EU Finance Ministers Approve Single Banking Supervisor Headed By ECB

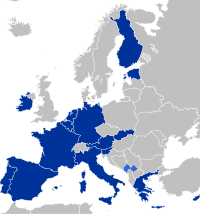

European Union Finance Ministers have reached an agreement to grant the European Central Bank powers to act as a supervisor of eurozone banks beginning in 2014. The measure must still be given the green light by EU leaders at their Thursday and Friday meeting in Brussels.

The agreement, if approved, could allow the ECB to monitor the activities of potentially 200 of Europe’s largest banks, as well as bailing-out troubled banks in the region.

It is expected that the ECB’s new supervisory role could become active by March 1, 2014.

According to the terms of the agreement, the actual supervisory mechanism would be composed of the ECB and national competent authorities, however the ECB would be responsible for the overall functioning of the supervisory mechanism.

Under the proposal, the ECB will have direct oversight of eurozone banks, although in a differentiated way and in close cooperation with national supervisory authorities. Non-eurozone member states wishing to participate in the supervisory mechanism will be able to do so by entering into close cooperation arrangements.

The ECB’s monetary tasks would be strictly separated from supervisory tasks to eliminate potential conflicts of interest between the objectives of monetary policy and prudential supervision. To this end, a supervisory board responsible for the preparation of supervisory tasks would be set up within the ECB.

Non-eurozone countries participating would have full and equal voting rights on the supervisory board. The board’s draft decisions would be deemed adopted unless rejected by the ECB governing council.

National supervisors would remain in charge of tasks not conferred on the ECB, for instance in relation to consumer protection, money laundering, payment services, and branches of third country banks.