Robert Reich: Who Will Bear The Pain? – OpEd

By Robert Reich

Get ready. The war on inflation is about to get ugly.

Tuesday’s consumer price index report shows annual inflation still roaring at 8.3%. Even without food and energy included, core inflation rose back above six percent year-on-year, according to the U.S. Bureau of Labor Statistics.

This means the Fed will almost certainly raise interest rates by another three-quarter of a point when it meets next week. And then probably keep raising rates.

How much economic “pain” — as Fed Chair Jerome Powell recently called it — will be needed to control the worst breakout of U.S. inflation since the 1980s?

Researchers at the International Monetary fund are now saying that the unemployment rate may need to reach as high as 7.5% — double its current level — to end the country’s outbreak of high inflation. This would entail job losses of about 6 million people.

Who will bear this pain? Not corporate executives. Not Wall Street. Not big investors. Not the upper-middle class.

The draftees into the war on inflation will be — already are — lower-wage workers. As the economy cools due to interest rate hikes, they will be first to be fired as the economy plunges and the last to be hired.

The Fed is obsessing about a “wage-price” spiral — wage gains pushing up prices — when it should be worried about a profit-price spiral.

Wages are going nowhere. Take a look:

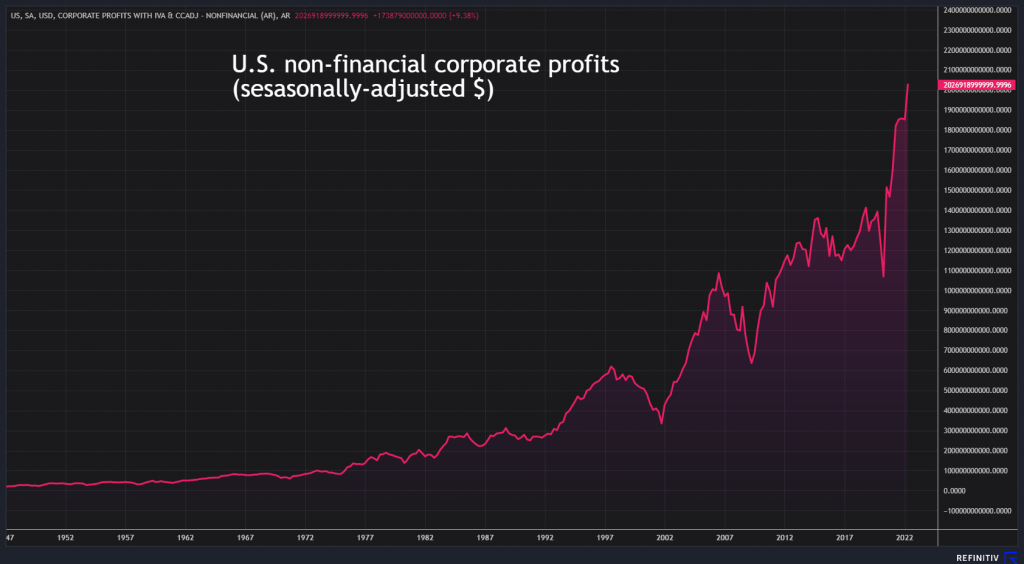

But profits have been soaring.

In the second quarter this year U.S. companies raked in profits that were the highest on record or close to levels not seen in over half a century. As a share of GDP, U.S. corporate profits in the second quarter rose to 12.25%, their highest levels since 1950.

So there you have it: Profits up. Wages down. So what’s pushing up prices? Profits.

Wages are lagging behind inflation. Most workers’ paychecks are shrinking, in terms of purchasing power.

Yet the Fed isn’t paying attention. Minutes of the Fed’s July 26-27 policy meeting reveal seven mentions of ‘wage’ or ‘wages’, 17 of ‘labor market’, eight of ‘job’ or ‘jobs’, and not one of ‘profit’.

Transcripts of Fed chief Jerome Powell’s press conference on July 27 show nine references to ‘wage’ or ‘wages’, 38 mentions of ‘labor market’, 15 mentions of ‘job’ or ‘jobs’, but not a single mention of ‘profit’, ‘corporate’, ‘company’, or ‘companies’.

Hello?

Instead of raising interest rates and slowing the economy toward (if not into) a recession, Congress and the Biden administration should be taking aim at corporate profits.

The Biden administration did pass a 1% tax on stock buybacks in the recently enacted Inflation Reduction Act, and a minimum corporate tax.

But these measures don’t go nearly far enough.

A windfall profits tax, price controls, higher taxes on corporations and the wealthy, and bolder antitrust enforcement are necessary.

Otherwise, the onus for controlling inflation falls entirely on the Fed.

The Fed will be using the blunt instrument of job-sapping and recession-seeding higher interest rates because interest-rate hikes are the only tools in the Fed’s tool kit.

Yet they put most of the burden of fighting inflation on average working people and the poor.

Mark my words. The war on inflation is about to get ugly – especially if the people who are drafted into it are mainly average working people and the working poor rather than top corporate executives and major investors