes it hard to predict future occurrences, though war or regime collapse are often pre-conditions. Hanke defines hyperinflation as a monthly rate of above 50% for at least 30 straight days. His research shows that there have been 62 episodes of hyperinflation in world history, starting in France in May 1795.

The poor are the most exposed as the dangers of hyperinflation increase. Hanke notes that the prices of many agricultural commodities are at, or near, all-time highs. He expects that food prices will continue to surge in developing countries. “The poor will pay through the nose because a large portion of their budgets are gobbled up by expenditures on food.”

Lebanon’s Crisis

The most recent episode of hyperinflation which Hanke has recorded was in Lebanon, beginning in July 2020. Lebanon therefore joined Venezuela which has been in a state of hyperinflation since 2016. Lebanon’s economy collapsed following the end of the currency peg to the US dollar and the port explosion in Beirut.

The banking system has largely ceased to operate and country lacks a fully functioning executive authority. Inflation in the food and non-alcoholic beverages averaged 254% in 2020 and has been a key driver of overall inflation. The World Bank forecasts overall inflation of 80% in 2021. Still, the Economist Intelligence Unit (EIU) predicts that price pressures will ease in 2023 to 2025 to an average of 15.7% a year as the currency stabilises, tax rates are raised and private consumption growth resumes.

Some in Lebanon question whether a currency board is the road to salvation. Nasser Saidi, a former Lebanese minister of economy and trade who has also served as the first vice governor of the country’s central bank, argued in a presentation in February that a currency board wouldn’t fix Lebanon’s problems.

Saidi argues that currency boards and fixed exchange rate regimes are associated with real exchange rate appreciation, a loss of competitiveness, and a worsening of the trade balance. A currency board where money is fully backed by foreign reserves would, he argues, not prevent a speculative attack on the currency because, in the context of an exchange rate crisis, all liquid money assets, which have an order of magnitude much greater than foreign reserves, can be converted into foreign exchange.

Flexible exchange rates, he says, provide more discipline because any lax fiscal policy is immediately punished via currency depreciation. “If sound economic policies are followed, there is no need for a currency board,” he argues. “Adopting one may hurt when truly exogenous shocks require an adjustment of nominal exchange rate parity.”

Saidi also questions whether central bank independence creates, or simply reflects, greater discipline. Countries which make a political decision to rely less on inflation, he argues, are more likely to adopt independent central banks.

“Zero Credibility”

Hanke rejects those arguments. “The contemporary experience with currency boards contradicts all of the unfounded assertions put forward by Saidi,” he says.

He points to Hong Kong’s currency board, installed in 1983 to combat exchange-rate instability, as a success story. As Sino-British talks on Hong Kong’s future dragged on, market volatility increased and the Hong Kong dollar slumped. Stability was quickly achieved once a currency board was established in October. “The board hasn’t missed a beat since,” even during Hong Kong’s recent political protests, Hanke says.

Along with economist Kurt Schuler, Hanke has analyzed financial data for the 70 currency boards created since the first one was established in Mauritius in 1849. “We have found no cases where real exchange rate appreciation and a loss of competitiveness occurred.”

“There has never been a successful speculative attack against a currency board, primarily because currency boards are, by design, speculation proof.”

A floating currency, Hanke argues, does little to discourage regimes determined to tax and spend. A depreciating currency is a recipe for inflation. “Flexible exchange rates provide little or no fiscal discipline precisely because they do not provide a hard budget constraint. A central bank with a flexible exchange rate can extend credit to the fiscal authority and therefore, contrary to a currency board, provides no fiscal discipline.”

The Lebanese currency peg to the US dollar which lasted from 1997 to 2019 did not prevent the central bank from financial engineering and discretionary monetary policy, both of which are prohibited under a currency-board arrangement, Hanke says. The central bank in Lebanon “has zero credibility. It’s never going to be fixed. The only way to end Lebanon’s nightmare is to establish a currency board.””

David Whitehouse, PhD is a freelance journalist in Paris, and business editor of The Africa Report.

This interview was originally published here: https://disruptionbanking.com/2021/05/06/steve-hanke-currency-boards-are-needed-to-quash-hyperinflation-risks/