EIA Forecasts $51 Per Barrel 2017 Brent Crude Oil Price – Analysis

By EIA

The U.S. Energy Information Administration’s (EIA) Short-Term Energy Outlook(STEO) released on November 8 forecasts that North Sea Brent crude oil prices will average $43 per barrel (b) in 2016 and $51/b in 2017. EIA expects that West Texas Intermediate (WTI) prices will average $43/b in 2016 and $50/b in 2017.

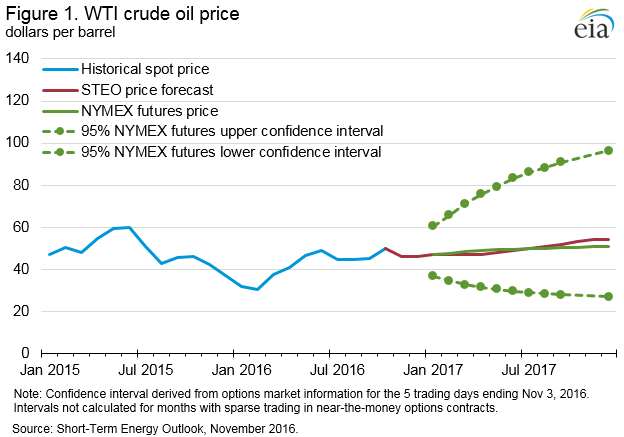

The values of futures and options contracts indicate significant uncertainty in the price outlook, with NYMEX contract values for February 2017 delivery traded during the five-day period ending November 3 suggesting that a range from $35/b to $66/b encompasses the market expectation of WTI prices in February 2017 with 95% confidence (Figure 1).

The 95% confidence interval for market expectations widens over time, with lower and upper limits of $27/b and $96/b for prices in December 2017.

The confidence range for crude oil prices as shown in Figure 1 is derived using a variation of the Black-Scholes model that is often used by financial analysts to estimate the price of options. EIA starts with options prices for WTI crude oil, and uses the Black-Scholes model to calculate the implied volatility. WTI futures contracts and options are the among the more actively traded commodity derivative products, involving many producers, consumers (including refiners, airlines, trucking companies, and fuel distributors), and other investors and risk-takers. The confidence interval is therefore a market-derived range that is not directly dependent on EIA’s supply and demand estimates.

The November STEO forecasts OECD and non-OECD production of petroleum and other liquids to both increase from 2016 to 2017, but their growth differs when examined quarterly. OECD is forecast to drop slightly in the first quarter of 2017 before increasing to over 27 million barrels per day (b/d) in the fourth quarter. Non-OECD likewise has a production decline in the first quarter of 2017, but production increase in the second and third quarters, before a slight decline to 71 million b/d in the fourth quarter.

The outlook for global consumption of petroleum products remains relatively robust because of generally positive global economic data. EIA expects global consumption of petroleum and other liquid fuels to grow by 1.3 million b/d and by 1.5 million b/d in 2016 and 2017, respectively. Forecast OECD consumption is up 0.1 million-b/d and 0.2 million-b/d in 2016 and 2017, respectively, compared with last month’s STEO. Non-OECD consumption remained virtually unchanged for 2016, but was revised up slightly (by about 50,000 b/d) to 50.1 million b/d for 2017.

The current global inventory forecast shows an OECD 0.1 million-b/d stock build in the fourth quarter of 2016 and a non-OECD 1.2 million-b/d stock build in the same period. In 2017, OECD and non-OECD are forecast to have stock builds of 0.1 million b/d and 0.4 million b/d, respectively. However, in the fourth quarter of 2017 the forecast for OECD and non-OECD diverges with a stock draw of 0.3 million b/d and a stock increase of 0.7 million b/d for OECD and non-OECD, respectively. Although the outlook for global consumption of petroleum products remains relatively robust because of generally positive global economic data, the potential for additional crude oil supplies in the global market could push prices lower.

U.S. average regular gasoline retail price flat, diesel fuel price drops

The U.S. average regular gasoline retail price on November 7 was $2.23 per gallon, virtually unchanged from both the previous week and the same time last year. The East Coast price increased two cents to $2.24 per gallon, and the Midwest price increased less than one cent to remain at $2.08 per gallon. The Rocky Mountain and Gulf Coast prices each fell three cents to $2.27 per gallon and $2.02 per gallon, respectively, and the West Coast price dropped by one cent to $2.69 per gallon.

The U.S. average diesel fuel price dropped one cent to $2.47 per gallon, down three cents from the same time last year. The Midwest price fell two cents to $2.43 per gallon, the Rocky Mountain and Gulf Coast prices each dropped one cent to $2.53 per gallon and $2.34 per gallon, respectively, and the East Coast price fell less than one cent to $2.47 per gallon. The West Coast price remained unchanged at $2.77 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 1.3 million barrels last week to 99.6 million barrels as of November 4, 2016, 4.4 million barrels (4.2%) lower than a year ago. Gulf Coast, East Coast, and Rocky Mountain/West Coast inventories each decreased by 0.4 million barrels, while Midwest inventories decreased by 0.2 million barrels.

Propylene non-fuel-use inventories represented 3.7% of total propane inventories.

Residential heating oil price decreases, propane price virtually unchanged

As of November 7, 2016, residential heating oil prices averaged $2.39 per gallon, one cent per gallon less than last week and four cents per gallon less than last year at this time. The average wholesale heating oil price is $1.50 per gallon, 11 cents per gallon less than last week and seven cents per gallon less than a year ago.

Residential propane prices averaged $2.06 per gallon, virtually unchanged from last week and 14 cents per gallon more than last year. Wholesale propane prices averaged nearly 66 cents per gallon, almost three cents per gallon lower than last week but 13 cents per gallon more than last year’s price.